![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

44 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

CIA MfAD

|

CIA MfAD

|

|

|

|

MfAD

|

Reflects the degree of uncertainty of the best estimate assumption

|

|

|

|

Reasons for deviation of actual from expected experience

|

a. Favorable or adverse error of estimation

b. Unexpected deterioration or improvement of expected experience c. Favorable or adverse statistical fluctuation |

|

|

|

Risk Margin - Characteristics

|

1) The less that is known about the current estimate and its trend, the higher the risk margin should be

2) Higher for low-frequency and high-severity lines 3) Higher for long-term contracts 4) Higher for wider probability distributions |

|

|

|

Risk Margin - Method should

|

a. Applied consistently over the lifetime of a contract

b. Be easy to calculate c. Be consistently determined for different time periods for the same entity d. Be consistently determined between entities at each reporting date |

|

|

|

Claims development

|

2.5% to 20%

|

|

|

|

Recovery from Reinsurance

|

0% - 15%

|

|

|

|

Investment Return Rate

|

25 bp to 200 bp

|

|

|

|

Situations where appropriate to use high margins

|

- Reinsurer financial distress resulting in risk of not recovering ceded claim

- Hyperinflation causing steep increases in the cost of claims - New line of business / Lack of data to use for reserving - Change in tort system / regulatory regime affecting future claims - Economic recession / volatile financial market causing high investment return risk - A significant degree of uncertainty in the assumptions used |

|

|

|

Risk in margin for IRR

|

Types of risks addressed

a. Mismatch between claim payments and liquidity of assets b. Error in estimating future claim payment patterns c. Asset risk 1) Credit/default risk 2) Liquidity risk |

|

|

|

Weighted Formula (MfAD)

|

|

|

|

|

Explicit quantification of 3 margins

|

Asset/Liability Mismatch Risk Margin + Time Risk Margin + Credit Risk Margin |

|

|

|

Asset/Liability mismatch

|

|

|

|

|

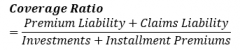

Coverage Ratio

|

|

|

|

|

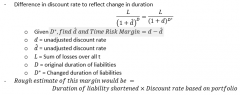

Interest Rate Movement |

|

|

|

|

Timing Risk

|

|

|

|

|

Credit Risk

|

Extrayield on corporate bond as compared to a risk-free bond |

|

|

|

Quantile approaches

|

- Multiple of standard deviation

- Percentile level / Confidence level / Value at risk (VaR) - Conditional Tail Expectation (CTE) / Tail Value at risk (TVaR) |

|

|

|

Practical issues quantile approaches |

- Stochastic modelling may be more appropriate for modelling premium liabilities when: o Lines of business in which coverage can extend for many years o Lines whose financial results are highly dependent on Economic forces o when there are significant correlations between Lines of business o Where aggregation of losses is driven by high frequency related to Economic or other circumstances o Skewed loss distributions such as stop loss reinsurance o Low frequency/high severity loss distributions o loss distributions with high variance o Long-tailed Lines of business o Catastrophic events |

|

|

|

High margin for claims development |

Considerations related to claims management o Significant changes in systems affecting claims handling Considerations related to underwriting o Significant changes in systems affecting underwriting Considerations related to other operations o Significant changes in consistent technology and processing systems Considerations related to data o Significant changes in the mix of business

Change in high margin allowed from 15% to 20% in situations where: - Automobile insurance undergoing tort reforms - Introduction of a new line or operations where data is insufficient

|

|

|

|

High margin for reinsurance ceded |

- Characteristics of high-margin situations o high ceded loss ratio o high ceded commission rate |

|

|

|

High margin for investment return rates |

o Significant mismatch of flows between assets and liabilities o Low asset quality

|

|

|

|

IFRS 4

|

IFRS 4

|

|

|

|

Reasons for issuing IFRS 4

|

a. to make limited improvements to accounting for insurance contracts until the Board completes phase II of its project on insurance contracts.

b. to require any entity issuing insurance contracts (an insurer) to disclose information about those contracts. |

|

|

|

Primary requirements of IFRS |

1. Classification of insurance contract 2. Enhanced disclosures in financial statements 3. Identifies and explains amounts in financial statement arising from insurance contract |

|

|

|

Liabilities adequacy test

|

An insurer shall assess at the end of each reporting period whether its recognized insurance liabilities are adequate, using estimates of future cash flows. If those insurance liabilities are inadequate, the entire deficiency shall be recognized in profit or loss.

|

|

|

|

Changes in accounting policies |

An insurer may change accounting policies for insurance contract if and only if it makes the financial statements' reliability and relevance more than unchanged (improve or not but not worse) An insurer shall judge relevance and reliability by the criteria in IAS 8. |

|

|

|

Insurance contract

|

A contract under which one party (the insurer) accepts significant insurance risk from another party (the policyholder) by agreeing to compensate the policyholder if a specified uncertain future event (the insured event) adversely affects the policyholder.

|

|

|

|

Reinsurance contract

|

An insurance contract issued by one insurer (the reinsurer) to compensate another insurer (the cedant) for losses on one or more contracts issued by the cedant.

|

|

|

|

Discretionary participation feature |

A contractual right to receive, as a supplement to guaranteed benefits, additional benefits:

a. whose amount or timing is contractually at the discretion of the issuer; and

b. that are contractually based on the performance of a specified pool of contract. |

|

|

|

At least one of following must be uncertain for it to be insurance contract

|

a. whether an insured event will occur;

b. when it will occur; or c. how much the insurer will need to pay if it occurs. |

|

|

|

KPMG Solvency II

|

KPMG Solvency II

|

|

|

|

Goarls of Solvency II regime |

a. Freedom for companies to choose their own risk profile and match it with an appropriate level of capital

b. An early warning system for deterioration in solvency by active capital management |

|

|

|

Three pillars |

Pillar 1 - describes quantitative requirements: balance sheet evaluation, the Solvency Capital Requirement (SCR), the Minimum Capital Requirement (MCR) Pillar 2 - describes qualitative requirements: the system of governance, a company's ORSA, and the supervisory review process Pillar 3 - describes disclosure requirements: the annual published solvency and financial condition report, information provided to the supervisors, and the link with IFRS 2 |

Pillar 1

- describes quantitative requires: balance sheet evaluation, the Solvency Capital Requirement (SCR), the Minimum Capital Requirement (MCR) Pillar 2 - describes qualitative requirements: the system of governance, a company's ORSA, and the supervisory review process Pillar 3 - describes disclosure requirements: the annual published solvency and financial condition report, information provided to the supervisors, and the link with IFRS 2 |

|

|

Benefit of Solvency II |

1) Ensuring consistent regulation in all territories. 2) Improve the solvency of the industry 3) Promises benefits of better capital management by aligning solvency with the risk profile of each firm. |

|

|

|

Compare US and EU |

US v. EU 1. EU explicitly models Operational Risk 2. EU considers Catastrophe Risk 3. EU uses VaR as risk measure whereas US uses none |

|

|

|

Blanchard & Klann

|

Blanchard & Klann

|

|

|

|

Principal function of reinsurance |

1. Increase large-line capacity - company wants to limit its exposure per policy but portions of market demand greater coverage

2. Provide catastrophe protection -company desires to reduce its potential loss from a catastrophic event

3. Stabilize loss experience a. Loss experience experiences annual fluctuations greater than management desires b. Motivated by demands of capital providers or its own desire to simplify capital management

4. Provide surplus relief -reduce net leverage ratios to a desirable level |

|

|

|

Increase large-line capacity

|

a. Surplus

i. No impact other than on earnings from additional business opportunities ii. Ceding company may decide or be required to hold more surplus for these greater risks: (1) Additional premiums (2) Additional reserves (3) Additional reinsurance collectability risk b. Loss reserves -both gross and net reserves increase i. Partly due to increased premium volume ii. Partly due to slower loss development of larger limits business being pursued c. Unearned premiums -increase but in proportion to premium increase d. Leverage ratios i. Net ratios increase slightly from change in the business model ii. Gross ratios may differ materially from net leverage ratios iii. Reinsurance leverage becomes important e. Income statement i. Little changed on a net basis ii. Riskier book and cost of reinsurance may introduce greater volatility |

|

|

|

Provide catastrophe protection

|

a. Surplus

i. If no catastrophe occurs, surplus decreased because of its cost ii. But if catastrophe occurs, it will substantially mitigate the risk of loss iii. If catastrophe occurs, reinsurance cost includes both original and reinstatement premiums b. Loss reserves i. No impact on net reserves unless covered event occurs ii. If catastrophe occurs, gross reserves can increase significantly for the payout period of the catastrophe iii. Net reserves will return to normal levels sooner than gross reserves as retained portion is paid first c. Unearned premiums i. Little or no change as reinsurance is normally a limited portion of total premium ii. Extent of change depends on policy term and accounting date d. Leverage ratios i. If no catastrophe, biggest impact from reduced surplus in denominators of ratios ii. If catastrophe occurs without reinsurance, significant impact on gross and net ratios iii. If catastrophe occurs with reinsurance, significant impact only on gross ratios iv. Ceded reinsurance leverage (i.e., ceded balances as a percent of surplus) is greatly affected after a major catastrophe prior to the runoff of those reserves e. Income statement i. Reduced in any case ii. Underwriting income is substantially protected with loss limited to the original ceded premium plus, if a covered catastrophe occurs: (1) Retention (2) Reinstatement premium (3) Excess of catastrophe loss above the reinsured limit |

|

|

|

Stabilize loss experience |

a. Surplus i. Overall surplus lowered by net cost of reinsurance ii. Period-to-period variation is reduced (1) Expected impact of surplus is a reduction, the net cost of reinsurance (2) Impact may vary between reductions and increases as gross losses are lower or higher than expected

b. Loss reserves i. Gross reserves reflect full volatility of the annual results ii. Net reserves should be smaller, more stable, and could be easier to estimate

c. Unearned premiums -reduced, unless reinsurance is purchased with a single effective date and the accounting date coincides with the reinsurance expiration date

d. Leverage ratios - more stable but slightly higher because of reduced surplus (assuming there is a positive net cost of insurance)

e. Income statement i. Lower results over time because of net cost of reinsurance and lower investment income ii. Year-to-year results should be more stable |

|

|

|

Provide surplus relief

|

a. Surplus

i. Reduction of assets equals reduction of liabilities plus net underwriting cost of reinsurance ii. Quota share can only increase surplus if business is written at a loss b. Loss reserves -net reserves are a fixed percentage of gross reserves c. Unearned premiums -net reserves are a fixed percentage of gross reserves d. Leverage ratios i. Net leverage ratios are significantly improved ii. Ceded reinsurance leverage ratios are significantly increased (1) Insurer's solvency becomes more reliant on reinsurer's solvency iii. Cession of more than x% required to obtain an x% reduction in net premium and reserve ratios to surplus because of the impact of cession on surplus e. Income statement -underwriting income is cut by the quota share amount and investment income is reduced |

|

|

|

Facilitate withdrawal from a market segment

|

a. Surplus

i. Slight reduction for assumed profitable business (1) Liabilities decline to zero but assets decrease due to cost of insurance ii. No longer susceptible to volatility in the runoff results b. Loss reserves i. Gross reserves are unchanged ii. Net reserves and their volatility eliminated c. Unearned premiums i. Gross reserves run-off over the year ii. Net reserves eliminated d. Leverage ratios -net leverage ratios are zeroi. Only remaining risk is reinsurance collectability risk ii. Surplus supporting the runoff business (less that needed for collectability risk) can support existing or new business e. Income statement i. Underwriting profit since ceding commission offsets expenses that were paid the previous year (1) This profit is slightly less than if the business had not been ceded ii. Risk is limited to reinsurance collectability and investments results |

|

|

|

Provide underwriting guidance

|

a. Conceptually equivalent to the situation involving increased large line capacity b. Impact on surplus and income depends on profitability and volume (after cessions) of the new business

|

|