![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

37 Cards in this Set

- Front

- Back

|

Correlation formula |

p1,2 = Cov1,2 ------------- σ1 σ2 |

|

|

Variance of a two asset portfolio |

with covariance: σ2 = w1^2 *σ1^2 + w2^2*σ2^2 + 2*w1*w2*covariance(1,2)

with correlation: σ2 = w1^2 *σ1^2 + w2^2*σ2^2 + 2*w1*w2*p1,2σ1σ2 |

|

|

Expected return on a 2 asset portfolio |

E(Rp) = w1E(R1) + w2E(R2)

where E(Rp) is the expected return on portfolio P w = weighting of that asset E(R) expected return on that asset

|

|

|

Capital allocation line (CAL) |

describes the combinations of expected return and standard deviation of return available by combining an optimal portfolio of risky assets with the risk-free asset; the graph of this starts at the intersection of the RFR return and is tangent to the efficient frontier of risky assets – the line itself represents an optimal portfolio of risky assets

Y = a +bX E(Rc) = [E(Rt) - Rfr] RfR + --------------------- x σc σt

|

|

|

Capital market line (CML) |

when investors share identical expectations about mean returns, variance of returns, and correlations of risky assets; when the CAL is the same for all investors E(RA) = [E(RM) - Rfr] x σA RfR + --------------- σM

|

|

|

Relationship between CAL and CML |

CML is when the CAL is the same for all investors |

|

|

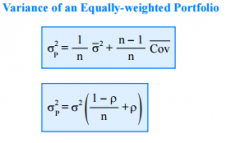

Equally weighted portfolio risk |

|

|

|

CML and CAPM |

CML represents the efficient frontier when the assumptions of the CAPM hold |

|

|

Security market line (SML) |

is the graph of the CAPM model, or the CAPM equation

CAPM = E(Ri) = RFR + Beta * (E(R of Market) – RFR) |

|

|

Beta definition as it relates to the market |

Beta is a measure of the asset’s sensitivity to movements in the market Covi,m ---------- σm^2 σi pi,m x --------- σm pi,mσiσm ------------- σm^2 |

|

|

Market risk premium |

E(Rm) - RFR |

|

|

Sharpe Ratio |

the ratio of mean return in excess of the RFR to the standard deviation of return (E(Ri) – RFR) -------------------- sd of Asset i |

|

|

Adding assets to the portfolio and the Sharpe Ratio |

Adding a new asset to your portfolio is optimal if the following condition holds: |

|

|

Market Model |

describes a regression relationship between the returns on an asset and the returns on the market portfolio |

|

|

Market Model assumptions |

The expected value of the error term is 0 |

|

|

Adjusted beta |

if historical beta is not deemed to be the best predictor, can use adjusted beta |

|

|

Historical beta |

assumes that beta for each stock is a random walk from one period to the next, and the error term mean is “0” – so Beta t+1 = Beta t + error (or 0) |

|

|

Multi-factor model |

multi-factor models could also address: interest rate movements, inflation, or industry-specific returns |

|

|

Active return |

return on portfolio – return on the benchmark (comparable to the portfolio) |

|

|

Active risk |

the standard deviation of active returns |

|

|

Active factor risk |

the contribution to active risk squared resulting from the portfolio’s different-than-benchmark exposures relative to factors specified in the risk model |

|

|

Active selection risk or Active specific risk |

the contribution to active risk square resulting from the portfolio’s active weights on individual assets as those weights interact with assets’ residual risk = sum of weight differences and variances of the asset’s returns unexplained by factors |

|

|

Tracking error |

synonym with active risk, but the term “error” is confusing as it is meant to represent “difference” here |

|

|

Tracking risk |

also a synonym of active risk = |

|

|

Separation theorem |

everyone holds the same portfolio of risky assets and individual investor’s determine the weight of that portfolio with their domestic RFR “separately” |

|

|

Real exchange rate movements |

are defined as movements in the exchange rates that are not explained by the inflation differential between the two countries |

|

|

Foreign currency risk premium working in concert with interest rate parity |

E(R) – RFR, or the expected movement in the exchange rate less the interest rate differential (domestic RFR – foreign RFR), and after factoring in appreciation/depreciation for the period |

|

|

Information ratio |

a tool for evaluating mean active returns per unit of active risk --------------------------------------- = ------ annualized residual risk w

IR = IC x √BR |

|

|

Information Coefficient |

measures managers forecasting accuracy if a manager makes N bets on the direction of the market and Nc are correct, the IC is the covariance between forecast and actual direction of the market

IC = 2x (Ncorrect/Ntotal guesses) - 1

when we add another source of information that is correlated, the skill (IC) of the manager does not increase proportionately. ICcom represents the new info. ICcom = ICorig x √(2/1+r)

where r = correlation

|

|

|

ex-post information ratio |

related to the t-stat one obtains for alpha in the regression of portfolio excess returns against benchmark excess returns: tα t statistic of alpha ---------------------------------------- √n number of years of data |

|

|

Value added |

Objective of active management is to maximize value added

VA = α - (λ x ω^2)

λ = risk aversion ω = residual risk |

|

|

Highest achievable value added * |

function of optimal level of residual risk and the portfolio managers IR

VA* = ω* x IR ---------- or 2

VA* = IR^2 ---------- or 4λ

VA* = IC^2 x√BR ------------- 4λ |

|

|

Breadth |

# of forecasts made in a year

IR = IC x √BR |

|

|

Optimal level of residual risk

ω* |

ω* = IR IC x √BR ----- = ------------ 2λ 2λ

λ = risk aversion |

|

|

Systematic Risk |

reflects factors that have general effect on the securities market as a whole and cannot be diversified away

for example macroeconomic risk represented by Beta |

|

|

Unsystematic risk |

can be reduced through diversification |

|

|

The single factor market model covariance calculation |

One of the predictions of the single-factor market model is that Cov(Ri,Rj) = bibjsM2. In other words, the covariance between two assets is related to the betas of the two assets and the variance of the market portfolio. |