![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

20 Cards in this Set

- Front

- Back

|

What does NPV stand for? |

Net present value |

|

|

What does IRR stand for? |

Internal rate of return |

|

|

What is the discounted cash-flow (DCF)? |

A technique which takes into consideration the time value of money |

|

|

What are the 2 types of DCF? |

1. Net present value (NPV) 2. Internal rate of return (IRR) |

|

|

What is NPV? |

A measure of the value or worth added to the company by carrying out a project |

|

|

What can NPV tell us? |

If the NPV is positive, the project merits further consideration but if it's negative than the project isn't a good option. Also when ranking projects, preference should be given to the project with the highest NPV. |

|

|

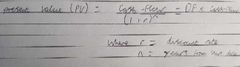

What is the equation for present value(PV)? |

|

|

|

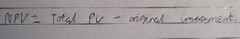

What is the equative for the net present value (NPV)? |

|

|

|

What is the profitability index? |

The ratio of the total present value to initial investment |

|

|

What can the profitability index (PI) tell us about the acceptability of a project? |

If PI is greater than 1 then accept the project. If it's less than 1 then decline the project |

|

|

What is the internal rate of return (IRR)? |

The value of the discount factor when the NPV is zero |

|

|

How can IRR be calculated? |

By using a NPV against discount rate graph |

|

|

What do you want the IRR to be for a project? |

As high as possible since the IRR is a measure of return on investment |

|

|

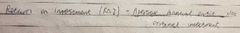

What is the equation for return on investment (ROI)? |

|

|

|

What are the advantages of the payback method? |

1. It's simple and easy to use 2. It reduces the projects exposure to risk and uncertainty by selecting the project with the shortest payback period 3. The uncertainty of future cash-flows is reduced 4. It's an appropriate technique to evaluate high technology projects where the technology is changing quickly and the project could run the risk of running out of stock 5. It's an appropriate technique for projects where the market demand tends to change frequently 6. Faster payback has a favourable short-term effect on earnings per share |

|

|

What are the disadvantages of the payback method? |

1. It doesn't consider the time value of money 2. It doesn't take into account when the cash-flow comes in. For example, a project with a high initial cash-flow would be ranked equally with a project that had a late income, if their payback period was the same 3. It isn't well suited for long term projects which take a while to make money 4. It isn't suitable for long term projects where the effects of differential inflation and interest rates could significantly change the results 5. The figures are based on the cash-flow only. All other financial and non-financial data is ignored |

|

|

What is the advantages of the return on investment (ROI) method? |

1. It's simple and easy to use 2. It considers the cash-flow over the whole project 3. The total outcome of the investment is expressed as profit and percentage return on investment. Both parameters are readily understood by management |

|

|

What is the disadvantage of ROI? |

It averages out the profit over successive years. An investment with high initial profits would be ranked equally with a project with high profits later of the average profit was the same |

|

|

What are the advantages of net present value? |

1. It introduces the time value of money 2. It expresses all future cash flows in today's values which enables direct comparisons 3.it allows for inflation 4. It looks at the whole project what if analysis using different values 5. It gives a more accurate profit and loss forecast than non-DCF calculations |

|

|

What are the disadvantages of NPV? |

1. Its accuracy is limited by the accuracy of the predicted future cash-flows 2. It's biased towards short term projects 3. It excludes non-financial data 4. It uses a fixed interest rate over the duration of the project |