![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

125 Cards in this Set

- Front

- Back

|

Which of the following is TRUE about the par value of common stock?

|

It represents an arbitrary value on a corporation’s books

|

|

|

At a shareholder’s meeting, three positions are up for election on the board of directors.If the voting is done on a cumulative basis and an owner has 1,000 shares, which of the following are acceptable ways to vote? I. 1,000 votes for one candidate II. 3,000 votes for one candidate III. 1,000 votes for each of three candidates IV. 3,000 votes for each of three candidates |

I, II, and III only |

|

|

Lee Digsworth III purchases 10 ABC convertiblebonds at 120 that are convertible at $25. The bonds are due to mature in 27years at par value, and they pay a coupon rate of 9 percent. What is the current yield of the bonds? |

7.5 percent |

|

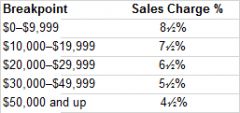

Mike Sparticus would like to purchase$30,000 of TOGA Aggressive Growth mutual fund. How many shares can Mike purchase if the NAV is $12.00, the POP is $13.11, and the sales charge percent is as follows?

|

2,362 |

|

|

Which TWO of the following option investors will receive the dividend if the option is exercisedprior to the ex-dividend date? I. The holder of a call option II. The holder of a put option III. The writer of a call option IV. The writer of a put option |

I and IV |

|

|

Which of the following securities are exempt from SEC registration? I. Private placements II. Intrastate offerings III. Interstate offerings IV. Variable annuities |

I and II only |

|

|

When is the last time an investor may trade a listed option? |

4:00 p.m. EST on the third Friday of the expiration month

|

|

|

While studying a particular stock, a technical analyst notices that it is in a “head and shoulders top formation.” Which of the following best describes a head and shoulder stop formation? |

Reversal of a bullish trend |

|

|

Which of the following MUST be a closed-end fund? |

NAV — 11.40, POP — 13.00 |

|

|

The Fed announces an increase in the discountrate from 5 percent to 51⁄2 percent.Which TWO of the following will MOST likely occur after the increase? I. Outstanding debenture prices will rise. II. Outstanding debenture prices will fall. III. U.S. imports of foreign goods will be more competitive. IV. U.S. exports will be more competitive. |

I and III |

|

|

Which of the following BEST illustrates the calculation of a net revenue pledge as it relates to municipal bonds? |

(Gross revenues – [operation + maintenance])÷ debt service |

|

|

An investor purchases an ABC corporate debenture with a 7 percent coupon and a basis of 7 percent. If the bond is to be called in five years with a yield to call of 71⁄4 percent,how much did the investor pay for the bond?

|

$1,000

|

|

|

Which of the following BEST describes dollar cost averaging as it pertains to mutual fund investing? |

Investing a fixed dollar amount periodically into the same investment |

|

|

Which of the following are TRUE of ADRs? I. The investor does not receive the actual certificate. II. The investor cannot receive dividends in cash. III. The actual shares are held in a custodianbank. IV. They represent receipts for U.S. securities that trade in foreign countries. |

I and III only |

|

|

All of the following are money market instruments EXCEPT |

ADRs |

|

|

An investor purchases a callable convertiblebond that is currently trading in the market at 96. The bond is convertible at$25. If the basis is 7.5 percent and the nominal yield is 7 percent, what is the current yield? |

7.29 percent |

|

|

Which of the following is/are TRUE regardingvariable annuities? I. The payouts depend upon the performance of the securities in the separate account. II. Investors may claim deductions for the current year as long as they have deposited money into the annuity prior to April 15 of the following year. III. “Life with period certain” provides thehighest payouts. IV. The assumed interest rate is the annualrate of return necessary to beat theS&P 500. |

I only |

|

|

An investor purchases 1,000 shares of DIM at $20 per share in a margin account. If this is the initial transaction and Reg T is 55 percent,what is the loan value? |

$9,000 |

|

|

An investor is long 1 DIP Jul 80 put for 9 and is short 1 DIP Jul 70 put for 3. In which TWO ways could the investor profit from this position?

I. The difference in the premiums widens. II. The difference in the premiums narrows. III. The options expire unexercised. IV. The options are exercised. |

I and IV |

|

|

You would like to show potential customers-some of your option picks and how you might be able to make them money. Advertisements pertaining to past option recommendations must include which of the following? |

All option recommendations made by your firm in the last year |

|

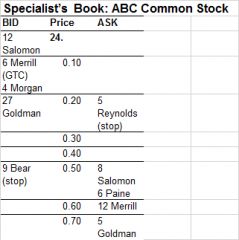

What is the inside market? |

24.20–24.50 |

|

|

Where can the specialist enter a quote forhis own inventory? |

24.30

|

|

|

Mary was a registered representative for 16years and left the business for a while dueto a nasty divorce. Mary would like to getback into the business and rebuild herbook. She is required to take her exams allover again if she has been unaffiliated witha broker/dealer for more than |

Two years

|

|

|

If a corporation issues 10,000 shares of 8percent preferred stock ($100 par), whichof the following will increase? I. Current assets II. Quick assets III. Net worth IV. Total liabilities |

I, II, and III only |

|

|

All of the following are considered leadingindicators EXCEPT |

industrial production |

|

|

All of the following are exempt from theTrust Indenture Act of 1939 EXCEPT |

debentures

|

|

|

John Bearishnikoff has a numbered accountwith his broker-dealer. John’s holdings areas follows: $150,000 in corporate debentures $100,000 in common stock $50,000 in preferred stock $50,000 in warrants $150,000 in cash If John’s broker-dealer declares bankruptcy,how much is John covered for? |

$450,000

|

|

|

Which of the following are TRUE ofopen-end investment companies but NOTclosed-end investment companies?

I. Investors may redeem their shares. II. Only common stock may be issued. III. Investors purchase at the NAV plus acommission. IV. New shares are constantly beingissued. |

I, II, and IV only |

|

|

According to Rule G-39, which of the followingis TRUE of cold-calling? I. Calls must be made after 8:00 a.m.or before 9:00 p.m. local time of thecustomer. II. Calls must be made after 8:00 a.m. orbefore 9:00 p.m. local time of the caller. III. The caller must disclose his name andthe firm’s name. IV. The caller must disclose the firm’s telephonenumber and/or address. |

I, III, and IV only |

|

|

Which of the following will cause anincrease in the deficit of the U.S. balance ofpayments? I. U.S. investors’ buying ADRs II. A drop in the discount rate III. The tightening of the U.S. dollar IV. Foreign investors’ buying U.S.companies |

I and III only

|

|

|

All of the following are possible reasons forinvestors to write covered calls EXCEPT

|

to generate a profit when the marketprice of the underlying security dropssignificantly

|

|

|

An investor has the following optionpositions: Short 1 ABC Oct 50 call at 3 Write 1 ABC Oct 45 put at 4 The investor has created a |

short combination

|

|

|

ABC common stock is trading at $44. WhichTWO of the following options are “in-the money”? I. ABC Oct 40 calls II. ABC Oct 40 puts III. ABC Oct 50 calls IV. ABC Oct 50 puts |

I and IV

|

|

|

An investor purchases ten DUD convertiblebonds at 90. The bonds are convertible at$25. One month after the purchase, the customerconverts the bonds into commonstock when the stock is trading at $23. If thecustomer sells the stock in the market atthis point, what is the tax consequence as aresult of these transactions?

|

$200 capital gain

|

|

|

The holders of which of the followingsecurities are considered owners of thecorporation? I. Mortgage bondholders II. Convertible debenture holders III. Preferred stockholders IV. Warrant holders |

III only

|

|

|

Unless otherwise stated, a CMO has aStandard and Poor’s rating of

|

AAA

|

|

|

Mrs. Bullishinski enters an order to buy 100shares of DIM at 40 stop limit. The ticker followingentry of the order is as follows: 39.75, 40, 40.25, SLD 40, 39.88, 40 The order was triggered at |

40 and executed at 39.88 |

|

|

Readham & Wheepe Broker-DealerCorporation purchases 10,000 shares ofDROP common stock for their own inventoryat a price of $27 per share. Severalweeks later, DROP is quoted in the marketat 25–25.25. If the brokerage firm wishes tosell 1,000 shares to one of its customers,which of the following prices must the brokeragefirm use as a basis for their markup?

|

25.25

|

|

|

Regarding the NASD 5% policy, which of thefollowing is/are TRUE?

I. The type of security is not aconsideration. II. Riskless transactions are not coveredby the 5% policy. III. Securities sold through a prospectusare exempt from the 5% policy. IV. The 5% policy is used as a guideline for |

III only

|

|

|

Which of the following types of bonds has amandatory sinking fund?

|

Term bonds

|

|

|

An investor purchases an XYZ 8 percentcallable bond at 80. The bond matures inten years. If the investor sells the bond at87 in six years, what is the gain or loss?

|

$50 loss

|

|

|

An investor purchases an XYZ 8 percentcallable bond at 80. If the bond matures inten years, how much does the investorhave to claim on his or her taxes each year?

|

$100

|

|

|

A customer purchases a new issue of GObonds. The confirmation sent to the customermust include all of the followingEXCEPT

|

the current yield calculated at the timeof sale

|

|

|

The Federal Reserve Board controls themoney supply by

I. changing the discount rate II. changing the prime rate III. engaging in open-market operations IV. changing the reserve requirements |

(B) I, III, and IV only

|

|

|

Which of the following does NOT occurduring the cooling-off period?

|

Stabilizing the issue

|

|

|

Which of the following is responsible forapproving an over-the-counter stock forpurchase on margin?

|

The FRB

|

|

|

Interest received from which of the followinginvestments is free from state income tax inall states?

I. Revenue bonds issued to build tollbooths II. Treasury bonds III. Bonds issued by the Commonwealth ofPuerto Rico IV. GNMAs |

II and III only

|

|

|

A registered representative is opening anew account for a customer. According tothe “know your customer” rule, the repshould determine which of the following?

I. The customer’s date of birth II. The customer’s investment objectives III. The customer’s risk tolerance |

I, II, and III

|

|

|

Who is the issuer and guarantor of all listedoptions?

|

The OCC

|

|

|

DORK Corp., a U.S. company that suppliesrubber products, shipped a supply toFrance. If DORK is to receive paymentin French Francs in 30 days, which ofthe following is the BEST strategy forDORK Corp.

|

Buy euro puts

|

|

|

Which of the following does NOT changethe strike price of a listed option?

|

A $0.60 dividend

|

|

|

DEF common stock has a market price of$60 per share and earnings per commonshare of $6. If DEF Corp. announces a 2-for-1stock split, which TWO of the following areTRUE after the split?

I. The PE ratio is 10. II. The PE ratio is 5. III. The EPS remains at $6. IV. The EPS reduces to $3. |

I and IV

|

|

|

All of the following are considered allowabletax deductions for an oil and gas limitedpartnership EXCEPT

|

principal expenses on a loan

|

|

|

All of the following may trade in the secondarymarket EXCEPT

I. Fed funds II. repurchase agreements III. American Depositary Receipts IV. bankers’ acceptances |

I and II only

|

|

|

An investor buys 4 ABC Oct 60 puts for3 each and purchases 400 shares of ABCfor $65 per share. Six months later, ABC istrading in the market at $67 per share. Atwhat market price does this investor breakeven, excluding commissions?

|

68 |

|

|

The Fed is about to announce the largestsale of T-bills in recent history. An investorwho wishes to profit from this anticipatedsale should do which TWO of the following?

I. Buy T-bond yield calls II. Buy T-bond yield puts III. Buy T-bond calls IV. Buy T-bond puts |

I and IV

|

|

|

Which of the following includes a zero-minustick?

|

27.13, 27.38, 27.38, 27.25, 27.25

|

|

|

Lee Dimwitty is in the process of purchasinga municipal GO bond in the secondarymarket for 92. The nominal yield of thebond is 6 percent and the basis is 6.6 percent.If Mr. Dimwitty is in the 28 percent taxbracket, what is the taxable equivalent yieldfor this bond?

|

9.16 percent

|

|

|

Individuals giving specific investmentadvice for a fee are required to have passedwhich exams?

|

The Series 7, Series 63, and Series 65

|

|

|

Melvin has a portfolio of securities with alot of liquidity. Melvin has an additional$20,000 to invest and would like to keepthe liquidity due to a business opportunitythat may be coming his way. Which of thefollowing investments would you LEASTlikely recommend?

|

An oil and gas limited partnership

|

|

|

Which of the following are NOT TRUEregarding the Uniform Gifts to Minors Act?

I. The donor may not be the custodianfor the account. II. Purchases in the account may be madeonly in a margin account. III. If a stock in the account receives rights,the rights must be exercised. IV. The custodian is responsible for alltaxes due from the account. |

I, II, III, and IV

|

|

|

A technical analyst notices that the marketis generally consolidating. What does thismean?

|

The trendline is moving sideways

|

|

|

What is the MOST likely reason for aninvestor to write covered call options?

|

To increase the yield on the investor’sportfolio

|

|

|

A customer opens a long margin accountby purchasing $30,000 in securities. Thecustomer signs a loan consent agreement,a credit agreement, and a hypothecationagreement. All of the following are TRUEEXCEPT

|

A change in the market value of thesecurities would affect the debitbalance

|

|

|

A variable annuity has an assumed interestrate of 41⁄2 percent, but the separate accountsannualized return is only 4 percent. WhichTWO of the following are TRUE?

I. The value of the accumulation unitwill rise.II. The value of the accumulation unitwill fall.III. The value of the annuity unit will rise. IV. The value of the annuity unit will fall. |

I and IV |

|

|

Zowee Securities holds a joint account forMr. and Mrs. Zazzo. Mr. Zazzo calls his registeredrepresentative at Zowee and tells himto “sell 100 shares of ZZZ common stockout of the account and send me a check tomy name only.” As the registered rep, youare required to tell Mr. Zazzo that

|

you will execute the trade right awaybut the check will have to be in his andhis wife’s name

|

|

|

One of your customers believes that interestrates are going to decrease over thenext ten years. Your customer is looking forinvestment advice. Which of the followingbonds are appropriate investments for thisinvestor?

I. Adjustable rate bonds with ten-yearmaturities II. Ten year bonds that are non-callable III. 15 year bonds callable at par in tenyearsIV. 15 year put bonds that can be put backto the issuer starting in five years |

II and IV only |

|

|

One of your customers has never investedin a DPP. Which of the following are considerationsfor her prior to investing? I. The goals of the partnership II. The general manager’s experience III. The projected time frame for the partnershipto become profitable IV. Whether she has enough liquidity inother investments |

I, II, III, and IV

|

|

|

Which of the following is NOT TRUE regardingwarrants?

|

Warrants provide the holder with a perpetualinterest in the issuer’s commonstock

|

|

|

Which of the following are considered“immediate family” under NASD Rule 2790? I. Mother-in-law II. Uncle III. Grandfather IV. Sister |

I and IV only

|

|

|

Joanne Smithy would like to invest inmutual funds, but she is not sure what sheshould be looking for. You should informher that the most important thing to considerwhen selecting mutual funds is thefund’s

|

investment objectives

|

|

|

Which of the following transactions is consideredstructured?

I. Mr. and Mrs. Johnson each transfer$9,900 to the same brokerage accounton the same day.II. Mr. Jones wires $9,000 to the sameaccount on three separate occasionsduring the same week. III. Two customers with no relation wire$9,000 to each of their own accountsone time. |

I and II only |

|

|

Which of the following statements are TRUEregarding municipal bond GO issues?

I. GO bonds are issued by the federalgovernment and therefore are exemptfrom federal taxes. II. Municipal GO bonds are exempt fromSEC registration. III. GO bonds are issued to fund revenueproducing facilities. IV. The largest backing for GO bonds isproperty taxes. |

II and IV only

|

|

|

On the same day, a customer purchases oneXYZ Oct 60 call at 6 and sells one XYZ Oct70 call at 2. What is this investor’s maximumpotential gain?

|

$600

|

|

|

A customer is long 100 shares of QHI at $45and sells 1 QHI Jul 60 call at 2. Six monthslater, QHI is trading at $50 per share. If thecustomer sells the stock at the currentmarket price and closes the option at 4,what is the gain or loss?

|

$300

|

|

|

A doctor earns $140,000 per year and hasno retirement plans except a traditionalIRA. If this doctor contributes the maximum$4,000 per year to the IRA, what are the taxconsequences?

|

The IRA contributions are fullytax-deductible

|

|

|

John Dough is the chairman of BIGICorporation. BIGI will be announcing amajor acquisition of SMLL Corporation inthe coming weeks. John is so excited thathe shares this information with his friendFred. Immediately after hearing the news,Fred calls his broker and purchases calloptions on SMLL Corp. Which of the followingis TRUE regarding insider trading rules?

|

They were violated by John and Fred |

|

|

Melvin Markowitz would like to open acash account at your firm and give tradingauthorization to his sister Marlene. Whichof the following documents is required foryou to open the account?

I. A new account form II. A hypothecation agreement III. A limited power of attorney IV. A joint account agreement |

I and III only

|

|

|

Which of the following is NOT TRUE regardingthe U.S. balance of payments?

|

When U.S. investors purchase foreignsecurities, the U.S. balance of paymentsincreases

|

|

|

A customer places a market order to sell200 shares of ZYX Corp. The initial executionreports shows that the trade occurredat 26.25 per share. However, upon furtherscrutiny, the firm discovers that the tradewas actually made at 26.00 per share.Which of the following is TRUE regardingthis transaction?

|

The customer will receive $5,200 lessany commissions

|

|

|

An investor has a margin account with amarket value of $30,000 and a debit balanceof $12,000. What is the buying power?

|

$6,000

|

|

|

A customer has placed an order to sell 200shares of ABC common stock at market. Thecustomer delivers two 100-share certificatesto the broker-dealer to complete the trade.Upon examination of the certificates, it isnoticed that the customer signed only oneand left the other one blank. What is the correctprocedure regarding the certificates?

|

Hold onto the certificates and send thecustomer a stock power along withinstructions that must be signed andreturned by the customer

|

|

|

You are setting up a strategic asset allocationplan for one of your 60-year old customers.Which of the following is MOST correct?

|

Having your customer invest 40 percentof his/her portfolio in stocks and60 percent in bonds and cash

|

|

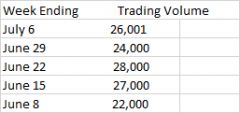

Vic Vantage has held onto his ZIMBrestricted stock for 11⁄2 years. There are 2.5million shares of ZIMB outstanding. Vic filedForm 144 on Tuesday, July 10. The ZIMBweekly trading volume for the previous5 weeks is as follows:

What is the maximum number of sharesthat Vic can sell under Rule 144? |

26,250

|

|

|

Maxine Moolah is a 65-year-old investor. Ifyou help her determine that she shouldhave a “defensive investment” strategy,which of the following types of investmentsare suitable for Maxine?

I. Blue chip stocks II. AAA rated bonds III. High-yield bonds IV. Call options |

I and II only

|

|

|

Mr. Bearclaw has a margin account with acurrent market value of $27,000 and a debitbalance of $15,000. Which of the followingare TRUE?

I. The account is currently restricted. II. The account has an SMA of $1,500. III. Mr. Bearclaw will receive a margin callfor $1,500. IV. Mr. Bearclaw will receive a maintenancecall if the market value dropsbelow $20,000. |

I and IV only

|

|

|

The resistance level is

|

the upper portion of the trading rangeof a security

|

|

|

Juanita Jingleham would like to purchasemunicipal bonds through your firm. If yousell her the bonds out of your firm’s inventory,which of the following is TRUE?

|

You should take into consideration thetotal amount of the sale when determiningthe markup charged

|

|

|

Mary Moneymountain purchased 1 HHH Jul40 call at 6 and 1 HHH Jul 35 put at 3. HHHincreased to 37 at expiration. If Mary hasnot previously exercised either option,what is her gain or loss?

|

$900 loss

|

|

|

Which of the following orders are considereddiscretionary and require a writtenpower of attorney to complete the order?

I. An order that specifies only thenumber of shares to be purchased andthe particular security to buy andleaves the price and/or time to purchaseup to the registered rep II. A market order that specifies onlywhich security to sell III. A limit order that specifies the priceand the security that is to be purchased |

II and III only

|

|

|

The S&P 500 has been increasing on a constantbasis, but the number of stocks thatare advancing as compared to the numberdeclining is starting to level off. A technicalanalyst might say that the market is

|

overbought

|

|

|

JAMB common stock is being sold to a syndicateduring an underwriting for $8.50 pershare. The public offering price is $9.50per share and the manager’s fee is $0.15 pershare. If the concession is $0.50 per share,what is the additional takedown?

|

$0.35

|

|

|

Jeemco broker-dealer is part of a syndicatethat is offering new shares of DIP Corp.common stock to the public. There are2,000,000 shares being offered to the public,and Jeemco is allocated 300,000 shares.After selling its allotment, 500,000 sharesremain unsold by other members. Howmuch of the remaining shares is Jeemcoresponsible for?

I. 75,000 shares if the offering was on anEastern account basis II. 75,000 shares if the offering was on aWestern account basis III. 0 shares if the offering was on anEastern account basis IV. 0 shares if the offering was on aWestern account basis |

I and IV only

|

|

|

Zack Zellig purchased 100 shares of FRMcommon stock at $40 per share. Zack additionallypaid a commission of $2 per share.If ABC pays a 10 percent stock dividend,what is the tax status of Zack’s investment?

|

He has 110 shares at a cost basis of$38.18 per share

|

|

|

Which of the following statements are TRUEregarding callable municipal revenuebonds?

I. Callable bonds usually have a higheryield than non-callable bonds. II. When interest rates increase, callablebonds increase in price more thannon-callable bonds. III. The issuer normally calls the bondswhen interest rates are decreasing. IV. In the event that the bonds are called,call premiums are set to make up thelost interest payments that the investorswould have received if the bond hadn’tbeen called. |

I and III only

|

|

|

Michelle opens a custodial account for her9-year-old niece Patricia. Which of the followingstatements are TRUE? I. The account cannot be opened becauseMichelle is not Patricia’s parent. II. Michelle cannot share the custodianjob with Patricia’s father. III. All trades in the custodial accountmust be on margin. IV. When Patricia reaches the age of majority,the account will be switched to hername. |

II and IV only

|

|

|

Which of the following are short-termmunicipal notes?

I. PNs II. BANs III. AONs IV. RANs |

I, II, and IV only

|

|

|

Kowabunga Ironing Board Corp. hasannounced in a recent tombstone advertisementthat it is issuing $4,000,000 worth ofconvertible mortgage bonds with a couponrate of 61⁄2 percent. The bonds are convertibleinto common stock at $20. The maturitydate is Oct 2026. Which TWO of the followingare TRUE?

I. The bonds are backed by the full faithand credit of Kowabunga. II. The bonds are backed by a lien onproperty owned by Kowabunga. III. The conversion ratio is 20. IV. The conversion ratio is 50. |

II and IV

|

|

|

One of your customers is interested in purchasingequity securities. If her main focusis to receive dividends, which of the followinginvestments would you LEAST likelyrecommend?

|

GHI warrants

|

|

|

Over the years, one of your customers purchased10,000 shares of DUD stock in 500-share increments whenever he had extramoney. The stock has been extremelyvolatile since your customer started purchasingDUD, and your customer would liketo sell off 3,000 shares of DUD but wouldlike to limit his tax liability. What accountingmethod would you recommend to yourcustomer to limit the amount of capitalgains taxes he will have to pay?

|

Identified shares

|

|

|

All of the following statements are TRUEregarding discretionary accounts EXCEPT

I. All order tickets must be marked“discretionary.” II. A hypothecation agreement is requiredfor all discretionary accounts III. All discretionary accounts must beapproved by a principal IV. A written power of attorney is requiredfor all discretionary accounts |

II only

|

|

|

DPPs that invest in raw land are considered

|

speculative investments

|

|

|

All of the following are acceptable stabilizingbids for a new issue with a public offeringprice of $20 per share EXCEPT

|

$20.25

|

|

|

Investors face an unlimited loss potential inwhich of the following situations?

|

They sold a put option and are shortthe stock

|

|

|

Account statements must be sent out tocustomers at least

|

quarterly

|

|

|

Which TWO of the following are TRUEabout Treasury STRIPS?

I. The security’s principal and interest ispaid at maturity. II. The security’s interest is paid semiannuallyand the principal is paid atmaturity. III. Investors must pay tax on interestearned annually. IV. Investors do not pay tax on interestearned until maturity. |

I and III

|

|

|

Mary has a short margin account with acredit balance of $5,600 and an SMV of$4,000. How much excess equity does Maryhave in her margin account?

|

None

|

|

|

The purchase of a put option as comparedto selling a stock short has all of the followingadvantages EXCEPT |

there is no loss on the time value as theput option is held |

|

|

Which of the following statements are TRUEregarding Roth IRAs? I. Earnings in the Roth accumulate tax-free. II. Withdrawals from a Roth IRA are nottaxable, provided that the investor hassatisfied the holding period. III. Contributions are made from pre-taxdollars. IV. Contributions are made from after-taxdollars. |

I, II, and IV only

|

|

|

Chicago, IL, is issuing $10,000,000 worthof callable bonds in the coming months.Which of the following is NOT TRUE aboutthe call feature of these municipal bonds?

|

Most municipalities like to add a callfeature in the indenture to make theissue more marketable.

|

|

|

Kathy Knox has an unrestricted long marginaccount at BD Securities. If the value ofKathy’s securities in the account increasesby $2000, her SMA will

|

increase by $1,000

|

|

|

Michael Mintek would like to move hisaccount from Varnish Brokerage toWaxman Securities. Which of the followingmust take place for this to happen? I. Michael must complete and sign anaccount transfer form from WaxmanSecurities. II. Varnish Brokerage must validate theaccount transfer form filled out byMichael. III. Varnish Brokerage must cancel any ofMichael’s open orders. IV. Varnish Brokerage has ten businessdays in which to complete the transfer. |

I, II, and III only

|

|

|

A double-barreled municipal bond is

|

backed by the full faith and credit ofthe municipality if revenues from thebacking project are insufficient

|

|

|

Approval of shareholders is required if acorporation would like toI. split its stockII. reverse split its stockIII. give investors a cash dividendIV. give investors a stock dividend

|

I and II only

|

|

|

All of the following are possible ways ofinvesting in variable annuities EXCEPT

|

periodic payment immediate annuity

|

|

|

A local municipality decides to issue bondsto build a public park. Which of the followingcharacteristics of the issuer should beconsidered when analyzing this municipalGO bond issue? I. Insurance covenants II. Ad valorem tax rate III. Flow of funds IV. Budgetary practices |

II and IV only

|

|

|

Which of the following investment strategiesis a long combination?

|

Buy 1 XZX Jun 40 call; buy 1 XZXJun 30 put

|

|

|

Which of the following are TRUE regardingindustrial development revenue bonds?

I. The money raised is used to constructa facility for a private corporation. II. The bonds are issued by municipalities. III. The bonds are backed by the full faithand credit of the municipality. IV. The bonds are backed by lease paymentsmade by the private corporation. |

I, II, and IV only

|

|

|

Which of the following are violations of the“wash sale rule”?

I. 20 days after selling ABC stock at aloss, the customer buys an ABCconvertible bond. II. 35 days prior to selling ABC stock at aloss, the customer buys ABC warrants. III. 15 days after selling ABC stock at aloss, the customer buys an ABC putoption. IV. 30 days after selling ABC stock at aloss, the customer buys an ABC calloption. |

I and IV only

|

|

|

Which of the following technical theoriesassumes that the small investor is usuallywrong?

|

Odd lot theory

|

|

|

Which of the following trades is/are subjectto the NASD 5% policy?

I. Riskless transactions II. Markdowns on stocks that werebought from a customer for thedealer’s inventory III. Markups on stocks that were sold to acustomer from the dealer’s inventory IV. Commissions charged to a customer onsecurities bought on an agency basis |

I, II, III, and IV

|

|

|

If the Fed raises the reserve requirements,which TWO of the following are MOST likelyto happen?

I. Interest rates will increase. II. Interest rates will decrease. III. Outstanding bond prices will decrease. IV. Outstanding bond prices will increase. |

I and III

|

|

|

It is required that all of the following arereviewed by a principal EXCEPT

|

interoffice memos

|

|

|

Under the Investment Advisers Act of 1940,which of the following is considered aninvestment adviser?

|

An investment letter available by paidsubscription that gives specific advicebased on a customer’s specific situation

|

|

|

An official notice of sale is published toindicate that a municipal offering is goingto be made

|

on a competitive basis

|