![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

347 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

Qualified plans |

qualified if it complies with the provisions of section 401 of the internal revenue code

Includes profit-sharing plans, defined contribution plans, defined benefit plans and 401K plan.

|

|

|

|

What are the four categories of statutory employees? |

1. HOMEWORKERS 2.Agent-Drivers or commission-drivers 3. LIFE INSURANCE SALESPERSON 4. Traveling or City Salesperson

|

HALT |

|

|

What are the 2 categories of statutory nonemployees? |

1. Qualified real estate agents 2. Direct Sellers |

|

|

|

What is the ABC test used to determine? |

The ABC test is used by many states to determine a worker's employment status under state unemployment insurance laws. |

|

|

|

Full time life insurance salespersons paid solely by commission are exempt from what taxes? |

FUTA TAX ONLY |

|

|

|

What form is used to determine the employement status of an individual for federal income and employment tax purposes? |

FORM SS-8 |

|

|

|

Name of the program Employers can use to verify the employment authorization status of new hires with US Citizenship and Immigration Services? |

The E-Verify Program is used to authorize employment status of new hires. |

|

|

|

How long must an Employer retain Form I-9? |

3 years from the date of hire or 1 year from |

|

|

|

What is the Reasonable Basis Test? |

Even though a worker meets the definition of an employee under the common law test, an employer may treat a worker as an independent contractor exempt from federal payroll tax laws if it has a "reasonable basis" for doing so, as determined by section 530 of the Revenue Act of 1978. |

|

|

|

The Backup Withholding Rate for Independent Contractor payments in excess of 600.00 in 2014 |

28% |

|

|

|

List 4 primary government agencies that set guidelines or rules for determining worker status |

IRS

STATE WAGE & HOUR AGENCIES. |

|

|

|

IRS Worker Misclassification Penalties: For non-withholding |

the penalty is 1.5% of the wages paid |

|

|

|

IRS Worker Misclassification Penalties: Failure to file an information return |

|

|

|

|

IRS Worker Misclassification Penalties: For not withholding SS and Medicare |

the penalty is 20% of the employee's share |

|

|

|

IRS Worker Misclassification Penalties: For failure to file returns |

penalty is 40% |

|

|

|

What does IRCA mean?

|

Immigration Reform and Control Act |

|

|

|

What factors are not considered when IRS makes determinations on worker misclassification?

|

If employee is Part Time or Full Time, location of work, and hours of work. |

|

|

|

The responsibility for determining the employment status of a person rest with whom? |

Employer |

|

|

|

Which Document Proves Both the Right to Work and Identity? |

Passport |

|

|

|

What is the ABC test used to determine? |

The ABC test is used by many states to determine a worker's employment status under state unemployment insurance laws. |

|

|

|

What are the 3 parts to the ABC test? |

1. Absence of control. The worker is free from control or direction in performing the work both by agreement and in reality. |

|

|

|

Reciprocity Agreements require employers to withhold state income tax only for their employees states of residence. |

True |

|

|

|

Employers who claim Section 530 status for their workers because a significant segment of their industry classifies workers the same way must show at least 50% of the industry are independent contractors |

FALSE - Employers must show the IRS that more than 25% of its industry treated workers as independent contractors |

|

|

|

Employees who fall into statutory employee categories must have the following requirement : |

Agree with employer all services are to be performed by worker |

|

|

|

Supplemental Wages |

Supplemental wages are wage payments to an employee that are not regular wages. They include, but are not limited to, bonuses, commissions, overtime pay, payments for accumulated sick leave, severance pay, awards, prizes, back pay, retroactive pay increases, and payments for nondeductible moving expenses. Other payments subject to the supplemental wage rules include taxable fringe benefits and expense allowances paid under a nonaccountable plan |

|

|

|

Engaged to be waiting |

If the employee restricts an employees behavior and does not permit any personal business or activities to be conducted while waiting to begin work, the employee is considered to be engaged to be waiting , these hours would be included in the employees time worked when figuring overtime hours |

|

|

|

Waiting to be engaged |

The law does not require you to include the time spent oncall if the employee is not physically at the employers premises but is merely asked to stay by the phone and is allowed to conduct personal business ,in this situation the employee is waiting to be engaged, time spent waiting to be engaged would not be included in calculating overtime pay |

|

|

|

2 Year Record Retention - FLSA Supplemental |

Timecards Wage rate tables Work time schedules Order, shipping and billing records Records of additions to our deductions from wages |

|

|

|

All of the following are reasons payroll keeps records except: A. compliance with laws B. Demonstrate accuracy of paychecks. C. Demonstrate security of payroll D. Periodic reporting |

C. Records are used to determine compliance, calculate pay and produce reports |

|

|

|

What must be kept in a master file? |

Back (Definition) |

|

|

|

Following types of records can be combined with payroll data in an integrated system except: A. Personnel B. Benefits C. Purchasing D. Human resources |

C. Integrated databases include payroll, benefits and other human resources data |

|

|

|

Employees Withholding Allowance Certificate |

Form W-4. Employees provide their marital status and withholding allowances when they fill out this form. |

|

|

|

The amount of federal income tax withheld from employees paycheck is determined by prescribed formulas these formulas take into account: |

Employees wages Pay period frequency Marital status Withholding allowances |

|

|

|

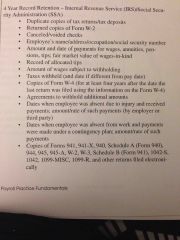

4 Year Record Retention - IRS/SSA |

Back (Definition) |

|

|

|

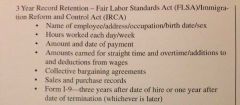

3 Year Record Retention - FLSA/IRCA |

Back (Definition) |

|

|

|

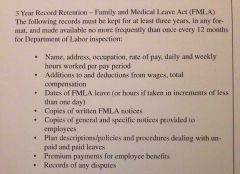

3 Year Record Retention - FMLA |

Back (Definition) |

|

|

|

W-4: Death of spouse |

Does not affect withholding marital status until the next year |

|

|

|

Employers do not have to compensate employees for attending meetings when all of the following for conditions apply: |

1. Attendance is outside the employees normal working hours. 2. Attendance is voluntary 3. The event is not directly job-related 4. The employee performs know a productive work during this period |

|

|

|

W-4: Notify employees by 12/1 |

Employer should notify employee by December 1 that they need to file an amended form W-4 if they're filing status on number of allowances has changed |

|

|

|

W-4: When you must change withholding |

You must reflect the change in withholding no later than the first payroll Ending on or after the 30th day after you received the amended form W-4 |

|

|

|

Invalid Form W-4 |

Invalid when there is any alteration, addition, or deletion till language or format of the form also invalid if the employee indicates in any way that it is false. Do not use an invalid W-4 form to calculate withholding, withhold as if the employee were single and claiming zero allowances |

|

|

|

W-4: Exempt |

Employees may be exempt if they had no taxes due last year and then are expected to be due this year. |

|

|

|

W-4: Who is exempt? |

Unless employees are claimed as a dependent, those who are less than the standard deduction in ordinarily claim to be exempt from withholding. Although earning less than the standard deduction does not guarantee that an employee qualifies for an exemption. |

|

|

|

W-4: Dependents |

In total income exceeds $1000 and includes more than 350 per year, an employee who is being claimed as a dependent by their parents or someone else cannot claim exemption from withholding. Unearned income includes interest earned on a savings account, dividends, capital games, or other investment income |

|

|

|

W-4 Exempt employees must refile each year |

Employees who want to continue their exempt status each year must file a new form W-4 with their employer by February 15 of each year. If no valid form W-4 is filed by the deadline, you must withhold based on the last valid W-4 in your file, if there is none, then you must withhold as if they were single with no allowances |

|

|

|

W-4: Employers Responsibilities Not responsible to verify the accuracy of an employee's marital status or withholding allowances; responsible for: |

Ensuring that form W-4 is complete Withholding as claimed Requesting that employees change form W-4 when appropriate Record Keeping Submitting Form W-4 to the IRS Lock-in Letters Checking forms claiming exempt status |

|

|

|

Requesting that employees change form W-4 when appropriate |

IRS regulations say that employers should remind their employees by December 1 to submit revised forms W-4 if your marital status number of allowances has changed |

|

|

|

W-4: Record Keeping |

Keep all forms W-4 on file for at least four years for the last tax return filed using information from the form W-4. Note the last tax return filed using using information from the W-4 is the employees personal income tax return (form 1040 that is filed on April 15) |

|

|

|

Major Payroll tasks: |

compliance with federal state and local regulations Timely and accurate issuance of paychecks Periodic reporting Record retention Control and security |

|

|

|

W-4: submitting forms W forward to the IRS |

You are not required to send forms W-4 to the IRS unless IRS specifically request the form. |

|

|

|

W-4: Lock In Letters |

If the IRS sends the employer a lock in the letter specifying an employees marital status and or withholding allowances, the employer must change the employees W-4 form status for the first payroll period beginning after 60 days have passed from the date on the IRS letter. This gives the employee time to try to convince the IRS that the employee is entitled to the marital status and or allowances on the form W-4 |

|

|

|

W-4 Form: Checking forms claiming exempt status |

Ensure the employee understands the rules for being exempt. An employee who submits a false form W-4 may be subject to a $500 penalty |

|

|

|

Deducting income taxed from pension income (form W-4P) |

Recipients of distributions such as qualified pension plans, profit sharing plans and other qualified deferred compensation can decline to have taxes withheld by filing form W-4P. Recipients also file form W-4P to specify the number of withholding allowances and any additional amount you want withheld. If they do not file form W-4P, you must figure withholding as if the recipient were claiming married with three allowances |

|

|

|

Federal income tax that is withheld from an employees regular wages is determined by formula that uses all of the following items except: A. Employees taxable wages B. Pay period C. A flat rate D. Marital status |

C. Only when paying a supplemental wage can an employer use the optional flat rate method to calculate federal income tax |

|

|

|

When does an employee first complete form W-4? A. When first hired B. When they need to have federal income tax withheld C. When the employee is married D. When the employee is divorce |

A. |

|

|

|

When must an employee amend their W-4? A. After receiving a pay increase B. After receiving overtime pay C. After becoming divorced D. After their spouse quits working |

C. An employee must file a new form W-4 when a change in status occurs that requires additional withholding. |

|

|

|

Which events require an employee to fill an amended form W-4 within 10 days? A. Legally separated from his or her spouse who was claimed as an allowance. B. Employees spouse quits job to stay home with the new baby C. Death of a spouse D. Adoption of a child |

A. When allowances increase( such as when a child is adopted or a spouse stops working) less tax is withheld; an employee can fill out a new form W-4 any time,however when allowances decrease the employee must fill out a new form W-4 within 10 days. In case of the death of a spouse, marital status and allowances are not affected until the next year. However it is not the employers responsibility to track or require these changes. |

|

|

|

What conditions can an employee claim exemption from withholding on form W-4? A. Receiving overtime pay B. Had no tax liability last year and expects no tax liability this year C. Anticipates receiving a bonus D. An employee takes her first job |

B. |

|

|

|

Employee claims exempt from withholding on his form W-4. To continue this exempt status for the next year a new form W-4: A. Must be filed by December 31 B. Must be filed by February 15 of the following year C. Is not necessary D. Is illegal unless Henry has more than 10 allowances |

B |

|

|

|

What must be kept in a master file? |

. |

|

|

|

Record Retention: EEOC |

EEOC Regulations require that employers keep all personnel or employment records for one year. If an employee is involuntarily terminated, his/her personnel records must be retained for one year from the date of termination. |

|

|

|

Record Retention: ADEA |

Under ADEA recordkeeping requirements, employers must also keep all payroll records for three years. Additionally, employers must keep on file any employee benefit plan (such as pension and insurance plans) and any written seniority or merit system for the full period the plan or system is in effect and for at least one year after its termination. |

|

|

|

FLSA: Child Labor Restrictions |

14 and under- bid in from working, other than on family farms. 14 and 15- are not allowed to work more than three hours per day or 18 hours per week while school is in session. During school sessions, the minor can only work between the hours of 7 AM and 7 PM. When school is not in session, the minor may not work more than eight hours per day or 40 hours per week and only between the hours of 7 AM and 9PM. |

|

|

|

Media |

Records may be maintained in any legible retrievable form, electronic storage, microfilm microfiche, hard copy. There is no federal requirement to maintain a paper copy of these records. |

|

|

|

Updating the master file? |

They are no federal requirements for how often the file must be updated. You may want to consider updating the files more often than once per month. |

|

|

|

Record Retention: 5 Years - OSHA |

Log of all occupational illness and accidents Other OSHA records |

|

|

|

FLSA: Child Labor Restrictions |

14 and 15-year-olds may not work in hazardous jobs. Minors under 16 years of age can perform certain work in retail, service and gasoline service Stabley Schmidts, that may not work in a job defined by the US department of labor as hazardous, manufacturing, or mining. Actors or performers and news paper carriers under the age of 14 are exempt from child labor restrictions. Miners 16 and 17 years of age are only limited to not working and hazardous jobs. Employers may be fine up to 11,000 for each violation of the child labor laws and up to 50,000 for violations that lead to the death or serious injury of a minor |

|

|

|

Income Withholding for Support form: |

Form used for income withholding in tribal, interstate and intrastate cases as well as all child support orders which are initially issued in the state on or after January 1, 1994 and all child support orders which are initially issued or modified in the state for January 1, 1994 if arrearages occur. |

|

|

|

Phantom Employee |

Is "hired" and set up in the payroll system. This phantom employee is then paid normally no excess hours or overtime to make the employee stand out on an edit report. |

|

|

|

Additional Medicare tax withholding |

In addition to withholding Medicare tax at 1.45%, you must withhold a .9% additional Medicare tax from wages you pay to an employee in excess of $200,000 in a calendar year. You are required to begin withholding additional Medicare tax in the period in which she pay wages if excess of $200,000 to an employee and continue to withhold it each pay period until the end of the calendar year. this tax is only imposed on the employee. There is no employer share of additional Medicare tax. |

|

|

|

Correcting Form 941 or Form 944: |

If you discover an error on a previously filed form 941 or 944, make the correction using form 941X ,adjusted employers quarterly federal tax return or claim for refund on form 944X, adjusted employers annual federal tax return. forms 941X and 944X are used by employers to claim refunds or abatements of employment taxes rather than 843 claim for refund and request for abatement. |

|

|

|

File by January 31 |

Form 1099 Form W-2 Form 941 Form 944 Form 940 Form 945 |

|

|

|

Form 941 - Employers Quarterly Tax return |

File form 941 for the 4th quarter of the previous calendar year and deposit any unde posited income, social security and Medicare taxes. You may pay these taxes with Form 941 if your total tax liability for the fourth quarter is less then 2500.

*If you timely deposited all taxes when you do, you have 10 additional calendar days from January 31 to file their appropriate return. |

|

|

|

Form 944 - Employers annual federal tax return |

File form 944 for the previous calendar year instead of form 941 if that I RS has notify you in writing to file form 944 and pay any undeposited income, Social Security and Medicare taxes. you may pay these taxes with 4944 if your total tax liability for the year is less then 2500.

*If you timely deposited all taxes when you do, you have 10 additional calendar days from January 31 to file their appropriate return. |

|

|

|

Form 945 - Annual Return of Withheld Federal Income Tax |

Use Form 945 to report withheld federal income tax from nonpayroll payments. Nonpayroll payments include: Pensions (including distributions from tax-favored retirement plans, for example, section 401(k), section 403(b), and governmental section 457(b) plans), and annuities; Military retirement; Gambling winnings; Indian gaming profits; Voluntary withholding on certain government payments; and Backup withholding. |

|

|

|

By February 15 |

Ask for a new form W-4 from each employee who claimed exemption from income tax withholding last year |

|

|

|

On February 16 |

Claiming exemption from withholding expires. Begin withholding taxes for any employee who previously claimed exemption but has not given you a new form W-4 for the current year. If the employee does not give you new form withhold tax base on the last valid form W-4 you have for the employee that does not claim exemption from withholding if one does not exist withhold as if he or she is single with zero withholding allowances. If the employee furnishes a new form W-4 claiming exemption after February 15 you may apply the exemption to the future wages but do not refund taxes withheld while the exempt status was not in place. |

|

|

|

File by February 28 |

Paper Form 1099 Paper Form W-2 Paper Form W-3 Paper Form 8027 |

|

|

|

File By March 31 |

File Electronic Form: 1099, 8027 with IRS

File Electronic Form: W-2 with SSA

|

|

|

|

By April 30, July 31, October 31 and January 31 |

Deposit FUTA Tax due if is it more than 500

File Form 941 and deposit any undeposited income, Social Security and Medicare taxes. |

|

|

|

Before December 1 |

New forms W-4. Remind employees to submit a new form W-4 if their marital status or withholding allowances have changed or will change for the next year |

|

|

|

What are supplemental wages? |

Supplemental wages are wage payments to an employee that are not regular wages. They include, but are not limited to, bonuses, commissions, overtime pay, payments for accumulated sick leave, severance pay, awards, prizes, back pay, retroactive pay increases, and payments for nondeductible moving expenses. Other payments subject to the supplemental wage rules include taxable fringe benefits and expense allowances paid under a nonaccountable plan. How you withhold on supplemental wages depends on whether the supplemental payment is identified as a separate payment from regular wages. |

|

|

|

Withholding on supplemental wages when an employee receives more than $1 million of supplemental wages from you during the calendar year. |

If a supplemental wage payment, together with other supplemental wage payments made to the employee during the calendar year, exceeds $1 million, the excess is subject to withholding at 39.6% (or the highest rate of income tax for the year). Withhold using the 39.6% rate without regard to the employee's Form W-4. In determining supplemental wages paid to the employee during the year, include payments from all businesses under common control. |

|

|

|

Employer obligations for temporary agency |

Responsibility is to temp agency for a fee, agency hires, screens, trains, pays. Temp agency responsible for withholding and remitting taxes not employer. |

|

|

|

Employer obligations for leased employee |

Employer pays fee and sets pay level, supervises, hires and fires. Leasing company is responsible for withholding and remaining taxes not the employer |

|

|

|

Verification of social security numbers: |

SSNVS- Social security number verification service E- Verify |

|

|

|

Independent Contractors: |

Need to provide a TIN and a W9 Taxes withholding not required Receive a 1099 MISC |

|

|

|

Completing I-9 |

Employee completes section 1 Within 3 days employer completes section 2 Retention: 3 years or 1 after termination |

|

|

|

Classification is based on responsibilities, not titles. T or F |

True |

|

|

|

Tips & Tip Credit |

Tips are subject to taxation if $20 a month If employee makes $30 a month in tips, employers may pay less than the minimum wage $2.13 and apply a tip credit of $5.12. $2.13 wage + $5.12 tip credit = $7.25. Must be allowed by state law |

|

|

|

Form SS-8 |

Determination of work or status for purposes of federal employment taxes and income tax withholding |

|

|

|

Minimum wage requirements |

Federal - $7.25 per hour, employees under age 20 can be paid $4.25 per hour in their first 90 calendar days on the job.

State - most state set their own minimum-wage higher than $7.25 per hour. If the employer is covered by both state and federal law and the two are not the same, then the employer is required to pay the higher minimum-wage based on the state in which the employee works. |

|

|

|

Shift premiums/shift differentials |

Additional compensation based on schedules Must be considered in regular rate of pay Employer determines terms |

|

|

|

Shift premiums/shift differentials |

Additional compensation based on schedules Must be considered in regular rate of pay Employer determines terms |

|

|

|

Paid time off |

Employers are not required to pay sick, holiday or vacation Does not need to be included in regular pay calculation If worked employer does not need to pay a premium Companies determine PTO policies |

|

|

|

Shift premiums/shift differentials |

Additional compensation based on schedules Must be considered in regular rate of pay Employer determines terms |

|

|

|

Paid time off |

Employers are not required to pay sick, holiday or vacation Does not need to be included in regular pay calculation If worked employer does not need to pay a premium Companies determine PTO policies |

|

|

|

Bonuses |

Supplemental wages taxed at 25% May be considered in regular rate of pay calculation Incentive payments to increase productivity |

|

|

|

Regular Rates - Included |

Base pay for hours worked, non-discretionary bonuses, fair market value of non-cash items, shift premiums, production bonuses, cost-of-living adjustments, retroactive pay,all payments not excluded by law |

|

|

|

Regular Rates - Excluded |

Reimbursed expenses, overtime in excess of FLSA requirement, employer benefit plan contributions, PTO pay for one worked hours, special occasion gifts, discretionary bonuses, stock options. |

|

|

|

Fire protection and law-enforcement |

No OT premiums due until employees exceed ratio 171 hours to 28 days For fire protection, ratio is 212 hours to 28 days |

|

|

|

Defining time worked: Included |

Call back show up: case-by-case basis, happens when an employee is called back after end of the day, or they show up and there is no work available. Waiting to work: Employee is engaged to work and performs no personal activity. |

|

|

|

Defining time worked: Included |

Call back show up: case-by-case basis, happens when an employee is called back after end of the day, or they show up and there is no work available. Waiting to work: Employee is engaged to work and performs no personal activity. |

|

|

|

Defining time worked: Not included |

On call: Employee is on call but not on premises.

Preparing to work: Employee is arranging their desk, signing on to work, etc. |

|

|

|

Defining time worked: Travel Time |

Home to work – not compensable Home to work in different state – compensable, may exclude usual travel time Travel as hard of daily duties – compensable Travel away – must be overnight. Paid if during work hours, not paid if passenger and not during work hours. |

|

|

|

Defining time worked: Seminars/meetings |

Employer not obligated to compensate employee if all four conditions apply: 1. attendance is outside normal work hours 2. Attendance is voluntary 3. Not directly job-related 4. No productive work is performed |

|

|

|

Invalid W-4 |

Alterations, flat dollar amount and percentages are invalid |

|

|

|

W4P |

Withholding certificate for pension or annuity payments Default is married with three exemptions Additional amount is allowed |

|

|

|

Employers restricts employees behavior and does not permit any personal business or activities to be conducted while: A. Preparing for a week B. Engage to be waiting C. Waiting to be engaged D. Employee commences their principal activities |

B |

|

|

|

FMLA applies to all private and public employers with 25 or more employees. T or F |

False |

|

|

|

FMLA- Family and medical leave act What is it? |

FMLA guarantees employees up to 12 weeks of unpaid leave within a 12 month period. eligible employees can have up to total 26 weeks in a 12 month.

|

|

|

|

FMLA- Family and medical leave act What is it? |

FMLA guarantees employees up to 12 weeks of unpaid leave within a 12 month period. eligible employees can have up to total 26 weeks in a 12 month.

|

|

|

|

FMLA- Family and medical leave act Who's eligible? |

Applies to all private and public employers with 50 or more employees, including part-timers and employees on leave or suspension, but not laid off employees. The definition of employee is the same as that under the fair labor standards act. An employee at a facility with less than 50 employees May still be eligible for the leave benefits, if the employer has at least 50 employees working within a 75 mile radius.

*Must have been employed by the employer for at least 12 months. *Must have worked at least 1250 hours within the previous 12 month period.. |

|

|

|

FMLA- Family and medical leave act What is it? |

FMLA guarantees employees up to 12 weeks of unpaid leave within a 12 month period. eligible employees can have up to total 26 weeks in a 12 month.

|

|

|

|

FMLA- Family and medical leave act Who's eligible? |

Applies to all private and public employers with 50 or more employees, including part-timers and employees on leave or suspension, but not laid off employees. The definition of employee is the same as that under the fair labor standards act. An employee at a facility with less than 50 employees May still be eligible for the leave benefits, if the employer has at least 50 employees working within a 75 mile radius.

*Must have been employed by the employer for at least 12 months. *Must have worked at least 1250 hours within the previous 12 month period.. |

|

|

|

FMLA- Family and medical leave act What kind of leave does it cover? |

*Newborn, newly adopted or foster child *Child, spouse or parent with serious medical condition *Employee with serious medical condition *Military member or active or pending duty |

|

|

|

Employees who are covered by the fair labor standards act minimum wage and overtime requirements are called: |

Non exempt |

|

|

|

Those who are not covered by the fair labor standard acts minimum wage and overtime requirements are called: |

Exempt employees |

|

|

|

Components governed under FLSA |

*guarantees employees a minimum wage *Requires employers to pay an overtime premium *Limit when miners can work *Provides equal pay protection |

|

|

|

Record Retention Two Years |

Supplemental - Time Cards, wage rate tables, work time schedules, records of additions to or deductions from wages |

|

|

|

Batch Processing |

Data is coded and collected Computer center processes the data with similar jobs to be processed Generally no axis to view as processing Less expensive than real-time But not as timely as real time |

|

|

|

Real Time Processing |

Online system Calculations and results are automatic Immediate availability View and interact with the processing |

|

|

|

What may cause reporting issues when a payment is voided in a subsequent quarter? A. Claim for refund from the IRS or other tax authorizes may need to be filed; W-2c may need to be issued. B. Make possible correction to state unemployment insurance reporting and taxation; Correct entries to the accounting records. C. A & B D. None of the above |

C |

|

|

|

Batch processing is always inactive. True or False |

False |

|

|

|

Payroll compliance means the ability to do the following: A) Deal with federal, state and local taxation. B) Deal with withholding, depositing and reporting requirements on a timely basis. C) Pay employees as the FLSA and state wage and hour rules require. D) All of the above. |

D |

|

|

|

What is Zero Balance Account? A) Special payroll checking account. B) Reconciliation between the payroll register and the general ledger account. C) When all payroll checks have cleared the account, the account balance should be zero. D) None of the above. |

C |

|

|

|

Once data is entered in the system, it will calculate, update records and return results to the user so it’s available immediately is known as: A) Batch processing. B) Online real-time processing. C) Journal entry. D) System edits. |

B |

|

|

|

Payroll bank accounts should be reconciled how often for outstanding and stale dated checks? A) Quarterly. B) Daily. C) Monthly. D) Weekly. |

C. Monthly |

|

|

|

Prenotification is mandatory. True or False |

False |

|

|

|

An open check number may signify that a manual check has: A) Been returned to the Payroll Department. B) Not been recorded or an employee as not cashed the check. C) Been stored under lock and key. D) Been recorded or an employee has cashed the check. |

B. |

|

|

|

What are benefit advantages for employees paid by Payroll cards? A) Cost savings, Independence, Prestige B) Freedom, Convenience, Time, Safety C) A & B D) All of the above |

C. A & B |

|

|

|

What information is required to set up direct deposit? A) Bank statement B) Type of account (Checking or Savings) C) Account and Bank Routing number D) B & C |

D. B & C |

|

|

|

What are the two most common withholding methods used for calculating withholding on regular wages? A) Percentage & Wage Bracket Methods. B) Optional & Wage Bracket Methods. C) Mandatory Flat Rate & Optional Methods. D) Aggregate & Percentage Methods. |

A) Percentage & Wage Bracket Methods. |

|

|

|

Wage attachments take precedence over voluntary deductions. True or False |

True |

|

|

|

What publication that give exempt amounts is provided with form 668-W? A) 596 B) 15 C) 1494 D) 521 |

C. 1494 |

|

|

|

Wages paid after death is subject to federal income tax withholding? True or False |

False |

|

|

|

Wages in excess of $200,000 are subject to what Medicare tax rate? (Pg. 3-12) A) 1.45% B) 2.35% C) 7.45% D) 6.20% |

B. 2.35% |

|

|

|

The maximum amount of an employee’s compensation subject to child support withholding is governed by: A) IRS B) DOL C) FLSA D) CCPA |

D. CCPA |

|

|

|

What are disposable earnings? A) Net pay. B) Gross – less required deductions. C) Employee earnings (bonuses, lump sum payments but not including tips). D) B & C. |

D. B & C |

|

|

|

When grossing up, the taxes paid by the employer are included in the employee’s taxable income. True or False |

True |

|

|

|

What are the federal limits for withholding garnishments? A) 25% of the debtor’s disposable pay. B) 15% of the debtor’s disposable pay. C) The amount by which the employee’s disposable pay for the week exceeds 30 times the federal minimum wage. D) A & C |

D. A & C |

|

|

|

Employers are required to withhold social security tax from its employees and pay the employer’s portion amount up to the maximum each year, regardless if the employee’s previous earnings are from another employer. True or False |

True |

|

|

|

A computerized payroll system can help the department accomplish the following tasks: |

-complying with federal/state/local regulations and company policies -timely and accurate issuance of pay checks/direct deposit -periodic reporting -Record retention -maintaining control and security |

|

|

|

Employee self-service |

The ability to update data Ability to view and print pay statements and W-2 forms |

|

|

|

Interfaces |

Refers to the point where two distinct data processing elements meet. It can be a connector between two pieces of hardware, between two software systems, or between hardware and software. Went to systems are in your face, the systems are organize so they can talk to each other |

|

|

|

Control Procedures |

Edits Balancing and reconciliation Documentation Apply Department Procedures Data Auditing and Validating Batch Controls Correction Procedures Accumulator Totals Upgrading/Updating the Payroll System Apply Departmental Procedures

|

|

|

|

Control Procedures |

Edits Balancing and reconciliation Documentation Apply Department Procedures Data Auditing and Validating Batch Controls Correction Procedures Accumulator Totals Upgrading/Updating the Payroll System Apply Departmental Procedures

|

|

|

|

The integrity of the data can be verified by: A. Balancing and reconciliations B. System edits C. Validity checks |

A. Balancing and reconciliations ensure that amounts in the system are correct. |

|

|

|

Checking inputs or outputs against predetermined constraints is called: A. internal control B. validity edit C. system safeguard D. parallel test |

B. One way to check for errors is to build validity edits into the system. The system automatically checks to make certain all the inputs and outputs are within normally accepted ranges. If not, operator is alerted. |

|

|

|

Payroll tax liability accounts should be reconciled at least weekly. True or False |

False. Reconciliations of liability accounts should occur at least monthly. |

|

|

|

Payroll documentation accomplishes all of the following except: A. Provide uniformity B. Simplify training C. Ensure procedures are followed D. Provide a reference tool |

C. Payroll management is entrusted with ensuring procedures are followed. |

|

|

|

Every month, all of the following records are reconciled except: A. Payroll liability accounts B. Master record of payments C. Payroll Bank checking account D. validity edits |

D. Monthly account reconciliations help validate the integrity of the information and your payroll system |

|

|

|

When system generated totals do not agree to batch control totals, what must occur? A. Continue processing B. Finding the cause and correcting the error C. Delay finding the error until more time is available. D. Document the difference and continue processing |

B. When the system is not in balance, it must be corrected before proceeding. |

|

|

|

Direct Deposit Reversal Procedures: |

An employee may be paid and air, which means a reversal may need to be made which will simply retrieve the funds from the account where the deposit was initially made and return such funds to your corporate account. A single item reversal is always for the exact amount of the initial deposit and must be executed within five days from the original payment date (settlement date) |

|

|

|

Impact of federal banking holidays: |

If direct deposit falls on a banking holiday, the employers policy will dictate when employees will be paid. If the policy requires payment prior to the normal payday, ACH processing will occur one day earlier. |

|

|

|

Knowledge of pay frequency/method governance |

State laws govern the method of payment.each states requirements must be reviewed if a change in payment method is being considered.each state requires employers to pay employees within a certain timeframe.States also limit the time. Between the end of the pay period and pay day. Most states do not allow employers more than 10 days between the end of the pay period and payday. |

|

|

|

Knowledge of Escheat laws: |

Most states dictate how long the employer must hold unclaimed wages if an employee does not cash your paycheck. Typically, the unclaimed amounts must be submitted to a state agency for further retention.State law and company procedures will dictate how and when unclaimed wages are recorded and then transferred to the appropriate state agency. |

|

|

|

Three pieces of information needed for direct deposit: |

Employees bank routing number Type of account Account number |

|

|

|

Chronological sequence for events associated with direct deposit: |

Company collects employee information Company creates ACH file Originating financial institution transmits data Settlement through ACH Employee receives deposit and his or her bank account |

|

|

|

Regulate Payments made by direct deposit: |

The consumer financial protection in euros regulation D allows the use of electronic funds transfer. NACHA provides the operational rules for EFT. State laws facilitate the payment process. |

|

|

|

Knowledge of allowed pay vehicles: Checks |

Many firms pay employees from a special payroll checking account. This facilitates reconciliation between the payroll register, the payroll checking account and the general ledger account. When all payroll checks have cleared the account, the account balance should be zero, that's the name of these types of accounts-zero balance account. Those responsible for entering payroll data are not responsible for canceling voiding checks. Procedure for keeping track of used check numbers should be implemented. Open check numbers must be reconciled. And open number may signify that a manual check has not been recorded or in employee has not cashed the check. Harrell checks should be stored under lock and key. Proper segregation of duties for the handling of checks should be in place and approved by her internal auditing department. Such steps can help guard against theft, fraud, or other misappropriations. |

|

|

|

Knowledge of allowed pay vehicles: Direct Deposit |

Direct deposit or EEFT allows employers to deposit employees pay electronically in their bank account. There is no paper or check signing equipment to safeguard and no checks to get lost. Direct deposit is more advantageous to employers then employees. One of the drawbacks for the employer is the loss of the float time on payroll funds. |

|

|

|

Knowledge of allowed pay vehicles: Pay cards |

Terrell cards are prepaid, host-based, stored value cards that can act as a tool to facilitate direct deposit payroll for employees, whether or not they have a current banking relationship. |

|

|

|

ACH Process: |

Employee authorization Company set up ACH file (Automatic Clearing House) ODFI - originating depository financial institution Post on us - new ACH file sent RDFI - receiving depository financial institution Posting to account - Descriptive Statement |

|

|

|

Knowledge of pre-notification process |

The first cycle of the direct deposit can be processed with a zero amount to verify that the bank code and financial institution account are accurate and that the bank is a member of the ACH. The receiving depository financial institution should notify the originating depository financial institution, which will notify the employer any discrepancies before the direct deposit is lie. Pre-notifications are optional. |

|

|

|

Knowledge of pre-notification process |

The first cycle of the direct deposit can be processed with a zero amount to verify that the bank code and financial institution account are accurate and that the bank is a member of the ACH. The receiving depository financial institution should notify the originating depository financial institution, which will notify the employer any discrepancies before the direct deposit is lie. Pre-notifications are optional. |

|

|

|

Knowledge of transit routing numbers: |

Verify that there are nine digits and the routing number.The entire routing number can be verified against a listing of financial institutions, which can be obtained from the originating depository financial institution. |

|

|

|

Knowledge of direct deposit authorization |

The direct deposit process is regulated by the consumer financial protection Bureau regulation E, NACHA's ACH operating rules and state laws. When an employee authorizes a direct deposit, they are authorizing a credit to their bank account. Most companies direct deposit authorization forms also include authorization to debit the account when an over payment has been made. |

|

|

|

Direct deposit reversal timing: |

You do not need employee authorization to correct a mistake. No debit authorization from employees are necessary for single entry reversals made in the exact amount of the original payment that are executed within the five banking days timeframe for corrections. |

|

|

|

Knowledge of stopping payment of checks: |

Voiding the payment in the payroll system is not sufficient to meet all organizational requirements and may cause reporting issues when a payment is avoided in a subsequent quarter. Avoided payment may require: - W-2c to be issued - A claim for refund from the IRS or other tax authorities - correction to state unemployment insurance reporting and taxation - correcting entries to the accounting records |

|

|

|

Payroll compliance means: |

Ability to deal with federal, state and local taxation, withholding, depositing and reporting requirements on a timely basis. Compliance requires ensuring employees are paid as the FLSA and state wage and hour rules require. |

|

|

|

Computerized systems help with these tasks: |

Compliance with regulations and policies Timely and accurate paychecks or direct deposit Periodic reporting Record retention Control and security |

|

|

|

Knowledge of batch totals: |

Batching the data into groups of similar data, developing totals of the data to be entered and then comparing the totals of the data entered into the system to the previously developed totals is one method of batch controls. This method ensures that the amounts that are anticipated to be entered have been entered. However it does not ensure that the data have been correctly entered into the system. |

|

|

|

Integrated system |

Ideal processing environment, has all data elements and a graded in a single database and available to all users at any time. Reduces data integrity issues, since information is entered and maintained in one location. Eliminates timing issues, since information is always assessible Eliminates interfacing |

|

|

|

Correction Processes: |

If system generated totals from the data do not agree with either batch Controls or other controls, procedures must be in place to determine the error, it's cause and how it should be corrected. Once erroneous data has been identified, it must be corrected. This will require developing batch of controls for the data correction entries. |

|

|

|

Online processing |

And online real-time system, as the data are entered into the computer, the system does calculations, updates records and returns the results to the user so they are available immediately. The operator has direct online computer communication with the data as the program is being run. |

|

|

|

System data edits: |

Edit functions can be installed in the payroll system to check for errors and sometimes correct them. Such validity edits verify that the system is operating normally by alerting you went inputs or outputs are outside accepted ranges. Alert for terminated employees with paychecks Alert for new hires so that you can verify their salary and hours An error message is no paycheck is generated for an active employee A special edit to identify compensation over a specified amount or payment generated for inactive employee alert for overtime hours or hours under standard time Alert when the rate of pay is changed |

|

|

|

Knowledge of system security |

Your dad a security system should offer the following three things: File security against unauthorized access Password protection so only authorized personnel can gain access to protected information Regular back up of data and off-site storage of data |

|

|

|

Purpose to reconcile |

Interface and integrated systems require extensive reconciliations to ensure the data shared between the systems is accurate |

|

|

|

Purpose of physical pay out |

For better protection against having phantom employees, conduct a surprise physical pay off or pay out at least once a year, preferably more often |

|

|

|

Ability to validate test results |

Reviewing a sample of the data for appropriateness and identify data problems that fall within the parameters of the system edits but are not actually valid |

|

|

|

Constructive Receipt |

Wages are considered paid when the employee actually receives the paycheck or when it is constructively received. A paycheck that has been set aside for employee is considered constructively received at that time. |

|

|

|

Taxable Income |

Backpage awards Bonuses Commissions Company vehicle for personal use Severance pay vacation pay Employer paid Transit passes and transportation in commuter Highway vehicle in excess of $130 a month Employer paid parking greater then 250 a month Gifts, gift cards, prizes and other awards Fringe benefits unless specifically excluded Group legal services Group term life insurance over 50,000 Overtime pay regular wages Tips Non-accountable reimbursed business expenses Non-cash fringe benefits, unless excluded by internal revenue code Sick pay and disability benefits Nonqualified moving expenses |

|

|

|

Nontaxable compensation |

Dependent child care assistance up to $5000 under a section 129 plan Company vehicle for business use only De minimis fringes Disability benefits employee contributions Educational assistance for job related courses no limit Group term life insurance premiums $50,000 or less Medical, dental, health plans employer contributions No additional cost Fringe benefits Qualified employee discounts on employer goods and services Qualified moving expenses Qualified transportation fringe benefits Reimbursed business expenses if accounted for in a timely manner Working condition fringe benefits which would be deductible if paid by employee Non-job related education assistance up to $5250 Long term care insurance Workers compensation benefits Health savings accounts |

|

|

|

Repayment Wages- overpayment and repayment in the same calendar year. |

Employee overpaid and repayment occurs in the same year, The repayment requested is the employees net overpayment. Employer can claim a refund from the IRS for the federal income, Social Security and Medicare taxes withheld from the employees hey and employers Social Security and Medicare taxes. The overpayment and repayment can be netted together on form W-2 |

|

|

|

Repayment Wages- overpayment and repayment occurs in a calendar year subsequent to when the payment was made in error |

The repayment requested is that employees rolls over payment less Social Security and Medicare taxes. The employer can claim a refund from that I RS for the employees withheld Social Security and Medicare taxes and the employers Social Security and Medicare taxes. The overpayment and repayment cannot be netted together for work hoarding on form W-2. The employee will deduct the repayment on the subsequent years federal income tax return to obtain a refund of their federal income tax |

|

|

|

Tips |

Considered supplemental wages. If employee receives and reports $20 or more in tips and a calendar month, federal income, Social Security and Medicare taxes must be withheld from the tips as well as cash wages. Employer must also pay the employers portion of the Social Security and Medicare taxes and pay federal unemployment tax on the tip amount. Withholding can be done at the optional flat rate of 25% or the tips can be added to the employees wages when calculating federal income tax withholding. For income tax purposes an employer may choose to treat tips as regular wages. |

|

|

|

Factors affecting withholding: |

Marital status Withholding allowances Pay frequency Regular or supplemental wages Pre-tax deductions |

|

|

|

Withholding methods |

Most common: Wage bracket method Percentage method

For supplemental wages, an optional flat tax rate of 25% can be used and under some circumstances a mandatory 39.6% rate must be used |

|

|

|

Wage bracket method |

When calculating manually, the quickest and easiest method is the wage bracket tables from. IRS circular E. When employees have wages in excess of the last wage bracket, use the percentage method. |

|

|

|

Percentage method |

Commonly used in computerized payroll systems. There are no limits on the amount of wages to which the percentage method can be applied. The amounts shown in the percentage method tables are net wages after the deduction for total withholding allowances. To use the percentage method, you first must reduce the employees taxable wages by the number of allowances. |

|

|

|

Supplemental wages |

Include any payment of wages by an employer that is not regular wages. Wages that very from payroll. To payroll. Based on factors other than the amount of time worked, such as commissions and bonuses, are supplemental wages if they are paid in addition to regular wages. If you pay supplemental wages such as bonuses, commissions, and overtime pay, along with regular wages but do not specify the amount of each, withhold income tax as if the total were a single payment for the payroll. |

|

|

|

If you pay supplemental wages separately or combined them with regular wages but specify the amount for each and your payroll records you have two choices: |

Use optional flat rate method at 25% or Use the aggregate method |

|

|

|

Optional flat rate method |

Multiply the amount of the supplemental compensation by 25% and withhold that some |

|

|

|

Aggregate method |

Add the supplemental wages to the regular wages, then figure the income tax as if the total were a single sum Subtract the tax already withheld from the regular wages Withhold the remaining tax from the supplemental wages |

|

|

|

Mandatory flat rate method at 39.6% |

When year to date supplemental wages reach $1 million, the supplemental tax rate required for supplemental wage payments in excess of $1 million is 39.6%. The aggregate method cannot be used when supplemental wage payments are in excess of $1 million. In this situation, withholding is based on the 39.6% rate. |

|

|

|

When to use aggregate method |

If the supplemental wages are sizable for example in the case of commissions or bonuses If there is no income tax withheld from the employees regular wages during the current or preceding years, you misuse the aggregate method, except when the employees year to date supplemental wages exceed $1 million. In that case, the mandatory flat 39.6 rate must be used. |

|

|

|

Optional flat rate and mandatory flat rate |

Do not consider marital status or allowances from the employees W-4 |

|

|

|

Rounding Federal Income tax withholding to the nearest whole dollar |

Amounts ending in 0.50 to 0.99 round up and 0.01 to 0.49 round down. 53.04 becomes 53 and 353.60 becomes 354. |

|

|

|

Aggregate Method |

1. Calculate taxes on the combined wages (regular wages and supplemental wages) 2. Calculate taxes on regular wages only 3. Subtract step two from step one – the remaining is considered supplemental wage tax amount. |

|

|

|

Medicare Wages |

When an employee's Medicare wages reached $200,000 the employee is subject to an additional Medicare tax of .9% for a total tax rate of 2.35% this only applies to the employee not the employer, the employers rate will remain at 1.45% |

|

|

|

Employer Loan Repayments |

The agreed repayment is a voluntary deduction and must be prioritized with other voluntary deductions by the employer. |

|

|

|

Involuntary deductions |

Are called wage attachments. Wage attachments are honored in the following priorities: Child-support orders Chapter 7 bankruptcy orders Other federal agency garnishments Federal tax levies State tax levies Creditor garnishments Student loan garnishment |

|

|

|

Form 668 – W, notice of Levy on wages, salary and other income: |

Take-home pay minus exempt amount documented and publication 1494. Deductions in effect prior to levy are okay No new voluntary deductions allowed In voluntary deductions mandated by company as condition of employment are okay, example the company becomes unionized and union dues are now due, this involuntary deduction would be okay Do not stop withholding until form 668 – D release of levy is received |

|

|

|

Amount exempt from a federal levy is based on: |

Filing status Number of exemptions claimed on part three of form 668 – W, divided by the number of payroll periods in the year. |

|

|

|

Child Support: Withholding |

Custodial parent can request the court to order immediate automatic withholding, even if the support payments are not past due. All support orders require immediate withholding unless specifically waived by court order or by the written consent of both parents. All orders that are in arrears will cause immediate withholding. |

|

|

|

Child Supports: Limits |

Order will state the amount to be deducted for child support. The maximum amount of an employees compensation that is subject to child support withholding is governed by the consumer credit protection act (CCPA) The maximum percentage that can be withheld is based on an employees disposable earnings (Gross earnings minus federal/state/local taxes). |

|

|

|

Child Supports: Limits |

Order will state the amount to be deducted for child support. The maximum amount of an employees compensation that is subject to child support withholding is governed by the consumer credit protection act (CCPA) The maximum percentage that can be withheld is based on an employees disposable earnings (Gross earnings minus federal/state/local taxes). |

|

|

|

Child Support: Maximum Withholding |

-if the employee supports a second family, the amount withheld cannot exceed 50% of the employees disposable earnings (55% if support is in arrears) -if the employee does not support a second family, the amount withheld cannot exceed 60% of the employees disposable earnings(65% if support is in arrears)

The maximum withholding allowed under a states law may be lower, but cannot be higher than the federal limits. |

|

|

|

Disposable earnings |

Disposable earnings equal all of an employee's earnings including bonus and other lump salary sum payments but not including tips after deducting taxes. Required deductions including federal, state and local taxes. |

|

|

|

Even though each state sets their own child support laws, they are limited by the federal laws in the following areas: |

-A state can allow the employer to deduct an administrative fee, in addition to the child support withholding, to offset the cost of maintaining the child support program. -Federal law requires the payment to be made within seven days of withholding the child support from the employees wages. State laws may require the payment to be made sooner. -Federal law requires the first withholding to be made with the first pay period 14 business days after the child support order is mail. State laws may require the first withholding to occur sooner |

|

|

|

Uniform interstate family support act (UIFSA) |

Clarifies the rules for processing out of state wage orders. |

|

|

|

Uniform interstate family support act (UIFSA) |

Clarifies the rules for processing out of state wage orders. |

|

|

|

Uniform interstate family support act (UIFSA) orders tells us: |

The duration and specific amount of periodic payments The person or agency to receive payments Medical support, stated as a specific amount or in order to provide coverage The amount of periodic payments of arrears and interest on arrears, stated as sum certain |

|

|

|

When administering the child support order, the rules from the employees work state are used when: |

Withholding the employers fee for processing an income withholding order. Determining the maximum amount permitted to be withheld from the obligor's income. Determining the time period within which they employer must implement the withholding order and forward the child support. There are orders for more then one obligee. |

|

|

|

Rejecting income withholding orders |

Since the IWO is a standard, OMB approved approved federal form sent to employers to withhold child support, there are very few changes that are acceptable. One of the reasons an employer can reject an income withholding order and return it to the sender is if the form is altered or contains invalid information. |

|

|

|

Acceptable changes to income withholding orders: |

The following may be changed on the form: Font Pagination Supplemental and or state specific information, such as state codes, maybe added |

|

|

|

Complying with more than one withholding order |

If an employee receives more than one child support withholding order state law decides how they must be handled. If the orders are from different states, the law in the state where the employee works generally applies. |

|

|

|

When an employee is over paid and the repayment occurs in the same year, the repayment requested is the employees: |

Net overpayment |

|

|

|

Examples of voluntary deductions |

Contributions to United Way or other charities Retirement programs Credit union payments Direct mortgage payments Health insurance premiums (outside of section 125 plans) Purchase of stock in the employers company Repayment of loans/advances from the employer Union dues/fees |

|

|

|

Charitable contributions thru payroll deductions need the following to substantiate: |

- A document by the employer showing the amount withheld from the taxpayers wages; this document could be form W-2 or the pay statement

- A document prepared by the charity, such as a pledge card. The taxpayer must have this document in their possession before filing personal income tax return. |

|

|

|

Limits for child support |

The maximum percentage that can be withheld is based on in employees disposable earnings.

Employee supports second family - amount withheld cannot exceed 50% of the employees disposable earnings (55% if in arrears)

Employee does not support second family - amount withheld cannot exceed 60% of the employee's disposable earnings (65% if support is in arrears) |

|

|

|

What is the easiest method to calculate federal income tax withholding on regular wages? |

Wage-bracket |

|

|

|

Multiple child support withholding orders: |

-State law governs the handling of multiple orders.

-Multiple state orders default to the state where the employee works. |

|

|

|

States resolve multiple order challenges in three ways: |

Allocate the available funds to each order on a percentage basis

Allocate available funds equally to all orders

Prioritize based on receipt of orders -current support orders calculated before arrearages. |

|

|

|

Standardized child support withholding order |

Developed by the federal office of child support enforcement with the assistance of the American payroll association. Used when notifying employers how to handle any child support withholding order.

Form list current child support obligations, amount in arrears and amounts due for medical support. It allows employers to make payments using a schedule that is consistent with their existing pay cycles. Form also indicates to whom checks are payable and the Payees address. |

|

|

|

eIWO - electronic Income Withholding Order |

Provides organizations the ability to receive and respond to withholding orders in an electronic format. Organizations receive a: A flat file that can be input directly into the payroll process or PDF format, which reduces the time between when the order is issued and when the employer receives it. |

|

|

|

Centralized support collections |

All states except South Carolina have implemented procedures allowing employers to send the child support payments they withhold from workers to A state disbursement unit within their state. Basically one unit to disburse payments. |

|

|

|

Creditor garnishments |

Involves a court order to attach the employees earnings in order to pay off a debt which the employee incurred. |

|

|

|

Consumer credit protection act |

Limits the amount of disposable earnings that can be garnished by creditors in a week. |

|

|

|

Consumer credit protection act |

Limits the amount of disposable earnings that can be garnished by creditors in a week. |

|

|

|

The withholding required by a garnishment cannot exceed the lesser of: |

25% of the employees disposable pay

The amount by which the employees disposable pay for the week exceeds 30 times the federal minimum wage. |

|

|

|

Higher education act |

Allows garnishment of employees wages to repay delinquent student loans. |

|

|

|

Higher education act |

Allows garnishment of employees wages to repay delinquent student loans. |

|

|

|

Student loan garnishments are subject to the following restrictions: |

-If garnishment is issued by state guarantee agency, no more then 15% of an employee's disposable earnings may be garnished unless the employee consents in writing to a higher percentage.

- employees may not be discharged or discriminated against because of a garnishment.

-employees must receive at least 30 days notice before withholding begins and must be given a chance to work out a repayment schedule with the agency guaranteeing the loan to avoid garnishment. |

|

|

|

Student loan garnishment: Employers responsibilities |

Department of education will send a wage garnishment order directing that employer to remit a portion of the debtor's wages. Employer will also be required to certify certain payment information. |

|

|

|

Maximum amount that should be withheld under a DCIA garnishment order is the lesser of: |

- The amount indicated in the order ( up to 15% of the debtor's disposable pay)

- The amount by which the debtors disposable pay exceeds 30 times the minimum wage. |

|

|

|

What does an employer use to calculate the amount to withhold for and IRS tax levy? A. disposable pay B. Net pay C. Take home pay D. Taxable wages |

C. Take home pay |

|

|

|

When does an employer stop deducting of federal tax levy from an employees wages? A. The amount of the levy is reached. B. The IRS issues Form 668-D C. The employee asks that the levy deduction be stopped. |

B. |

|

|

|

What does an employer use to calculate the amount to withhold for a child support withholding order? A. Disposable Pay B. Net pay C. Take home pay D. Taxable wages |

A. |

|

|

|

What does an employer use to calculate the amount to withhold for a creditor garnishment? |

Disposable pay |

|

|

|

The federal minimum wage is used when figuring the amount to withhold for a creditor garnishment? |

True |

|

|

|

Which of the following to ductions require an employee's authorization before it can be deducted from the employees check? A. Garnishments B. Levies C. Child support payments D. repayment of employer loans |

D., it's a voluntary deduction you need employees permission. |

|

|

|

Bankruptcy Orders |

One the employer receives an order from the trustee under a court approved plan, the employer must stop withholding on any garnishments against the employee except for child support orders. |

|

|

|

State Income Tax |

-calculated by applying the wage bracket or percentage method to that employees taxable wages. -some states calculate taxes as a flat percentage of the employees wages. -others use a percentage of the employees withheld federal income tax Each state has different requirements that must be followed and each state in which the employer operates should be contacted to determine that states requirements. |

|

|

|

Local Income Taxes |

More varied than state income taxes. Cities, counties, school districts and other governmental authorities may have the authority to enact a tax on income that employers are required to withhold, pay and report. Each local taxing authority has different requirements that must be followed, each locality and which the employer operates should be contacted to determine its requirements. |

|

|

|

State disability Taxes |

Calculated at a fixed percentage of the employees wages up to a maximum wage. Employers are required to retain records, file reports and deduct the appropriate taxes if they do not withhold the disability tax, the employer becomes responsible for paying the tax. |

|

|

|

State unemployment insurance tax withholding |

Three states have provisions for withholding state unemployment tax: Alaska, New Jersey and Pennsylvania The amount withheld is a flat percentage of wages up to the state unemployment wage base in Alaska and New Jersey. All Pennsylvania wages are subject to withholding of state unemployment tax.

|

|

|

|

State unemployment insurance tax withholding |

Three states have provisions for withholding state unemployment tax: Alaska, New Jersey and Pennsylvania The amount withheld is a flat percentage of wages up to the state unemployment wage base in Alaska and New Jersey. All Pennsylvania wages are subject to withholding of state unemployment tax.

|

|

|

|

Deceased employees |

-accrued wages, vacation pay and other compensation paid after the date of death are taxable. -For federal income tax it is not the employee who is subject to the tax but whoever receives the payment is taxed. Because of this requirement, wages paid after death are not subject to federal income tax withholding.

|

|

|

|

State unemployment insurance tax withholding |

Three states have provisions for withholding state unemployment tax: Alaska, New Jersey and Pennsylvania The amount withheld is a flat percentage of wages up to the state unemployment wage base in Alaska and New Jersey. All Pennsylvania wages are subject to withholding of state unemployment tax.

|

|

|

|

Deceased employees |

-accrued wages, vacation pay and other compensation paid after the date of death are taxable. -For federal income tax it is not the employee who is subject to the tax but whoever receives the payment is taxed. Because of this requirement, wages paid after death are not subject to federal income tax withholding.

|

|

|

|

If the amounts due the deceased employee are paid during the same year the employee dies: |

- social Security tax and Medicare tax must be withheld and the amounts paid must be reported as wages in boxes 3 (social Security wages) and box 5 (medicare wages) on the W-2 Form. - social Security and Medicare tax withholding is reported in box 4 (social Security tax) and 6 (medicare tax). The amount is not reported as federal income taxable wages and box one but must be reported on form 1099-Misc in box 3 (other income), using the name and tax payer identification number of the deceased employees estate or beneficiary. |

|

|

|

If the amounts are paid after the year of death: |

No Social Security or Medicare tax is withheld or paid and no reporting is done on form W – 2. The amount is reported on form 1099 – MISC in box 3, using the name and tax payer identification number of the deceased employees estate or beneficiary |

|

|

|

If an employee dies and a final payment is made, the employer continues to withhold taxes as if the employee was still alive? T or F |

False Federal income tax is not withheld from wages paid after employees death as wages subject to federal income tax are paid to the employees estate or beneficiary and reported on form 1099-MISC. |

|

|

|

For a payment after the employees death but in the year of the death, what taxes, will be withheld? A. Federal income tax only B. Social Security and Medicare taxes only C. Federal income, Social Security and Medicare taxes D. No taxes will be withheld. |

B. Social Security act requires withholding Social Security and Medicare taxes from wages paid in the year of an employee's death. These wages are paid to the employees estate or beneficiary and reported on form W-2. |

|

|

|

For a payment after the employees death in the year after the death, what taxes will be withheld? A. Federal income tax only B. Social Security and Medicare taxes only C. Federal income, Social Security and Medicare taxes D. No taxes will be withheld. |

D. Social Security act requires that Social Security and Medicare taxes not be withheld from wages paid in the year after an employee's death. These wages are paid to the employees estate or beneficiary and are not reported on form W-2 |

|

|

|

Gross Up |

When the employer wants to pay the employees taxes you start with the net you want the employee to receive and then calculate the gross that includes the tax withholding amounts. This is known as a gross up. |

|

|

|

Gross Up |

When the employer wants to pay the employees taxes you start with the net you want the employee to receive and then calculate the gross that includes the tax withholding amounts. This is known as a gross up. |

|

|

|

Why Gross Up? |

Examples: - sales person receives $100 bonus. The sales manager wants the sales person to receive hundred dollars in cash after withholding taxes, so the gross bonus will be more than $100. - The employer decides to pay the employees taxes on taxable relocation expenses - The value of excess group term life insurance for a terminated employee is calculated but Social Security tax or Medicare tax was not withheld, gross is required. -The employer fails to withhold taxes from the employees wages at the time of payment, gross up is required. |

|

|

|

Fringe Benefits Fair market value of non-cash compensation |

The fair market value of a fringe benefit is the amount the employee would have paid a third-party to buy or lease the fringe benefit |

|

|

|

When determining the value of the benefit, keep the following two statements in mind: |

The employees perceived value of the benefit is not relevant The amount the employer paid for the benefit is not a determining factor |

|

|

|

Imputed Income |

Imputed income represents the value of the taxable benefits employees receive from the employer and must be included in the employees income. Employers are required to impute income to employees for each taxable non-cash benefit received by the employee.

Imputing income reduces employees net pay by increasing taxes. The employee does not receive additional pay in the form of cash. An example of imputed income is taxable group term life insurance. |

|

|

|

Imputing should occur as frequently as possible. |