![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

100 Cards in this Set

- Front

- Back

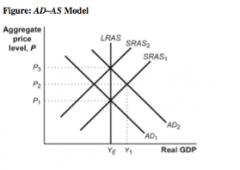

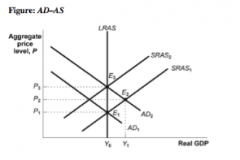

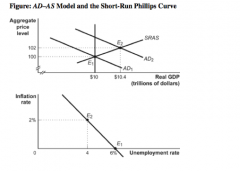

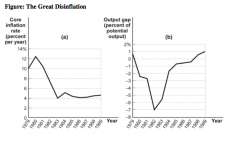

1. (Figure: AD–AS Model) Refer to the information in the figure. Suppose the economy is at YE with a price level of P1. Which of the following would represent the new long-run equilibrium position if the aggregate demand curve shifted to the right from AD1 to AD2 as a result of an increase in the money supply?

A) YEandP2 B) YE and P1 C) Y1 and P2 D) YE and P3 |

D) YE and P3

|

|

|

2. In the classical model, it is thought that the longrun:

A) and short-run aggregate supply curves are both upward sloping. B) aggregate supply curve is vertical and the short-run aggregate supply curve is upward sloping. C) and short-run aggregate supply curves are both vertical. D) aggregate supply curve is upward sloping and the short-run aggregate supply curve is vertical. |

C) and short-run aggregate supply curves are both vertical.

|

|

|

3. Which of the following is the BEST explanation for an upward-sloping short-run aggregate supply curve?

A) Prices are perfectly flexible. B) Wages are perfectly flexible. C) Wages and prices of some goods are sticky in the short run. D) Wages and prices of some goods are flexible in the short run but sticky in the long run. |

C) Wages and prices of some goods are sticky in the short run.

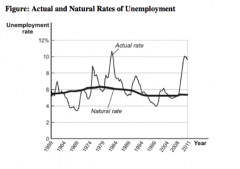

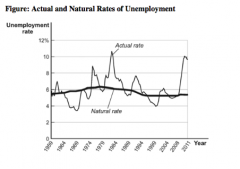

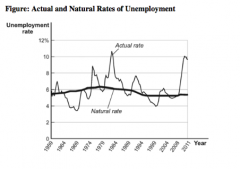

|

|

|

4. In the short run in periods of low inflation, an increase in aggregate demand from a position of full employment leads to:

A) higher prices and higher unemployment. B) higher prices and higher output. C) lower prices and higher output. D) lower prices and higher unemployment. |

B) higher prices and higher output.

|

|

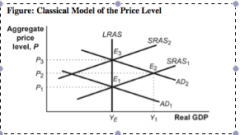

5. (Figure: Classical Model of the Price Level) Refer to the information in the figure. If the central bank increases the money supply such that aggregate demand shifts from AD1 to AD2, according to this classical model, real GDP would:

A) not change. B) increase from YE to Y1. C) increase from Y1 to YE. D) establish a new potential output. |

A) not change.

|

|

6. (Figure: Classical Model of the Price Level) Refer to the information in the figure. If the central bank increases the money supply such that aggregate demand shifts from AD1 to AD2, according to this classical model, the price level will:

A) not change. B) increase from P1 to P2. C) increase from P1 to P3. D) decrease from P1 to P2. |

C) increase from P1 to P3.

|

|

7. (Figure: Classical Model of the Price Level) Refer to the information in the figure. If the central bank increases the money supply such that aggregate demand shifts from AD1 to AD2, according to this classical model, the equilibrium point would:

A) not change. B) immediately move from E1 to E2. C) immediately move from E2 to E1. D) immediately move from E1 to E3. |

D) immediately move from E1 to E3.

|

|

|

8. During periods of low inflation, the short-run aggregate supply curve is:

A) vertical. B) horizontal. C) upward sloping. D) downward sloping. |

C) upward sloping.

|

|

|

9. In the long run, any given percentage increase in the money supply:

A) decreases real GDP . B) leads to an equal percentage increase in the overall price level. C) increases real GDP . D) leads to an equal percentage decrease in the unemployment rate. |

B) leads to an equal percentage increase in the overall price level.

|

|

|

10. In economies with persistently high inflation, an increase in the money supply:

A) will translate into a proportional increase in the aggregate price level much faster than usual. B) will translate into a proportional increase in the aggregate price level only in the long run. C) will not affect either the aggregate price level or the aggregate output. D) will translate into a proportional increase in the aggregate output much faster than usual. |

A) will translate into a proportional increase in the aggregate price level much faster

than usual. |

|

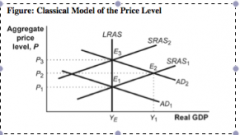

11. (Figure: AD–AS) Refer to the AD–AS diagram. Suppose the economy is initially at E1, where AD1 intersects SRAS1 and LRAS. Now, suppose that the AD1 shifts to AD2. That shift could be due to:

A) an increase in the aggregate price level. B) a decrease in government expenditure. C) an increase in tax rates. D) an increase in money supply. |

D) an increase in money supply.

|

|

12. (Figure: AD–AS) Refer to the AD–AS diagram. Suppose the economy starts at E1 and moves to E2, where AD2 intersects SRAS1. Now, suppose that the SRAS1 will shift to SRAS2, because:

A) real wages rise in the long run. B) nominal wages rise in the long run. C) the real money supply rises in the long run. D) aggregate real output rises in the long run. |

B) nominal wages rise in the long run.

|

|

13. (Figure: AD–AS) Refer to the AD–AS diagram. Suppose the economy starts at E1 and moves to E2, where AD2 intersects SRAS1. Finally the economy moves to E3. The classical model of price level:

A) assumes that the economy moves from E1 to E3 and ignores E2; thus, inflation increases but real GDP remains the same. B) assumes that the economy moves from E2 to E3 and ignores E1; thus, real GDP increases but inflation remains the same. C) assumes that the economy moves from E2 to E3; thus, inflation decreases but real GDP remains the same. D) assumes that the economy moves from E1 to E2 and ignores E3; thus, both inflation and real GDP remain the same. |

A) assumes that the economy moves from E1 to E3 and ignores E2; thus, inflation increases but real GDP remains the same.

|

|

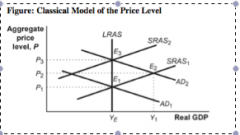

14. (Figure: AD–AS) Refer to the diagram in AD–AS. If our economy has low-level inflation and the Fed uses expansionary monetary policy, the initial effect is that:

A) AD1 will shift to AD2 and the economy will move from E1 to E2. B) SRAS1 will shift to SRAS2 and the economy will move from E2 to E3. C) SRAS2 will shift to SRAS1 and the economy will move from E3 to E2. D) AD2 will shift to AD1 and the economy will move from E2 to E1. |

A) AD1 will shift to AD2 and the economy will move from E1 to E2.

|

|

15. (Figure: AD–AS) Refer to the diagram in AD–AS. If our economy is at equilibrium and the Fed uses expansionary monetary policy:

A) AD2 will shift to AD1 and the economy will move from E2 to E1. Then very quickly nominal wages will rise, SRAS1 will shift to SRAS2, and the economy will move from E2 to E3. B) SRAS1 will shift to SRAS2 and the economy will move from E2 to E3. Then AD2 will shift to AD1 and the economy will move from E2 to E1. C) SRAS2 will shift to SRAS1 and the economy will move from E3 to E2. Then AD2 will shift to AD1 and the economy will move from E2 to E1. D) AD1 will shift to AD2 and the economy will move from E1 to E2. Then very quickly nominal wages will rise, SRAS1 will shift to SRAS2, and the economy will move from E2 to E3. |

D) AD1 will shift to AD2 and the economy will move from E1 to E2. Then very quickly nominal wages will rise, SRAS1 will shift to SRAS2, and the economy will move from E2 to E3.

|

|

|

16. According to the classical model of the price level, an increase in the money supply will create:

A) inflation with no long-run increase in real GDP. B) inflation and a long-run increase in real GDP. C) no inflation and a long-run increase in real GDP. D) deflation with no long-run increase in real GDP. |

A) inflation with no long-run increase in real GDP.

|

|

|

17. The inflation tax is:

A) the higher tax paid by individuals whose incomes are indexed to inflation. B) the taxes paid during periods of inflation. C) the reduction in the value of money that is held by the public caused by inflation. D) the higher prices consumers pay due to inflation. |

C) the reduction in the value of money that is held by the public caused by inflation.

|

|

|

18. Fiat money is:

A) money backed by gold. B) money that only the government will accept to pay taxes. C) paper money with no intrinsic value. D) used only in the United States as a medium of exchange. |

C) paper money with no intrinsic value.

|

|

|

19. If the money supply is $3 billion and inflation is 6%, the inflation tax is:

A) $3.18 billion. B) $50 billion. C) $180 million. D) $1.8 billion. |

C) $180 million.

|

|

|

20. If the public holds $300 billion in monetary purchasing power and the inflation rate is 5%, then the inflation tax that year is:

A) $5 billion. B) $15 billion. C) $60 billion. D) $1500 billion. |

B) $15 billion

|

|

|

21. If a high inflation rate leads people to ______ their money holdings, this may lead to a further increase in the money supply and ______ inflation.

A) reduce; lower B) increase; lower C) reduce; higher D) increase; higher |

C) reduce; higher

|

|

|

22. From 2000 to 2008 Zimbabwe's prices:

A) decreased by 50%. B) increased by 50%. C) increased by 100%. D) increased by 80 trillion percent. |

D) increased by 80 trillion percent.

|

|

|

23. Zimbabwe's economic instability was caused primarily by:

A) its joining the Coalition of the Willing in the Iraq war. B) its attempts to join the European Union. C) the government's seizure of the country's farms, which disrupted production. D) its high tariffs on imported goods. |

C) the government's seizure of the country's farms, which disrupted production.

|

|

|

24. When the output gap is negative, the actual unemployment rate is:

A) above the natural rate. B) below the natural rate. C) equal to the natural rate. D) The actual and natural unemployment rates are not related to the output gap. |

A) above the natural rate

|

|

25. (Figure: Actual and Natural Rates of Unemployment) Refer to the information in the figure. In 1982, the actual unemployment rate was approximately:

A) zero. B) 4%. C) 6%. D) 10%. |

D) 10%.

|

|

26. (Figure: Actual and Natural Rates of Unemployment) Refer to the information in the figure. In 1982, the cyclical unemployment rate was approximately:

A) zero. B) 4%. C) 6%. D) 10%. |

B) 4%.

|

|

27. (Figure: Actual and Natural Rates of Unemployment) Refer to the information in the figure. In 1982, the natural unemployment rate (structural plus frictional) was approximately:

A) zero. B) 4%. C) 6%. D) 10%. |

C) 6%.

|

|

|

28. The relationship between the output gap and the unemployment rate can be summarized thus:

A) When the output gap is negative, the unemployment rate is below the natural rate. B) When the output gap is zero, the unemployment rate is also zero. C) When there is an inflationary gap, the unemployment rate is above the natural rate. D) When the output gap is positive, the unemployment rate is below the natural rate. |

D) When the output gap is positive, the unemployment rate is below the natural rate.

|

|

|

29. Suppose actual aggregate output is equal to the potential output; the actual unemployment rate is:

A) equal to the natural rate of unemployment. B) higher than the natural rate of unemployment. C) zero. D) equal to the cyclical rate of unemployment. |

A) equal to the natural rate of unemployment.

|

|

|

30. If an economy has just had a serious recession but real GDP is expanding once again,

we can conclude the unemployment rate will: A) automatically fall. B) automatically rise. C) actually rise, if people who were previously discouraged enter the work force but do not find jobs right away. D) actually fall, if people who were previously discouraged enter the work force but do not find jobs right away. |

C) actually rise, if people who were previously discouraged enter the work force but do not find jobs right away.

|

|

|

31. If actual output growth is 5% when potential output growth is 5%, then the unemployment rate will:

A) not change. B) rise. C) fall. D) be zero. |

A) not change.

|

|

|

32. The idea that a 1% increase in the output gap will decrease the unemployment rate by 0.5% is known as:

A) Okun's law. B) Phillip's law. C) Greenspan's law. D) Keynes's law. |

A) Okun's law.

|

|

|

33. The natural rate of unemployment is 4%, and the economy is producing 95% of its potential output. Okun's law predicts an unemployment rate of:

A) 4%. B) 5%. C) 6.5%. D) 9%. |

C) 6.5%.

|

|

|

34. According to recent estimates of Okun's law, if the unemployment rate fell by a full percentage point, it would most probably be attributable to a:

A) 3% increase in real GDP . B) 2% increase in real GDP . C) 1% increase in real GDP . D) 3% decrease in real GDP . |

B) 2% increase in real GDP .

|

|

|

35. Assume that the economy is contracting and unemployment is rising. Which of the following would be a logical explanation for a sudden fall in the unemployment rate even while the economy continues to contract?

A) a reduction in the number of discouraged workers B) an increase in the number of discouraged workers C) an increase in the level of employment D) a decrease in the level of employment |

B) an increase in the number of discouraged workers

|

|

|

36. Okun's law suggests that:

A) a 1% increase in a positive output gap increases the unemployment rate by 0.5%. B) a 1% increase in a positive output gap decreases the unemployment rate by 0.5%. C) a 0.5% increase in a positive output gap increases the unemployment rate by 1%. D) a 0.5% increase in a positive output gap decreases the unemployment rate by 1%. |

B) a 1% increase in a positive output gap decreases the unemployment rate by 0.5%.

|

|

|

37. If the natural rate of unemployment is 5% and the actual rate of unemployment is 4%:

A) disinflation is likely to occur. B) there will be no effect on prices. C) inflation will increase. D) the short-run Phillips curve will shift down. |

C) inflation will increase.

|

|

|

38. A supply shock caused by an increase in the price of gasoline causes:

A) a decrease in output and prices. B) a decrease in output and an increase in prices. C) an increase in output and prices. D) an increase in output and a decrease in prices. |

B) a decrease in output and an increase in prices.

|

|

|

39. The short-run Phillips curve shows:

A) a direct relationship between unemployment and inflation. B) an inverse relationship between unemployment and inflation. C) consequences of the misperceptions theory. D) the optimal level of employment. |

B) an inverse relationship between unemployment and inflation.

|

|

|

40. A supply shock:

A) moves our economy along the short-run aggregate supply curve. B) moves us along the short-run Phillips curve. C) shifts the short-run Phillips curve. D) shifts the short-run aggregate supply curve but not the short-run Phillips curve. |

C) shifts the short-run Phillips curve.

|

|

|

41. Along a Phillips curve:

A) consumption depends on prices. B) the inflation rate varies inversely with the unemployment rate. C) the inflation rate varies directly with the unemployment rate. D) prices and tax rates are directly related. |

B) the inflation rate varies inversely with the unemployment rate.

|

|

|

42. Suppose that the unemployment rate rises at the same time that the inflation rate declines. This situation would be consistent with a movement along the:

A) vertical Phillips curve. B) horizontal Phillips curve. C) positively sloped Phillips curve. D) negatively sloped Phillips curve. |

D) negatively sloped Phillips curve.

|

|

43. (Figure: AD–AS Model and the Short-Run Phillips Curve) Refer to the information in the figure. If the central bank increases the money supply so that aggregate demand shifts from AD1 to AD2, then real GDP will increase by:

A) zero. B) 2%. C) 4%. D) 6%. |

C) 4%.

|

|

44. (Figure: AD–AS Model and the Short-Run Phillips Curve) Refer to the information in the figure. If the central bank increases the money supply so that aggregate demand shifts from AD1 to AD2, then the inflation rate will be:

A) zero. B) 2%. C) 4%. D) 6%. |

B) 2%

|

|

|

45. An increase in the expected rate of inflation:

A) shifts the short-run Phillips curve down. B) shifts the short-run Phillips curve up. C) moves the economy along the short-run Phillips curve to higher rates of inflation. D) moves the economy along the short-run Phillips curve to higher rates on unemployment. |

B) shifts the short-run Phillips curve up.

|

|

|

46. Expectations of a higher inflation rate shift the short-run aggregate supply curve to the _________, changing the trade-off between inflation and unemployment. As a result, the short-run Phillips curve shifts _________.

A) left; down B) right; up C) left; up D) right; down |

C) left; up

|

|

|

47. During the 1950s and 1960s, the short-run Phillips curve for the U.S. economy showed a(n):

A) positive relationship between unemployment and inflation. B) inverse relationship between unemployment and inflation. C) positive relationship between interest rates and inflation. D) inverse relationship between interest rates and inflation. |

B) inverse relationship between unemployment and inflation.

|

|

|

48. Stagflation is a combination of:

A) restrictive trade policies and inflation. B) budget deficits and trade deficits. C) unemployment and higher taxes. D) unemployment and inflation. |

D) unemployment and inflation.

|

|

|

49. An increase in expected inflation will affect the short-run Phillips curve:

A) by shifting it downward; the actual rate of inflation at any given unemployment rate will fall by the same amount. B) by shifting it upward, as a result the actual rate of inflation at any given unemployment rate will also be higher when the expected inflation rate is higher. C) by moving along the same curve, where it equals the actual rate of inflation. D) only if the economy is at the nonaccelerating inflation rate of unemployment. |

B) by shifting it upward, as a result the actual rate of inflation at any given unemployment rate will also be higher when the expected inflation rate is higher.

|

|

|

50. If the natural rate of unemployment _________, the NAIRU _________, and the long-run Phillips curve shifts to the left.

A) falls; falls B) rises; rises C) falls; rises D) rises; falls |

A) falls; falls

|

|

|

51. When workers and firms become aware of a rise in the general price level:

A) they will not do anything, because they know they are powerless to counter any economic changes. B) they will incorporate higher prices into their expectations of future prices. C) firms with sticky prices will ultimately adjust their prices downward. D) they will agree to renegotiate wage contracts downward. |

B) they will incorporate higher prices into their expectations of future prices.

|

|

|

52. In the long run, when the actual inflation rate gets embedded into people's expectation:

A) the trade-off between inflation and unemployment becomes even stronger. B) it is possible to achieve lower unemployment in the long run by accepting higher inflation. C) there is no longer a trade-off between inflation and unemployment. D) actual inflation at any unemployment rate is always higher than expected inflation. |

C) there is no longer a trade-off between inflation and unemployment.

|

|

|

53. The NAIRU is:

A) the inflation rate at which the unemployment rate does not change over time. B) a trade-off between unemployment and inflation. C) the unemployment rate at which inflation does not change over time. D) a rate at which it is possible to achieve lower unemployment by accepting higher inflation. |

C) the unemployment rate at which inflation does not change over time.

|

|

|

54. Which of the following accurately describes disinflation?

A) It must be accompanied by a decline in the price level. B) The inflation rate rises at a higher rate. C) It is the process of bringing down the inflation that has become embedded in expectations. D) It is a gradual reduction in the price level over time. |

C) It is the process of bringing down the inflation that has become embedded in expectations.

|

|

|

55. To bring disinflation to an economy, policy makers must:

A) slow down labor productivity growth. B) increase the money supply in order to release the economy from the liquidity trap. C) keep unemployment below its natural rate for an extended period. D) lower expectations about inflation. |

D) lower expectations about inflation.

|

|

|

56. Analysis of the Phillips curve reveals that a __________ in unemployment, like that of the early 1980s, is needed to break the cycle of inflationary expectations.

A) permanent increase B) permanent decrease C) temporary increase D) temporary decrease |

C) temporary increase

|

|

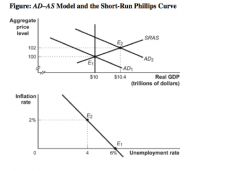

57. (Figure: The Great Disinflation) Refer to the information in the figure. In the early 1980s, the inflation rate was beaten down by the Federal Reserve's tight monetary policy. In the short run this policy led to a ______ level of actual output and a ______ rate of unemployment.

A) high; high B) low; high C) low; low D) high; low |

B) low; high

|

|

|

58. The U.S. government reports a core inflation rate that excludes _____ and _____ prices to remove the volatility of those two sectors from inflation estimates.

A) housing; automobile B) steel; housing C) energy; food D) gasoline; housing |

C) energy; food

|

|

|

59. Deflation:

A) hurts borrowers and helps lenders. B) helps borrowers and hurts lenders. C) unlike inflation, affects neither borrowers nor lenders. D) has effects on borrowers and lenders that depend on the amount of the loan. |

A) hurts borrowers and helps lenders

|

|

|

60. The problem of debt deflation deepens during an economic slump because:

A) borrowers have to reduce spending to pay back burdensome debts. B) the Fisher effect raises the nominal interest rate during a period of deflation. C) lenders have to lower spending in order to accommodate higher returns from loans. D) the zero bound on the nominal interest rate is broken. |

A) borrowers have to reduce spending to pay back burdensome debts.

|

|

|

61. During periods of deflation _____ will be hurt and _____ will be helped.

A) firms; borrowers B) borrowers; lenders C) consumers; firms D) home buyers; home sellers |

B) borrowers; lenders

|

|

|

62. When economists state that there is a zero bound on nominal interest rates, they mean that:

A) the real interest rate cannot go below zero. B) the nominal interest rate cannot go below zero. C) the real interest rate can very well be negative. D) the nominal interest rate can always go below zero. |

B) the nominal interest rate cannot go below zero.

|

|

|

63. If the economy is in a liquidity trap:

A) both monetary and fiscal policies are effective. B) neither monetary nor fiscal policy is effective. C) monetary policy is effective, but fiscal policy is not. D) fiscal policy is effective, but monetary policy is not. |

D) fiscal policy is effective, but monetary policy is not.

|

|

|

64. Expecting the inflation rate to be 3%, Tony decides to put his savings in a 12-month certificate of deposit yielding a fixed 6% interest rate. If the actual inflation rate is ________, it can be argued that ________ is (are) worse off.

A) above 3%; the bank issuing the certificate B) exactly 6%; both the bank and Tony C) below 3%; Tony D) below 3%; the bank issuing the certificate |

D) below 3%; the bank issuing the certificate

|

|

|

65. A liquidity trap is a situation in which:

A) using expansionary monetary policy is not effective because the real interest rate is negative. B) aggregate demand falls because consumers do not have enough liquidity to consume. C) using expansionary monetary policy is not effective because the nominal interest rate is almost zero. D) lenders are trapped by large loans with declining rates of return. |

C) using expansionary monetary policy is not effective because the nominal interest rate is almost zero.

|

|

|

66. A liquidity trap results from the:

A) inflation tax. B) expansionary fiscal policy. C) Fisher effect. D) zero bound of the nominal interest rate. |

D) zero bound of the nominal interest rate

|

|

|

67. The liquidity trap is associated with all of the following EXCEPT:

A) a large reduction in the demand for loanable funds. B) the nominal interest rate falls to zero. C) monetary policy becomes ineffective. D) fiscal policy becomes ineffective. |

D) fiscal policy becomes ineffective.

|

|

|

68. When Fed officials worried about the possibility of “Japanification” in the United States, it meant that they were worried that the U.S. economy would:

A) grow faster than the economy of Japan after World War II. B) accumulate large trade surpluses, like Japan. C) fall into a period of hyperinflation. D) fall into a deflationary trap. |

D) fall into a deflationary trap.

|

|

|

69. The measure used by the Fed that excludes food and energy prices is the:

A) consumer price index. B) wholesale price index. C) core inflation rate. D) federal funds rate. |

C) core inflation rate.

|

|

|

70. The Fed tries to keep the core inflation rate around: A) zero.

B) 2%. C) 4%. D) 5%. |

B) 2%

|

|

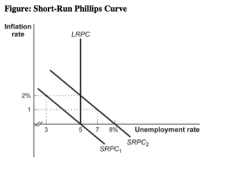

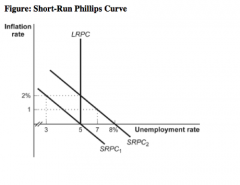

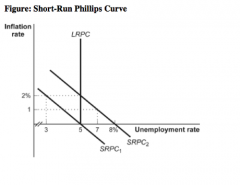

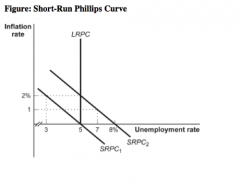

71. (Figure: Short-Run Phillips Curve) Refer to the information in the figure. based on an expected inflation rate of:

A) zero. B) 1%. C) 2% D) 5%. |

C) 2%

|

|

72. (Figure: Short-Run Phillips Curve) Refer to the information in the figure. based on an expected inflation rate of:

A) zero. B) 1%. C) 2%. D) 3%. |

A) zero

|

|

73. (Figure: Short-Run Phillips Curve) Refer to the information in the figure. rate of unemployment is:

A) 3%. B) 5%. C) 7%. D) 8%. |

B) 5%

|

|

74. (Figure: Short-Run Phillips Curve) Refer to the information in the figure. The NAIRUis:

A) 3%. B) 5%. C) 7%. D) 8%. |

B) 5%.

|

|

|

75. Suppose the economy is in long-run equilibrium. The government has just decided to lower income taxes. The long-run impact of this policy will be:

A) a decrease in the natural rate of unemployment and an increase in inflation. B) a decrease in the natural rate of unemployment and no change in inflation. C) no change in the natural rate of unemployment and an increase in inflation. D) no change in the natural rate of unemployment and no change in inflation. |

C) no change in the natural rate of unemployment and an increase in inflation.

|

|

|

76. In the long run, an increase in the money supply:

A) will increase real GDP and the price level. B) causes people to hold onto large sums of money. C) results in no change in real GDP. D) encourages people to save more money. |

C) results in no change in real GDP.

|

|

|

77. When an economy has high inflation:

A) wage and price stickiness lessen or disappear. B) the Keynesian model of the economy is most relevant. C) wages become more inflexible as workers wait for prices to stabilize. D) changes in the money supply take much longer to affect the inflation rate. |

A) wage and price stickiness lessen or disappear.

|

|

|

78. If a central bank pursues an expansionary monetary policy:

A) the aggregate price level and level of real GDP will increase in the short run. B) the level of real GDP will increase, but the aggregate price level will stay the same in the long run. C) nominal prices and nominal wages will be unaffected in the long run. D) the aggregate price level will increase and the level of real GDP will decrease in the short run. |

A) the aggregate price level and level of real GDP will increase in the short run.

|

|

|

79. Government's right to print money to finance deficits is referred to as:

A) open-market sales. B) seigniorage. C) fiat money implementation. D) crowding out. |

B) seigniorage.

|

|

|

80. When inflation is high:

A) people will increase their level of real-money holdings. B) people will save more. C) lenders gain at the expense of borrowers. D) people will decrease their level of real-money holdings. |

D) people will decrease their level of real-money holdings.

|

|

|

81. During an inflationary gap:

A) the unemployment rate is less than the natural rate of unemployment. B) actual output is less than potential output. C) the unemployment rate is equal to the natural rate of unemployment. D) wages and prices must fall in order to restore the economy to its potential output. |

A) the unemployment rate is less than the natural rate of unemployment.

|

|

|

82. A negative output gap is associated with:

A) an unusually low unemployment rate. B) a natural rate of unemployment. C) an unusually high unemployment rate. D) no changes in the unemployment rate. |

C) an unusually high unemployment rate.

|

|

|

83. A negative output gap implies:

A) an unemployment rate above the natural rate. B) an unemployment rate below the natural rate. C) an unemployment rate equal to the natural rate. D) an unemployment rate that equals the frictional and structural amounts of unemployment. |

A) an unemployment rate above the natural rate.

|

|

|

84. As a result of a downturn in the economy, a firm cuts back on workers' hours but does not fire workers. Following Okun's law, this is one reason:

A) the relationship between the output gap and the unemployment rate is positive. B) the relationship between the output gap and the unemployment is negative and less than a one-to-one relationship. C) a negative output gap is associated with an unusually low unemployment rate. D) a positive output gap is associated with an unusually high unemployment rate. |

B) the relationship between the output gap and the unemployment is negative and less than a one-to-one relationship.

|

|

|

85. Suppose an economy's aggregate price level increases and its aggregate level of real GDP decreases. This could arise from:

A) a positive demand shock. B) a negative supply shock. C) a positive supply shock. D) a negative demand shock. |

B) a negative supply shock.

|

|

|

86. If an economy's short-run Phillips curve shifts up, this is most likely due to:

A) a change in the inflation rate. B) an increase in the unemployment rate. C) an increase in expected inflation. D) a contractionary fiscal policy. |

C) an increase in expected inflation.

|

|

|

87. Disinflation:

A) involves eliminating inflation in an economy. B) policy often results in plunging the economy into a major recession. C) occurs as a result of a policy makers' attempts to correct a major recession. D) results in a fall in the unemployment rate. |

B) policy often results in plunging the economy into a major recession.

|

|

|

88. When an economy has debt deflation:

A) aggregate demand increases, since the real debt burden is reduced. B) aggregate demand is not affected, since real variables are not affected. C) aggregate demand decreases as borrowers' real debts increase, which leads to less spending. D) the economy moves quickly to its potential output. |

C) aggregate demand decreases as borrowers' real debts increase, which leads to less spending.

|

|

|

89. During a liquidity trap:

A) monetary policy is ineffective, since nominal interest rates cannot fall below zero. B) the money market is in disequilibrium. C) the only tool that the Federal Reserve finds effective is expansionary monetary policy. D) nominal interest rates will rise regardless of what policy the Federal Reserve pursues. |

A) monetary policy is ineffective, since nominal interest rates cannot fall below zero.

|

|

|

90. Investment banks differ from commercial banks because:

A) commercial banks are allowed to advertise, but investment banks are prohibited from advertising. B) commercial banks can have offices only in one state, but investment banks can have offices in many countries. C) commercial banks do not sell foreign currencies, but investment banks do. D) commercial banks accept deposits from customers, but investment banks do not. |

D) commercial banks accept deposits from customers, but investment banks do not.

|

|

|

91. A financial intermediary that provides liquid assets in the form of deposits to savers and

uses its funds to finance illiquid investment spending needs of borrowers is a(n): A) insurance company. B) bank. C) pension fund. D) hedge fund. |

B) bank.

|

|

|

92. A shadow bank is a:

A) branch of the main office of a bank. B) bank that is operated by a shadow government. C) financial firm that is not closely watched or effectively regulated. D) a credit union or a savings and loan institution. |

C) financial firm that is not closely watched or effectively regulated.

|

|

|

93. Without banks, people would:

A) hold more of their wealth as cash. B) hold less of their wealth as cash. C) invest most of their wealth in real estate. D) earn higher rates of return and enjoy more liquidity. |

A) hold more of their wealth as cash.

|

|

|

94. Depository banks:

A) borrow on a short-term basis from depositors and lend on a long-term basis to others. B) borrow on a long-term basis from depositors and lend on a long-term basis to others. C) borrow on a short-term basis from depositors and lend on a short-term basis to others. D) borrow on a long-term basis from depositors and lend on a short-term basis to others. |

A) borrow on a short-term basis from depositors and lend on a long-term basis to others.

|

|

|

95. Most of a bank's short-term liabilities are:

A) loans from the Federal Reserve. B) loans from the U.S. Treasury. C) loans to its customers. D) deposits of customers' savings. |

D) deposits of customers' savings.

|

|

|

96. Maturity transformation is converting:

A) short-term liabilities into long-term assets. B) short-term liabilities into short-term assets. C) long-term liabilities into long-term assets. D) long-term liabilities into short-term assets. |

A) short-term liabilities into long-term assets.

|

|

|

97. Which of the following is an example of maturity transformation?

A) Anne sells her house for $200,000 and uses the money to open a bakery. B) Matthew sells his car and uses the money to pay college tuition. C) Justin takes $10,000 from his savings account and uses it to buy some Apple stock. D) Michael closes his checking account at Bank of America and opens a checking account at a local credit union. |

C) Justin takes $10,000 from his savings account and uses it to buy some Apple stock.

|

|

|

98. Which of the following is an example of maturity transformation?

A) Jordan borrows $15,000 to buy a car. B) Aaron buys new running shoes and pays for them with his American Express credit card. C) Angela gives Russell $100 in cash for a graduation gift. D) Tyler lends $1,000 to his roommate Nick for a year. |

D) Tyler lends $1,000 to his roommate Nick for a year.

|

|

|

99. Shadow banks differ from commercial banks because shadow banks:

A) accept deposits only from businesses and state and local governments, not from individuals. B) are not subject to as many regulations as commercial banks. C) are not allowed to pay interest on deposits. D) can operate branches in more than one state. |

B) are not subject to as many regulations as commercial banks.

|

|

|

100. Since the early 1980s, shadow banks have increased because they:

A) are not subject to capital requirements and reserve requirements. B) offer online bill payment to their depositors. C) pay lower interest rates on their deposits than commercial banks. D) offer lower interest rates on their commercial loans than commercial banks. |

A) are not subject to capital requirements and reserve requirements.

|