![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

17 Cards in this Set

- Front

- Back

|

Public Expenditure |

This is government spending that represents a significant portion of the aggregate demand (AD) in economies. The expenditure can be broken down into three catergories; Current Expenditure, Capital Expenditure and Transfer Payments. |

|

|

Current Expenditure (Public Expenditure) |

These include daily payments required to run the government & public sector e.g wages of public employees, payments for goods/services. |

|

|

Capital Expenditures (Public Expenditure) |

These are investments in infrastructure & capital equipment e.g new hospitals. |

|

|

Transfer Payments (Public Expenditure) |

Payments made by the Government for which no goods/services are exchanged e.g Unemployment Benefits, Disability Payments |

|

|

Factors affecting the Size & Composition of Public Expenditure |

Changing incomes affecting Government Revenue, Changing Age Distributions affecting pensions & healthcare, Changing Public Expectations. |

|

|

Progressive Tax System |

As incomes rise a larger percentage of income is paid in tax, this system is built around the idea of marginal tax rates- the amount of additional tax paid for every additional pound earned |

|

|

Regressive Tax System |

As incomes rise a smaller percentage of income is paid in tax e.g Excise duties on alchol & petrol, this can have big impacts on low-income households. |

|

|

Proportional Tax System |

The percentage of income paid in tax is constant, no matter what the level of income. |

|

|

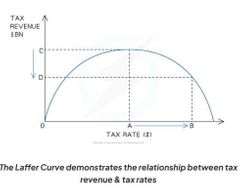

Impacts of Tax Rate Changes |

Incentive to work may fall if taxes rise, if taxes increase so much it can actually reduce Government Revenue as workers are disincentivized resulitng in less income (See graph), Income Distribution, Unemployment may rise as AD falls, |

|

|

Automatic Stabilisers |

These are automatic fiscal changes as the economy moves through stages of the business/trade cycle e.g a fall in tax revenues during a recession. They do not require active intervention from the government but happen automatically in the background. |

|

|

Discretionary Fiscal Policy |

A demand-side policy that uses government spending & taxation policy to influence aggregate demand (AD) |

|

|

A Fiscal Defecit |

Occurs when the level of Government spending is greater than the Government tax revenue in any given year. |

|

|

The National Debt |

The accumulation of all previous deficits, the defecit in one year adds to the national debt from previous years. |

|

|

Cyclical Deficits |

Occur due to downturns in the business/trade cycle, usually as a result of a recession. Governments recieve less tax revenue, these defecits tend to correct themselves as the economy starts to grow again. |

|

|

Structural Deficits |

They are deficits that are present even when an economy may be operating at the full employment level of output and may be caused by tax avoidance, poor governance etc. |

|

|

Factors influencing the Size of Fiscal Deficits |

State of the Economy, Housing Market, Political Priorities, Unforseen Events. |

|

|

Factors influencing the Size of National Debts |

Size of Fiscal Defecits, Government Policies. |