![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

57 Cards in this Set

- Front

- Back

|

Appraisal |

An estimate or opinion of market value supported by an analysis of relevant property data |

|

|

Appraisers must be _________ according to state law and in accordance with federal regulations. |

Licensed or certified |

|

|

What other designations May an appraiser have? |

MAI - Member of the Appraisal Institute Or SRA - Senior Residential Appraiser |

|

|

Purpose and function of appraisals |

Seek to estimate market value on behalf of a lender but could be used by sellers estimating the market value of their property |

|

|

An appraisal is required for all ____________ from federal regulated lenders: conventional, insured conventional, FHA, and VA loans |

Federally related loans |

|

|

When is an appraisal not required? |

Seller financed or contract for deed |

|

|

Appraisals are also used for insurance, condemnation proceedings, and when the borrower wants to stop paying ____________ (80% LTV is reached). |

Private Mortgage Insurance (PMI) |

|

|

What can a licensed real estate agent perform and not perform? |

Can perform - CMA (competitive market analysts) Can not perform - appraisal |

|

|

A broker may charge a fee for the CMA/BPO/BOV but should make it clear that it is __________. |

NOT an appraisal |

|

|

What is market value? |

The most probable price that a property should |

|

|

What is market price? |

Actual sale price or what someone actually paid |

|

|

Essential Characteristics of Value |

Remember DUST Demand Utility Scarcity Transferability |

|

|

Essential Characteristics of Value: Demand |

Desire and affordability |

|

|

Essential Characteristics of Value: Utility |

Property’s usefulness for its intended purpose |

|

|

Essential Characteristics of Value: Scarcity |

Their is a finite supply of land Land in specific areas is limited (scarce) |

|

|

Essential Characteristics of Value: Transferability |

Must have marketable title |

|

|

Principles of Value |

1. Highest and best use 2. Anticipation 3. Supply and Demand 4. Substitution 5. Conformity 6. Contribution |

|

|

Principles of Value: Highest and Best Use |

Is the use that produces the highest value over time. |

|

|

Principles of Value: The appraiser must show current _____________ in the appraisal. |

Highest and best use Not includes in a CMA/BPO/BOV |

|

|

Principles of Value: Anticipation |

Future benefits determined the present value |

|

|

Principles of Value: Supply and Demand |

1. Supply: number of avails is me properties a) price moves opposite of supply; when supply goes up, prices goes down 2. Demand: number of properties that will be purchased a) price moves with demand; when demand goes up, price goes up. |

|

|

Principles of Value: Supply and demand determine _______________. |

Sale price and rental rates |

|

|

Principles of Value: Substitution |

The most important principle in appraisal!!! It is the basis of the sale comparison approach and used in all three approaches. The lowest price with the highest value will sell first.

|

|

|

Principles of Value: Conformity |

Values tend to move toward surroundings. |

|

|

Principles of Value: Conformity Regression |

The value per square foot of over improved property declines |

|

|

Principles of Value: Conformity Progression |

The value per square foot of under improved property increases |

|

|

Principles of Value: Conformity Values are most stable when ___________. |

All properties are similar |

|

|

Principles of Value: Contribution |

The value of an improvement is not what it costs to build but what it adds to the market value of the property |

|

|

Principles of Value: Contribution ____________: improvements add more value than they cost (rare) ____________: improvements add less value than they cost (common) |

Increasing returns Decreasing returns |

|

|

Methods of Valuation |

1. Sales comparison/market data approach 2. Cost approach 3. Income approach |

|

|

Methods of Valuation: Sales Comparison/market data approach |

The most important method for residential property and vacant land The estimate of value is based on adjusted sale prices of similar properties the recently sold. |

|

|

Methods of Valuation: Sales Comparison/market data approach Area of Improvement |

Area is determined by the exterior dimensions of the finishes, heated living area |

|

|

Methods of Valuation: Sales Comparison/market data approach Subject Property |

Property being appraised Never adjust the subject property |

|

|

Methods of Valuation: Sales Comparison/market data approach Comparable Sales (comps) |

Similar properties that have recently sold. Adjustments always made to the comparable or comps Most recent comps preferably sold within 6 months and no more then 12 months |

|

|

Methods of Valuation: Sales Comparison/market data approach Property elements of comparison and adjustment |

1. Lot size 2. Area of the improvement based upon exterior dimensions 3. Configuration (number of beds, baths, fireplaces, garage stalls, etc) 4. Date of sale of the comparable 5. Days on market 6. Amenities 7. Not the agreed upon purchase price or initial acquisition cost of subject property |

|

|

Methods of Valuation: Sales Comparison/market data approach Adjustments |

Adjustments are only made to the comparables If comps is superior to the subject, subtract If comps are inferior to the subject, add |

|

|

Methods of Valuation Cost Approach |

The most important method for unique or special purpose properties, such as churches and schools |

|

|

Methods of Valuation: Cost Approach Formula |

Cost to build - accrued depreciation + land value = estimated value |

|

|

Methods of Valuation: Cost Approach Reproduction Cost New |

Cost to rebuild an exact replica with same or highly similar material a) used for historic properties and rarely used |

|

|

Methods of Valuation: Cost Approach Replacement Cost New |

Cost to replace improvement with the same functionality/utility Commonly used |

|

|

Methods of Valuation: Cost Approach Depreciation |

Is the loss of value Does not affect land |

|

|

Methods of Valuation: Cost Approach What are the 3 types of depreciation? |

Physical (deterioration) Functional obsolescence Economic obsolescence |

|

|

Methods of Valuation: Cost Approach Physical (deterioration) |

1. Deferred maintenance 2. Wear and tear |

|

|

Methods of Valuation: Cost Approach Functional Obsolescence |

Design or other inadequacies: obsolete equipment, poor floor plan; etc Examples: outdated electrical system and plumbing fixtures or a four bedroom home with one bathroom |

|

|

Methods of Valuation: Cost Approach Economic Obsolescence ( locational or external obsolescence) |

1. External factors (location or surroundings) Example: property is in a flight path from a nearby airport 2. Outside the property boundaries - typically not curable |

|

|

Methods of Valuation Income Approach |

Used for properties that generate income Example: apartment buildings, shopping centers, or office buildings |

|

|

Methods of Valuation: Income Approach Investors determine what they will pay based on the rate of return or ____________. |

Capitalization rate |

|

|

Methods of Valuation: Income Approach The capitalization rate can be determined by complaining the ________ and _______. |

Net income and selling price |

|

|

Methods of Valuation: Income Approach Capitalization |

Process of converting estimated future net income into present value |

|

|

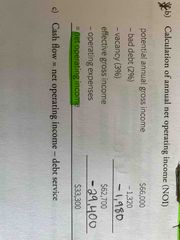

Methods of Valuation: Income Approach Calculation of annual net operating income (NOI) |

Back (Definition) |

|

|

Methods of Valuation: Income Approach Capitalization Math Formula |

Income = rate x value Or I = R X V I = net operating income (NOI) R = capitalization rate V = value |

|

|

Methods of Valuation: Income Approach Gross rent multiplayer |

A simple alternative to capitalization and primarily for single - family rental homes |

|

|

Methods of Valuation: Income Approach Gross rate multiplier formula |

Value = GRM x RENT |

|

|

Methods of Valuation: Income Approach To solve GRM problems what must match? |

Rent must match the given multiplier A) if given an annual multiplier and a monthly rent, convert monthly rent to annual rent (x 12) B) if given monthly multiplier and annual rent, convert annual rent to monthly rent (/12) MATCH THE MULTIPLIER |

|

|

Reconciliation |

The appraiser reconciles the three approaches to value to arrive at a final estimate of value |

|

|

How does the appraiser determine a subjects estimated value? |

Each approach is weighed. It is not an average. |

|

|

The appraiser consider all three approaches but gives the most weight to the approach that is the __________________. |

Most appropriate for the property type. |