![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

27 Cards in this Set

- Front

- Back

|

What is a journal?

|

A journal is a record in which transactions are initially recorded in chronological order

|

|

|

What is a journal entry?

|

A journal entry is the record of a single transaction that in entered in a company’s journal.

|

|

|

What is a general ledger?

|

The general ledger is the primary record of a company’s financial information. It contains all the accounts maintain by the company – asset, liability, equity, revenue and expense accounts.

|

|

|

What is posting?

|

Posting is the process of transferring the amount from the journal to the general ledger.

|

|

|

What is a chart of account?

|

All of a company’s accounts can be found on the company’s chart of accounts. A chart of accounts is a list of all the accounts in a firm’s accounting records along with account numbers to assist in maintaining accurate accounting records.

|

|

|

How do accountants record transactions?

|

The method accountants use to record transactions in the journal and post them to the general ledger is called double-entry bookkeeping. The word “double” is used because each dollar amount in a transaction will be recorded in at least two accounts.

|

|

|

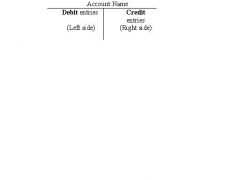

What is a debit?

|

Debit – the left side of an account.

|

|

|

What is a credit?

|

Credit – the right side of an account.

|

|

|

How does a debit affect an asset account?

|

Assets are increased with debits and decreased with credits.

|

|

|

How does a debit affect a liability or a shareholder's equity account?

|

Liabilities and shareholders’ equity are increased with credits and decreased with debits

|

|

|

What is a normal balance?

|

A normal balance is the increase side of an account.

|

|

|

How does a debit affect a revenue?

|

Revenues are increased with credits and decreased with debits.

|

|

|

How does a debit affect an expense?

|

Expenses are increased with debits and decreased with credits.

|

|

|

What is the accounting cycle?

|

The accounting cycle is the steps an accountant follows to analyze and record business transactions, prepare the financial statements, and get ready for the next accounting period

|

|

|

What is the first step in the accounting cycle?

|

The first step is the cycle is to analyze and record transactions in the journal.

|

|

|

What is the second step in the accounting cycle?

|

The second step is to post the journal entries to the general ledger.

|

|

|

What does posting mean?

|

Posting – transferring the amounts from journal entries to the general ledger accounts.

|

|

|

What is the third step in the accounting cycle?

|

The third step is to prepare an unadjusted trial balance at the end of the accounting period.

|

|

|

What is a trial balance?

|

A trial balance is a list of all the accounts in the general ledger with the respective debit or credit balances at a given point in time. The trial balance ensures debits = credits in the accounting records.

|

|

|

How are debits and credits used in a journal entry?

|

The general ledger’s system of debits and credits will have the dollar amount of debits equal to the dollar amount of credits in every journal entry.

|

|

|

What is the format of preparing a journal entry?

|

Debits are always listed first, and credits are listed after all the debits.

|

|

|

What is working capital?

|

Working capital is a measure used to evaluate liquidity.

|

|

|

How do you compute working capital?

|

Working capital = Current assets – Current liabilities

|

|

|

What is a quick ratio?

|

Quick ratio is a measure of a company’s ability to meet its short-term obligations.

It is also known as the acid-test ratio. |

|

|

What balance sheets accounts are included in a quick ratio?

|

Quick ratio = Cash, accounts receivable, and short-term investments divided by current liabilities.

|

|

|

What is a T Account?

|

T-accounts are used to represent a page in the general ledger. The left side is the debit side and the right side is the credit side.

|

|

|

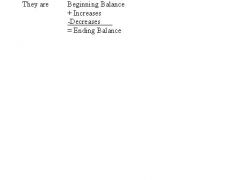

How do you calculate an account balance?

|

Every account balance is derived from four components

|