![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

18 Cards in this Set

- Front

- Back

|

What does PV and FV mean?

|

Present value of future cash flows (discounted at the appropriate discount rate)

Future value of cash flows after one or more periods. |

|

|

What is another term for discount rate?

|

Interest rate - the exchange rate between earlier and later money.

|

|

|

What is the formula for future value of money.

|

FV = PV(1+r) t

r = period interest rate, expressed as decimal t = number of periods t should be small (to the power of). |

|

|

What is simple interest?

|

Interest earned only on the original principal (amount).

|

|

|

What is compound interest?

|

Interest earned on principal and on the interest received.

|

|

|

What is the FV formula for simple interest?

|

FV = PV + (PV x r%)

Therefore FV with compound is: FV = PV(1+r%) t (in order words... PV(1+r)(1+r)(1+r) etc) |

|

|

"What is the interest on interest" means...

|

Compound interest total - simple interest total

How much interest did you get, from gaining further interest on the interest. |

|

|

What are the 2 important relationships of future value?

|

Longer time period = greater FV

Higher interest rate = greater FV |

|

|

What is present value?

|

The current value of an amount to be received in the future.

The current value of future cashflows discounted at the appropriate discount rate. |

|

|

Why is present value less than future face value?

|

- Opportunity cost

- Risk and uncertainty |

|

|

What is discounting?

|

Finding the present value of one or more future amounts.

|

|

|

What is the formula for present value?

|

PV = FV / ( 1 + r%) t

Basically divide instead for PV, Example FV = 10 * (1.05)t PV = 10 / (1.05)t t only occurs after the / or * to the 1.% figure, not the whole sum! |

|

|

What are the important relationships of present value?

|

Longer time period = smaller present value

Higher interest rate = smaller present value OPPOSITE relationships for future value |

|

|

How do you find out the implied discount rate?

|

r = (FV / PV) 1/r[as a power] THEN MINUS 1

You are looking at an investment that will pay £1200 in 5 years if you invest £1000 today. r = (1200/1000) POWERED /0.2 MINUS 1 = 0.037 = 3.7% |

|

|

How do you find out the implied number of periods?

|

t = In(FV/PV) / In(1+r)

|

|

|

Describe the rule of 72 method.

|

A quick way of checking how long it will take to double your money given an interest rate and compound interest.

Example: double £1000 at 8% = 72/8% = 9 years |

|

|

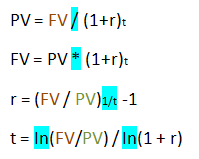

Summary:

What are the calculations for PV, FV, r and t. |

|

|

|

How do you calculate simple interest?

|

Principle x r x t

|