![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

21 Cards in this Set

- Front

- Back

|

What are the 2 key types of analysis

|

Quick and dirty - Cash on cash, Payback period, GRM

Hardcore Analysis - Disc Cash Flow, NPV, IRR, Profitability Index |

|

|

What are the 4 ways to make $$$ in Real estate

|

Cash Flow

Debt Paydown K appreciation Tax Strategies |

|

|

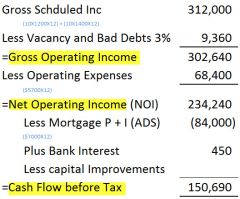

What is the pro forma for Cash Flow

|

|

|

|

4 Reasons why you do not want to own an aligator

|

Are you an Investor or speculator

If prices drop then forced to hold and pay for the privalige monthly or eat a sizeable loss TDS will quickly min the # you can buy If you loose your job then become a forced/distessed seller |

|

|

How is GOIncome calculated? What numbers feed into it?

|

|

|

|

What is an APOD? Why do we use it?

|

|

|

|

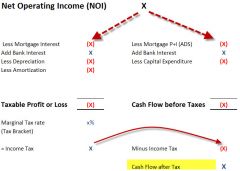

What are the 2 paths (with detail) where NOI splits

|

Less Mortgage Interest (X) Less Mortgage P+I (ADS) (X)

Add Bank Interest X Add Bank Interest X Less Depreciation (X) Less Capital Expenditure (X) Less Amortization (X) Taxable Profit or Loss (X) Cash Flow before Taxes (X) |

|

|

What is Equity Build up

|

Debt Paydown +

K Appreciation |

|

|

What is Debt Paydown

|

(Tenant) paying off your mortgage

|

|

|

Use 5 or 10 year money

|

consider 10 because cheap

|

|

|

What am should we close a deal at and why

|

Highest Am

because pay it off more aggressively and if get into difficulty then revert back to a smaller monthly amount |

|

|

What are the 3 key mortgage criteria we are keen on seeing

|

Prepayable - can pay Mort off more quickly than origional contract

Assumable - next buyer can take over mortgage (subj to him qualifying). Only if we are completely off mortgage. Portable - can carry it to the next property (provided same size or bigger Mort). Therefore get to avoid penalty or carry across a great rate |

|

|

Difference between Fixed and Var Int rate

|

3 mos int rate V larger of Int or IRD

Driven by BOC/var, Bond Mkt/Fix Fixed int rate for term V fixed to prime +/- say .7, but will move with prime. |

|

|

What is K appreciation

|

the rate of growth in value of an asset over a defined period of time.

|

|

|

Whats the rule of 72

|

Looks at the time taken for an asset to double in value given its expected annualk rate of return (72/10 = 7.2 years)

|

|

|

Why is the concept of you make your monbey on the buy not the sell so important

|

Buying right (for the right price) is the key. (Really does it cash flow when we run a set of approp rental and cost base figures). If you are relying on the greater fool theory then you are merely speculating

|

|

|

What are the 2 animals when it comes to K Apprec

|

Single family/Duplex - apprec driven by what the neighbourhood comps have done

Multiplexs - Driven by pur numbers (NOI and cap rates) |

|

|

How is capital gains calculated for normal transaction. How does it work with 1. PPR 2. Lot of Churn

|

|

|

|

What are the 2 legal structures we might consider and why

Do we hold in own name or corp and why If buying as a couple what must we cognicent of |

|

|

|

What are the 2 legal structures we might consider and why

Do we hold in own name or corp and why If buying as a couple what must we cognicent of |

|

|

|

Why might we consider selling fully owned unit and buying 2

How does VTB work and why might a seller consider doing it Why might we do an equity withdrawl and when is it tax deductible |

|