![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

53 Cards in this Set

- Front

- Back

|

All NFP orgs must prepare at least 3 FS

|

Statement of Financial Position

Statement of Activities Statement of Cash Flows |

|

|

NFP Orgs include:

|

Hospitals

Colleges/Universities Voluntary health & welfare organizations |

|

|

VHW's must also prepare a ____ in addition to 3 required FS

|

Statement of Functional Expenses

|

|

|

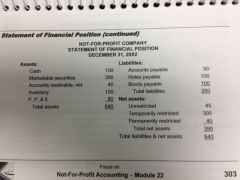

Statement of Financial Position includes ___

|

Assets

Liabilities Net Assets ---Unrestricted net assets ---Temporarily restricted net assets ---Permanently restricted net assets |

|

|

Unrestricted net assets

|

available for general use, including those set aside by board of trustees

|

|

|

Temporarily restricted net assets

|

donated by outside party & restricted to specific purpose

|

|

|

Permanently restricted net assets

|

donated by outside party & required to be invested with earnings restricted or unrestricted

|

|

|

Format of Statement of Financial Position

|

|

|

|

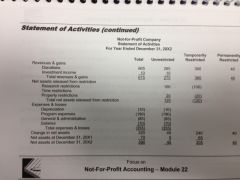

Statement of Activities

|

Reports revenues, gains, expenses, and losses, &

Temporarily restricted assets released from restriction Categorized activities among unrestricted, temporarily restricted, & permanently restricted to provide change in net assets for each. Change added to beg bal to provide ending NA for each category |

|

|

Statement of Activities - expenses classified by

|

Object (nature of item/service obtained)

Function (program or activity to which attributed) Character (periods benefited from pmts) |

|

|

Format of Statement of Activities

|

|

|

|

Statement of Cash Flows

|

Special treatment for donated assets restricted for LT purposes

Clasified as CF from financing activities |

|

|

Statement of Functional Expenses

|

Classified expenses into program services & support services

|

|

|

Program Services

|

expenses directly related to org's purpose

|

|

|

Support services

|

expenses necessary but not directly related to org's purpose (fundraising, admin)

|

|

|

Statement of Functional Expenses - Expenses classified by

|

Object

Nature Character |

|

|

Contributions that are part of the major, ongoing, & central operations are considered ___. Those that are not are considered ___.

|

Revenues; gains

|

|

|

J/E: Unrestricted cash donations

|

Dr. Cash

---Cr. Donations (unrestricted funds) |

|

|

J/E: Permanently restricted donations

|

Dr. Cash

---Cr. Donations (permanently restricted funds) |

|

|

J/E: Donated Services

|

Dr. Program Expense

---Cr. Donations (unrestricted funds) |

|

|

J/E: Cash donations restricted for a specific purpose

|

When made:

Dr. Cash ---Cr. Donations (temporarily restricted funds) When used: Dr. Temporarily restricted net assets ---Cr. unrestricted net assets Dr. Expense ---Cr. Cash |

|

|

J/E Cash donated for purchase of property

|

When made:

Dr. Cash ---Cr. Donations (temporarily restricted funds) When used: Dr. Temporarily restricted net assets ---Cr. unrestricted net assets Dr. Property ---Cr. Cash |

|

|

Pledges

|

Promise by outside parties to donate assets

Recognized in period of pledge Allowance for uncollectible amt established If there is a time restriction - temporarily restricted |

|

|

J/E: Pledges

|

Dr. Pledges

---Cr. Allowance for uncollectible pledges ---Cr. Donations (unrestricted funds) ---Cr. Donations (restricted funds) |

|

|

Donations of art, antiques, or artifiacts are not recognized if

|

Asset held for research or exhibition

Asset preserved & unaltered Proceeds from sale of asset to be used to buy additional art, antiques, artifacts |

|

|

Donated assets to be held in trust

|

Not recognized by NFP

Disclosed in footnotes |

|

|

Hospital revenues - patient service revenue is recorded at

|

gross value of services

billing may be less due to Medicare allowance or employee discount difference recorded in allowance acount statement of activities will report net amount |

|

|

How are services provided for free due to charity recognized for hospitals?

|

Not recognized as revenues

|

|

|

Hospital Revenues: Bad debts

|

recognized as expense on statement of activities

not reduction of revenue |

|

|

Hospital Revenues: Misc. revenues from cafeteria, gift shop, parking lot fees, and education programs

|

classified as other revenue

|

|

|

Hospital Revenues: donated supplied

|

reported as operating revenue and expensed when used

|

|

|

Hospital Revenues: donations of essential services and unrestricted donations

|

nonoperating revenues

|

|

|

College tuition revenues: refunds to students

|

reduce tuition revenues

|

|

|

College tuition revenues: price breaks to students (scholarships/reduction due to family staff member)

|

Tuition recognized at gross amt

Price break recognized as expense |

|

|

Contributed services, when recognized, are recognized as both ____ and ____.

However, contributed services should be recognized only when the services ___. |

revenue and expense

(1) create or enhance nonfinancial assets, or (2) require specialized skills, are provided by individuals possessing those skills, and would typically be purchased if not provided by donation. |

|

|

Endowments (permanently restricted) are restricted in both the ___ and the ____ from the fund. Therefore ___.

|

Endowment and income

Therefore no amount of unrestricted contribution revenue should be recognized in the year donated. |

|

|

Charity care represents

|

health care services that are provided but are never expected to result in cash flows

o Not recognized as revenue. o No need to estimate uncollectible accounts. Bad debts expense does not include an amount related to charity care. |

|

|

Bad debts expense is

|

an operating expense, not deducted from patient service revenue.

|

|

|

Items deducted in determining net receivables

|

Allowance for uncollectible accounts

Allowance for contractual adjustments Allowance for employee discounts |

|

|

Does designation of assets by trustees does change classification?

|

No.

|

|

|

A donor’s conditional promise to give is considered unconditional when

|

the possibility that the condition will not be met is remote.

|

|

|

A quasi endowment is

|

an unrestricted net asset.

|

|

|

Interest earned on board-designated investments is reported as unrestricted revenue.

|

unrestricted revenue.

|

|

|

Unconditional promises to give are reported in what period?

|

the period the pledges are made, not in the period of cash collection.

Note that the contributions will be reported as temporarily restricted net assets on the statement of activities if they are not received until future years. |

|

|

Performance indicator

|

revenue and gains over expenses and losses

Can include net assets released from restrictions if used for operating expenses. |

|

|

Unrealized gains and losses from other than trading securities which are not restricted by donors are reported

|

after the performance indicator on the statement of operations.

|

|

|

A transfer of assets with a conditional promise are accounted for as

|

a refundable advance (liability) until the conditions have been substantially met.

|

|

|

Restricted contributions for LT purposes (endowments, plant, future programs) are ____ activities.

|

financing

|

|

|

For the statement of cash flows to reconcile to the change in cash and cash equivalents reported in current assets, cash flows reported in the investing activities section has to equal

|

the amount reported in the financing section.

|

|

|

For both private sector and governmental health care organizations, financial statements include

|

a balance sheet

a statement of operations a statement of changes in net assets a cash flow statement notes to the financial statements The statement of operations may be combined with the changes in net assets, or may be presented separately. |

|

|

Does an expiration of donor imposed conditions cause a reporting classification?

|

No. However, expiration of donor imposed restrictions does.

|

|

|

All expenses are reported as _____. Thus, expenses are deducted only from _____.

|

decreases in unrestricted net assets on the statement of activities

unrestricted revenues and other additions. |

|

|

Operating expenses are presented as

|

decreases in unrestricted net assets

|