![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

33 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

Can be bought or sold between 2 parties and has basic terms defined with amount borrowed, interest rate, maturity and renewal date.

|

Debt Instruments |

|

|

|

Formal unconditional promise, made under seal to pay a specified sum of money at a determinable future date and to make periodic interest payments at a stated rate until the principal sum is paid. |

Bonds |

|

|

|

Certificate of indebtedness issued by the bond issuer which entitles the bondholder to receive principal and interest payments. |

Bond Certificate |

Serves as proof of ownership over bonds by the imvestor. |

|

|

Unconditional contract between the bond issuer and the bondholder that specifies terms of the bond |

Bond Indenture |

Deed of trust, bond resolution or bond contract |

|

|

Bonds which matures on a single date |

Term bonds |

|

|

|

Bonds with a series of maturity dates

|

Serial bonds |

|

|

|

Bonds secured by a mortgage |

Mortgage bonds |

|

|

|

Bonds secured by stocks and bonds of other corporation |

Collateral trust bonds |

|

|

|

Bonds guaranteed by another party's promise to pay in case the bond issuer fails to make payments |

Guaranteed bonds |

|

|

|

Bonds without any security or collateral |

Debenture Bonds |

|

|

|

Classification of Debt Instrument |

FVTPL, FVOCI, FAAC |

|

|

|

Classification of Debt Instrument |

FVTPL, FVOCI, FAAC |

|

|

|

Measurement for Debt Instrument |

FV + Transaction cost, except FVTPL |

|

|

|

FV Determinant |

Quotation price in an active market PV of related cash flows using EIR |

|

|

|

FS Presentation |

FVTPL-Current Assets FVOCI, FAAC- Noncurrent Asset unless due within 12 months |

|

|

|

FVTPL Classification |

Held for trading Irrevocable designation at FVTPL Other investments that do not satisfy the requirements for measurement at AC and FVOCI |

|

|

|

FVTPL Initial Measurement |

Acquisition cost TC expensed outright |

|

|

|

FVTPL Business Model |

To sell bonds in near term to take advantage of the fluctuations for short term profit taking |

|

|

|

FVTPL UG/UL |

P/L |

|

|

|

Premium or Discount in FVTPL |

Not amortized at the end of reporting period Interest income will include the nominal or stated interest earned during the period. |

|

|

|

Realized Gain on Derecognition on FVTPL |

Recognized in P/L Difference between the net selling price and CA (FV to date) Consideration received XX Less: Interest income on investment sold XX Transaction cost XX Net Selling Price XX LESS CA @ FV TO DATE |

|

|

|

FAAC initial measurement |

Acquisition cost + Transaction cost |

|

|

|

Bond Schemes |

At face amount: Proceeds= Face Value At Premium: Proceeds } Fave Value At Discount: Proceeds { Face Value Maturity Value : Face Amount |

|

|

|

At Premium |

Effective Rate is less than Nominal Rate |

|

|

|

At Discount |

Effective rate is more than nominal rate |

|

|

|

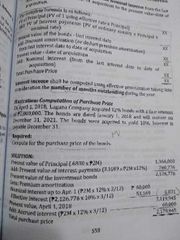

Bond Computation on Purchase Price/ Present Value |

PV of Principla Payment PV of Interest Payment |

|

|

|

Term Bonds Acquired in Between Interest Dates |

1 Compute the Present value of the bonds on the last interest date |

|

|

|

Purchase Price, PV Date of Acquisition, PV on last interest date formula |

|

Not yet done |

|

|

Acquisition of investment bonds with warrants |

Use Relative Fair Value to allocate the acquisition cost |

|

|

|

Computation of PV on serial bonds |

|

|

|

|

Subsquent Measurement of FAAC |

Amorization by EIR |

|

|

|

Subsequent Measurement of FAAC |

Amortized cost using EIR |

|

|

|

Amortization of Premium or Discount |

EntroEnt |

|