![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

22 Cards in this Set

- Front

- Back

|

What is FOB Shipping point?

|

FOB Shipping Point – the buying firm pays the shipping costs, the amount is called freight-in and is included in the cost of inventory.

|

|

|

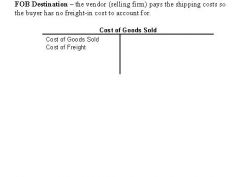

What is FOB destination?

|

FOB Destination – the vendor (selling firm) pays the shipping costs so the buyer has no freight-in cost to account for.

|

|

|

What does the term merchandising mean?

|

Merchandising firms buy merchandise to sell to their customers. They are also called retailers.

|

|

|

What do service firms do?

|

Service firms provide services to customers

|

|

|

What is cost of goods sold?

|

Cost of goods sold is the total cost of the merchandise sold during the period.

|

|

|

What is gross profit?

|

Gross profit is the difference between sales revenue and cost of goods sold. It is also called gross margin.

|

|

|

How are goods requested?

|

When someone in a company requests goods or services the company needs they prepare a purchase requisition and send it to the company’s purchasing agent.

|

|

|

How are goods ordered?

|

The purchasing agent then sends a purchase order – a record of the company’s request to a vendor for goods or services.

|

|

|

What is the purpose of a receiving report?

|

A receiving report is prepared after the goods arrive to show the condition and quantity received.

|

|

|

What are purchase returns and allowances?

|

Purchase returns and allowances are amounts that decrease the cost of inventory due to returned or damaged merchandise.

|

|

|

What is a purchase discount?

|

Purchase discounts are offered in order speed up payments to the seller. It is treated as a reduction in purchase price.

|

|

|

What is the Sales Returns and Allowances account?

|

Sales Returns and Allowances is an account that holds amounts that reduce sales due to customer returns or allowances for damaged merchandise. It is a contra-revenue account – an account that is an offset to a revenue account, deducted from the revenue of the financial statements.

|

|

|

What is a sales discount?

|

Sales discounts are reductions in the sales price of a product offered for prompt payment.

|

|

|

What is a service fee?

|

Sales using credit cards are subject to a fee. This fee is accounted for in a separate account called Service Fee.

|

|

|

What is a perpetual inventory system?

|

A perpetual inventory system is a method of record keeping that involves updating the accounting records at the time of every purchase, sale, and return.

|

|

|

What is a periodic inventory system?

|

A periodic inventory system is a method of record keeping that involves updating the accounting records only at the end of the accounting period.

|

|

|

What is a single-step income statement?

|

A single-step income statement is an income statement in which all revenues are presented first, and all expenses are subtracted in one step to arrive at net income.

|

|

|

What is a multiple-step income statement?

|

A multiple-step income statement is an income statement that highlights the components of net income.

|

|

|

What is the formula for a gross profit ratio?

|

The gross profit ratio equals gross profit divided by sales revenue. It is also called the gross margin ratio or the gross profit percentage. It measures the portion of sales dollars a company has left after paying for the goods it made or purchased

|

|

|

What is the purpose of a profit margin ratio?

|

Profit margin ratio measures the percentage of each sales dollar that results in net income; calculated by dividing net income by net sales. It is also called return on sales.

|

|

|

What does inventory need to be protected from?

|

Inventory must be protected from damage or theft.

|

|

|

What is segregation of duties?

|

Segregation of duties is a control that helps companies minimize the risk of losing inventory to error or theft. This is a control of having different individuals perform related duties. The person with physical control of an asset is not the person who keeps the accounting records for that asset.

|