![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

16 Cards in this Set

- Front

- Back

|

What is PIMS |

Profit Impact of Market Strategy Showing links between strategy & results in different market & competitive settings |

|

|

Similarity between PIMS & Portfolio planning |

Both take as starting point that financial objectives for a business, and at least some of the general characteristics of the strategy it should adopt, depend on 1) its strategic position, and 2) the characteristics of the marketplace |

|

|

Differences Pims & Portfolio Planning |

1) Portfolio systems attempt to explain business performance in terms of just a few key factors. PIMS to explore many possible dimensions of strategy & market environment that might influence performance. 2) PIMS uses a database to determine how strategies affect results under different circumstances |

|

|

What is the link between Buzzel & Gale's article & the BCG (Hedley) |

Buzzel & Gale's PIMS research draws the assumption, amongst others, that many "dogs" and "questions mark" businesses generate cash, while many "cash cows" are dry. This is in contrast to what the BCG matrix is based on. |

|

|

What is Buzzel & Gale's (1987) critique to the positioning school? |

1)From the findings from PIMS there is found that quality of products & services is the single most important driver of performance 2) Market share and profitability are strongly related (not a causal relationship) |

|

|

What are Porters 5 Forces? |

Threat of new antrants Threat of substitutes Bargaining power of suppliers Bargaining power of buyers Rivalry among existing firms |

|

|

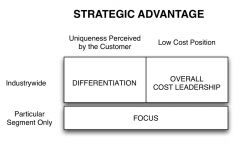

What are Porter's three generic strategies? |

|

|

|

What do Baden-Fuller & Stopford (1992) claim about the role of market share in succes? To what article does that stand in contrast? |

Market share is the reward, not the cause of success. Buzzel & Gale (1987) stated in their PIMS research, that market share & profitability are strongly related. |

|

|

According to Barney (1991) what are four empirical indicators of resources that generate sustained competitive advantage? |

Value - it exploits opportunities / neutralizes threats Rarenes Imitability - Imperfectly Imitable Substitutability |

|

|

When is a resource imperfectly imitable? |

- The ability to obtain a resource is dependent of unique historical conditions - The links between the resources and the sustained competitive advantage is causally ambiguous - The resource is socially complex |

|

|

What is the main difference between Barney's (1991) and Porter's (1979)? |

Barney focusesses on a firm's resources (internal) and Porter on industry competition (external). |

|

|

When is competitive advantage sustainable? |

Competitive advantage is when a firm is implementing a value creating strategy not simultaneously being implemented by any current or portential competitors. Sustained competitive advantage adds to this that these other firms are unable to duplicate the benefits of this strategy. |

|

|

On what assumption does the RBV build? |

Firm resources are heterogeneous and immobile. |

|

|

What does Barney (1991) see as the most appropriate way to develop strategy and why? |

Informal, emergent & autonomous strategy development can be seen as a resource that can contribute to sustained competitive advantage, whereas formal strategic planning is not valuable, rare, imperfectly imitable and insubstitutible. |

|

|

What is, according to Grant & Baden-Fuller (2004) the difference between knowledge exploration and - exploitation? |

Explorarion = knowledge generation, increase stock of knowledge Exploitation = application, deploy existing knowledge to create value |

|

|

Contrasting the predictions of knowledge-accessing and knowledge acquisition theories of interfirm alliances |

Development of the alliance partners' knowledge bases Stability of alliances Longevity of alliances Numbers of alliances Impact of uncertainty over future links between knowledge inputs and product outputs |