![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

82 Cards in this Set

- Front

- Back

|

Bonds (corporate) |

Issued by corporations to raise capital or funds for expenditures such as plant construction, equipment, etc. Corp bonds w/ maturities of 5 years or more are called "funded debt." |

|

|

Bonds (government) |

Treasury (T) bills: < 1 year maturity Notes: 2 to 10 years maturity Bonds: Maturity > 10 years Backed by full faith and credit of government and its unlimited taxing power |

|

|

Bond (municipal) |

Debt obligations of state and local governments and their agencies. Issued to raise capital to finance public works or construction projects that benefit the public |

|

|

Bond Interest (Coupon) Rate |

Calculated from bond's par (face) value which is usually $1,000 per bond. Will be redeemed for $1,000 at maturity |

|

|

Interest on Bonds |

Accrues daily. Paid in semiannual installments over life of bond. Final semiannual interest payment is combined with repayment of principal amount. |

|

|

Bond Maturity Structures |

Term Maturity: Principal of whole issue matures at once Serial Maturity: Portions of principal mature at intervals Balloon Maturity: Hybrid of term and serial. Part of principal paid before final maturity. Pays off majority at maturity. |

|

|

Series Issues |

Issuing of bonds over period of time - usually over several years |

|

|

Coupon (Bearer) Bonds |

No record kept of purchasers. Whoever possesses them can collect interest on, sell, or redeem |

|

|

Registered Bond |

Issuer's transfer agent records the bondholder's name |

|

|

Book-entry Bonds |

Owners do not receive certificates. Transfer agent maintains the security's ownership record. |

|

|

Denominations (bonds) |

Bearer bonds: $1,000 and $5,000 Registered bonds: $1,000, or multiples of $5,000 up to $100,000 |

|

|

Bond Pricing |

Determined primarily by interest rates Once issued, bonds are traded on secondary market |

|

|

Par |

Face value of bond. Usually $1,000. Represents the amount loaned to issuer and amount repaid at maturity. |

|

|

Price of Bonds |

Par - face value Discount - below par Premium - above par |

|

|

Bond Price Quotes |

Price changes are quoted in newspapers in points 1 pt = 1% of $1,000 ($10) 1/4 pt = $2.50 Minimum quote is usually 1/8 or $1.25 100 basis points in each point (1/100 of 1%) |

|

|

Bond Rating |

Standard & Poor's (S&P) Moody's Evaluate the credit quality of bond issues and publish ratings |

|

|

Investment Grade |

A municipal bond must be investment grade (BBB/Baa or higher) to be suitable for purchase by banks. These are known as "bank-grade" bonds |

|

|

Safety hierarchy of debt securities (safest to least safe) |

1. U.S. Gov't bonds - Treasury bills, notes, bonds, savings bonds 2. US Gov't Agencies - GNMA, FFCB, FHLMC, FNMA 3. Municipal Issues - general obligation (GO's) 4. Corporate debt securities |

|

|

Debt Service |

The schedule of interest and principal payments due on a bond issue |

|

|

Sinking Fund |

Issuer cash account (held by trustee) for paying off/redeeming bonds |

|

|

Call Feature |

Allows issuer to redeem a bond issue before its maturity date |

|

|

Call Premium |

Price paid to bondholders (higher than par) in return for calling bond early. Difference between the call price and par |

|

|

Term Bonds |

Called by random drawing |

|

|

Serial Bonds |

Called in inverse order of their maturities |

|

|

Tendering |

The act of issuer buying bonds on the open market if there is not a call provision |

|

|

Call Protection |

Non-callable period of 5 to 10 years to provide protection to investors |

|

|

Refunding |

Practice of raising $$ to call a bond. Often done by issuer selling a new bond issue. Common for bonds approaching maturity |

|

|

Pre-Refunding (Advance Refunding) |

A new issue is sold at a lower coupon before the original bond issue can be called. Locks in a favorable interest rate. Form of defeasance of the issuers obligation (no longer part of issuer's debt) |

|

|

Pre-Refunded Bonds |

AAA rated Considered "defeased". Once pre-refunded, the issue is no longer part of oustanding debt Funds are escrowed in gov't securities |

|

|

Tender Offers |

Offer made by issuer to buy back bonds at a premium to induce bond holders to tender their securities |

|

|

Bond Yield |

Is the cash interest payments in relation to the bond's value |

|

|

Nominal Yield (aka: coupon yield) |

Is the fixed percentage of the bond's par value Is set at issuance and printed on the face of the bond |

|

|

Current Yield |

Measures a bond's coupon payment relative to it's market price Coupon pymnt / market price = current yield ex: 6% bond trading @ $800 $60 / $800 = 7.5% (current yield) |

|

|

Current Yield (con't) |

When price of bond balls, yields rise. When price of bond rises, yield falls ex: 6% bond $1,000 6% trading @ $800; CY = 7.5% 6% trading @ $1,200; CY = 5% |

|

|

Yield to Maturity |

Annualized return of the bond if held to maturity annual interest - (premium / years to maturity) / avg. price of bond ex: 10% coupon bond bought @ 105 w/ 10 yrs maturity 100 - (50 / 10) / 1025 = 95/1025 = 9.3% |

|

|

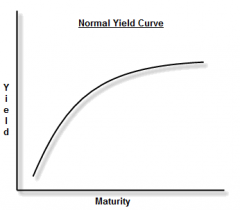

Yield Curve |

The difference in yields between short-term and long-term bonds of the same quality |

|

|

Normal (positive) yield curve |

As term of security increases, the yield increases |

|

|

Inverted (negative) yield curve |

When long-term interest rates are lower than short term interest rates |

|

|

Secured Corporate Bond |

Bond is secured when issuer has identified specific assets as collateral Trustee holds title In a default, bondholder can lay claim to collateral |

|

|

Mortgage Bonds |

Have highest claim on assets pledged as collateral In general, considered safe, however only as secure as the assets that secure them |

|

|

Open-end Indenture |

Permits the corporation to issue more bonds of the same class later. Subsequent issues are secured by the same collateral backing initial issues. Have equal liens on property. |

|

|

Closed-end Indenture |

Does not permit corporation to issue more bonds of the same class in future. Any subsequent issue has a subordinated claim on the collateral |

|

|

Collateral Trust Bonds |

Issued by corporation that own securities of other companies as investments Those securities are pledged as collateral |

|

|

Equipment Trust Certificates (ETC's) |

Used to finance purchase of capital equipment. Issued serially - amount outstanding goes down year to year in line with depreciating value of collateral (aircraft, railroad cars, etc). |

|

|

Unsecured Bonds |

Have no specific collateral backing Classified as debentures or subordinated debentures |

|

|

Debentures |

Unsecured bonds backed by the cred of the issuing corporation Debentures are below secured bonds and above subordinated debentures and preferred and common stock in the priority of claims on corporate assets |

|

|

Subordinated Debentures |

Owners are paid last of all debt obligations, including general creditors in case of liquidation. Generally offer higher yields than debentures or secured bonds |

|

|

Hierarchy of Claims on Company's Assets (Liquidation) |

1. Unpaid wages 2. IRS (taxes) 3. Secured debt (bonds and mortgages) 4. Unsecured liabilities (debentures) and general creditors 5. Subordinated debt 6. Preferred stockholders 7. Common stockholders |

|

|

Guaranteed Bonds |

Backed by a company other than the issuer (ex: parent company) |

|

|

Income Bonds (aka Adjustment Bonds) |

Used when a company is reorganizing and coming out of bankruptcy. Interest is paid only if company has enough income and BOD declares a payment. Noncumulative. Not suitable for customers seeking income. |

|

|

Zero-Coupon Bonds |

An issuer's debt obligations that do not make regular interest payments. Issued, or sold, at deep discount to face value and mature at par. Issued by corporations, municipalities, and US Treasury |

|

|

Taxes on Zero-Coupon Bonds |

Investors owe income tax each year on the amount by which the bonds have accreted. Tax is due regardless of direction of market price. Zero reinvestment risk because no interest payments |

|

|

NYSE - Listed Bonds |

NYSE provides a central marketplace for trading corporate bonds. Brokerage firms usually enlist bond brokers to execute orders on their behalf. Most corporate bonds still trade in the OTC market |

|

|

Convertible Bonds |

Corporate bonds that may be exchanged for a fixed number of shares of the issuing company's common stock Pay lower interest rates Fixed interest rates and maturity dates |

|

|

Advantages of Convertible Securities (for issuer) |

- Sold with a lower coupon rate - Elimination of fixed interest charge as conversion takes place - Conversion does not have averse affect on stock price - Corp avoids immediate dilution of primary earning per share - At issuance, conversion price is higher than market price of the common stock |

|

|

Disadvantages of Convertible Securities (for issuer) |

When bonds are converted, shareholders' equity is diluted Substantial conversion could cause a shift in control of the company Loss of leverage Raises corp's taxable income |

|

|

Advantages of Convertible Securities (holder) |

Pays interest at a fixed rate; redeemable at face value Convertible bondholders have priority over common stockholders Price tends to be more stable Market price tends to move upwards if the stock price moves up Investor incurs no tax liability on conversion |

|

|

Conversion Price |

Stock price at which a convertible bond can be exchanged for shares of common stock |

|

|

Conversion Ratio (conversion rate) |

The number of shares of stock a bond may be converted into Ex: Bond with conversion price of $40 $1,000 / $40 = 25 Conversion ratio of 25:1 Convertible preferred stock Stock with conversion at $20 $100 / $20 = 5 shares |

|

|

Conversion Parity |

Parity means that two securities are of equal dollar value (a convertible bond and the common stock into which it can be converted) |

|

|

Calculating Conversion Parity |

Market price of bond / conversion ratio (# of shares) = parity price of common stock Ex: RST bond is convertible to common @ $50. Bond is currently trading at $1,200. $1200 / 20 = $60 (parity price of stock) Market price of common stock x conversion ratio = parity price of convertible bond Ex: RST bond is convertible to common stock @ $50. Common is trading for $45. 20 x $45 = $900 |

|

|

Forced Conversion |

When an issuer calls its convertible bonds and it is in the best interest of the bondholders to convert their bonds rather than let them be called away. |

|

|

Reverse Convertibles |

Put options that allow the bond's issuer the right, but not the obligation, to convert the bond's principal into shares of equity at a predetermined set date. The option is exercised if shares underlying the option fell below a set price. Bondholders would receive the equity (shares) rather than their principal when the bond matures. |

|

|

Government/Agency Securities |

The Treasury Dept. determines the quantity and types of government securities it it must issue to meet federal budget needs Market place determines interest rates Treasury securities are classified as bills, notes and bonds |

|

|

Treasury Bills (T-Bills) |

Short-term obligations at a discount from par. Zero coupon. Return is difference between discount and par. Issued in denominations between $100 and $5M. Maturities of 4, 13 and 26 weeks. Auctioned weekly. |

|

|

Treasury Notes (T-Notes) |

Pay interest every 6 months. Sold at auction every 4 weeks. Intermediate term bonds that mature every 2 to 10 years. Issued in denominations of $100 to $5M. Issued, quoted and traded as a percentage of par in 1/32's. |

|

|

Treasury Bonds (T-Bonds) |

Long-term securities (10 to 30 years) that pay interest every 6 months. Issued in denominations of $100 to $5M. |

|

|

Treasury Receipts |

Brokers/dealers buy Treasury securities, place them in trust at a bank and sell separate receipts against the principal and coupon payments. Not backed by US Government |

|

|

Separate Trading of Registered Interest and Principal Securities (STRIPS) |

Bonds that are stripped into interest and principal components. Government's direct obligation but banks and dealers do the actual stripping |

|

|

Treasury Inflation Protection Securities (TIPS) |

Protects purchasers from purchasing power risk. Issues with a fixed interest rate, but the principal amount is adjusted semiannually by an amount equal to the change in the Consumer Pricing Index (CPI) |

|

|

Agency Issues |

Farm Credit Administration GNMA (Gov't National Mortgage Assoc) Freddie Mac (Fed. Home Loan Mortgage Corp) Federal National Mortgage Assoc (FNMA) Student Loan market Assoc (SLMA) Agency sometimes refers to entities that are not technically government agencies but that do have ties to the govt. |

|

|

Agency Issues: Yields and Maturities |

Agency issues have higher yields than direct obligations of federal gov't but lower yields than corporate debt securities. Maturity ranges from short to long-term. Trade actively on secondary market. |

|

|

Agency Issues: Taxation |

Taxed on federal, state and local levels. |

|

|

Government National Mortgage Association (Ginnie Mae) |

Gov't owned corporation that supports the Dept. of Housing and Urban Development. Only agency securities backed by full faith and credit of federal gov't. -$1,000 minimums -Monthly interest and principal payments -Pass-through certificates -Significant reinvestment risk |

|

|

GNMA: Types of Issues |

Does not originate mortgage loans, nor does it purchase, sell or issue securities. Private lending institutions approved by GNMA originate eligible loans, pool them into securities (known as pass-through certificates) and sell the GNMA mortgage backed securities (MBS). Include mortgage companies, commercial banks and thrift institutions. |

|

|

GNMA: Taxation |

Taxable at federal, state and local levels |

|

|

Farm Credit System |

National network of lending institutions that provides agricultural financing and credit.

Privately owned, government sponsored. Raises loanable funds through the sale of Farm Credit Securities. Issues discount notes, bonds and master notes. Maturity is from 1 day to 30 yrs. Exempts from state and local taxes |

|

|

Federal Home Loan Mortgage Corp (FHLMC - Freddie Mac) |

Public corporation. Created to promote development of nationwide, secondary market in mortgages. Buys residential mortgages from financial institutions and packages them into mortgage-backed securities for sale to investors. |

|

|

Pass-Through Certificates |

Created by pooling a group of mortgages and selling certificates representing interests in the pool. The "pass-through" refers to the mechanism of passing home buyers' interest and principle payments from the mortgage holder to the investors. Fannie Mae, Ginnie Mae and Freddie Mac function this way. |

|

|

Federal National Mortgage Association (FNMA - Fannie Mae) |

Publicly held corporation that provides mortgage capital. Purchases conventional and insured mortgages from agencies like FHA and VA. Backed by FNMA's general credit. |

|

|

FNMA: Types of Issues |

Issues debentures, short-term discount notes, and mortgage-backed securities. Notes are issued in denominations of $5,000, $25,000, $100,000, $500,000 and $1M. Debentures mature between 3 and 25 years and are issued in minimum denominations of $10,000 in increments of $5,000. |

|

|

|

` |