![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

8 Cards in this Set

- Front

- Back

|

Discuss the price discovery role performed by the September 2010 BAB futures market with reference to the data in Table 13.3.

|

On 10 June 2010, the September 2010 BAB futures contract traded at a price of 95.12 revealing that the markets expectation of 90-day rates in September was 4.88% at that time.

Futures contracts that are actively traded can be expected to perform the price discovery function On 10 June nearly 40,000 contracts (each with a face value of $1m) were traded, which represents a very active market and thus 4.88% is probably the ‘fair’ value for the September forward rate for 90-day BABs. The discovery of short-term forward yields performed in the BAB futures market informs FRA and swap dealers. (p. 338, p. 347) |

|

|

Explain how the clearinghouse accepts each trader’s default risk. Refer to novation and marking to market in your answer.

|

-The clearinghouse accepts the default risk of traders through its margin payment requirements and by becoming a counterparty to each trader through a process known as novation.

-The clearinghouse requires traders to pay initial margins into their margin accounts and to maintain the balance in these accounts in excess of their nominal loss through a system of daily resettlement (based on the process of ‘marking-to-market’). -By being the counterparty to each trader, the clearinghouse has the authority to closeout a trader’s position should the trader default on a margin payment. -These processes have been very successful in managing default risk within the futures market. (pp. 341-342) |

|

|

Describe the main features of BAB futures contracts.

|

-The contract item is 90-day BABs with a face value of $1 million

-It has one of four contract dates per year (March, June, September, December) for the next five years the settlement date being the second Friday of the contract month -On each settlement date the BABs potentially would be issued and thus (for example) the March contract is for March BABs -Its quotation price for trading is 100 minus the yield as a % pa to two decimal points and -the contracts are deliverable. (pp. 344-345) |

|

|

Explain the trades a borrower would make in the BAB futures market when hedging the interest rate risk arising from a $50 million one-year bill facility using 90-day bills starting in June 2010.

|

-The borrower’s physical exposure is the sale of BABs with a face value of $50m in June 2010 to be rolled over in September 2010, December 2010 and March 2011.

-In order to hedge this exposure the borrower requires a strip of futures contracts each consisting of short positions in 50 BAB futures contracts with settlement dates in June 2010, September 2010, December 2010 and March 2011. -The borrower would closeout each short position on its settlement date by taking a long position in 50 BAB futures contract with the relevant settlement date -For example, the borrower would take a long position in 50 June 2010 BAB futures on the settlement date in June (closing out its short position in 50 June 2010 BAB futures) and the cash settlement would have the effect of delivering the forward rate. (p. 348) |

|

|

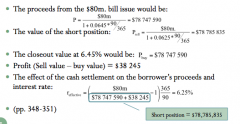

Demonstrate how in February a position in the March BAB futures contract (trading at 93.75) can be used to lock in a forward rate for a planned issue of $80 million worth (face value) of 90-day bank bills assuming that the market rate for the March settlement date is 6.45%

|

|

|

|

Explain how an active equity portfolio manager could use the SPI futures contract to avoid the effect of a 500-point fall in the index on their portfolio. Assume the value of the portfolio is 50 times that of the value of the June 2010 SPI futures contract shown in Figure 13.3.

|

-Given that the portfolio is worth $5,551,250 (50*4441*$25), the manager would take a short position of 50 contracts in the June contract at 4441.

-If the index falls by 500 points before mid June the closeout (this is of course a ‘buy’ trade at 3941 (4441-500) will achieve a profit of $625,000 (500*$25*50) which offsets the fall in the value of the actual share portfolio, such that the manager has a portfolio that has a lower value but has $625,000 to offset this fall. (pp. 358-359) |

|

|

Explain the trading arrangements in the futures market and show the consequence of a trader closing out its long position in a contract prior to the contract’s settlement date.

|

-The futures market is an order-driven market that uses an automatic trading system.

-Orders can be limit or at-market, and are entered by brokers or by traders using online trading systems provided by their brokers. Trades are made when a buy order matches a sell order, and unmet limit orders are stored. -Settlement is arranged by the market’s clearinghouse. -Traders with futures positions are able to closeout their position prior to the contracts’ settlement date through a ‘reversing’ transaction. -So the holder of a long position would close-out that position by selling the same number of contracts with the same contract item and settlement date. This results in the buyer (another trader) taking over the long position. (p. 340) |

|

|

Explain when the September 2010 BAB futures contract would trade at the spot 90-day rate in the money market.

|

-BAB futures become spot contracts on their last day of trading and so on this day the contracts can be closed out at the same rate as BABs can be transacted at in the money market.

-On this day the futures contracts become deliverable 90-day BABs -For the September 2010 contracts this would be prior to 12 noon on the business day immediately prior to the second Friday in September. (p. 349) |