![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

30 Cards in this Set

- Front

- Back

|

Define cost of capital |

Amount that must be earned to meet required return for all investors

Each category of investment has a different risk, the cost of capital is a weighted average of all different categories- it is referred to as the weighted average cost of capital |

|

|

How is the cost of capital calculated? |

Cost of equity capital: CAPM = rf + B (rm - rf) GGM = D1/ r - g Cost of debt capital: =interest rate (1-tax rate) |

|

|

How does one calculate the weighted average cost of capital? |

Back (Definition) |

|

|

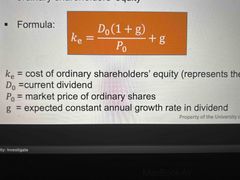

How can one calculate cost of equity with ordinary shareholders? |

2 methods (GGM - gordons growth model aka Dividend discount model) (CAPM - capital asset pricing model) |

|

|

When should one use GGM (DDM) method to estimate cost of equity? |

-can only be used by entities that pay dividends -model assumes that dividends grow at a constant rate annually, which is not always the case |

|

|

What other method can one use to estimate cost of equity besides DDM (GGM)? |

Capital asset pricing method, because it measures risk with the beta coefficient |

|

|

Explain the dividend discount model (GGM): |

-size, frequency and stability of dividend payments depend on entity’s dividend policy -ordinary shareholders expect dividend increase each year- therefore adopt policy whereby dividends increase at constant rate each year -the constant dividend growth model states that the market price of a share is assumed to be the present value of the future dividends |

|

|

What is the formula for GGM |

Back (Definition) |

|

|

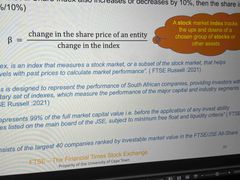

What is the formula for the capital asset pricing model? |

Formula: |

|

|

What does the beta coefficient measure in the CAPM? |

Measures market risk |

|

|

How does one calculate market risk? |

Back (Definition) |

|

|

Discuss the cost of equity for preference shareholders |

-dividends are paid to preference shareholders and distributed after tax profits Therefore preference dividends are not deductible for tax purposes, irrespective of whether or not the preference shares are redeemable |

|

|

What does the cost of preference shares depend on? |

Whether they are redeemable or not |

|

|

How can one calculate cost of preference shareholders equity? |

If preference shares are non redeemable: cost can be calculated using perpetuity principles (perpetuity makes payments indefinitely) If shares are redeemable: cost can be calculated using annuity principles (annuity makes regular payments throughout a specific time frame but has an expiry date) |

|

|

What is the formula for calculating non redeemable preference shares? |

Back (Definition) |

|

|

Discuss cost of debt |

-the cost of debt is the return that the entity’s lenders demand on new debt - it is the interest rate that entities must pay on debt If debt is non redeemable- the cost of debt can be calculated using perpetuity principles If debt is redeemable- the cost of debt can be calculated using annuity principles |

|

|

What is the main difference between calculating cost of shares and cost of debt? |

The shares on the debt is tax deductible whereas dividend on shares is not tax deductible |

|

|

How is the interest on cost of debt tax deductible? |

The cost of debt offer a tax shield which means companies are allowed to treat interest payment as an expense, therefore the taxable income of a company will be lower than if it had been financed by equity only |

|

|

How does one calculate mon redeemable debt? |

Back (Definition) |

|

|

What is weighted average cost of capital? |

-overall return that an entity must generate on its existing assets to maintain the value of an ordinary share, preference shares and debt |

|

|

Why must the WACC be determined? |

-each cost of a capital component has a different cost -the different costs are due to different levels of risk that different capital providers attach to the entity -debt generally cheapest source of funding thus the lowest cost of capital |

|

|

What is the cheapest source of funding? |

Debt |

|

|

What is the second cheapest source of funding? |

Preference is the second cheapest source |

|

|

What is the most expensive form of funding? |

-ordinary shareholders capital |

|

|

How can weighting of average cost of capital be determined ? |

Is determined by using book values or market values of these sources Market values are preferred because they provide a more accurate measure of an entity’s value |

|

|

What is book value? |

Net value of firm’s assets found on its books or balance sheet |

|

|

What is market value? |

Company’s worth based on the total value of its outstanding shares in the market (market capitalisation) |

|

|

Give a summary of how to calculate cost of capital |

Back (Definition) |

|

|

How does one calculate weighted average cost of capital? |

Back (Definition) |

|

|

What is the importance of the WACC in investment decisions? |

-determines which potential project are worthwhile for capital investment purposes and which are not -business only make investment if expected return is greater than WACC -in situation where multiple investments are considered: -accept only investments with positive differences between the IRR and the WACC -start with the investment with the highest positive difference |