![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

22 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

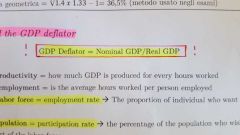

GDP deflator |

|

|

|

|

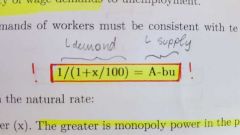

Labour supply and demand |

u=unemployment rate |

|

|

|

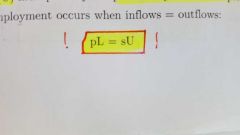

Inflow/outflow of Labour market |

p = prob to lose the job L = people employed s = prob to find a job U= people unemployed |

|

|

|

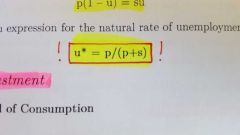

Natural rate if unemployment |

u*= natural unemployment rate p and s prob to lose and to find a job respectively |

|

|

|

Keynesian Model of Consumption |

|

|

|

|

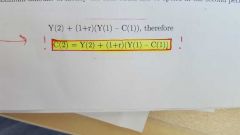

Multiplier in the Keneysian model of Consumption |

|

|

|

|

Permanent Income Model |

C = consumption in different periods (1 or 2) Y = Income in different periods (1 or 2) r= interest rate |

|

|

|

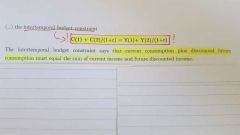

Intertemporal Budget Constraint |

|

|

|

|

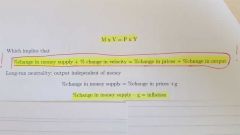

Quantity Theory Model |

|

|

|

|

Phillips Curve |

|

|

|

|

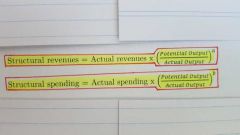

Government structural revenues & spending |

a = elasticity of government revenues b= elasticity of government spending |

|

|

|

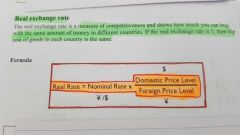

Real Exchange Rate (RER) |

!!!! NON ha unità di misura !!!! RER > 1 domestic country is more expensive RER = 1 same prices in both countries RER < 1 domestic country is cheaper |

Not to confuse with Real Interest Rate (RIR) |

|

|

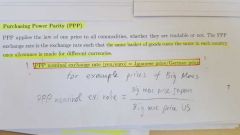

PPP nominal exchange rate |

|

|

|

|

Government intertemporal Budget Constraint |

|

|

|

|

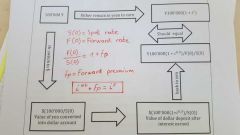

Covered Interest Parity (CIP) |

|

|

|

|

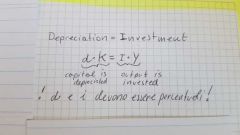

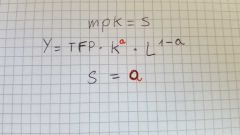

Steady State |

|

|

|

|

Golden Rule |

The golden rule is the optimal (= maximized consumption) investment rate between all the possible steady states of an economy a = share of capital of the production function |

|

|

|

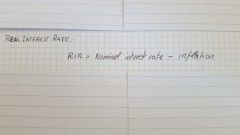

Real Interest Rate (RIR) |

|

Not to confuse with Real Exchange Rate (RER) |

|

|

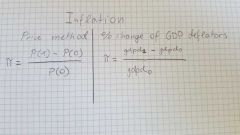

Inflation (two methods) |

|

|

|

|

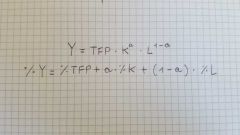

Cobb-Douglass production function |

a = share of Capital 1- a = share of Labour |

|

|

|

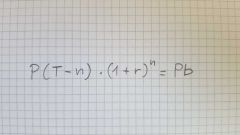

Hotelling Rule |

P(T-n) is the price of the exhaustibe resource at period T - n Pb = Backstop price = price of the last unit of the exhaustibe resource at period T, when the Demand D=0 |

|

|

|

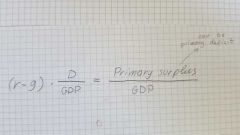

Sustainable level of government debt |

r = nominal interest rate g = nominal GDP growth D/GDP is the sustainable level of government debt and must be a % Primary Surplus/GDP is also a % and its called primary surplus or primary deficit depending if positive or negative |

|