![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

71 Cards in this Set

- Front

- Back

|

Mean-variance analysis |

based on the idea that the value of investment opportunities can be meaningfully measured in terms of mean return and variance of return

All investors are risk averse; they prefer less risk to more for the same level of expected return (not all investors have the same level of tolerance though) |

|

|

Correlation formula |

p1,2 = Cov1,2 ------------- σ1 σ2 |

|

|

Variance of a two asset portfolio |

with covariance: σ2 = w1^2 *σ1^2 + w2^2*σ2^2 + 2*w1*w2*covariance(1,2)

with correlation: σ2 = w1^2 *σ1^2 + w2^2*σ2^2 + 2*w1*w2*p1,2σ1σ2 |

|

|

Expected return on a 2 asset portfolio |

E(Rp) = w1E(R1) + w2E(R2)

where E(Rp) is the expected return on portfolio P w = weighting of that asset E(R) expected return on that asset

|

|

|

Efficient portfolio |

one offering the highest expected return for a given level of risk as measured by variance or standard deviation of return |

|

|

Minimum-variance portfolios |

portfolios that have minimum variance for each given level of expected returns; the set of efficient portfolios is a subset of the set of minimum variance portfolios |

|

|

Minimum-variance frontier |

a curve that represents the minimum variance (risk) that can be achieved for a given level of expected return |

|

|

To solve for the Minimum-variance frontier |

Calculated the range of possible expected returns – minimum and maximum |

|

|

Capital allocation line (CAL) |

describes the combinations of expected return and standard deviation of return available by combining an optimal portfolio of risky assets with the risk-free asset; the graph of this starts at the intersection of the RFR return and is tangent to the efficient frontier of risky assets – the line itself represents an optimal portfolio of risky assets

Y = a +bX E(Rc) = [E(Rt) - Rfr] RfR + --------------------- x σc σt

|

|

|

Capital market line (CML) |

when investors share identical expectations about mean returns, variance of returns, and correlations of risky assets; when the CAL is the same for all investors E(RA) = [E(RM) - Rfr] x σA RfR + --------------- σM

|

|

|

Relationship between CAL and CML |

CML is when the CAL is the same for all investors |

|

|

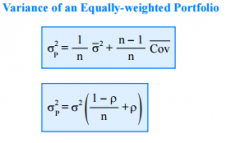

Equally weighted portfolio risk |

|

|

|

CML and CAPM |

CML represents the efficient frontier when the assumptions of the CAPM hold |

|

|

Security market line (SML) |

is the graph of the CAPM model, or the CAPM equation

CAPM = E(Ri) = RFR + Beta * (E(R of Market) – RFR) |

|

|

Beta definition as it relates to the market |

Beta is a measure of the asset’s sensitivity to movements in the market Covi,m pi,mσiσm σi ---------- = ------------- = pi,m x -------- σm^2 σm^2 σm |

|

|

Market risk premium |

E(Rm) - RFR |

|

|

Sharpe Ratio |

the ratio of mean return in excess of the RFR to the standard deviation of return (E(Ri) – RFR) -------------------- sd of Asset i |

|

|

Adding assets to the portfolio and the Sharpe Ratio |

Adding a new asset to your portfolio is optimal if the following condition holds: |

|

|

Market Model |

describes a regression relationship between the returns on an asset and the returns on the market portfolio |

|

|

Market Model assumptions |

The expected value of the error term is 0 |

|

|

Market Model predictions |

Expected return for asset ‘i’ depends on the expected return to the market, E(Rm), the beta, and the alpha |

|

|

Adjusted beta |

if historical beta is not deemed to be the best predictor, can use adjusted beta |

|

|

Historical beta |

assumes that beta for each stock is a random walk from one period to the next, and the error term mean is “0” – so Beta t+1 = Beta t + error (or 0) |

|

|

Reasons for and problems related to instability in the minimum-variance frontier |

Small changes in input assumptions can lead to large changes in the minimum-variance (and efficient) frontier, because uncertainty exists about the expected returns, variances, and covariances used in tracing out the minimum-variance frontier |

|

|

Multi-factor model |

multi-factor models could also address: interest rate movements, inflation, or industry-specific returns |

|

|

Macroeconomic factor models |

the factors are surprise in macroeconomic variables that significantly explain equity returns; can affect either the expected future cash flows of companies or the interest rate used to discount these cash flows back to the present |

|

|

Fundamental factor models |

factors are attributes of stocks or companies that are important to explaining cross-sectional differences in stock prices (factors that have been used: P/B, Market Cap, P/E, and financial leverage) |

|

|

Statistical factor models |

statistical methods are applied to a set of historical returns to determine portfolios that explain historical returns in one or two senses (less used) |

|

|

Factor analysis models |

the factors are the portfolios that best explain (reproduce) historical return covariances |

|

|

Principal –components models |

the factors are portfolios that best explain (reproduce) the historical return variances |

|

|

Arbitrage pricing theory (APT) |

is an alternative to CAPM and describes expected return on an asset (or portfolio) as a linear function of the risk of the asset (or portfolio) with respect to a set of factors. Like CAPM, APT describes a financial market equilibrium, but makes less-strong assumptions than CAPM |

|

|

Assumptions of Arbitrage pricing theory (APT) |

A factor model describes asset returns |

|

|

Factor risk premium (or factor price) |

the expected return in excess of the RFR for a portfolio with a sensitivity of 1 to that factor and 0 to all other factors |

|

|

APT compared to multi-factor model |

APT relates to multi-factor models, in that its intercept is the expected return of an asset in equilibrium vs. a multi-factor model intercept as just the expected return of an asset |

|

|

APT compared to Fundamental factor model |

uses the same equation structure, but factors are stated as returns rather than surprises, the expected return intercept has a different value/meaning, and the sensitivities are specific to the asset and standardized |

|

|

Active return |

return on portfolio – return on the benchmark (comparable to the portfolio) |

|

|

Active risk |

the standard deviation of active returns |

|

|

Active factor risk |

the contribution to active risk squared resulting from the portfolio’s different-than-benchmark exposures relative to factors specified in the risk model |

|

|

Active selection risk or Active specific risk |

the contribution to active risk square resulting from the portfolio’s active weights on individual assets as those weights interact with assets’ residual risk = sum of weight differences and variances of the asset’s returns unexplained by factors |

|

|

Tracking error |

synonym with active risk, but the term “error” is confusing as it is meant to represent “difference” here |

|

|

Tracking risk |

also a synonym of active risk = |

|

|

Factor portfolio |

has a sensitivity of 1 for a factor and 0 for all other factors within a multi-factor model; a portfolio with exposure to only one risk factor, exactly representing that risk |

|

|

Tracking portfolio |

a portfolio with factor sensitivities that are matched to those of a benchmark or other portfolio, “tracking the benchmark” to control the risk relative to the benchmark |

|

|

Why an investor can possibly earn a substantial premium for exposure to dimensions of risk unrelated to market movements? |

CAPM provides an incomplete description of risk compared to multifactor models with greater transparency/visibility into the drivers of return |

|

|

Efficiency of the market portfolio in the CAPM and the relation between the expected return and beta of an asset when restrictions on borrowing at the risk-free rate and on short selling exist |

Since the linear relation between betas and expected returns does not necessarily hold when borrowing is limited and short selling is restricted or not possible, the CAPM risk adjustment is questionable (two CAPM assumptions conflict with one another) |

|

|

Practical consequences that follow when restrictions on borrowing at the risk-free rate and on short selling exist |

The relationship between expected return and beta is not linear and that the market portfolio may not be efficient |

|

|

International market integration |

Integrated world financial market would achieve international efficiency, in that capital flows across markets would instantaneously take advantage of any new information throughout the world |

|

|

International market segmentation |

Impediments to capital mobility – legal restrictions or other forms of constraints that segment one national market from others |

|

|

Assumptions of the domestic capital asset pricing model (CAPM) |

Investors care about risk & return; are risk-averse and prefer less risk and more expected return |

|

|

Separation theorem |

everyone holds the same portfolio of risky assets and individual investor’s determine the weight of that portfolio with their domestic RFR “separately” |

|

|

Why an extension of domestic CAPM is needed to fit an International context |

Domestic CAPM in an international context would require the domestic RFR + the market cap weighted portfolio of all risky assets in the world for the market portfolio. This can only be justified when: |

|

|

Real exchange rate movements |

are defined as movements in the exchange rates that are not explained by the inflation differential between the two countries |

|

|

Foreign currency risk premium working in concert with interest rate parity |

E(R) – RFR, or the expected movement in the exchange rate less the interest rate differential (domestic RFR – foreign RFR), and after factoring in appreciation/depreciation for the period |

|

|

Risk pricing relation |

when the expected return on any asset is simply a function of its covariance with the domestic market portfolio |

|

|

The effect of market segmentation on the ICAPM |

Segmentation occurs when securities that have the same risk characteristics and are listed in two different markets, have different expected returns |

|

|

Information ratio |

a tool for evaluating mean active returns per unit of active risk --------------------------------------- = ------ annualized residual risk w

IR = IC x √BR |

|

|

Information Coefficient |

measures managers forecasting accuracy if a manager makes N bets on the direction of the market and Nc are correct, the IC is the covariance between forecast and actual direction of the market

IC = Ncorrect 2x ( ------- ) -1 N

when we add another source of information that is correlated, the skill (IC) of the manager does not increase proportionately. ICcom represents the new info. ICcom = ICorig x √(2/1+r)

where r = correlation

|

|

|

ex-post information ratio |

related to the t-stat one obtains for alpha in the regression of portfolio excess returns against benchmark excess returns: tα t statistic of alpha ----- √n number of years of data |

|

|

Value added |

Objective of active management is to maximize value added

VA = α - (λ x ω^2)

λ = risk aversion ω = residual risk |

|

|

Highest achievable value added * |

function of optimal level of residual risk and the portfolio managers IR

VA* = ω* x IR ---------- or 2

VA* = IR^2 ---------- or 4λ

VA* = IC^2 x√BR ------------- 4λ |

|

|

Breadth |

# of forecasts made in a year

IR = IC x √BR |

|

|

Optimal level of residual risk

ω* |

ω* = IR IC x √BR ----- = ------------ 2λ 2λ

λ = risk aversion |

|

|

Steps towards an active portfolio include |

Estimate the beta of each security and its residual risk, from E(Rm) – RFR determine the securities’ required rate of return |

|

|

Elements of IPS |

i. Brief client description |

|

|

Asset allocation included in the IPS |

requires the examination of the interaction of objectives and constraints with long-run capital market expectations; the planning process involves concrete elaboration of an investment strategy either: passive (or indexing or strict buy and hold), active (holdings differ from the benchmark; looking to produce alpha), or semi-active (risk controlled and somewhat indexed) |

|

|

Capital market expectations |

include long-run risk and return forecasts for various asset classes |

|

|

Strategic allocation |

combines the IPS and capital market expectations to determine target asset class weights – in single and/or multi-period perspectives; single period having the advantage of simplicity and multi-periods addressing liquidity and tax considerations that arise from rebalancing portfolios over time, as well as serial correlations (long- and short-term dependencies) in returns, but is more costly to implement |

|

|

Professional standards (two types) for managing investment portfolios |

standards of competence and standards of conduct; merely drawing a livelihood from managing or advising on the investment of client monies is insufficient in itself to make an investment professional |

|

|

Systematic Risk |

reflects factors that have general effect on the securities market as a whole and cannot be diversified away

for example macroeconomic risk |

|

|

Unsystematic risk |

can be reduced through diversification |

|

|

The single factor market model covariance calculation |

One of the predictions of the single-factor market model is that Cov(Ri,Rj) = bibjsM2. In other words, the covariance between two assets is related to the betas of the two assets and the variance of the market portfolio. |