![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

51 Cards in this Set

- Front

- Back

|

fiscal policy

|

CONGRESS & PRESIDENT

changes in FED TAXES & PURCHASES affects NATIONAL ECONOMY thru AGGREGATE DEMAND by changing PRICE LEVEL & REAL GDP |

|

|

govt. purchases

|

spending by fed. govt. on goods & services (salaries of fed. govt. agencies, purchase of aircraft carriers)

RESULT IN PROD. OF NEW GOODS & SERVICES NO TRANSFER PAYMENTS |

|

|

govt. expenditures

|

fed. govt. purchases + all other govt. spending

(1) interest on national debt (payments to holders of the bonds the fed. govt. has issued to borrow $ (2) grants to state & local govts. (payments made by fed. to support govt. activity @ state & local levels) (3) TRANSFER PAYMENTS (Social Security, Medicare, unemployment insurance, programs to aid poor) - largest & fastest-growing category |

|

|

automatic stabilizer

|

govt. spending & taxes that automatically increase/decrease along w/ business cycle

happens w/o govt. action expansion - employment & incomes increasing, govt. spending on unemployment insurance payments decrease & govt. collection of taxes increase b/c ppl. are paying higher taxes on higher incomes opp. for recession |

|

|

discretionary fiscal policy

|

govt. takes actions to change spending/taxes

|

|

|

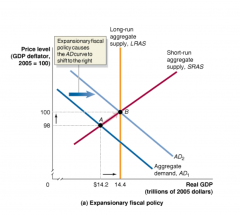

expansionary fiscal policy

|

increasing govt. purchases/decreasing taxes

increases AD actual GDP < potential GDP real GDP & price level rise |

|

|

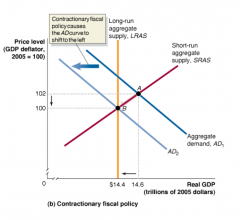

contractionary fiscal policy

|

decreasing govt. purchases/increasing taxes

reduces AD actual GDP > potential GDP real GDP & price level fall |

|

|

timing

|

potential fiscal policy problem

delays caused by legislative process can be very long even after a change has been approved, it takes time to implement |

|

|

crowding out

|

potential fiscal policy problem

decline in private expenditures as result of increase in govt. purchases |

|

|

fed. govt. budget

|

relationship btwn. EXPENDITURES & TAX REVENUE

|

|

|

budget deficit

|

govt. expenditures > tax revenue

increases during wars & recessions (b/c of automatic stabilizers: wages & profits fall -> tax revenues fall, govt. increases spending on TR; discretionary fiscal policy: increasing spending/cutting taxes to increase AD; usually takes place w/o Congress or president taking action) |

|

|

budget surplus

|

govt. expenditures < tax revenue

|

|

|

fed. govt. debt.

|

total value of US Treasury bonds outstanding

deficit: Treasury must borrow funds from investors by selling Treasury securities, debt grows surplus: Treasury pays off existing bonds, debt shrinks |

|

|

Fed. Reserve

|

in charge of managing $ SUPPLY & INTEREST RATES (2 monetary policy targets)

|

|

|

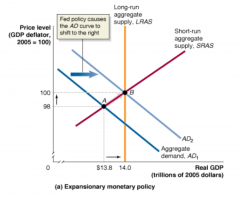

expansionary monetary policy

|

FOMC orders expansionary policy -> $ supply increases & interest rates fall -> I, C, & NX increase -> AD shifts right -> real GDP & price level rise

|

|

|

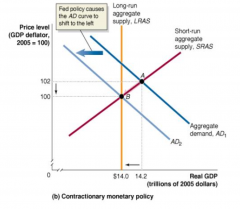

contractionary fiscal policy

|

FOMC orders contractionary policy -> $ supply decreases & interest rates rise -> I, C, & NX decrease -> AD shifts left -> real GDP & price level fall

|

|

|

real GDP

|

value of final goods & services evaluated @ base-yr. prices

hold prices constant (PURCHASING POWER of dollar remains same from 1 yr. to next) which makes it a better measure than nominal GDP greater than nominal in yrs. before base yr. & less for yrs. after base yr. & equal in base yr. drawback - over time prices may change |

|

|

nominal GDP

|

value of final goods & services evaluated @ current yr. prices

|

|

|

GDP

|

included: domestically prod. final goods & services (including capital goods), new construction of structures, changes to inventories (GDP = final sales + changes to inventories)

not included: intermediates goods & services, inputs, used goods, financial assets likes stocks & bonds, TR, foreign-prod. goods & services |

|

|

frictional unemployment

|

short-term that arises from process of matching workers w/ jobs

low unemployment rate, periods of unemployment are shorter, suggesting most of unemployment is frictional opp. during high unemployment rate |

|

|

structural unemployment

|

arises from persistent mismatch btwn. skills & attributes of workers & requirement of jobs

last longer periods b/c workers need time to learn new skills |

|

|

cyclical unemployment

|

caused by a business cycle recession

|

|

|

natural rate of unemployment

|

full-employment rate of unemployment

normal rate of unemployment frictional + structural |

|

|

labor force

|

sum of unemployed & employed workers in economy

BLS CLASSIFIES PPL. WHO DON'T HAVE A JOB & WHO AREN'T ACTIVELY LOOKING FOR A JOB AS NOT IN THE LABOR FORCE |

|

|

GDP deflator

|

measure of price level

calculated by dividing nominal GDP by real GDP x 100 measure of avg. level of prices of FINAL GOODS & SERVICES in economy BROADEST MEASURE OF PRICE LEVEL & may not clearly indicate how inflation affects typical household |

|

|

Consumer Price Index (CPI)

|

avg. of prices of goods & services purchased by typical urban family of 4

COST-OF-LIVING INDEX |

|

|

Producer Price Index (PPI)

|

avg. of prices received by prods. of good & services @ all stages of prod. process

measure prices of raw materials, intermediate goods, or final goods used by prods. instead of consumers |

|

|

consumption

|

increases when: current disposable income, household wealth, & expected future income increases

decreases when: price level and interest rate increases |

|

|

investment

|

increases when: expectations of future profitability & profits (cash flow) increases

decreases when: interest rate & taxes increase |

|

|

net exports

|

increases when: price level in US relatively lower than other countries

decreases when: growth rate of US GDP relatively higher than other countries & when the exchange rate btwn. dollar & other currencies is more valuable in US currency |

|

|

movement along AD curve

|

CHANGES IN PRICE LEVEL only affects QUANTITY OF GOODS & SERVICES DEMANDED in economy, NOT DEMAND FOR GOODS & SERVICES

|

|

|

shift AD curve left

|

increase in INTEREST RATES (MONETARY POLICY, raise cost to firms & households of borrowing, reducing C & I)

decrease in DISPOSABLE INCOME (INCOME + TR - T) decrease in EXPECTED PROFITS FROM FIRMS decrease in EXPECTED FUTURE INCOME increase in PERSONAL TAXES (FISCAL POLICY, C falls when T rises) increase in BUSINESS TAXES (FISCAL POLICY, I falls when T rises) increase in VALUE OF DOMESTIC CURRENCY RELATIVE TO FOREIGN CURRENCIES (M rise, X fall -> reducing NX) decrease in GOVT. PURCHASES increase in growth rate of domestic GDP relative to foreign GDP (M increase > X -> reduces NX) |

|

|

shift AD curve right

|

increase in govt. purchases (FISCAL POLICY)

increase in households' expectations of their future incomes (C increases) increase in firms' expectations of future profitability from I (I increases) |

|

|

shift SRAS curve right

|

DOESN'T SHIFT B/C OF FISCAL OR MONETARY POLICY

increase in labor force/capital stock (SHIFTS LRAS RIGHT; more output can be prod. @ every price level) increase in productivity (SHIFTS LRAS LEFT, costs of prod. output fall) |

|

|

shift SRAS curve left

|

increase in future price level (workers & firms increase wages & prices)

increase in workers & firms adjusting to having previously under-estimated the price level (workers & firms increase wages & prices) increase in expected price of important natural resource (cost of prod. output rise) |

|

|

key assets on bank's balance sheet

|

reserves

loans holdings of securities (US Treasury bills) |

|

|

assets

|

value of anything owned by firm

|

|

|

liabilities

|

value of anything firm owes

s |

|

|

stockholders' equity

|

diff. btwn. total value of assets & total value of liabilities

represents value of firm if it had to be closed, all its assets were sold, & all its liabilities were paid off CORP.'S STOCKHOLDERS' EQUITY REFERRED TO AS ITS NET WORTH |

|

|

reserves

|

deposits a bank keeps as cash in vault/on deposit w/ Fed. Reserve

NOT LOANED OUT OR INVESTED not part of currency circulation |

|

|

required reserves

|

reserves a bank is legally required to hold, based on checking account deposits

banks are required by law to keep as reserves 10% of checking account deposits |

|

|

required reserve ratio

|

min. fraction of deposit banks are required by law to keep as reserves

|

|

|

excess reserves

|

reserves that banks hold over & above legal requirement

to guard against possibility that many depositors may simultaneously make w/drawls from their accounts |

|

|

consumer loans

|

households

|

|

|

commercial loans

|

businesses

|

|

|

deposits

|

banks' largest liability

checking accounts, savings accounts, & certificates of deposit |

|

|

monetary policy tools

|

that Fed. uses to manage $ supply

open market operations discount policy reserve requirements |

|

|

open market operations

|

buying & selling of Treasury securities by Fed. Reserve to control money supply

|

|

|

FOMC

|

TO INCREASE $ SUPPLY: directs TRADING DESK located @ Fed. Reserve Bank in NY, to BUY US Treasury securities from public; when the sellers deposit the funds into their banks, reserves rise -> starts process of increasing loans & checking account deposits -> increases $ supply

TO DECREASE $ SUPPLY: directs trading desk to SELL Treasury securities; when buyers pay for them w/ checks, reserves fall -> starts contraction of loans & checking account deposits -> reduces $ supply |

|

|

discount policy

|

discount rate: rate @ which Fed. loans out $ to banks as lender of last resort

rate increased - more expensive for banks to borrow in order to meet required reserve amounts -> causes banks to be more careful about reserves, keep more reserves, & make fewer loans -> decreases checking account deposits & $ supply when banks borrow from Fed., banks' reserves increase |

|

|

reserve requirements

|

when Fed. reduces required reserve ratio, it converts required reserves into excess reserves

|