![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

48 Cards in this Set

- Front

- Back

|

Front (Term) Money |

Back (Definition) Any commodity or token that is generally acceptable as a means of payment. |

|

|

Front (Term) Money serves 3 functions: |

Back (Definition) -Medium of exchange -Unit of account -Store of value |

|

|

Front (Term) Medium of Exchange |

Back (Definition) Any object that is generally accepted in exchange for goods and services. |

|

|

Unit of Account |

An agreed measure for stating the prices of goods and services. |

|

|

Store of Value |

It can be held and exchanged later for goods and services. |

|

|

Money consists of: |

-Currency -Deposits at banks and other depository institutes |

|

|

Currency |

The notes and coins held by individuals and businesses. |

|

|

Deposits |

Also counted as money because the owners of the deposits can use them to make payments. |

|

|

Measures of Money |

M1: Currency held by individuals and businesses plus chequable deposits owned by individuals and businesses M2: Consists of M1 and all other deposits. |

|

|

M1 & M2 |

M1: Is money as chequable deposits and currency are a means of payment. M2: Is money as they can be easily converted into a means of payment. |

|

|

What is money? |

-Deposits are money but cheques are not -Credit cards are not money |

|

|

Depository Institute |

Private firm that takes deposits from households and firms and makes loans to other households and firms. -Chartered banks, credit unions & causes populaires, trust and mortgage loan company |

|

|

Chartered Bank |

Private firm to receive deposits and make loans. |

|

|

Chartered Bank |

Private firm to receive deposits and make loans. |

|

|

Credit Unions & Caisses Populaires |

Cooperative organization that receives deposits from and makes loans to its members. |

|

|

Trust & Mortgage Loan Companies |

Privately owned depository that receives deposits, makes loans and acts as a trustee for pension funds and estates. |

|

|

Trust & Mortgage Loan Companies |

Privately owned depository that receives deposits, makes loans and acts as a trustee for pension funds and estates. |

|

|

What depository institutions do: |

-Cheque clearing -Account management -Credit cards -Internet banking -Most is from depositors used to make loans and buy securities to earn higher interest rate than that paid to depositors |

|

|

Reserves |

Notes & coins in a depository's vaults or its account at the Bank of Canada. |

|

|

Reserves |

Notes & coins in a depository's vaults or its account at the Bank of Canada. |

|

|

Liquid Assets |

Government of Canada treasury bills and commercial bills. |

|

|

Reserves |

Notes & coins in a depository's vaults or its account at the Bank of Canada. |

|

|

Liquid Assets |

Government of Canada treasury bills and commercial bills. |

|

|

Securities |

Government of Canada bonds and other bonds such as mortgage-backed securities. |

|

|

Reserves |

Notes & coins in a depository's vaults or its account at the Bank of Canada. |

|

|

Liquid Assets |

Government of Canada treasury bills and commercial bills. |

|

|

Securities |

Government of Canada bonds and other bonds such as mortgage-backed securities. |

|

|

Loans |

Commitments of funds for an agreed-upon period of time. |

|

|

Depository Institutions: |

-Create liquidity -Pool risk -Lower cost of borrowing -Lower cost of monitoring borrowers |

|

|

Bank of Canada |

Canada's central bank that is: -The banker to banks and government -Lender of last resort -Sole issuer of bank notes |

|

|

BOC Assets & Liabilties |

Asset: -Government securities -Loans to depository institutes Liabilities: -Bank of Canada notes -Depository institution deposits |

|

|

Open Market Operation |

BOC conducts and open market operation, which is the purchase or sale of government securities by the BOC in the open market. |

|

|

Limiting Factors in Quantity of Loans |

-Monetary base -Desired reserves -Currency drain ratio |

|

|

Monetary Base |

Size of the base limits the total quantity of money a banking system can create. |

|

|

Desired Reserves Ratio |

Reserves a bank plans to hold. Ratio of reserves to deposits the bank plans to hold. |

|

|

Currency Drain Ratio |

Leakage of bank reserves into currency. The ratio of currency to deposits. |

|

|

Excess Reserves |

Bank's actual reserves exceed its desired reserves, causing an excess. |

|

|

Money Multiplier |

Ratio of the change in the quantity of money to the change in monetary base. |

|

|

Influences on Money Holding |

-The price level -The nominal interest rate -Real GDP -Financial innovation |

|

|

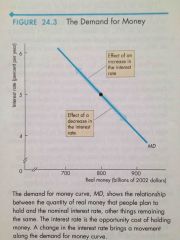

Demand for Money |

Relationship between the quantity of real money demanded and the nominal interest rate when all other influences on the amount people wish to hold remain the same. |

|

Front (Term) Demand for Money |

Back (Definition) Interest Rate: -Increase-Up along curve -Decrease-Down along curve |

|

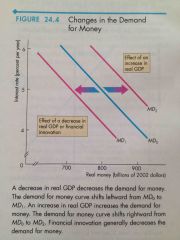

Front (Term) Changes in Money Demanded |

Back (Definition) -Increase-Shift right -Decrease-Shift left |

|

|

Short Run & Change in Money Supply |

If there is a surplus of money and people hold more than quantity demanded they enter loan able funds market and buy bonds. If it decreases they sell bonds. |

|

|

Long-Run Equilibrium |

The price level will rise by the same percentage as the rise in the quantity of money. |

|

|

Quantity Theory of Money |

Proposition that in the long-run, an increase in the quantity of money brings an equal percentage increase in the price level. |

|

|

Quantity Theory of Money |

Proposition that in the long-run, an increase in the quantity of money brings an equal percentage increase in the price level. |

|

|

Velocity of Circulation |

Average number of times a dollar of money is used annually to buy the goods and services that make up GDP. |

|

|

Inflation Rate |

=Money Growth Rate - Real GDP Growth Rate |