![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

90 Cards in this Set

- Front

- Back

|

What are the two types of tax? |

Direct taxes - taxes on income and wealth. Indirect taxes - on expenditure |

|

|

What are the 2 types of indirect tax? |

Specific tax - a certain amount of tax paid per unit (e.g. 35p per litre). Ad Valorem tax - a proportion of price (e.g. 20% of price). |

|

|

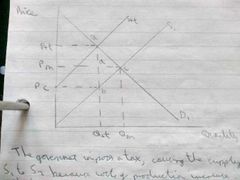

Construct a chain of reasoning for taxes leading to a full in market output. |

Taxes increase the costs of production of producers. This leads to a decrease in supply. This leads to an increase in price. This leads to a contraction in demand. This leads to a fall in equilibrium quantity. |

|

|

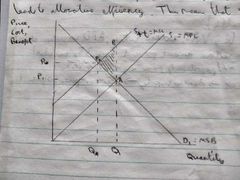

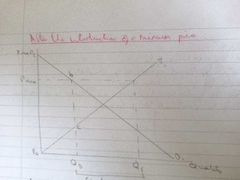

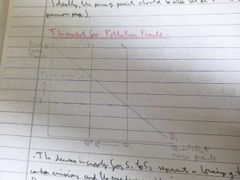

Draw a diagram showing the effect do a specific tax. |

|

|

|

Total tax revenue = ? |

Quantity x tax per unit |

|

|

Assuming the tax fully corrects any externalities, what is the tax per unit equal to? |

The MEC (marginal external cost) per unit |

|

|

What is the aim of the government when setting an indirect tax? |

To set a level of taxation equal to the MEC per unit and this correct the externality. |

|

|

What does in mean if an externality has been 'internalised'? |

The level of the tax is equal to the MEC. The externality has been effectively eliminated. |

|

What is the tax per unit in this diagram? Is the market allocatively efficient after the tax is introduced? |

Tax per unit is equal to the distance AB. The market is alocatively efficient, as the welfare loss has been eliminated. |

|

|

How is the size of the tax per unit shown in a diagram? |

The vertical distance between he 2 supply curves. |

|

On this diagram, what area represents the total tax revenue; the amount of tax paid by consumers; and the amount of tax paid by producers? |

Total tax revenue: abPcP+t Total amount of tax paid by consumers: adPmP+t Total amount of tax paid by producers: dbPcPm |

|

|

When PED is elastic, does the burden of tax fall mainly on consumers or producers? |

Mainly on producers. |

|

|

When LED us inelastic, does the burden of the tax fall mainly on consumers or producers? |

Mainly on consumers. |

|

|

When will revenue from an indirect tax be largest? |

When PED is inelastic. |

|

|

When will a tax be most effective at reducing quantity demanded? |

When PED is elastic. |

|

|

When PED=PES, how does the incidence of a tax fall? |

The burden will be equal. |

|

|

What are the advantages of using a tax to correct market failure? |

Discourages production and consumption, and hence reduces negative externalities/overconsumption if demerit goods. Raises revenue for the government which can be spent on correcting market failure cause by externalities. This is called Hypothecation: increasing taxes in order to find other subsidies. |

|

|

What are the issues with using taxes to correct market failure? |

Regressive nature of indirect taxes mean it will takes a higher proportion of income from those on lower incomes: inequitable. It is difficult to determine the correct level of taxation to correct externalities. Elasticity of demand: if PED is inelastic taxes may need to be high to discourage demand enough to reach socially optimum output. However, if PED is elastic taxes will be less effective at raising revenue for the government. The incidence of the tax will change depending on PED. If the tax is aimed at reducing consumption, then the incidence should be mainly on the consumer. To be effective, taxes need to be enforced. The government incurs significant costs in terms ofnpolicijgnand enforcement. Tax yield minus collecting costs may be low. |

|

|

What are the macroeconomic issues with using taxes to correct market failure? |

Raising firms costs if production could lead to unemployment. Taxes make UK producers Les internationally competitive. Taxes may lead to lower growth, damaging the economy. Increasing taxes may lead to cost lush inflation. |

|

|

What are some useful evaluation points for taxes? |

Size of the tax PED Ceteris Paribus How the tax revenue is used. |

|

|

What is a Pigouvian tax? |

A tax which perfectly corrects an externality. |

|

|

What is a subsidy? |

A payment given to producers to encourage the production or consumption of a good or service. |

|

|

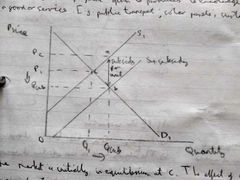

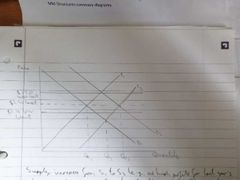

Draw a diagram showing the effect of a subsidy. |

|

|

What price do consumers pay and producers receive before and after the subsidy? |

Before: consumers pay P1, producers receive P1. After: consumers pay Psub, producers receive Pc. |

|

On this diagram, which areas represent the following? Total cost of subsidy Producer revenue before the subsidy Producer revenue after the subsidy Consumer expenditure before the subsidy Consumer spending after the subsidy |

Total cost of subsidy: abPsubPcProducer revenue before the subsidy: P1CQ1OProducer revenue after the subsidy: PcaQsubOConsumer expenditure before the subsidy: P1CQ1OConsumer spending after the subsidy: PsubbQsubO |

|

|

When will a subsidy be most effective at increasing production and consumption? |

When PED is elastic. |

|

|

When will the cost of a subsidy to the government be relatively low? |

When PED is elastic. |

|

|

When PED is inelastic, who gets most of the benefit from the subsidy? |

Consumers. |

|

|

What are the benefits of a subsidy? |

Increase production and consumption of merit goods and services/goods and services with positive externalities. Addresses underconsumption/production. Increase producer and consumer surplus. May reduce inequality by making goods and services affordable for the less well off. May ensure supply of essential goods and services (e.. fuel, transport, food). Support producers in markets where price is volatile (e.g. agriculture). Protects jobs nd improves the international competitiveness of producers because relative cost of production are lower. |

|

|

What are the problems with subsidies? |

Long run effects on market - distorts price signals, may support inefficient firms. Difficult to set a subsidy that accurately reflects the size of the externality it is designed to correct. The cost of the subsidy and it's administration to the taxpayer: there will be an opportunity cost. If PED is relatively elastic: the cost of the subsidy will be low, producers receive a high proportion of the subsidy which ma support inefficient firms. If PED is relatively inelastic: the subsidy will be less effective at increasing equilibrium quantity, the proportion received by consumers is high, and so will benefit all consumers regardless of their income. |

|

|

What are some useful evaluation points for a subsidy? |

Size of subsidy relative to market price. Duration/permanance of subsidy. Elasticity of demand Intention of subsidy. Incidence of subsidy. |

|

|

What are the different types of subsidy? |

A guaranteed payment on the factor cost of production (e.g. a guaranteed minimum price offered to farmers). An input subsidy (subsidised the costs if inputs used in production e.g. employment subsidies). Government grants to cover losses Bail-outs Financial assistance for businesses setting up in high unemployment areas. |

|

|

What are some notifications for subsidies? |

To keep prices down and control inflation. To encourage consumption of merit goods and services/goods and services with positive externalities. Reduce the cost of capital investment - help increase LRAS. Slow down the process of long term decline in an industry (e.g. mining). Boost demand during a recession. |

|

|

What are some arguments against subsidies? |

Distorts price-signalling in the market. Arbitrary assistance: decisions about who receives subsidies can be arbitrary/political. Financial cost: imposes an opportunity cost on the government. Supports inefficient firms. Risk of fraud. Burden of subsidies fall on taxpayers who may receive little to no benefit. |

|

|

Define regulation when it is used to correct market failure. |

Any rules, limits, restrictions, bans or other methods imposed by government to control production and/or consumption of a good or service that are backed by law. |

|

|

Give some examples of regulation that affect consumers. |

Smoking bans, minimum age laws, speed limits. |

|

|

Give some examples of regulation that affect producers. |

Fishing quotas, emissions limits for vehicles. |

|

|

What are the benefits of regulation? |

Acts directly to influence production and consumption of certain goods. Effective at increasing production and consumption of merit goods (through direct provision). Effective at improving quality of information. Effective at reducing monopoly power. |

|

|

What are the costs of regulation? |

Significant enforcement costs, which have an opportunity cost. Government failure of various types: - Imperfect information causes government to over/underestimate the size of the problem. - Conflicting objectives can prevent laws from being effective. - Unintended consequences may arise. - Banned goods may still be sold in underground markets where the quality of the good may be compromised. - Banning goods increases the price of the good, forcing consumers to commit crimes to be able to afford it. Regulatory capture: the best people to oversee an industry will have worked in, and built up social and financial interests in, that industry. This will affect their ability to regulate with due strictness. |

|

|

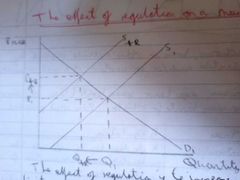

What is the effect of regulation on a market? |

Regulation increases firms' costs of production. This leads to a decrease in supply from S1 to S+R. This leads to an increase in price from P1 to P+R and a contraction in demand. This means that equilibrium quantity will fall from Q1 to Q+R. |

|

|

What is state provision of a good or service? |

The government finances the provision of certain goods or services and provides them free (or nearly free) at point of use. |

|

|

What does the supply curve of a state provided good look like? Why? |

The supply of a state provided good (e.g. healthcare) is perfectly inelastic. This is because it is determined by e.g. political factors and not related to price. |

|

Given that price = 0, what does this mean for the market? And what actions are taken to fix this? |

There will be excess demand (Qd to Qs). This means that consumption will have to be reduce din other ways e.g. waiting lists, priority given to those in greatest need. |

|

|

What are the advantages of state provision? |

The state can fund the provision of public goods through taxation, meaning they replace missing markets. This means that public goods such as street-lamps and defence are adequately provided. The state can provide merit goods, which in a market economy are underproduced and underconsumed. This means that consumption of merit goods can reach the socially desirable level. (Same for goods with positive externalities). By providing essential goods to everyone (often free at point of use) the government reduces inequality. |

|

|

What are the disadvantages of state provision? |

Government owned firms lack the profit motive, which can lead to inefficiency. Due to the lack of price-signalling in the market, consumer preferences may be ignored. This may lead to resources being allocated in a way that doesn't suit consumer preferences (price mechanism). There is an opportunity cost of reducing government spending in other areas (e.g. pensions). |

|

|

What points should you use to evaluate state provision? |

What goods and services are provided, how much is provided and who provides them is determined by: - Political factors - The degree of market failure perceived to exist. - The government's view on the socially optimal level of output. - The amount of taxation the government feels it can raise to publicly fund goods and services. - The government's assessment of the relative efficiency of the public and private sectors in producing the products. |

|

|

When is state provision of information suitable and what is it? |

If a good or service is over-produced/over-consumed because of information failure the government can increase information/reduce the cost of acquiring information. This means that rational consumers can make choices based on more complete information and uncertainty for firms is reduced. |

|

|

What is assumed about information in competitive markets? |

That there is perfect information - producers and consumers have full knowledge about prices, benefits and costs of the goods and services available. |

|

|

What are some of the causes of information failure? |

Uncertainty Addiction/habit Difficulty finding prices Poor knowledge of long term impacts Assymmetric information Complex information |

|

What information failure does this diagram represent? |

Individuals behaving imperfect information about the private benefits of a good or service. Better information leads to the MPB curve shifting outwards leading to a higher equilibrium quantity. |

|

|

What are the advantages of state provision of information? |

May be less expensive than subsidies/state provision. May be effective as modifies behaviour by changing preferences. May address the market factors associated with consumption of merit/demerit goods/goods with externalities. |

|

|

What are the disadvantages of state provision of information? |

May be expensive and impose opportunity cost. May not be effective at changing behaviour (e.g. if it doesn't reach target audience). May be viewed as excessive involvement by government in private decision making. |

|

|

(Evaluation) State provision of information is more likely to be effective if... |

The behaviour change targeted is one-iff or episodic rather than habitual (e.g. Vaccination rather than exercise). Campaigns include multiple interventions. There is little marketing with opposing messages. |

|

|

What is a maximum price? |

When a price below the market equilibrium is fixed by law. |

|

|

What will be the effect of a maximum price? |

A shortage. This so because a price below the equilibrium will cause demand to extend and supply to contract. This means there is excess demand. This leads to a shortage. |

|

|

What are the benefits of a maximum price? |

Reasons of equity (i.e. to ensure an essential good is affordable). E.g. rent controls, staple food prices. To increase consumption of merit goods e.g. rented housing, preventative medicine. |

|

|

What are some issues with imposing maximum price? |

Shortages due to excess demand (solved by methods of limiting demand e.g. Rationing/queues). May lead to black market, which are inequitable. Reduced profit for firms, leading to lower investment. Difficult to set the price exactly so it has the desired effect. |

|

|

Give some examples of price ceilings. |

Rent controls Rice prices Maximum price on roaming charges Maximum energy prices |

|

|

The main issue with maximum prices is that they lead to excess demand. What are some solutions to this? |

Allowing only certain groups to be eligible, meaning demand will decrease. Increasing supply through subsidies or direct provision. Buffer stock system (government intervening in the market to maintain price stability by buying up surpluses when the price is too low and releasing them when the price is too high). |

|

|

What is the problem with all these solutions? |

They all impose an opportunity cost in terms of other ways of tackling market failure. |

|

|

What is a minimum price? |

When a price above the equilibrium is fixed by law. |

|

|

(Advantages) Why might a government impose a minimum price? |

To deter consumption not demerit goods e.g. alcohol. Reasons of equity (e.g. minimum wage). To raise incomes of producers where goods are deemed to be essential and/or prices are likely to fluctuate. |

|

What are the consumer and producer surpluses on this diagram, representing a market before the imposition of a minimum price? |

Producer surplus: P1,a,P0 Consumer surplus: P1,a,P2 |

|

What are the new consumer and producer surpluses in this diagram, representing a market after the imposition of a minimum price? |

New consumer surplus: P2,Pmin,b New producer surplus: P0,c,b,Pmin. |

|

|

What are the disadvantages of a minimum price? |

Excess supply, resulting in: - Black/illegal/shadow markets at below the price floor as suppliers try to sell excess output. - Surpluses. |

|

|

What are some potential solutions to these problems? |

The government eliminates the surplus by purchasing excess supply. The government sets a quote which would keep equilibrium price = Pmin (but then only a limited number of producers are able to sell their output). The government increases demand (e.g. by advertising) so a new demand curve intersects supply at Pmin. |

|

|

What is the problem with all these possible solutions? |

They all impose an opportunity cost I terms of other ways to deal with the market failure. |

|

|

What are some evaluation points for price controls? |

If price is set too close to the equilibrium price then it will have little impact. Effectiveness depends on PED and PES. Government may incur enforcement costs Leads to excess demand/excess supply which may lead to illegal markets/additional government intervention. May benefit/disadvantage those on a lower income |

|

|

What is price volatility? |

When prices in a market fluctuate rapidly, creating uncertainty for producers and consumers. |

|

|

Why is the agricultural market price volatile? |

Because both the demand and supply of agricultural products is inelastic. |

|

|

Why is the demand for agricultural products inelastic? |

They are necessities. They are a relitavely small percentage of the household budget. There aren't many close substitutes. |

|

|

Why is the supply of agricultural products inelastic? |

The goods are perishable and hard to store. It is hard to switch production between different goods quickly. There are few producer substitutes. |

|

|

What is a buffer stock system? |

A system that holds back a product from the market in times of entry to be released into the market I t ones of scarcity. This is done by identifying a target price and a target balance of supply and demand. If supply outstrips demand, prices will fall so the agent withholds the necessary quantities of product from the market to return it to the target price. If demand outstrips supply and prices rise, stocks are released back onto the market to bring prices back to equilibrium. |

|

|

What are the 2 objectives of a buffer stock system? |

To maintain price stability. To maintain availability of essential goods. |

|

|

Give some examples of a buffer stock system. |

CAP (EU's common agricultural policy). The wool price reserve scheme. OPEC. |

|

|

What are some advantages of a buffer stock system? |

Stabilises markets, increasing income, profit and standard of living for producers. Increases productivity by promoting investment due to greater certainty. Secured availability of essential goods and services. Ensures goods and services are sold at reasonable prices. |

|

|

Draw a diagram of a buffer stock system where demand outstrips supply. |

|

|

|

Draw a diagram for a buffer stock system where supply outstrips demand. |

|

|

|

What are the disadvantages of buffer stock systems? |

Cost of setting up and administering scheme including storing surpluses. Difficult to identify 'fisr' price. Price may be too high leading to constant surpluses or too low leading to stocks running out. Increased inefficiency in farming. Externalities involved in over-production. |

|

|

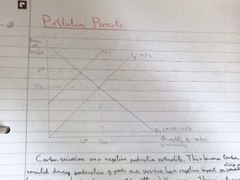

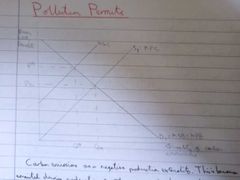

What your of externality are carbon emissions? Why? |

A negative production externality. This is because carbon emitted during production has a negative impact on a third party (society) not involved in the transaction. Since the impacts are not directly felt by the producer, they are not reflected in the market price (MSC exceeds MPC). At outputs from Q* to Qm, the cost to society of producing the good is greater than the benefit. The good is overproduced and over-consumed, resulting in a welfare loss. |

|

|

What does carbon trading do? |

It uses the market mechanism to change prices to incentivise producers and consumers to reduce their carbon emissions. The scheme sets a cap on carbon emissions from certain industries (which decreases over time). Permits to emit carob are then auctioned or allocated, after which they can be traded on the open market. |

|

|

Why is this effective? |

Businesses must buy enough permits to cover their CO2 emmissions, which means it is more expensive for firms to emit carbon, increasing their incentive to reduce their emissions. By reducing the cap and increasing the scarcity of permits over time, the price of permits will increase and businesses will have still greater incentives to cut pollution. |

|

|

Give some examples of pollution permits. |

The EU carbon emissions trading scheme. The US sulphur dioxide emissions trading scheme. |

|

|

Why is the system referred to as 'Cap and trade'? |

The cap refers to the cap on overall emmissions and the trade refers to the ability to trade emissions between companies. |

|

Where should the price of a permit be set, ideally? |

P* |

|

What does the decrease in supply from S1 to S2 represent? And why does demand contract? |

The decrease in supply represents a lowering of the cap on overall carbon emissions band the number of permits issued. Demand contracts because, as the price if the permits increases, some firms may find it is cheaper to reduce their carbon emissions than buy additional permits, so will exit the market for pollution permits. |

|

|

Why is making the permits tradeable a good idea? |

Forms will sell on their permits if the cost of reducing pollution (the national cost of abatement) is less than the market price of the permit. This provides an additional incentive for the firm to reduce its emmissions because it can sell on its permits if it does not use them itself. |

|

|

What are the advantages of pollution permits? |

Internalised the externality by making firms pay to pollute. Reduces pollution and allows government to decide optimal level of pollution (i.e. MSB of emmissions = MSC of emissions). Incentivises firms to adopt less polluting production methods. May raise revenue for issuing authority that can be used to address pollution. |

|

|

What are the disadvantages of pollution permits? |

Problems with estimating socially optimal level of pollution and number of permits. Cost of regulation, monitoring and enforcement (if fines are less than cost to firms if not polluting, fiend will be ineffective). Difficulties achieving international consensus, firms may move to unregulated countries. Some firms/countries can 'afford to pollute'. May disadvantage poorer producers. |

|

|

Evaluation points for pollution permits. |

Pollution permits will be even more effective if they are accompanied by other measure to tackle pollution (e.g. taxes, subsidies, regulation, etc). |