![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

20 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

DPU Calculation

|

Find RTY =. 937

DPU = - ln (RTY) =-ln(. 937) DPU =- (-. 065) =.065 |

|

|

|

Y=f (x)

|

Find

|

|

|

|

ROI

|

ROI = Income + Cost

|

|

|

|

Cpk Calculation

Vaibhav, Ques: The reported Cpk, for a process with an average of 28, a spread of 10 units, and upper and lower specification limits of 35 and 15 respectively, would be: |

Vaibhav : In the question process spread is given 10 units... And you have taken it as standard deviation directly....

This process spread of 10 units is assumed to be 6 sigma. Thus sigma is 10/6. Thus Cpk = Min ( ( USL-X bar) /3sigma), ( X bar - LSL) /3 sigma) Cpk = (USL - X bar) /3 sigma =(35-28)/3 *(10/6) =(35-28)/5=7/5=1.4 I have not calculated from LSL as it is evident that process mean is shifted towards USL and Cpk calculation is min. of both calculation.. So it saved time. Vaibhav : In the question process spread is given 10 units... And you have taken it as standard deviation directly.... This process spread of 10 units is assumed to be 6 sigma. Thus sigma is 10/6. Thus Cpk = Min ( ( USL-X bar) /3sigma), ( X bar - LSL) /3 sigma) Cpk = (USL - X bar) /3 sigma =(35-28)/3 *(10/6) =(35-28)/5=7/5=1.4 I have not calculated from LSL as it is evident that process mean is shifted towards USL and Cpk calculation is min. of both calculation.. So it saved time. 😊 Thanks Rajan...in my note I have mentioned that I was not clear with question if its 10 unit of spread or 10 is stdev....as far as I gone I interpreted it as 10 stdev....so took 10*3. My mistake in interpreting the question. Thanks for correction. The spread is 10 means that 6 sigmas =10 then 3 sigmas = 5 |

|

|

|

10. If a sample size of 16 yields an average of 12 and standard deviation of 3, estimate the 95% confidence interval for the population (assume a normal distribution).

a. 10.40 < < 13.60 b. 10.45 < <13.55 c. 10.53 < <13.47 d. 10.77 < <13.23 How is this calculation performed? Correct Answer is A. |

per Vaibhav: Normality exists in population...since sample is smaller than 30 we Should use t two sided confidence

Oh...u solved it Nandan. Nice Good one |

|

|

|

9. In the regression equation y = mx + b, y increases with x in all cases:

a. If b is positive b. If b is negative c. If m is positive d. If m is negative Anyone, Why is C the best answer? What do each of the letters represent the? How are they related? |

Because an average unit change in X brings change in Y .means positive relationship. If such case exists r or Rsq. would be more than .75. If it is perfectly linear than value reaches 1 which means x is the only factor contributing in change of Y

Why does m has to be positive? If m is negative then reverse relationship. If m is zero or say statistically insignificant then no relationship. As per question m is positive Per Vaibhav: Sorry- rephrasing it. A unit change in X brings an average unit change in Y. Mathematically a vector of all X where x11, x12, x13, ...x1n are following normal distribution and leads a positive change in Y1. Similarly when we form matrices of X1,X2,X3....against Ys we receive estimated line of Yhat which is positively increasing with increasing X. This is multiple linear regression. In case of question there is only one X so it is a vector. |

|

|

|

How to Master SSBB Statistical Questions

|

Per Rajan:

Darrah.. For solving statistical problems... Focus on clearing statistical concepts... And these problems become easy eventually.... Take any statistics fundamentals book and start reading it from first page and try to solve its problems... And also make attempt on examples... You will find it challenging but these attempts to solve problems are worth it....I have used complete business statistics for preparation.. But you can use any basic book. After this make attempt on QCI primer questions... And please share with group if you find any problem daunting... Certainly someone from group will help you out in clearing the concepts about the problem.. Keep sharing your progress and Happy Preparation!! |

|

|

|

[1/28, 8:57 AM] +1 (416) 553-3618: Can anyone answer this question with explanation? A sample size of size 50 from Machine A has a mean of 18.2 and sd of 3.1. A sample of size 40 from machine B has a mean of 17.6 and std dev of 2

[1/28, 8:58 AM] +1 (416) 553-3618: Sd of w [1/28, 8:58 AM] +1 (416) 553-3618: Sd of 2.8. Do these data indicate that the population for machine A has larger mean? |

Per Vaibhav:

[1/28, 9:52 AM] +65 8350 2087: Apply 2t test at respective degree of freedoms which is 49 and 39. Use aplha at .05 significance level. Compute variance by using 3.1/sqrt(50) and 2/sqrt(40).....compare t calculated with t tabulated. If t calculated lies in rejection region of upper significance it is larger else not. [1/28, 9:56 AM] +65 8350 2087: Correct Rajan..only thing is that Null hypothesis should be Ho is lesser than or equal to Ha [1/28, 10:00 AM] +91 98119 54800: Vaibhav.. Can you please elaborate it little further... [1/28, 10:51 AM] +65 8350 2087: I hope it is visible now [1/28, 10:51 AM] +65 8350 2087: Ur calculation and logic is absolutely true...but hypothesis formulation is contradictory to each other...null and alternate |

|

|

|

Vaibhav, Ques#2: A process consists of three sequential steps with the following yeild: Y1=99.8, Y2 =97.4 and Y3=96.4 Determine the total defects per unit.

|

[2/3, 4:15 PM] Darrah: Vaibhav, Ques#2: A process consists of three sequential steps with the following yeild: Y1=99.8, Y2 =97.4 and Y3=96.4 Determine the total defects per unit.

[2/3, 10:35 PM] +65 8350 2087: Sorry for interrupted reply as I am at workplace and sim internet is not up to the mark [2/3, 11:47 PM] +20 122 015 6364: DPU= -ln (0.937) = 0.065 [2/4, 2:12 AM] Darrah: What is -ln? How do you get from .063 to .065? [2/4, 2:13 AM] Black Belt Study Group2: Logarithm function [2/4, 2:14 AM] Black Belt Study Group2: Applied to the number 0.9 [2/4, 2:19 AM] Darrah: Verify: DPU = -ln (RTY)=- (-.065) DPU =.065 [2/4, 2:26 AM] +91 98119 54800: RTY =. 937 DPU = - ln (RTY) =-ln(. 937) DPU =- (-. 065) =.065 [2/4, 2:40 AM] +65 8350 2087: Its natural log which is 0 for 1 and negative for inputs in fraction [2/4, 2:42 AM] +65 8350 2087: Say ln1 is 0, ln10 is 1 and ln100 is 2....this way since it is negative for fractions DPU is defined as -ln(RTY)...to achieve positive no |

|

|

|

Vaibhav, Ques: The reported Cpk, for a process with an average of 28, a spread of 10 units, and upper and lower specification limits of 35 and 15 respectively, would be:

|

Find

|

|

|

|

Cp vs Pp & Cpk vs Ppk

[1/30, 12:26 PM] +20 115 400 3031: High, I need to understand the difference between Cp vs Pp & Cpk vs Ppk. When to apply process performance or process capability. Appreciate your help |

Per Vaibhav:

[1/30, 2:20 PM] +65 8350 2087: Cp and Cpk has to be used for short term variability where variation is computed through R bar/d2 or else S bar/c4.based on sample inferences. While Pp and Ppk are computed over long term variability where standard deviation is computed using general formula of Std dev for normal distribution. Which is square of (x-x bar)/n-1 [1/30, 2:21 PM] +65 8350 2087: For Pp and Ppk we consider whole population |

|

|

|

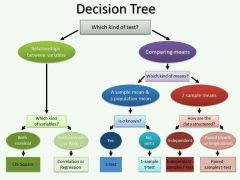

Decision Tree

|

|

|

|

|

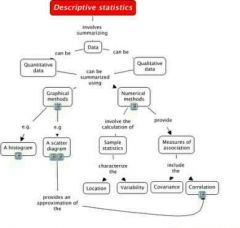

Descriptive Statistics

|

|

|

|

|

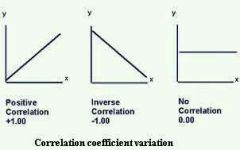

Correlation Coefficient Variation

|

|

|

|

|

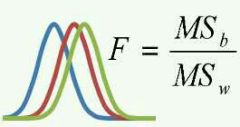

F Ratio in ANOVA

|

|

|

|

|

Steps for Experimental Design Selection

|

|

|

|

|

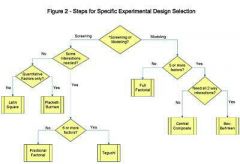

Steps for Specific Experimental Design Selection

|

|

|

|

|

SS Formula Sheet & Study Method

|

Per Rajan: [2/3, 8:51 AM] +91 98119 54800: Darrah... There is a formula sheet in my folder.. Have a look on it... It covers about 65% of formulas you require for exams.... And for rest ( like design of experiments, control charts and capability studies) you can make your own formula compilation..

PerZaid:[2/3, 9:14 AM] Black Belt Study Group2: My formulary of concepts is really nice so in the exam u will not lose time checking the big books [2/3, 9:14 AM] Black Belt Study Group2: U need to think on saving time because in the exam time is not gold it is gold diamonds and petrol all together [2/3, 9:15 AM] Black Belt Study Group2: U need to study as if you would have not accessed to any material [2/3, 9:15 AM] Black Belt Study Group2: Then u can make it |

|

|

|

PV & NPV

|

[2/14, 6:40 AM] Darrah: Rajan, Please compare PV, NPV and IRR calculations. What are the formulas for each?

[2/14, 7:47 AM] +919811954800: Darrah : The use of NPV and IRR calculation is to arrive a decision to accept or reject projects or sometimes prioritize the projects available to execute. [2/14, 8:06 AM] +919811954800: NPV is basically a way of measuring the value of future cash flow. Because of the time value of money, a dollar earned in future won't be worth as much as one earned today. For example, if a businessman wants to buy a factory, he would first estimate the future cash flow that factory would generate and then, discount those cash flow into one lump-sum present value amount ( suppose $80,000)... If the owner of factory was willing to sell his factory for less than $80,000 the businessman will likely to accept the offer as it presents a positive NPV investment. Thus only those projects are approved which offer positive NPV... Otherwise it is not worth to do them. [2/14, 8:16 AM] +919811954800: IRR ( internal rate of return) on the other hand is the percentage earned on each dollar invested for each period it is invested. IRR is the also another term people use for interest. [2/14, 8:19 AM] +919811954800: How NPV is related to IRR : IRR is that interest rate at which NPV becomes zero so if in formula of NPV if you put NPV as 0 and calculate for i... The value you will get for i is IRR... [2/14, 8:25 AM] +919811954800: First companies do NPV for a project.. And see that NPV is coming positive or not... Only in case of positive NPV project is done.... And after that if alternative projects is there.. Companies go for IRR calculation... The project which gives higher IRR is selected 💰💰💰💰💰💸💸💸💸 [2/14, 8:43 AM] Darrah: What about Present Value (PV) and IRR? Formulas and objectives? [2/14, 8:44 AM] +919811954800: 💡💡What is difference between Present value ( PV) and Net present Value ( NPV) : ✨Present value is the result of discounting future amounts to present. For example a cash amount of $ 10, 000 received at the end of 5 years will have a present Value of $6210 if the future amount is discounted at 10% compounded annually. ✨Net present Value is the present Value of the cash inflows minus the present Value of the cash outflows. For example, let's assume let's assume that an investment of $ 5000 today will result in one cash receipt of $10000 at the end of 5 years. If the investor requires a 10% annual return compounded annually, the net present Value ( NPV) of the investment is $1210. This is result of the present Value of the cash inflow $ 6210 minus the present Value of the $5000 cash outflow. NPV = present Value of cash inflow - present Value of cash outflow = $ 6210 - $ 5000 = $ 1210 [2/14, 10:26 AM] +919811954800: Objectives of IRR and PV is also explained above. The formula of IRR as explained is derived from formula of NPV... Set value of NPV as 0 and calculate for i... This calculated value of i is IRR only. Formula for PV is PV = FV / ( 1 + r)^n PV is present Value. FV is Future value. r is interest rate. n is the number of years [2/14, 10:28 AM] +919811954800: Now as practice question what is present Value of $9000 in 3 years with 10% interest rate (. 10 in decimal)? [2/14, 10:42 AM] +20 122 015 6364: $ 6761.8 [2/14, 11:24 AM] +919811954800: 👌👍👏✌ [2/14, 11:35 AM] +919811954800: You invest $500 now 💰 and get back $570 💸 next year. Use an Interest rate of 10%. What is NPV.... |

|

|

|

NPV & IRR

|

[2/14, 6:40 AM] Darrah: Rajan, Please compare PV, NPV and IRR calculations. What are the formulas for each?

[2/14, 7:47 AM] +919811954800: Darrah : The use of NPV and IRR calculation is to arrive a decision to accept or reject projects or sometimes prioritize the projects available to execute. [2/14, 8:06 AM] +919811954800: NPV is basically a way of measuring the value of future cash flow. Because of the time value of money, a dollar earned in future won't be worth as much as one earned today. For example, if a businessman wants to buy a factory, he would first estimate the future cash flow that factory would generate and then, discount those cash flow into one lump-sum present value amount ( suppose $80,000)... If the owner of factory was willing to sell his factory for less than $80,000 the businessman will likely to accept the offer as it presents a positive NPV investment. Thus only those projects are approved which offer positive NPV... Otherwise it is not worth to do them. [2/14, 8:16 AM] +919811954800: IRR ( internal rate of return) on the other hand is the percentage earned on each dollar invested for each period it is invested. IRR is the also another term people use for interest. [2/14, 8:19 AM] +919811954800: How NPV is related to IRR : IRR is that interest rate at which NPV becomes zero so if in formula of NPV if you put NPV as 0 and calculate for i... The value you will get for i is IRR... [2/14, 8:25 AM] +919811954800: First companies do NPV for a project.. And see that NPV is coming positive or not... Only in case of positive NPV project is done.... And after that if alternative projects is there.. Companies go for IRR calculation... The project which gives higher IRR is selected 💰💰💰💰💰💸💸💸💸 [2/14, 8:43 AM] Darrah: What about Present Value (PV) and IRR? Formulas and objectives? [2/14, 8:44 AM] +919811954800: 💡💡What is difference between Present value ( PV) and Net present Value ( NPV) : ✨Present value is the result of discounting future amounts to present. For example a cash amount of $ 10, 000 received at the end of 5 years will have a present Value of $6210 if the future amount is discounted at 10% compounded annually. ✨Net present Value is the present Value of the cash inflows minus the present Value of the cash outflows. For example, let's assume let's assume that an investment of $ 5000 today will result in one cash receipt of $10000 at the end of 5 years. If the investor requires a 10% annual return compounded annually, the net present Value ( NPV) of the investment is $1210. This is result of the present Value of the cash inflow $ 6210 minus the present Value of the $5000 cash outflow. NPV = present Value of cash inflow - present Value of cash outflow = $ 6210 - $ 5000 = $ 1210 [2/14, 10:26 AM] +919811954800: Objectives of IRR and PV is also explained above. The formula of IRR as explained is derived from formula of NPV... Set value of NPV as 0 and calculate for i... This calculated value of i is IRR only. Formula for PV is PV = FV / ( 1 + r)^n PV is present Value. FV is Future value. r is interest rate. n is the number of years [2/14, 10:28 AM] +919811954800: Now as practice question what is present Value of $9000 in 3 years with 10% interest rate (. 10 in decimal)? [2/14, 10:42 AM] +20 122 015 6364: $ 6761.8 [2/14, 11:24 AM] +919811954800: 👌👍👏✌ [2/14, 11:35 AM] +919811954800: You invest $500 now 💰 and get back $570 💸 next year. Use an Interest rate of 10%. What is NPV.... |

|