![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

13 Cards in this Set

- Front

- Back

|

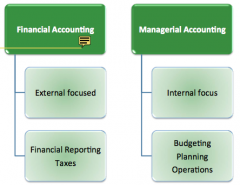

Financial Accounting vs. Managerial Accounting |

|

|

|

3 Primary Financial Statements |

-balance sheet -income statement -statement of cash flows |

|

|

**Assets Calculation |

assets = liabilities + owner's equity |

|

|

Balance Sheet |

Provides a real-time view of the financial position of a business. It discloses the resources owned by an entity (practice; department) and the claims against those resources. Snapshot of financial health of the company at that very moment. |

|

|

Assets |

-cash -accounts receivable ---money that you will be getting in the future (e.g., from Medicare for a service already given) -inventory -furniture & fixtures -equipment -real estate |

|

|

Liabilities |

-accounts payable ---money that you will have to pay out (e.g., gas bill, hearing aids because you pay 30-90 days after you place the order) -salaries payable -short-term notes -long-term notes |

|

|

Owner's Equity |

-capital stock ---owner equity of the business - has a value (may not necessarily be what you can sell it for) -retained earnings |

|

|

**Working Capital Calculation |

Working Capital = Current Assets - Current Liabilities

-measures ability to cover your obligations/bills -should be a positive number -AuD practices usually have minimal working capital needs -slow payment from 3rd party payors can put a strain on liquidity |

|

|

*Current Ratio Calculation |

Current Assets / Current Liabilities

-expresses working capital in a ratio form -no set rule for audiology practices |

|

|

*Working Capital Needs Calculation |

-average monthly operating expenses * 1.5 + (5000 * # of physical locations) |

|

|

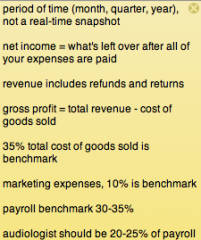

Income Statement |

-profit & loss -provides summary of a business' performance over a period of time, detailing revenues, expenses, and net income |

|

|

Income Statement tells you/things to look out for... |

|

|

|

Statement of Cash Flows |

|