![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

245 Cards in this Set

- Front

- Back

|

Week 04 What are the 2 methods for recognizing Uncollectible Accounts |

|

|

|

Week 04 Describe Direct write-off method |

|

|

|

Week 04 Allowance Methods |

|

|

|

Week 04

Net Accounts Receivable = ? |

(Gross) Accounts Receivable - Allowance for Doubtful Accounts (XA). The contra account for A/Rs.

Instead of directly reducing the A/Rs, it is stored in the contra account similar to the Depreciation contra account. |

|

|

Week 04 What is the accounts receivables ledger? |

It is a ledger that containers the A/R from each customer. For instance

A/R Ledger A/R = A/R(customer 1) + A/R(customer 2) + A/R(customer 3) + ... |

|

|

Week 04 Time of Sale Equation |

Cash(A) + A/R - Allowance for Doubtful Accounts) = Revenue - Expense |

|

|

Week 04 What are the different names for doubtful accounts? |

Uncollectible or bad debts. |

|

|

Week 04 Bad debt expense account are also called |

Provisions for uncollectible accounts or provisions for doubtful accounts because they sound more pleasant. |

|

|

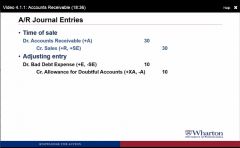

Week 04 Describe the A/R Journal |

|

|

|

Week 04 What type of accounts are an expense account and is it on the left or right side of the T-account? |

It's a debit account. However, it is placed on the right side of the T-account. It is balanced by the shareholder equity Dr. Expense (+E,-SE) |

|

|

Week 04 How does a Bad Debit Expense look as a journal entry? |

Dr. Accounts Receivable (+A) 30 ____Cr. Sales (+R, +SE) 30

Dr. Bad Debt Expense (+E,-SE) 10 ____Cr. Allowance for Doubtful Accounts (+XA, -A) 10

|

|

|

Week 04 In the T-account, what do write-offs do to the A/Rs |

They reduce them since A/Rs are debit accounts and the write-off gets credited to the A/Rs account. |

|

|

Week 04 In the T-Account, what do write-offs do to the Allowance for Doubtful Accts (XA) |

They decrease them since Allowance for Doubtful Accts (XA) are contra accounts which are credit accounts and write-offs are debited to these accounts

In other words, the allowance is no longer allowed because it is accounted for in the A/Rs. |

|

|

Week 04 How does the accounting work if an account has been written off? |

Unexpected Recovery Dr. Accounts Receivable (+A) 10 ___Cr. Allowance for Doubtful Accts (+XA,-A) 10 Dr. Cash (+A) ___Cr. Accounts Receivables (-A) 10 10 |

|

|

Week 04 How many entries do recoveries take? |

Two.

1. a. Restore A/R b. Restore allowance to balance restoration to A/R 2. a. Record cash collection (reduce receivables, zero out) b. Record cash

|

|

|

Week 04 What are the Two Allowance Methods |

|

|

|

Week 04 Describe the Percentage of sales allowance method? |

|

|

|

Week 04 Aging-of-accounts receivable method |

|

|

|

Week 04 Why are there two allowance estimating methods? |

If a company is going to estimate bad debt they can do it based on amount of balance sheet A/Rs at the end of the period or the income amount credit sales or they can use both methods and use an average. Companies have to decided what gives them the most accurate method. |

|

|

Week 04 What is the equation for bad debt expense using the percentage of sales method? |

Bad Debt Expense = Credit Sales x Estimated Uncollectible Pct. For example, if a company had $75K in sales and an estimated uncollected pct of 2% then then Bad Debt Expense = $75K x 2% = $1,500 |

|

|

Week 04 How does a company come up with the percentage number? |

|

|

|

Week 04 Describe the aging of accounts receivable method? |

0-30 days $8K 5% 31-60 days $4K 10% 61-90 days $2K 30% Over 90 days $1K 50% Total $15K $1900

Notice the Estimated uncollected pct goes up the longer the account is outstanding.

|

|

|

Week 04 How do A/Rs bad debts show up on the Cash Flow statement? |

|

|

|

Week 04 What are the two methods for accounting for A/R and bad debts on the Cash Flow statement using the indirect method?

Which method will a company use? |

1. First method

Cash from Operating Activities -------------------------------------------- Net income + Net Bad Debt Expense +/- Change in Gross A/R ---------------------------------------------- Cash Flow from Operating Activities

2. Second Method

Cash from Operating Activities ---------------------------------------------- Net Income

+/- Change in Net A/R ----------------------------------------------- Cash Flow from Operating Activities

The first method is for companies that have a big problem with bad debt expense. The second method is for companies that do not have as much of a problem. The bottom line is the company should use the method that best communicates to the users of their financial reports. |

|

|

Week 04 How can companies collect their A/Rs more quickly? |

|

|

|

Week 04 Receivables is a ____________ portion of revenue. |

non-cash |

|

|

Week 04 Most companies don't explicitly show ____________ collections from customers. How does one figure it out? |

cash, it has be figured out using the T-accounts. Explain the process from Video 4.2. A/R Receivable Disclosure Example |

|

|

Week 04 What is a credit sales vs. a cash sale? |

A credit sale is a collection account such as A/R whereas cash sales are credited immediately? |

|

|

Week 04 Do companies report cash sales and credit sales as separate items? How does one figure it out? |

No. Cash sales show up as cash collections so the ending balance of the A/R can be subtracted from total sales to determine cash collections which equal cash sales.

Cash collections = Total Sales - A/R Acct ending balance = Cash Sales |

|

|

Week 04

What is the quick and dirty method for determining a bad debt expense and why would one use it? |

Compute the percentage of Gross A/Rs that are expected to be uncollectible accounts using the following estimate:

Percent uncollectible = Allowance / (Net A/R + Allowance) Percentage - of - sales method Aging of accounts receivable method but one believes a company is using bad debt expense to increase earnings to please investors by decreasing this amount. |

|

|

Week 04 Difference in Inventory accounting for a manufacturing firm vs. a retail firm |

1. Retail

Dr. Inventory ____Cr. Cash or Accounts Payable

Dr. Cost of Goods Sold Expense (Product Costs) ____Cr. Inventory

Dr. SG&A Expenses ____Cr. Cash (for Period Costs)

Manufacturing

1. Raw Materials

Dr. Raw Materials (+A) ____Cr. Cash or Accounts Payable (-A)

Dr. Work in Progress (+A) ____Cr. Raw Materials (-A) Journal entry will be done as an adjusting entry at end of period to reduce time spent account for small inventory items like screws.

Dr. Work in Process with Direct Labor and Overhead ___Cr. Cash with Direct Labor and Overhead Overhead includes anything that is not Labor or Material (Electricity, Depreciation for any machine in production, etc.) Work in process can be further broken down to reflect total value of asset:

Dr. Work in Process (+A) ____Cr. Cash (-A) Dr. Work in Process (+A) ____Cr. Cash (-A) Dr. Work in Process(+A) ____Cr. Accumulated Depreciation (+XA) If debit depreciation expense immediately, it would be put on the income statement immediately if it is a work in process, if not then it would go into debit depreciation immediately. Once goods are finished we move them into the finished goods debit account. The journal entry is:

Dr. Finished Goods (+A) $X ____Cr. Work in Progress (-A) $X

|

|

|

Week 04 What is the equation for Inventory and COGS |

Cost of Goods Available for Sale = COGS + COG Held ---------------------------------------------------------------------------- Begin Inventory + New Inventory = COGS + Ending Inventory (Known) (Known) (Unk) (Unk)

New Inventory

Inventory/COGS computation methods 1. Periodic System

2. Perpetual System

|

|

|

Week 04 Why do companies need to track their inventory? |

To track non-revenue sales (theft), they need to track inventory once a year even though today's technology helps with the process of keeping help of all the items that go into end products. |

|

|

Week 04 Inventory Valuation: Lower |

Ending Balance of Inventory must be carried at the lower of historical cost or fair market value

|

|

|

Week 04 If historical cost < or = FMV, then __________ |

Ending Inventory = Original Cost Not adjusting entry needed |

|

|

Week 04 If FMV < Historical Cost, then |

Ending Inventory = Replacement Value Need an adjusting entry to write-down inventory from original to replacement cost

Dr. COGS (+E, -SE) ____Cr. Inventory (-A) |

|

|

Week 04 What is the difference between US GAAP and IFRS once inventory has been written down to FMV |

|

|

|

Week 04 Do inventory cost flows have to follow the physical flow of goods? |

No. Think about bananas |

|

|

Week 04 What are the Inventory Cost Flow Assumptions? |

It would be difficult to track toothpaste or salad dressing, otherwise. |

|

|

Week 04 Describe FIFO |

Oldest inventory costs go in COGS first. Ending inventory. LISH. Last in still here. |

|

|

Week 04 Describe LIFO |

Newest inventory costs go in COGS first. FISH First in still here. OFIL. It's an Owful way to do accounting. Became popular after World War II. |

|

|

Week 04 Describe the Weighted Average method of tracking inventory vs LIFO or FIFO |

Give results that look a lot like FIFO |

|

|

Week 04 LIFO Liquidation |

Trying to sale excess inventory. You sell more inventory that you produce. |

|

|

Week 04 Does any other country allow LIFO |

No other Country allows LIFO except US, necessary to know for comparison to other firms. |

|

|

Week 01 Definition of Accounting |

Accounting is a system for recording information about business transactions to provide summary statements of a company's financial position and performance to users who require such information |

|

|

Week 01 What are the 3 Parts of definition of accounting |

1. Recording Information about business transactions. This will be done even if there seems like there is nothing going on. |

|

|

Week 01 What are the 3 set of books |

1. Financial Accounting - Standardized reports for external stakeholders |

|

|

Week 01 What are the financial reporting requirements? |

* The SEC requires periodic financial statement filings

|

|

|

Week 01 What is GAAP and what does it stand for? |

When preparing financial statements, companies generally comply with these principles.

It stands for GENERALLY Accepted Accounting Principles.

This formally only comply to public companies. However, public companies generally comply to apply for loans since this is what format the bank requires. |

|

|

Week 01 Does GAAP apply to other countries? |

Yes. However, even though countries have annual reports one might see semi-annual reporting instead of quarterly reporting. |

|

|

Week 01 Periodic filing requirements create much of the ________ in financial accounting |

tension |

|

|

Week 01 Who makes the GAAP rules? |

The rulemaking ultimately falls on Congress. However, it is delegated in the following order:

|

|

|

Week 01 What does FASB stand for? |

Financial Accounting Standards Board |

|

|

Week 01 What does EITF stand for? |

Emerging Issues Task Force |

|

|

Week 01 What does IFRS stand for, what's its function, where's it based and who established it? Does it apply to US firms. |

International Financial Reporting Standards, establishes REQUIRED accounting standards for over 100 countries. It's based in London and was established by the International Accounting Standards Board. No, the US still uses GAAP |

|

|

Week 01 What does IASB stand for and what does it do? |

International Accounting Standards Board. It regulates accounting standards in over a 100 countries. |

|

|

Week 01 Why doesn't the US conform to IFRS? |

There was a plan to do that in 2008 but with Lehman-Brothers collapse the plan got pushed back even though the US should be currently under IFRS. |

|

|

Week 01 Is US GAAP similar to IFRS? |

Yes |

|

|

Week 01 Who is responsible for financial reports? |

Ironically, managers. So look at them with skepticism for opportunistic behavior. |

|

|

Week 01 What are the checks and balances to check for managers opportunistic behavior? |

|

|

|

Week 01

What are the 4 required financial statements? |

Balance Sheet - Financial position (listing of resources and obligations) on a specific date

Income Statement - Results of operations over a period of time using accrual accounting (i.e., recognition of transactions tied to business activities. Statement of Cash Flows (SCF) - Sources and uses of cash over a period of time. Statement of Stockholders' Equity - Changes in stockholder's equity over a period of time |

|

|

Week 01 Why is it not a good method to do "teenage" accounting, that is, add up everything that come in and subtract everything that went up where everything is done in cash? |

All a company would have to do to post earning is borrow money or sell stock but that says nothing about revenue from sales or investments.

In theory a business like a ponzi scheme could just take in money and not have a legitimate product that it sells for revenue.

A business would want to segregate it cash flows, that is,

Cash flows from Operations Cash flows from Investing in the business

and

Cash flows from financing.

Even though the result would be the same as "teenage accounting", the bottom line would be the same on the cash flow statement, but a SCF would give a much clearer picture. |

|

|

Week 01 What is salvage value? |

It's the value of an asset what a company is done with using it. |

|

|

Week 01 What can be inferred net income? |

It lets a company know whether or not, it priced its products or services high enough relative to cost of providing the product or service. |

|

|

Week 01 What is accrual accounting? |

Results of operations are reported over time and RECOGNITION OF TRANSACTIONS is TIED TO BUSINESS ACTIVITIES as opposed to being tied to cash flows. |

|

|

Week 01 Does the income statement use accrual accounting or cash flows? |

It uses accrual accounting where results of operations are reported over a period of time.

Accural Accounting gives a measure of business activities not cash flow. |

|

|

Week 02

What are two other names for net income and does it show (equal) the net change in cash? |

Earnings or

Net Profit It DOES NOT EQUAL THE CHANGE IN CASH since accrual accounting is used and a credit transaction (e.g. accounts receivable) does not involve cash although it would be temporarily booked as an asset (debit). Accural Accounting gives a measure of business activities not cash flow. |

|

|

Week 03 Since cash is king, should the cash flow statement only be used? |

No. It should be used in conjunction with the other statements since each provides a piece to the puzzle, that is, hopefully, different vital and meaningful information. |

|

|

Week 02 Contrast a Cash Flow from Operations of (22,000) to a Net Income for the same period of 27,000 |

A deficit of (22,000) says you did not have enough Cash Flow from Operations to cover your expenses. However, with a net positive income of 27,000, says that you SHOULD have enough cash in the future to cover costs of producing the product or service. |

|

|

Week 02 What is the balance sheet? |

It shows the financial position of a company at any given moment in time.

By the financial position, it is meant the resources (assets) and obligation (liabilities and stockholders' equity) |

|

|

Week 01 What are the resources and obligations of a company and on which report are they shown? |

The resources are the assets and the obligations are the liabilities and stockholders' equity. They are shown on the balance sheet. |

|

|

Week 01 What are assets? Describe first in terms of economic benefit. Second define in terms of cash flows. |

|

|

|

Week 01 What are liabilities? |

Claims on assets by "creditors" (non-owners) that represent an obligation to make future payment of cash, goods, or services. |

|

|

Week 01 Is a creditor an owner or non-owner? |

non-owner. |

|

|

Week 01

|

Owners' Equity which is claims on assets by owners of a business

These 2 sources add up to make up Owner's Equity, therefore,

Owner's Equity = Contributed Capital + Retained Earnings.

This expands the balance sheet equation. |

|

|

Week 01 What is another name for stockholders' equity? |

Owners' equity. |

|

|

Week 02 What is the 1 RULE OF GRAMMAR in accounting? |

The balance sheet equation. This is a good thing because as in other languages this can be an arduous task. |

|

|

Week 02 What is the balance sheet equation? Typical, Expanded Before Expenses and Dividends, Expanded After Expenses and Dividends |

Assets (cash + non-cash) = Liabilities + Stockholders' Equity (Contributed Capital and Retained Earnings)

Cash + Noncash Assets = Liabilities + Contributed Capital + Retained Earnings

Cash + Noncash Assets = Liabilities + Contributed Capital + Prior Retained Earnings + Revenue - Expenses - Dividends |

|

|

Week 02 What is an alternative way of writing the balance sheet equation in terms of resources? |

Resources (cash + non+cash) = Claims on Resources by Outsiders + Owners |

|

|

Week 02 What are the key features of the balance sheet equation? |

Reminds me of the Law of Conservation of Energy which states that the total energy of an isolated system cannot change. Energy can be neither created nor destroyed, but change forms (e.g. chemical energy to kinetic) |

|

|

Week 02 What is Double - Entry Bookkeeping? |

This concept applies to the balance sheet equation and states that in order to keep the equation in balance when something is added or subtracted something must be also added or subtracted.

Think of Newton's 3rd Law, for every reaction, there's an opposite and equal reaction.

|

|

|

Week 03 What is the difference in SCF from the previous year to the current year? Describe conceptually. |

Cash + Noncash Assets (Partial Balance Sheet at 12/31/14) | | Statement of Cash Flows for year ended 12/31/15 | Cash + Noncash Assets (Partial Balance Sheet at 12/31/15) |

|

|

Week 02 What is the difference in the Income Statement from the previous year to the current year? Describe conceptually. |

Retained Earnings (Partial Balance Sheet at 12/31/14) | | Income Statement for year ended 12/31/15 | Retained Earnings (Partial Balance Sheet at 12/31/15) |

|

|

Week 02 Describe how the financial crisis of 2008 affects the balance sheet but has no impact on cash. |

Hypothetically, for illustration, assume the total value of the subprime mortgages where $10B (Noncash Asset) with a liabilities of $9.5B leaving Owner's Equity of $.5B.

Also, for the sake of illustration, let's say the value of the "toxic assets" drops the value of the total mortgage assets from $10B to $1B. Well, the liabilities are still owed and that's why there was a government bailout. In other words, the government assumed the liability letting the original lenders off the hook.

There is no change in cash in the Cash + Noncash part of the balance sheet but the Noncash assets drop by $9B dropping the stockholder's equity to ($8.5B), that is, in the hole (or red) by $8.5B. |

|

|

Week 02 What is the equation for Stockholders' Equity? |

Stockholders' Equity = Contributed Capital + Retained Earnings |

|

|

Week 02 What is the equation for Retained Earnings? |

Retained Earnings = Prior Retained Earnings (Qtr, Year, etc) + Net Income - Dividends

Retained Earnings (Partial Balance Sheet at 12/31/14) | | Income Statement for year ended 12/31/15 | Retained Earnings (Partial Balance Sheet at 12/31/15) |

|

|

Week 02 What is the equation for Net Income? |

Net Income = Revenue - Expenses

Note: Revenue by itself includes expenses |

|

|

Week 01 What are the 2 criteria for recognizing an asset |

Examples:

|

|

|

Week 01 What are the 2 criteria for recognizing a liability? |

Examples:

|

|

|

Week 01

Are the 2 criteria essentially the same for recognizing an asset or liability? |

Yes. In both cases, there has to be some kind of transaction or exchange

One has to be able to REASONABLY measure the obligation. |

|

|

Week 01 Are there 2 criteria for Owner's Equity like assets and liabilities? How is it determined? What are other names for equity. |

No. It is the RESIDUAL claim on assets AFTER settling claims of creditors ( = Assets - Liabilities ), so as long as the assets and liabilities are correct the equity is just what is leftover.

Also called

|

|

|

Week 02 What is par value of a stock? |

It is an archaic concept where company's could not issue new stock or pay dividends if their stock was below par value but these laws are gone now.

When stock is issued the amount of the par value is placed into the common stock account and the remainder is placed in the additional paid-up in capital account.

|

|

|

Week 02 What are dividends? Are they considered an expense? How are they recorded until they are paid. |

They are a distribution of retained earnings. They are not an expense.

They are recorded as a reduction of retained earnings on the declaration date (creates a liability until payment date ), dividend payable, and reduce shareholder equity (-SE). |

|

|

Week 02 What is an expense in accounting? |

It is a cost of generating revenue. |

|

|

Week 02 Why are dividends not an expense even though they reduce shareholder equity? Why do they become a liability before the paid date? |

They do not fit the definition of an expense, a cost of generating revenue. They become a liability because they are moved to the liability category as a dividend payable, hence, making the shareholder a creditor of the company which is counterintuitive |

|

|

Week 02 There is a disagreement in the accounting world whether or not debits and credits should still be taught, True or False |

True |

|

|

Week 01 What's interesting about the word Bookkeeping |

It's the only word in the English language with three consecutive double letters.

Generally in accounting, everything occurs in 2s and there are three basic components to the balance sheet equation. |

|

|

Week 02 What is the equation for the sum of the debits and credits? |

Sum of Debits must equal the Sum of the Credits

Sum of Debits = Sum of Credits |

|

|

Week 02 What is the equation for the beginning and ending account balances? |

Beginning account balances + Increases - Decreases ---------------------------------------- Ending Account Balances

In other words, the beg account balance plus increases and minus decreases must equal the ending account balance.

As an example, consider retained earning, along with net income (+) and dividends (-) |

|

|

Week 02 What are 3 equations of accounting? |

|

|

|

Week 02 What does debit mean? |

Debit means a LEFT side entry |

|

|

Week 02 What does credit mean? |

Credit means a RIGHT side entry |

|

|

Week 02 What is the abbreviation for debit and credit and who came up with them? |

Dr. and Cr, respectively, The British |

|

|

Week 02

|

No. They are treated as a reduction in earnings. No they are removed from the balance sheet equation |

|

|

Week 02 Why are expenses on the left side of the balance sheet equation and T account under debits? |

In the following balance sheet equation, expenses are taken from retained earnings to net income. It is the only negative value in the equation so we move it to the right to avoid having a negative increasing value on the right side of the equation.

This line of reasoning is carried over to the T account. |

|

|

Week 02 How would one represent the balance sheet equation in terms of Debits and Credits? |

Debits (Left) = Credits (Right) |

|

|

Week 02 Are negative numbers allowed under the rules of Debits and Credits? |

No. |

|

|

Week 02 Every transaction must have at ________ one _______ and at least _________ ____________. |

least, debit, one, credit.

Think about Newton's third law. |

|

|

Week 02 3 Rules of Credits and Debits |

For 1, think of Newton's Third Law. For 2, think about the law of conservation of energy. |

|

|

Week 02 Why is accounting called accounting? |

Because everything is put into an account. |

|

|

Week 02 How does one denote an asset account in the T account at the top in the title? |

With an (A) as follows:

Accounts Receivable (A) ---------------------------------------------------------- Beg. Balance 1000| New Sales 100 |80 Cash Collect ---------------------------------------------------------- End. Balance 1020|

Notice how the the 3 equations are incorporated:

|

|

|

Week 02 How does one denote a liability account in the T account at the top in the title? |

With an (L) as follows:

Accounts Payable (L) ---------------------------------------------------------- | 1000 Beg. Balance 80 Cash Payment | 100 New Purchases ---------------------------------------------------------- | 1020 End. Balance

Notice how the the 3 equations are incorporated:

|

|

|

Week 02 How do Debits and Credits work on their respective accounts? |

Debit | Credit ------------------------------------------------------------- Debit + | _ Credit - | +

Debits

Credit

|

|

|

Week 02 What are the 3 questions in analyzing a transaction? |

|

|

|

Week 02 What is a journal entry? |

It is a short-hand way of showing what happened in the transaction. |

|

|

Week 02 Describe the journal entry format. Should debits or credits be shown. |

Dr. {Name of Account Debited} $$$$ Cr. {Name of Account Credited} $$$$

|

|

|

Week 02 Describe the 5 steps in "The Accounting Cycle" |

Loops through life of the business

|

|

|

Week 02 What is the General Ledger? |

It's the aggregate of the T accounts. |

|

|

Week 02 What is the Entity Concept? |

The Entity Concept states that the only transactions that should go in a company's books are transactions for the company.

For example, if a partner borrows money to contribute it to the company that transaction would not be recorded unless the partner was representing the company in the transaction. Otherwise, the borrowed money is a liability of the partner, separate from the company. |

|

|

Week 02 When does one use the inventory account as opposed to the asset account for purchases to be used in the business? |

The inventory account is only used for goods that are purchased that are intended to be sold at a markup.

If inventory is purchased for use in a business such as the example that was given in this course for the company Relic Spotter where metal detectors were purchased so they could be rented out, then these items, the metal detectors, belong to the business, therefore, they are inventory but would not go in the inventory account because they will not be sold for profit. |

|

|

Week 02 In accounting, what is tricky about recognizing an expense or asset when money is spent by the company. |

When it is intangible such as a service, remember that an asset has to provide a future benefit to the company. |

|

|

Week 02 Is there a pre-paid advertising account? |

Yes. It is a debit account. |

|

|

Week 02 Why is the "value" of pre-paid advertising as opposed to its cost recorded as an asset with value? |

Only the "cost" of the advertising can be recorded as an asset in the pre-paid advertising account.

It cannot be recorded as an asset of "value" because its value cannot be reasonable estimated, referring back to the requirements for recognizing a transaction as an asset. |

|

|

Week 02 What is the difference between notes receivable and accounts receivable? |

Loans to individuals is recorded in notes receivable whereas goods sold on credit are recorded in accounts receivable. |

|

|

Week 02 When a company declares a dividend does it get recorded? |

Yes. The dividend gets recorded as a liability and it's taken out stockholder equity.

This is counterintuitive because the owners' become creditors with the transaction going into the liability account. |

|

|

Week 02 What happens to stockholder equity if a company has more liabilities than assets in terms of the balance sheet equation? |

Stockholder equity would be a negative balance to keep the equation in balance. |

|

|

Why do companies form subsidiaries? |

A subsidiary corporation or company is one in which another, generally larger, corporation, known as the parent corporation, owns all or at least a majority of the shares. As the owner of the subsidiary, the parent corporation may controlthe activities of the subsidiary. This arrangement differs from a merger, in which a corporation purchases another company and dissolves the purchased company's organizational structure and identity.Subsidiaries can be formed in different ways and for various reasons. A corporation can form a subsidiary either by purchasing a controlling interest in an existing company or by creating the company itself. When a corporation acquires anexisting company, forming a subsidiary can be preferable to a merger because the parent corporation can acquire a controlling interest with a smaller investment than a merger would require. In addition, the approval of the stockholders ofthe acquired firm is not required as it would be in the case of a merger.When a company is purchased, the parent corporation may determine that the acquired company's name recognition in the market merits making it a subsidiary rather than merging it with the parent. A subsidiary may also produce goodsor services that are completely different from those produced by the parent corporation. In that case it would not make sense to merge the operations.Corporations that operate in more than one country often find it useful or necessary tocreate subsidiaries. For example, a multinational corporation may create a subsidiary in a country to obtain favorable tax treatment, or a country may require multinational corporations to establish local subsidiaries in order to do businessthere.Corporations also create subsidiaries for the specific purpose of limiting their liability in connection with a risky new business. The parent and subsidiary remain separate legal entities, and the obligations of one are separate from those ofthe other. Nevertheless, if a subsidiary becomes financially insecure, the parent corporation is often sued by creditors. In some instances courts will hold the parent corporation liable, but generally the separation of corporate identitiesimmunizes the parent corporation from financial responsibility for the subsidiary's liabilities. Source: http://legal-dictionary.thefreedictionary.com/Wholly-owned+subsidiaries

|

|

|

What is a disadvantage of a subsidiary in terms of taxation?

|

One disadvantage of the parent-subsidiary relationship is the possibility of multiple taxation. Another is the duty of the parent corporation to promote the subsidiary's corporate interests, to act in its best interest, and to maintain a separate corporate identity.

If the parent fails to meet these requirements, the courts will perceive the subsidiary as merely a business conduit for the parent, and the two corporations will be viewed as ONE entity for LIABILITY purposes. |

|

|

Week 02 Where is the most important information in financial statements? |

In the footnotes, the small print, disclaimers, etc. Remember back to my flying days. These correspond to the notes, cautions and warnings.

|

|

|

What is an indirect wholly owned subsidiary?

|

Since the Internet had no information on this, I asked a lawyer, who by his own admittance said he wasn't positive, but believed that:a wholly owned indirect subsidiary is a wholly owned subsidiary (Company 3) that itself is owned by a wholly owned subsidiary (Company 2) of another company (Company 1). Such that Company 3 is a "wholly owned indirect subsidiary" of Company 1. Geico is an indirect wholly owned subsidiary of Berkshire Hathaway.

|

|

|

What are tiered subsidiaries?

|

In descriptions of larger corporate structures, the terms "first-tier subsidiary", "second-tier subsidiary", "third-tier subsidiary" etc. are often used to describe multiple levels of subsidiaries. A first-tier subsidiary means a subsidiary/daughter company of the ultimate parent company,[9][10] while a second-tier subsidiary is a subsidiary of a first-tier subsidiary: a "granddaughter" of the main parent company.[11] Consequently, a third-tier subsidiary is a subsidiary of a second-tier subsidiary—a "great-granddaughter" of the main parent company. Source: http://en.wikipedia.org/wiki/Subsidiary |

|

|

Week 02 What does accounting income attempt to measure? |

It attempts to measure business activity which is in contrast to cash flow

|

|

|

Week 02 All income statements are based on ______________ accounting |

accrual

|

|

|

Week 02 Revenues are recognized when __________ and ________ are ___________ |

goods, services, provided

|

|

|

Week 02 Expenses are recognized in the ________ period as the ______________ they helped to _____________ |

same, revenues, generate

|

|

|

Week 02 Does net income equal net cash flow? |

No, not necessarily

|

|

|

Week 02 What are the 2 criteria for recognizing Revenue?In other words, what is the Revenue recognizing criteria? |

WhenIt is earned (i.e. good or services are provided) ANDIt is realized (i.e. payment for goods or services received in cash or something that can be converted to a known amount of cash) |

|

|

Week 02 What is revenue in terms of shareholders' equity? |

Revenue is an increase in shareholders' equity (not necessarily) from providing goods or services.

|

|

|

Week 02 Describe the EARNED requirement for a software company where all the good and services may have not been provided? |

The company may have on going revenue they earn from providing updates where that revenue is not book right away.

|

|

|

Week 02 Describe a situation where the REALIZED requirement for booking revenue can be intentionally violated to boost earnings. |

There was a CEO who was a turn around expert where he'd reduce the workforce, streamline the operations, and make aggressive accounting decisions, thereby, turning the company around very quickly. He shipped some products that were not ordered on one of his stops. This is illegal.

|

|

|

Week 02 Well over 50% of enforcement actions for the SEC is because of what criteria? |

The REvenue recognition criteria.

|

|

|

Week 02 As a mnemonic, what does the R and E stand for in the REvenue recognition criteria? |

RealizedEarned

|

|

|

Week 02 What is an expense in terms of shareholders' equity? |

Expenses are decreases in shareholders' equity (not necessarily cash) that arise in the process of generating revenues

|

|

|

Week 02 What are the 2 criteria for recognizing Expenses?In other words, what is the Expense recognizing criteria? |

WhenRevenues, related, are recognized (product costs) ORIncurred, if difficult to match with Revenues (period costs and unusual events)

|

|

|

Week 02 What is a product costs?When is it recognized?Does this include labor to make the product? |

The costs that go into making a product. It is an expense that stays with the product until the product is sold at which time is it recognized. This includes labor to make the product.

|

|

|

Week 02 What is a period cost?When are they recognized?What is another name for them? |

These are costs that are separate from "producing" the product For example, R&D ( these are ideas that may not ever materialize)Sales TeamMarketing StaffHuman ResourcesTop management They are recognized when they are incurred. Another name for them is Selling, General & Administrative ( abbreviated SG&A )

|

|

|

Week 02 Name the two underlying recognition concepts and explain them? |

Matching principle (product vs. period costs) - states that expenses should be matched to the revenue they generateConservatism principle (unusual events) - This principle goes against human nature, that is, something bad is going to happen, then let's wait until it happens, and something good is going to happen, let's recognize it right away. The conservatism principle says recognize anticipated losses immediately and defer recognition of anticipated gains until they are realized.

|

|

|

Week 02 Can companies book Revenue from the sale of its stock? |

No. Revenue is provided only from the sale of good or services.

|

|

|

Week 02 What is the difference between a COST and expense?When does a cost become an expense? |

A cost is any cash outlay in the past, present or future that is required to run the businessExpenses are the only costs that show up on the income statementA cost becomes an expense when it gets recorded on the income statement

|

|

|

Week 02 Expenses should match _________ ___________ on the ___________ ____________. |

business activities, income statement. |

|

|

Week 02 What 2 journal entries are like the salt and pepper of accounting. |

The net value of this transaction (the sale of goods) is the difference in Revenue and the COGS (Expenses) which is the profit. |

|

|

Week 02 Which account does Salaries & Wages get applied to? |

The Salaries & Wages Expense Account |

|

|

Week 02 What is the definition of Adjusting Entries? |

Adjusting Entries are internal transactions that update account balances in accordance with accrual accounting prior to the preparation of financial statements. |

|

|

Week 02 What are the 2 big categories for Adjusting Entries and how do they apply? |

NOTE: These entries never involve cash. |

|

|

Week 02 What type of expenses (transactions) does one typically see as a deferred expense? |

Are there any assets that have been "used up" this period and should be expensed?

|

|

|

Week 02 What type of revenues (transactions) does one typically see as a deferred revenue? |

Are there any liabilities that have been fulfilled by delivered of good or services that should be recognized as revenue?

|

|

|

Week 02 What type of expenses (transactions) does one typically see as a accrued expense? |

Have any expenses accumulated during the period that have not yet been recorded.

Examples:

|

|

|

Week 02 What type of revenue (transactions) does one typically see as accrued revenue? |

Have any revenues accumulated during the period that have not yet been recorded?

Examples:

|

|

|

Week 02 What is the goal of Depreciation and Amortization? |

|

|

|

Week 02 To what type of assets does Depreciation and Amortization apply? |

|

|

|

Week 02 Is depreciation deducted from the Tangible Asset Account? Where is depreciation recorded? |

No. It is recorded in a Contra Asset Account, a companion account, (XA) called Accumulated Depreciation, which

Contra is latin for it opposite of where one would expect it to be.

It has a credit balance because it is keeping tracking of a decrease in value of the asset so it captures the decreases (credits) to an asset.

It like an expense account which sits on the opposite side in a T account. Think of it as a contra account to shareholders' equity (cash).

If there's an increase (debit) in an expense it decreases (debits) the retained earnings by reducing (crediting) cash. |

|

|

Week 02 Where is Amortization recorded in contrast to depreciation? |

Amortization does not have a "companion contra account". It is recorded in the Intangible Asset Account. |

|

|

Week 02 What does PP&E stand for? |

Property, Plant and Equipment |

|

|

Week 02

|

The formula is

Depreciation = (Original Cost - Salvage Value ) / Period of Life (Useful Life)

|

|

|

Week 02

Does a central government determine the useful life on an asset? |

No. Managers determine this.

Example: International Airline uses primarily new airplanes for years. There's a domestic airline that uses their airplane for 20 years (Southwest), so their salvage value is less at the end but with no information, their costs are probably lower, even substantially lower. |

|

|

Week 02 What method of depreciation is used for tax purposes? |

Accelerated. |

|

|

Week 02 Useful life and salvage value are managers' ______________ estimate |

best |

|

|

Week 02 Where can investors find out about upcoming orders even though they haven't shown up on the balance sheet or income statement? |

In the annual report (10-K) |

|

|

Week 02 Describe the adjusting entry timeline. How many different types of adjusting journal entries are there? |

Dr. Cash ----------------> Dr. Liability_______________Deferred Revenue ____Cr. Liability___________Cr. Revenue

Dr. Asset ----------------> Dr. Expense______________Deferred Expense ____Cr. Cash_______________Cr. Asset

------+-------------------------------------+---------------------------------+----- __Cash____________________Accounting___________________Cash Transaction_______________Recognition_____________Transaction

Accrued Expense__________Dr. Expense------------------>Dr.Liability ________________________________Cr. Liability______________Cr. Cash

Accrued Revenue __________Dr. Asset------------------>Dr.Cash ________________________________Cr. Revenue__________Cr. Asset

There are 4 adjusting journal entries shown above. All adjusting journal entries will fit into one of these 4.

|

|

|

Week 02 Can buildings be written up in value? |

No, but they can be written down. This goes back to the conservatism principle. |

|

|

Week 02 Adjusting Entries are the _________ writing part of accounting where __________ have __________ to best show the business activities of a business. |

creative, managers, discretion |

|

|

Week 02 What is the adjusting trial balance? |

The adjusting trial balance is where debits and credits are checked to make sure they are equal |

|

|

Week 02 What does operating income tell a reader of the income statement? |

It tells an outsider or investor the company priced its goods and services in order to make a profit. |

|

|

Week 02 What is being referred to by the "magic line" or above or below the line? |

This is the operating income on the income statement. |

|

|

Week 02 Describe the general format for the income statement |

(1) Revenue ( or Sales ) - Cost of Goods Sold (COGS) ---------------------------------------- (2) Gross Profit - Operating (SG&A) Expense (includes Bldg. Depreciation) ---------------------------------------- (3) Operating Income -Interest, Gains, and Losses ----------------------------------------- (4) Pre-tax Income - Income Tax Expense ----------------------------------------- (5) Net Income |

|

|

Week 02 Everything above the operating line is considered _______________ business. Will managers try to move things above or below the "magic line" |

core. yes. To increase core operations or move things out of core operations. |

|

|

Week 02 What is the order of the balance sheet? |

|

|

|

Week 02 What do closing entries involve? |

It involves closing temporary accounts - Internal transactions that "zero out" temp accounts at the end of the accounting period

Journal Entries Revenues: Dr. Revenue Accounts (-R, -SE) ____Cr. Retained Earnings (+SE)

Expenses: Dr. Retained Earnings (-SE) ____Cr. Expense Accounts (-E, +SE) |

|

|

Week 02 What is a temporary account? |

|

|

|

Week 02 What are permanent accounts? |

|

|

|

Week 02 What is the post-closing trial balance? |

|

|

|

Week 02 What is the one account that can have a debit or credit balance? |

Retained Earnings. |

|

|

Week 02 Can land be depreciated? |

No. Depreciation only applies to physical assets that are "used up".

On the balance sheet, it looks as if land is being depreciated but that's not the case but has been the accounting standard for the last 400 years. |

|

|

Week 03 What does the statement of cash flows report? |

Reports changes in cash due to operating, investing and financing activities. |

|

|

Week 03 What is the format for the SCF? |

Statement of Cash Flows format:

Net cash from operating activities + Net cash from investing activities + Net cash from financing activities = --------------------------------------------------- Net change in cash balance |

|

|

Week 03 Where are non-cash transactions such as trading a building for land be on the SCF? |

Non-cash transactions are disclosed at the bottom of the statement of cash flows. |

|

|

Week 03 Where is cash interest paid and cash income taxes disclosed on the SCF? |

Theses items on the statement of cash flows is either at the bottom of the statement or in the footnotes. |

|

|

Week 03 What are operating activities on the SCF? |

These are transactions related to providing goods and services to customers and to paying expenses related to generating revenue (i.e. "income statement")

One way to think about these activities are that they are analogous to the income statement in that cash collected from Deferred or Accrued activities will impact the statement. |

|

|

Week 03 What are the cash inflows and outflows under the SCF operating activities |

Note: Under IFRS, interest and dividends received and paid may classified as operating, investing, or financing. The company must be consistent. |

|

|

Week 03 Why do interest and dividends received on investments appear under operating activities instead of investing activities on the SCF? |

The FASB decided since these items show up on the Income Statement also it wanted this item paired with the Cash Inflows under Operating Activities. |

|

|

Week 03 Which 2 items that appear on the income statement must be adjusted for the SCF under operating activities? |

|

|

|

Week 03 What are Investing Activities on the SCF? |

These are transactions related to acquisition or disposal of long-term assets. |

|

|

Week 03

What are the cash inflows and outflows under Investing Activities on the SCF? |

Cash Inflows ( Sale Sale Sale Not Product )

- Divestitures of businesses - Sale of PPE & intangibles - Sale of investments Cash Outflows ( Buy Buy Buy Not Product ) - Acquisition of businesses - Acquistion of PPE & intangibles - Purchase of Investments (Important to note that income from investments gets reported under Operating Activities) |

|

|

Week 03 In relation to operating activities and investing activities, how would an investment be categorized? |

As a rule of thumb, if an investment is held for more than 1 year then it would go under investing activities, otherwise, it would go under operating activities.

Remember this is not an iron-clad law. |

|

|

Week 03 What are Financing Activities on the SCF? |

These are transactions related to owners or creditors (save interest payments).

|

|

|

Week 03 Why are interest payments not included under financing activities? |

The FASB wanted comparability between the income statement and cash from operations so they decided to included interest payments in operating activities to parallel the interest expense under net income.

So the disclosure is included for cash paid for interest so if a reader of the financial statements does want it in operating activities then it can be removed. |

|

|

Week 03 What are the cash inflows and outflows under Financing Activities on the SCF? |

Note: Under IFRS, interest and dividends received and paid may classified as operating, investing, or financing. The company must be consistent. |

|

|

Week 03 What are the 4 stages of the company and describe what their statement of cash flows would look like? |

_____________1__________2__________3__________4 _________________Start-up______Early Growth______Mature_________Decline Operating Cash___(3)______________(7)_______________15_______________4 Investing Cash___(15)_____________(12)_______________(8)______________(1) Financing Cash___18_______________5________________(7)______________(3) ---------------------------------------------------------------------------------------------------------- Net Cash Flow_____0________________0________________0_______________0__

|

|

|

Week 04 Are the bad debt expense and allowance for doubtful accounts (XA, A/Rs contra or companion acct) the same |

No. |

|

|

Week 04 What type of an account is the Allowance for Doubtful Accts? |

It is a companion account to A/Rs and is a credit account that absorbs those POTENTIALLY non-paying clients until the bad debt is moved to the bad debt expense account. |

|

|

Week 04 What would the adjusting journal entry look like for A/R of 30, Sales of 30, Bad Debt Expense of 10 |

Journal Entry Time of Sale Dr. Account Receivable (+A) ____Cr, Sales (+R, +SE)

Adjusting Entry Dr. Bad Debt Expense (+E, -SE) ____Cr. Allowance for Doubtful Accounts (+XA, -A) |

|

|

Week 03 What are the only transactions that will go on the SCF? |

The only transactions that will go on the SCF are the ones that either have a Dr. (debit) or Cr. (credit) to cash. |

|

|

Week 03 How would a transaction involving buying a building and land and borrowing money from a bank to finance part of the purchase be categorized on the SCF |

The journal entry would look like this:

Dr. Building (+A)_______52,000 Dr. Land (+A)_________103,000 ___Cr. Mortgage Payable (+L)____124,000 ___Cr. Cash (-A)___________________31,000

In the Relic Spotter cash the transaction would be recorded under Investing and Financing as follows:

No. Transaction_______Cash|Operating__Investing__Financing -------------------------------------------------------------------------------------- (1)Sell Shares______250,000|_________________________250,000 (2)Legal Fees________(3,900)|__(3,900) (3)Buy Bldg&Land_(31,000)|_____________(155,000)___124,000

Note how the Buy of Bldg and Land requires two entries, since we investing in Bldg&Land and financed part of the purchase |

|

|

Week 03 What is a capital improvement? Contrast a capital improvement of an asset to maintenance of an asset and how these transactions would get recorded on the SCF. |

A capital improvement is anything that increases the value of a an asset such as a bldg. Under the SCF, this would get categorized as an Investing Activity.

This should not be confused with maintenance which would be an expense under the SCF and get categorized as an operating cash flow.

|

|

|

Week 03 If a company lends money, would it be an operating or investing activity? |

Recall the rules for whether a capital expenditure is an operating or investing activity based on the length of time it will be used.

If the loan is greater than a year then it would be an investing activity. Otherwise, it would be an operating activity. |

|

|

Week 03

Where do the smartest people in the US work? |

The US Mint because all they do all day is make cents.

|

|

|

Week 03 Do adjusting entries ever involve cash? |

No. |

|

|

Week 03 What are the 2 methods for preparing the SCF? |

|

|

|

Week 03 Companies that use the direct method for preparing their SCF, are they required to use indirect method? |

Yes. |

|

|

Week 03 Describe the format for the Indirect Method for preparing the SCF |

|

|

|

Week 02 What is the definition of COGS? |

Cost of Goods Sold are the DIRECT attributable to the production of the goods sold by a company. This amount includes the cost of the materials used in creating the good along with the DIRECT labor costs used to produce the good. It EXCLUDES INDIRECT EXPENSES such as distribution costs and sales force costs.

Source: Wikipedia, It was not defined in the videos |

|

|

Week 02 What is another name for COGS? |

Another name for COGS is Cost of Sales (or Products)

Source: Wikipedia |

|

|

Week 03 Can the depreciation expense create more cash flow since it is added back into to Net Income to create the SCG? |

No. In the words of Prof. Bushee, the depreciation "cash flow machine". Many companies will test job applicants on this concept because it's tricky. It initially appears that depreciation can generate more cash flow.

However,It has a "zeroing effect because depreciation while increasing cash flow decreases net income as in the following examples. The first example shows a normal abbrev. SCF, both direct and indirect. The second example shows what happens if depreciation is increased by $10. Notice that net income decreases by $10. So, in the indirect method the "top line" net income decreases by $10, and the second line "add deprec. exp" increases by $10. So, it is a zero sum game.

First example: __________________Net __________________Income____DIRECT SCF___________INDIRECT SCF --------------------------------------------------------------------------------------------------- Sales:$100 cash______100____Collections from_100__Net Income___30 ________________________________customers COGS:$60 inventory__(60)___Payments to______(60)__Add Dep Exp__10 acquired with cash____________suppliers Depreciation: $10_____(10) ____Net Income________30____Operating CF____40__Operating CF_40

Second example, modifying deprec. exp by $10 __________________Net __________________Income____DIRECT SCF___________INDIRECT SCF --------------------------------------------------------------------------------------------------- Sales:$100 cash______100____Collections from_100__Net Income___20 ________________________________customers COGS:$60 inventory__(60)___Payments to______(60)__Add Dep Exp_20 acquired with cash____________suppliers Depreciation: $10_____(20) ____Net Income________20____Operating CF____40__Operating CF_40

|

|

|

Week 03 Why does depreciation have to be added back in to the cash flow statement? |

Because it is a noncash expense that must be accounted for. Look at the following example to see how in the Direct SCF, it has no impact. Therefore, if it is left out in the Indirect Method the Cash Flow in the indirect method would be lower.

__________________Net __________________Income____DIRECT SCF___________INDIRECT SCF --------------------------------------------------------------------------------------------------- Sales:$100 cash______100____Collections from_100__Net Income___30 ________________________________customers COGS:$60 inventory__(60)___Payments to______(60)__Add Dep Exp__10 acquired with cash____________suppliers Depreciation: $10_____(10) ____Net Income________30____Operating CF____40__Operating CF_40

|

|

|

Week 03 Describe the impact of A/Rs on the Indirect SCF. |

With the indirect method, one starts with net income. Intuitively since Net income includes noncash sales such as A/Rs it has to be subtracted out of Net Income to get to the Indirect SCF.

__________________Net __________________Income____DIRECT SCF___________INDIRECT SCF --------------------------------------------------------------------------------------------------- Sales:$80 cash______100____Collections from_80__Net Income____30 ____$20 A/R ________________________________customers COGS:$60 inventory__(60)___Payments to______(60)__Add Dep Exp__10 acquired with cash____________suppliers Depreciation: $10_____(10)____________________________Incr. in A/R_(2) ____Net Income________30____Operating CF____20__Operating CF_20

|

|

|

Week 03 Describe the impact of over purchasing inventory and buying inventory on account? |

Intuitively, if a company over purchases inventory that is a loss of a use of that cash, so the excessive inventory has to subtracted out of the Indirect SCF. In contrast, if a company buys inventory on account, the cash they didn't spend right away has to be added into the Indirect SCF.

__________________Net __________________Income____DIRECT SCF___________INDIRECT SCF --------------------------------------------------------------------------------------------------- Sales:$80 cash______100____Collections from_80__Net Income____30 ____$20 A/R ________________________________customers COGS:$60 inventory__(60)___Payments to____(50)__Add Dep Exp__10 but purchased $75 of_________suppliers inventory, $50 paid in__________________________________Incr in A/R_(20) cash and $26 Accts Pay_________________________________Incr in Inv_(15) Depreciation: $10_____(10)_____________________________Incr. in A/P__25 ____Net Income________30____Operating CF____30__Operating CF__30

|

|

|

Week 03 When evaluating, whether a cash item should be added or subtracted from Net Income on the Indirect SCF, what equation should be used? |

The balance sheet equation.

Cash + Noncash Assets = Liabilities + Owner's Equity

As a result of the transaction if cash goes up, then the cash should be added to Net Income in the Indirect SCF.

Conversely, if cash goes down, the cash should be subtracted to Net Income in the Indirect SCF.

|

|

|

Week 03 What are some of the complications that occur with SCF? That is, why does the change in balance sheet numbers often not equal the number on the SCF? |

|

|

|

Week 03 What are some of the disagreements of the FASB classifications that investors and analysts have with FASB? |

|

|

|

Week 03 How is EBITDA used? |

EBITDA (Earnings before interest, taxes, depreciation, and amortization) is often used as a proxy (representative) for cash flow that excludes interest and taxes.

Because it excludes interest and taxes, it eliminates the problem of Cash Flow from Operating Activities which may include taxes and interest from Financing and Investing Activities, depending on how the company being reviewed has prepared their Operating Activities SCF.

However, EBITDA does not act as a good proxy for Cash Flow if there were large changes in A/Rs. In fact, it suffers from the same manipulation of "channel stuffing" where products are shipped without the permission of the receiver or even just shipping and the end of the quarter to bolster numbers.

To correct for "channel stuffing" subtract A/R from EBITDA as one would in preparing the Operating Activity SCF using the indirect method.

|

|

|

Week 03 What is "channel stuffing"? |

Shipping products just before the end of the quarter to bolster earning numbers. Even if the products are shipped on credit which would increase Net Income. |

|

|

Week 03 How does Prof. Bushee feel about EBITDA as a proxy for Cash Flow even though many think it is? |

Unless adjustments are made for working capital such as A/Rs, EBITDA is just as easy to manipulate as earnings are. |

|

|

Week 03 What is meant by "Cash is King"? |

This implies that cash should only be look at from Cash from Operations or EBITDA and not even look at earnings because earnings are too easily to manipulate.

However, according to Prof. Bushee, research has shown that earnings are a better predictor of future cash flows.

This is because earnings are trying to measure the creation of value. It tells the reader of the Income Statement are you able to price the cost your products high enough the cover all the costs of doing business. If so, you tend to get high cash flows in the future, even though you might not have current high cash this period. Whereas cash flow from operations can be time dependent.

The bottom line both the income statement and cash flows should be used to get the best data. |

|

|

Week 03 What is free cash flow (the equation)? |

Free Cash Flow = Operating Cash Flow - Cash Use for Long-term Investments |

|

|

Week 03 Describe the valuation model using free cash flow? |

The free cash flow valuation model states that if ONE FORECAST A COMPANY'S FUTURE FREE CASH FLOWS and discount them back to Present Value, then you'll get a measure of how much the company's stock prices should be. |

|

|

Week 03 What is the problem with operating cash flow as it relates to free cash flow?

What are the 6 ways operating cash flow is computed? |

There is no standard measure for operating cash flow. Example for different textbooks include:

NOTE: This definition often changes across companies so look at the disclosures to determine how free cash flow is defined. |

|

|

Week 03 |

|

|

|

Week 04 What is the difference between

|

Adjusting Entry Dr. Bad Debt Expense (+E, -SE)_______10 ____Allowance for Doubtful Accounts (+XA, -)_10 |

|

|

Week 04 What is important to remember about LIFO and FIFO with respect to the actual flow of goods vs. the flow of cost. |

A company good have a flow of goods of LIFO but actually account for them using FIFO and vice versa.

It's important to emphasize that the flow of goods do not have to match the flow of costs. |

|

|

Week 04 Can a FIFO firm be converted to LIFO |

No. It would be a daunting task because a company using FIFO would have to back at look at all it previous inventory. |

|

|

Week 04 What is the equation for the LIFO Reserve? |

LIFO Reserve = FIFO End Inventory - LIFO End Inventory

Notice the FIFO inventory is first |

|

|

Week 04 How does one adjust the income statement using (Delta) LIFO Reserve? |

Use the equation: (Delta-change in) LIFO Reserve = LIFO COGS - FIFO COGS

FIFO Net Income = LIFO Net Income + [(Delta)LIFO Reserve*(1-tax rate)] |

|

|

Week 05 How are ratios misused? |

Not understanding how the ratio is defined in the context it is being used |

|

|

Week 05 How are ratios contextual? |

There is no right or wrong. They don't provide answers but they help to better structure one's questions. |

|

|

Week 05 What is ROE? |

Net Income / Average Shareholders' Equity |

|

|

Week 05 is $10M in net income good? |

It depends. What is the value of the shares, for instance? |

|

|

Week 05 What are two drivers of ROE? |

|

|

|

Week 05 What is the ROE Framework? |

______________Return on Equity ______________________|____________ |--------------------------X------------------| Return on Assets____________Financial Leverage |

|

|

Week 05 Two Drivers of Return on Assets? |

|

|

|

Week 05 What is de-levering net income? |

Adding Net Income Back In at the tax rate of the company (1-tax rate) * Interest Rate |

|

|

Week 05 What is the dupont formula |

______________Return on Equity ______________________|____________ |--------------------------X------------------| Return on Assets____________Financial Leverage _________|__________________ Return of Sales X Asset Turnover

ROE = Net Income/Sales x Sales/Assets x Assets/Equity _____= Profitability_______xEfficiency____xLeverage

Two Type of Companies:

High Turnover, Low Markup (The companies with Mart in their name) Low Turnover, High Markup(Shops downtown in the shopping district.) |

|

|

What is common sizing and to which financial statements does it apply? |

the balance sheet and income statement. the cash flow statement is not as susceptible to common size. With common sizing everything is expressed in terms of assets and it gives a better picture of what's going on.

Everything could also be expressed in terms of liabilities and equities. |

|

|

Dupont Analysis is good for determing if ______________ performance is ____________ |

Operating, increasing. |

|

|

What are authorized stock? |

The maximum number of stock a company can issue based on its charter. To change this amount requires approval of the shareholders. |

|

|

What are outstanding stock? |

This value must be less than authorized stock and is comprised of float (public) and restricted (key employee) stock. |