![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

31 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

What is the double entry for Sales returns |

Dr Sales/Sales Rtns Cr Receivables |

Opposite of a normal Sale double entry |

|

|

What is a credit note |

Note showing them the amount they no longer own |

|

|

|

What is the double entry for Purchase returns |

Dr Payables Cr Purchase/Purchase Rtns |

Opposite of normal double entry |

|

|

What is a debit note |

Formal request for a credit note |

|

|

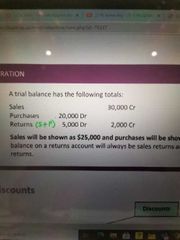

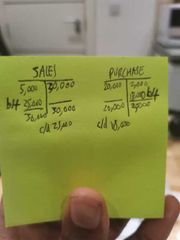

Explain using a T account why sales will be £25,000 and purchases will be £18,000 on the accounts |

|

|

|

|

What are the 2 types of discounts |

Trade and Early Settlement |

|

|

|

What is the definition of trade discount |

Reduction in the cost of goods usually from bulk buying/certain type of customer |

|

|

|

Do you apply the trade discount from the list price |

Yes, it is always deducted from the list price |

|

|

|

What is a settlement discount |

A reduction in the amount in return for immediate or early cash payment |

|

|

|

How is the Settlement discount applied to the customer |

If Expected then sale includes (Net) the settlement discount If not expected then sale doesn't include discounts |

|

|

|

What happens if behaviour is not expected |

Accounts are adjusted at point of receipt |

|

|

|

What would double entry be for credit sale of £1000 with 5% discount if paid within 7 days IF customer expected to pay early |

Dr Rec 950 Cr Sales 950 |

|

|

|

What would double entry be for receipt of credit sale of £1000 with 5% discount if paid within 7 days IF customer pays early |

Dr Cash 950 Cr Rec 950 |

|

|

|

What would double entry be for receipt of credit sale of £1000 with 5% discount if paid within 7 days IF customer pays late |

Dr Cash 950 Cr Rec 950 Cr Sales income 50 |

|

|

|

What would double entry be for credit sale of £1000 with 5% discount if paid within 7 days IF customer expected to pay late |

Dr Rec 1000 Cr Sales 1000 |

|

|

|

What would double entry be for receipt credit sale of £1000 with 5% discount if paid within 7 days IF customer pays late |

Dr Cash 1000 Cr Rec 1000 |

|

|

|

What would double entry be for receipt credit sale of £1000 with 5% discount if paid within 7 days IF customer pays early |

Dr Cash 950 Dr Sales Income 50 Cr Rec 1000 |

|

|

|

What is the double entry for refunds |

Dr Receivables Cr Cash |

|

|

|

What is an example of indirect tax |

VAT |

|

|

|

What is Vat tax (Number) |

20% |

|

|

|

What is output tax |

Tax that businesses charge to customers, on behalf of HMRC |

|

|

|

What is input tax |

Tax that businesses are charged when purchasing, that are recoverable against what they have to pay to HMRC |

|

|

|

Enter the double entry for £100 Purchase on credit, with VAT @ 20% |

Dr Purchase 100 - Net Tax Cr Payables 120 - since you pay full amount Dr VAT Control - since HMRC owe you |

|

|

|

Enter the double entry for £100 sale on credit, with VAT @ 20% |

Dr Receivables 120 Cr Sales 100 Cr VAT Control 20 - That's what you owe to HMRC |

|

|

|

General Note |

Receivables and Payables are gross (with) of tax Sales, Purchases and assets are net (without tax) |

|

|

|

What is the purpose of a sales/VAT Control account |

Shows amount owed to or from HMRC, this will be a Receivable or payable in SFP |

|

|

|

What does VAT apply to |

Most goods and services |

|

|

|

What does Zero rate apply to |

Non luxury foods, children's clothes and they can still recover VAT on their purchases |

|

|

|

Who does Exempt apply to |

Health, burial. They cannot charge or recover VAT from HMRC |

|

|

|

What does direct tax mean |

Directly charged at source eg Income |

|

|

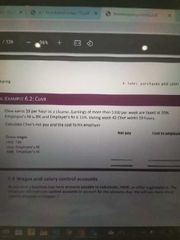

Complete question |

Net Pay 272.72 CoE 389.61 |

|