![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

38 Cards in this Set

- Front

- Back

|

Capital Asset Pricing Model

CAPM |

RFR + b (market - RFR)

CAPM can be also considered a special case of APT where there is only one risk factor and this |

|

|

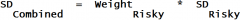

Standard deviation of investment that

combines risky with risk-free? |

|

|

|

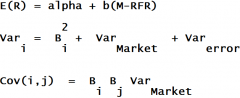

Market Model Predicts

|

|

|

|

Strategies

|

THINK: BICCCO

Basis Index Curve Correlation Capital Structure Options |

|

|

Law of one price

|

A good should have the same real price in all countries

|

|

|

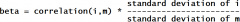

beta =

|

|

|

|

Active Return

|

portfolio - benchmark

|

|

|

Sources of Active Return

|

1. Factor tilts

2. Asset Allocation |

|

|

Active Risk

|

Standard deviation of active return over time

Standard deviation of portfolio - benchmark |

|

|

Information Ratio

|

Active Return........Portfolio - Benchmark...

--------------- = --------------------------- .Active Risk......standard deviation of p - b |

|

|

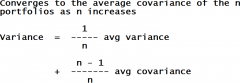

FCRP

|

Foreign Currency Risk Premium

|

|

|

RFR has what standard deviation/variance?

and covariance with other assets? |

All Zero

|

|

|

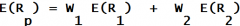

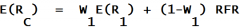

Expected Return on 2 asset portfolio

|

|

|

|

Expected Return Two Assets one being RFR

|

|

|

|

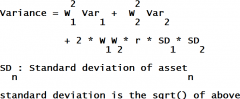

Variance of two assets

|

|

|

|

Variance of equally-weighted portfolios

|

|

|

|

Lower correlation leads to what diversification?

|

Greater

|

|

|

alpha

|

Forecast - CAPM

|

|

|

Foreign Currency Risk Premium

|

|

|

|

2 Ways to calc domestic currency (DC) return to

holding foreign bond |

1. DC return = FC interest + FC appreciation

2. DC return = DC interest + Foreign Currency Risk Premium (FCRP) |

|

|

Money Demand Model

|

Inc real econ activity leads to inc demand domestic currency,

currency appreciates, stock prices up Dec econ activity causes currency depreciation, stock prices down |

|

|

Traditional Model

|

Decrease currency lead to strong economy in

long run |

|

|

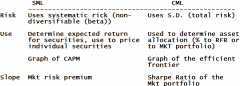

Security Market Line (SML)

|

Expected return vs. Beta

Slope is the market risk premium (Mkt-RFR) Intercept is the RFR Inc expected inflation or RFR moves line up |

|

|

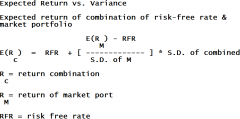

Capital Market Line (CML)

|

Expected return vs. variance

This is a line. Market portfolio (M) is the tagency portfolio of the RFR line to the efficient frontier. At RFR 100% lending (T-bills), at M 100% funds in tagency portfolio, above M on RFR line borrowing since more than 100% invested. Slope = sharpe ratio of market portfolio "Best combination of risk reward" |

|

|

SML vs CML

Security Market Line vs. Capital Market Line |

|

|

|

Capital Market Line (CML) equation

|

|

|

|

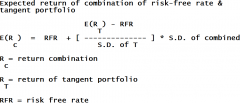

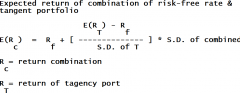

Capital Allocation Line (CAL) equation

|

|

|

|

Minimum-Variance Frontier (MVF)

|

Expected Return vs. Variance

Set of portfolios with lowest variance at expected return |

|

|

Capital Allocation Line (CAL)

|

Expected return vs. variance

CAL is the line from the risk-free rate (RFT) to the point of tagency on the efficient frontier "Best risk portfolio" |

|

|

Capital Allocation Line (CAL) equation

|

|

|

|

Differences between CAL and CML

|

1. Only one CML - the tagency is the market portfolio

2. Unlimited CALs, each developed unique per investor 3. Tangency for CAL can differ accros investors depending on expectations. 4. CML is a special case of CAL. CML is the "Market Portfolio" |

|

|

Market Model

|

the regression mode used to estimate beta

Return = alpha + (beta)(return on market) + error |

|

|

Multifactor Models. Give 3 types:

|

Market Model is 1 factor model. Assests explained by return of

market porfolio 1. Macroeconomic 2. Fundamental 3. Statistical |

|

|

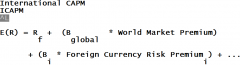

International CAPM

ICAPM |

|

|

|

In ICAPM R sub f

is |

domestic currency risk free rate

|

|

|

Market Price of Risk

|

= Sharpe ratio of market portfolio

= Slope of CML (Capital Market Line) = Market risk premium per unit of market risk |

|

|

If CAPM assumptions don't hold

|

1. Market Porfolio not on efficient frontier

2. non-linear relation expected return and beta 3. Not allowing shorts 4. Risk adverse investor may hold diff then more risk-adverse investor |

|

|

Portfolio Management Planning Process

|

Analyse

1. Risk/Return 2. Constraints: Liquidity, time horizion, legal/regulation, taxes, unique circum 3. Develop IPS: purpose, duties, objectives, modify policy, rebalancing guidlines 4. Determine Strategy: Passive/Active 5. Select Asset Allocations: Weight based on capital market expectations |