![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

56 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

What are the primary functions oc the environment? (3) |

Provide Resources To provide resources (Raw materials) to make goods and services. The environment supplies some crucial resources that are required in the production process. Firms need energy as an input and the environment provides this in the form of fossil fuels etc.

Provide amenities To provide amenities. People derive utility from using beaches, walking in parks and enjoying fresh air.

Absorb waste It acts as an absorber of waste. Firms and households generate waste that must be disposed of. |

|

|

|

What forms of market failure associated with externalities can be applied to the environment? |

All four: Negative externalities in production Positive externalities in production Positive externalities of consumption |

|

|

|

Explain why environmental negative externalities of production may exist |

Green house gas emissions lead to global warming Poor air quality can be damaging to people's health. People living in areas with heavy air pollution such as China are at greater risk of developing lung cancer. |

|

|

|

Explain why environmental positive externalities of production may exist |

Investing in more energy efficient production may result in long-term benefits and can reduce pollution. Costs of production may fall. Once the technology is complete other firms can copy it. The firm doesn't take into account the benefits to these firms. Their benefit is actually a cost to the firm. |

|

|

|

Explain why environmental negative externalities of consumption may exist |

When individuals use a beach they do not care about the fact that they are contributing to over-crowding and diminishing the enjoyment of others, nor the fact that overtime excessive consumption can damage the beach for future generations. |

|

|

|

Explain why environmental positive externalities of consumption may exist

|

??!!! Using public transport generates benefits to third parties as it reduces pollution and congestion on the roads. however, individuals ignore this when making consumption decisions, meaning SMG is greater than PMB and there is therefore overconsumption in the market.???!?!?

|

|

|

|

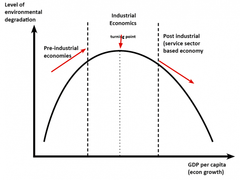

What does the Kuznets Curve look like? |

|

|

|

|

What happens in the early stages of development? |

Environmental damage increases. this is because industrialisation is likely to be taking place, with relatively inefficient technology in production processes. There is also a positive YED for energy, car ownership and other polluting goods and services so their demand and consumption rises. |

|

|

|

What happens in the later stages of development and why? (

|

The government is likely to impose more environmental regulation and be able to enforce this better when the economy is developed. Economic growth and development usually see a growth in the size of government as a share of GDP. The link between economic growth and living standards can be weaker for bigger economies. Focusing on living standards can become politically popular. With higher rates of economic growth, people have more discretionary income after paying for basic necessities so they are more amenable to paying higher prices in return for better environmental standards. The primary driving force behind long-term economic growth is improved technology and higher productivity. With higher productivity, we can see higher output, with less raw materials used. A good example of how improved technology has reduced potential for environmental damage is the progress in solar technology. Initially, economic development leads to shifting from farming to manufacturing. This leads to greater environmental degradation. However, increased productivity and rising real incomes see a third shift from industrial to the service sector. An economy like the UK has seen industrialisation shrink as a share of the economy. The service sector usually has a lower environmental impact than manufacturing. Rising income has a diminishing marginal utility. The benefit from your first £10,000 annual income is very high. But, if income rises from £90,000- £100,000 the gain is very limited in comparison. Having a very high salary is of little consolation if you live with environmental degradation (e.g. congestion, pollution and ill health). Therefore a rational person who is seeing rising incomes will begin to place greater stress on improving other aspects of living standards. |

|

|

|

Sustainable development

|

Development that meets the needs and wants of the current generation without negatively impacting the ability of future generations to meet their needs and wants.

|

|

|

|

Is it sustainable for the environment to continue to fulfil these three functions for many years to come?

|

Raw materials may become depleted. It may not be possible to extract some resources in the future. Amenities may be reduced as greenfield sites are turned into brownfield sites There is a limited amount of space where waste can be put. Greenhouse gases cause global warming, so it becomes increasingly damaging to emit greenhouse gases. |

|

|

|

Non-renewable resources |

A resource that cannot be renewed (restored) once it's supply is exhausted. |

|

|

|

Why in theory would the market mechanism cope with non-renewable resources becoming increasingly scarce? |

As supply falls, the price will increase. This incentivises the use of renewable resources and investment in renewable energy. |

|

|

|

Why may this not slow depletion of non-renewable resources? |

Investing in green energy is very expensive. They may provide subsidies to firms to stimulate research and development in order to tackle the issue.

Demand for oil has been rising. The rapid economic growth of India and China whose extremely large populations each exceed a billion has resulted in increasing demand in the global marketplace. It is important that fish stocks are carefully managed so fish populations do not dwindle. It is harder to grow the population once it has shrunk. |

|

|

|

Renewable resources |

A resource that can replenish overtime |

|

|

|

What are some drawbacks of renewable resources? |

It may not be cost effective to use. use. . |

|

|

|

What is the problem with commonly owned resources?

Consider a village in which the land is communally owned by all inhabitants. This is clearly means that any of the residents can carry out production on the land, such as grazing cattle. |

The land may be overused. The quality of the land would begin to decline. The land may no longer ne able to be used in the future. This increases scarcity of land which increases costs of production for firms.

There are a lack of property rightd. This would stop the land being over used by too many individuals.

If the land was excludable and someone owned it there would be disincentive for the owner to overuse it. This means environmental degredation would be reduced. |

|

|

|

What is NIMBY (Not in my back yard) syndrome? |

Where people agree that a project needs to be carried out but individuals are unwilling to bear the cost. (E.g. citizens may not want a garbage disposal near their home) |

|

|

|

How can taxation be used to solve environmental market failure? |

If the tax per unit is equal to the externality per unit then the exterbality would be internalosed. Individuals/firms now consider the cost of the tax which is equivalent cost to the environment. This is the polluters pay principal. |

|

|

|

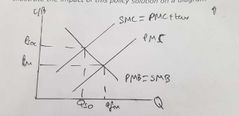

Illustrate the impact of imposing an indirect tax on a diagram. |

|

|

|

|

What are the implications of this policy solution? |

It is difficult to know the size of the tax to implement. Depending on elasticities, the cost of the tax may not go to the right parties (consumers or producers) who are causing the externalities. |

|

|

|

Hypothecation |

The principal that revenues raised from an indirect tax should be used to improve the market in which the tax is imposed. |

|

|

|

What is an example of hypothecation? |

The London congestion charge. Tax is invested into improving the transport system. |

|

|

|

How can a quota be used to solve environmental market failure? |

It prevents overproduction or consumption of a good or service. It's a physical limit on what a firm is allowed to produce. |

|

|

|

Illustrate the impact of a quota as a policy solution on a diagram |

|

|

|

|

What are the limitations of a quota? |

The government may not know the socially optimal level of output. Market conditions may change so Qso may also change. It is difficult to enforce a quota. It is very costly. It is not a market based solution. The polluter does not pay |

|

|

|

What could be a solution to the commons problem? |

To assign property rights to air. Local residente could own the air and charge firms for pollution. |

|

|

|

What are the limitations of this solution? |

In practice it is difficult to assign property rights to air. Air flows about and moves into different areas. Air constantly mixes and this cannot be prevented well.

The government should enforce policies to regulate the environment. It is better for them to take ownership rights on behalf of residents. |

|

|

|

Why is subsidising transport an effective solution to environmental market failure in the transport market? |

It would reduce the use of car travel and increase the use of public transport. Effectiveness depends on the XED of car travel with respect to public transport. The pollution caused by car travel is greater than by public transport. |

|

|

|

Illustrate the impact of this policy solution on a diagram |

|

|

|

|

Why is subsidising public transport also important? (2) |

People will only use it if the quality is high enough. Subsidising it will provide firms with the funds needed to invest in improvements. In many rural areas, without a subsidy a bus service wouldn't be profitable, which would leave some communities isolated. |

|

|

|

What are the limitations of the policy solution? |

Subsidies may not be passed on to consumers. Demand is likely to be inelastic since it takes up a small proportion of income and is a necessity for many. Inelastic demand means the consumer incidence is small. It also depends on XED. Transport links may not cover some journeys or take too long for people to consider. |

|

|

|

What are tradable pollution permits? |

Tradable permits are a specific solution designed to overcome the problem of pollution. Under this system, firms are only allowed to pollute if they hold a pollution permit. Each permit allows a firm to emit a specific level of pollution. The government decides on the total number of permits. These permits can be traded between polluters at a price determined by a free market for permits. If a firm needs to pollute more than the number of permits they own entitles them to, they will need to purchase more permits. Failure to do so will result in a fine from the regulator. |

|

|

|

Draw a diagram illustrating the market for permits |

|

|

|

|

What are the advantages of tradable permits? (3) |

It can achieve a specific level of pollution Since the government sets the number of permits they can guarantee achieving a specific amount of pollution, rather than imposing a tax and letting the market decide.

It's a market based solution which creates incentives to reduce pollution Firms prefer this option because it isn't like a tax. Instead, firms know that if they reduce pollution they can sell permits and make money. There is a financial incentive to be environmentally friendly. Firms are incentivised to reduce pollution as much as they can.

It follows the polluter pays principal The externality is internalised. The biggest polluters pay the most money rather than the generic tax on output where those who are environmentally efficient suffer as much as bigger polluters. An environmentally friendly firm may not be overproducing.

|

|

|

|

What are the limitations of tradable permits? (5) |

The optimal level of pollution is unknown. It is impossible to know how many permits to grant because the government cannot measure the size of the externality and therefore do not know what the optimal level of pollution is. Granting too few permits could lead to underconsumption and government failure and with too many the problem may not be overcome. This could still result in government failure due to the admin costs spent and funds which would be wasted.

It's hard to work out how to allocate permits Granting permits directly to firms is problematic as it gives an advantage to the bigger/incumbant firms.

It's costly to enforce Checking whether firms are actually sticking to polluting the amount they are allowed given the number of permits they have purchased is difficult. It's a unilateral solution to a multilateral problem. Consumers may substitute to buying products from firms abroad in countries who do not comply with the policy. Additionally, environmental standards in these countries are likely to be worse, meaning co2 emissions could, increase. Firms may hoard pollution permits to monopolize the industry. |

|

|

|

How has the system of tradable permits worked in practice? |

The Kyoto summit of 1997 laid foundations for actions to reduce emissions of carbon dioxide and other greenhouse gases that are seen to be causinf climate change. The US withdrew in 2001 saying the US economy would be harmed but 178 other countries reached an agreement on how to enforce the Kyoto accord. US absence is significant since they are the world's largest emitter of carbon dioxide, responsible for a quater of the world's greenhouse gas emissions. At the heart of agreement was to plan to reduce greenhouse gas emissions by an arranged percentage by 2010. This was based on a tradable pollution permits system (carbon credits). This was especially demanding for countries like Japan, whose industry is already relatively energy efficient. |

|

|

|

What is PFI (Private finance Initiative)? |

PFI launched in 1992 was a way of trying to increase the involvement of the private sector in the provision of public services. The public sector specifies the service that it requires and invites private sector firms to bid for the contract. The government completes a project through tendering a contract |

|

|

|

How could this be funded? |

It may be self-funded, for example a bridge might be built by a private sector firm with the cost recouped through user charges such as a toll. The public sector may purchase services provided by the private sector firm. |

|

|

|

Advantages of FPI (2) |

It provides funds for public sector projects that would otherwise not be able to go ahead. It improves efficiency. Competition in the bidding process and the profit incentive should bring down the costs of such projects. |

|

|

|

Disadvantages of PFI |

It raises the cost of schemes as the government will be paying for an element of private sector profits. Additionally, Private sector firms may have higher costs of production since they have higher borrowing costs.

The private sector may pay less attention to health and safety concerns. Project may go unfinished |

|

|

|

Cost-benefit analysis (CBA) |

A decision making tool accounting for the social costs and social benefits of a project over time to establish net present value. It is a method of appraising large scale investment projects, often involving public spending, such as railway links, motorways and airports. |

|

|

|

Why is the application of CBA crucially important for large-scale projects that can have far-reaching effects on thr econimy? |

The importance of externalities in regard to environmental and other issues mean that it is especially important to be aware of externalities when taking decisions that are likely to affect the environment. |

|

|

|

What are the steps of CBA? (4) |

Identify the relative costs and benefits Valuation Discounting the future Calculating the net present value |

|

|

|

Explanation and example of identifying the relevant costs and benefits |

The first step is to identify all the relevant costs and benefits, both direct and indirect, and this is where the externality effects need to be considered. In a road building scheme, direct costs would include costs of construction. Indirect costs would include the opportunity cost and the noises caused by traffic. Benefits would include reducing costs of production for firms. ?What actually counts as an indirect cost or benefit?? |

|

|

|

Valuation |

A value judgement. The costs and benefits need to be given a monetary valuation for them to be compared. For externalities or other indirect costs or benefits without a market valuation it is necessary to establish a shadow price - an estimate of monetary value of an item that does not carry a market price. Some costs may have a probability of occurring. For example, the better quality of life (saving a lot of time) that people get from the road building. e.g. an accident has a 10% chance of occuring but would cost £6000 so this cost is considered as being £600. When a valuation is given, an appropriate weighting is given to the chance of it happening. |

|

|

|

Discounting the future |

The costs and benefits that will flow from the project in some point need to be expressed in terms of that value in the present. The choice of discount rate is quite subjective. The government may prefer to provide benefits in the present to persuade the electorate, rather than taking decisions that will not bear fruit until the distant future

NUMBERS ARE CREDITED IN THE EXAM

Example: Year 1: Cost: 100m Benefit: 0m Year 2: Cost: 2m Benefit: 50m Year 3: Cost: 2m Benefit: 70m With a discount rate of 5%

The net present value would be calculated by (-100) + ((50-2)/(1.05)) + ((70-2)/(1.05)(1.05)). +7.39m

If the discount rate were changed to 10% then net present value would fall to -0.16m

|

|

|

|

Calculate the net present value

|

Net present value is the estimated value in the current time period of the discounted future net benefit of a profit. Alternatively cost to benefit ratios can be calculated to use as evidence to make decisions between choices. If net present value exceeds zero, it helps to achieve allocatively efficient. If it is negative it is an allocatively inefficient project. |

|

|

|

What are the direct costs of the 2010 Winter Olympics? (3)

|

Infrastructure costs Bid costs, security costs, administrative costs, translation costs Promotion, opening and closing ceremony costs, insurance |

|

|

|

What are the indirect costs of the 2010 Winter Olympics? (3)

|

There is a danger of it being a white elephant project, where the investment is short-term. Many facilities can only be used for the 3 week duration of the Olympics. After that there is a danger that facilities cannot be effectively reused. Opportunity cost, the cost of Olympic games cannot be spent on alternative investment schemes like transport and education. Congestion externalities |

|

|

|

What are the direct benefits of the 2010 Winter Olympics? (3)

|

The revenue generated from ticket sales. Influx of foreign visitors. Hosting Olympics will provide a boost to tourism and travel to Vancouver, during the Olympics and hopefully after. Tax revenue increases both directly and indirectly. |

|

|

|

What are the indirect benefits of the 2010 Winter Olympics? (2)

|

Primary effect of 'Halo', national pride. There may be positive externalities when citizens feel proud of hosting the games in their country. Job creation. Typically, major sporting events require investment in building the stadium and hotels. This creates jobs for the local economy for up to 4 years before these events. |

|

|

|

Advantages of CBA (3)

|

It allows for efficient allocation of resources. It is easy to understand. You are simply looking at whether benefits outweigh costs. It's simplicity also means that doing CBA is easily possible for various scenarios, locations and more. It decreases negative externalities. The process forces consideration of the unquantifiable impacts of projects, rather than basing decisions purely on monetary considerations. It may enable he relative net benefits of an alternative projects to be compared under similar assumptions about the future path of the economy, even If the assumptions are speculative. |

|

|

|

Disadvantages of CBA (3) |

Assumptions needed for the calculations are highly speculative, which leads to a substantial range of uncertainty. Changing circumstances can make initial projects appear grossly inaccurate. The initial budget for the 2012 London Olympic games was £9.3bn but costs rose to £11bn at the time of the games. Higher interest rates and inflation rates and falling exchange rates can dramatically affect costs.

Accuracy with regard to benefits and costs must be closely monitored because benefits are easy to double count. For example, if you are using CBA to decide whether to build a highway, you may be tempted to tally the increase in property values along with reduced travel time. However, property values to a large extent the value of the location with regard to travel time. This means if both were counted benefits of the project would be overestimated.

CBA may be ignored for political reasons (e.g. A government that is feeling vulnerable may prefer to provide benefits in the present to persuade the electorate. Net present value can be manipulated through the discount rate |

|

|

|

In order to solve the market failure arising from private car use, the government has been considering two projects - HS2 project and Regional airport project. However, due to the limited budget, the government can only chose one of them. Use an appropriate diagram to illustrate what the market failure is in this case |

|

|

|

|

Look over how to calculate which project is better. |

|

|