![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

33 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

(Ch. 02) for convertivbles… parity for bond

|

mkt px common stock * conv ratio

|

None

|

|

|

(Ch. 02) for convertivbles… parity for common

|

mkt px bond / conv ratio

|

None

|

|

|

(Ch. 02) for convertivbles… whats conv ratio

|

conv ratio = bond par / conv px

|

None

|

|

|

(Ch. 01) calc for current yld and its aka

|

annual div / mkt px aka dividend yld

|

|

|

|

(Ch. 01) cumulative vs statutory voting

|

cumulative = allocate votes any stat = one vote per share for each ballot item

|

|

|

|

(Ch. 01) dates to remember re divident dist

|

"DERP" -declaration -ex divident -record -payable

|

|

|

|

(Ch. 01) excempt securities under act of 1933 exampt issuers under act of 1933

|

270 days or less usgovt, muni, banks non profits exampt

|

|

|

|

(Ch. 01) formula for treasury stock

|

treas stock = issued - o/standing

|

|

|

|

(Ch. 01) how are reit dividents taxed

|

taxed as ord income

|

|

|

|

(Ch. 01) re stock rights… duration?

|

short term 30 to 45 days

|

|

|

|

(Ch. 01) re stock rights… exercise px above or below mkt

|

exer px below mkt at issue

|

|

|

|

(Ch. 01) re stock rights… how many

|

one right per share o/s

|

|

|

|

(Ch. 01) re stock rights… offered to who

|

offered to existing shareholders

|

|

|

|

(Ch. 01) re stock warrants… duration?

|

lont term

|

|

|

|

(Ch. 01) re stock warrants… exercise px above or below mkt

|

exer px above mkt at issue

|

|

|

|

(Ch. 01) re stock warrants… how are they traded

|

trade as separate security

|

|

|

|

(Ch. 01) re stock warrants… what offered?

|

offered as sweeteners

|

|

|

|

(Ch. 01) what type of entity is a reit not also what pnl is passed through

|

not ltd partnership not and invest co passes through income, not losses

|

|

|

|

(Ch. 01) where are reits traded

|

traded exch or otc

|

|

|

|

(Ch. 01) 2 percentage req for an entity being a reit

|

75% income from re dist 90% of income to s/h to avoid taxation as trust

|

|

|

|

(Ch. 02) 2 things about govt natl mtg assoc

|

backed by usgovt interest fully taxable

|

|

|

|

(Ch. 02) at what levels are govt bonds taxed

|

taxed at fed level exempt from state and local

|

|

|

|

(Ch. 01) 3 characteristics of treasury stock

|

1-no vote right 2- no dividents 3- not traded in mkt

|

|

|

|

(Ch. 02) distinguish btwn fed funds rate and discount rate

|

fed funds is set by markets discount rate is set by frb

|

|

|

|

(Ch. 02) distinguish btwn refunding and prefunding

|

refunding = refinance prefunding = defeased

|

|

|

|

(Ch. 01) 3 voting rights and 1 thing for which there is no voting right

|

1- directors 2- issue of converts 3- issue of preferred no voting rights on dividents

|

|

|

|

(Ch. 02) in corp bonds, what is funded debt

|

5 yrs or more until maturity

|

|

|

|

(Ch. 02) ratings (min) for invest grade -s&p -moodys

|

s&p = BBB moodys = Baa

|

|

|

|

(Ch. 02) re cmo's - diff btwn planned amort class and targeted amort class

|

planned -> protect against prepymt and extension risk targeted -> protect against pre only

|

|

|

|

(Ch. 02) STRIPS vs treasury receipts

|

STRIPS backed by usgovt tsy receipts not

|

|

|

|

(Ch. 02) two things to remember re tips

|

-issued at fixed rate -prin is adj for inflat

|

|

|

|

(Ch. 02) what is trust indenture

|

covenants btwn trustee and issuer for benefit of bond holders

|

|

|

|

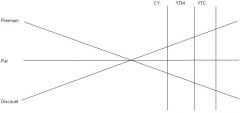

Graph for CY, YTM and YTC for Prem, Disc & Par Bonds

|

Drawing

|

|