![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

24 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

general liens |

affect all property real or personal, judgements issued by a court , personal property liens, federal and state income tax liens |

Judgment lien, personal property tax lien , IRS income tax lien |

|

|

priority liens |

real property taxes, real property tax assessments, personal property tax assessments |

|

|

|

priority (superior) liens |

after real property tax, real property tax assesments and person property tax asses. the deed of trust is paid if there is any money remaining other liens are generally paid in the order in which they are recorded |

|

|

|

commercial broker lien |

allows a commercial broker to place a lien on a property to protect their commission, must be filed when a broker has fully performed her/his duties but before closing |

|

|

|

tax liens |

state tax liens- general involuntary lien against all property, federal tx lien- general involuntary lien |

|

|

|

terminating an easement |

when purpose no longer exsists, merger of two properties, non use of prescriptive easement |

|

|

|

encroachment |

unwanted intrusion on another persons property and make both titles unmarketable |

fences garages, these are identified by a survey |

|

|

liens |

all liens are encumbrances,if not repaid the creditor has recourse agaisnt the owner, may affect the transfer of title. provide security for a debt. |

|

|

|

encumbrance or "limitation" |

not all encumbrances are liens. restricts use or prohibits |

may make title unmarketable, deed restrictions |

|

|

voluntary liens |

created voluntarily or of free will. created by contractual obligation |

deed of trust pledges property as collateral to lender |

|

|

involuntary lien |

lien created by law against ownder of debt, lien if field by creditor not free of will of owner |

tax lien, judgment lien, mechanics lien |

|

|

easement |

not a form of ownership it merely grants the use of property |

|

|

|

ways to create an easement |

three ways. express grant -typically written may be verbal. verbal agreement-may not be upheld by courts.easment by necessity all owners must have ingress and egress ( land cannot be locked from entry) |

|

|

|

machinery act |

regulates standards for real property taxation , standards for property ta assesments, standards for porperty tax appraisal and requirements for tax exempt status |

regulates |

|

|

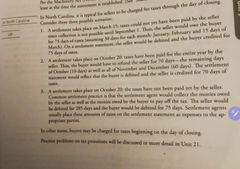

nc taxation timetable |

jan 1- tax lien is filed, jan 5 last years tax must be paid, jan 31 taxable property listed, July 1- new tax rate set, Aug- tax bills mailed, Sept 1- tax due and payable, Dec 31- end of the taxt year |

|

|

|

ad valorem |

"per value" |

|

|

|

appraised value = |

market value |

|

|

|

octenial reappraisal |

property must be reapprasied every 8 yrs can be reassessd sooner |

|

|

|

Mills |

To convert to mills into percent divide the number of mills by 1000 |

32÷1000=0.032 or 3.2% |

|

|

Taxes |

|

|

|

|

Nc machinery act |

Mandates that assessed value is 100% of market value |

|

|

|

Special assessments |

The second category of real estate taxes are special taxes levied on real estate for public improvements made to that real estate |

|

|

|

Property taxation |

Annual taxes = tax rate x assessed value Assessed value= annual taxes ÷ tax rate Tax rate = annual taxes ÷assessed valuev |

|

|

|

Specific lien |

Affects only identified property |

Vendors lien,mechanics liens,mortgage lien,real estate tax lien,special assessment and utilities lien |