![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

19 Cards in this Set

- Front

- Back

|

Derecognition of FAAC |

PV as of date versus considertion received. Recognized in P/L |

|

|

1 The business model is achieved both by collecting contractual cash flows and by selling financial assets2 The contractual cash flows are solely for payment of principal and interest on the principal outstanding c ⁿ |

FVTOCI Business Model |

|

|

FVTOCI Initial Measurement |

FV + TC |

|

|

1 Financial asset is held within a business model whose objective is to hold financial assets in order to collect contractual cash flows 2 SPPI |

FAAC Business Model |

|

|

Held for Trading Means: |

1 Acquired or incurred principally for the purpose of selling or repurchasing on a near term 2 Part of the portfolio identified financial instrument that are managed together and for which there is evidence of a recent actual pattern of short profit-taking 3 A derivative |

|

|

FVTOCI UG/UL Presentation |

Cummulative - Equity (SFP) OCI- Movement of UG/UL during the current year presented (SCI) |

|

|

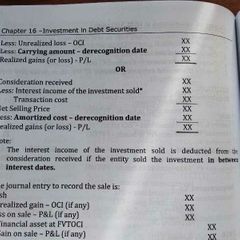

Derecognition of FVTOCI |

|

|

|

UG/UL FVTOCI DEBT VS. EQUITY |

FVTOCI DEBT- Recycled to P/L FVTOCI EQUITY- Transferred directly to RE |

|

|

Impairment of Financial Assets |

Covered in PFRS 9 |

|

|

Scope of Impairment |

Entity shall recognize Allowance for ECL on FAAC, FVTOCI (DEBT), lease receivable, contract asset on a loan commitment and financial guarantee contract. |

|

|

The difference between the contractual cash flows that are due to an entity in accordance with the contract and all the cash flows that the entity expects to receive discounted on EIR. |

Credit Loss |

|

|

Derecognition Gain/ Loss FVTOCI & FAAC |

Presented in P/L |

|

|

Impairment Loss FVTOCI & FAAC |

P/L |

|

|

Derecognition Gain FVTOCI & FAAC |

P/L no limit |

|

|

Expected Credit Loss Classification |

1 12 month ECL has not increased significantly since initial recognition; portion of lifetime ECL that represent the ECL that result from default of events within 12 months after reporting date 2 Lifetime ECL - has increased significantly since intial recognition that result from possible default events over the expected life of financial asset. |

|

|

FVTOCI Loss Allowance |

Presented in OCI |

|

|

Approaches in ECL: |

1Explicit Probability of Default Approach 2 Loss Rate Approach 3 Simplified Approach (Provision Matrix) |

|

|

The likelihood that a loan will not be repaid and will fall into default. |

Probability Default |

|

|

ECL under Approach 1 |

ECL= Probability Default * Loss Given Default * Exposure at Default |