![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

69 Cards in this Set

- Front

- Back

|

Note |

During Bank reconciliation the 2 adjustments that should be occur to the bank statement is:

1-Adding deposits in transit 2-Subtracting outstanding checks |

|

|

Note

|

Estimation of uncollectible accounts expense using the ratio of past actual losses from uncollectible accounts to past net credit sales follows the accounting concept of Matching Principle.

|

|

|

Note

|

Net sales should reflect estimated sales returns but not exchanges.

|

|

|

Note

|

Footnote 2 of SFAS No 6, Classification of Short-Term Obligations Expected to Be Refinanced, states "if equity securities have been issued [after the B/S date but before the B/S is issued], the short-term obligation, although excluded from current liabilities, shall not be included in owners' equity."

This entry is not allowed: Dr: Short term liability Cr: CS But rather: Dr:Short term liability Cr:long term liability |

|

|

Note

|

Cash in a bond sinking fund is restricted cash.

|

|

|

Note

|

Discount on Bonds payable should be deducted from the bonds payable & not added

|

|

|

Note

|

A short-term obligation may be excluded from current liabilities & included in non-current debt if the company has both the intent & the ability to refinance the debt on a long-term basis, as evidenced by an actual refinancing before the issuance of the FSs, or by the existence of a noncancelable financing agreement from a lender with the financial resources to accomplish the refinancing.

|

|

|

Note

|

Inventory Turnover = COGS/Average Inventory

|

|

|

Note

|

When the current market value of the inventory is less than the fixed purchase price in a purchase commitment, the loss must be recognized at the time of the decline in price, a liability must be recognized on the B/S & a description of the losses must be described in the footnote s.

|

|

|

Note

|

During bank reconciliation, If the check has not yet been mailed to the supplier yet before the year end it should be added back to the checkbook balance

|

|

|

Note

|

A short-term obligation may be excluded from current liabilities & included in non-current debt if the company has both the intent & the ability to refinance the debt on a long-term basis, as evidenced by an actual refinancing before the issuance of the FSs, or by the existence of a noncancelable financing agreement from a lender with the financial resources to accomplish the refinancing.

|

|

|

Note

|

To allocate the shipping cost between ending inventory & COGS you must use the percentage of each item from the total inventory that were available

|

|

|

Note

|

The write-off of obsolete inventory is treated as an operating loss & not as cost of goods sold.

|

|

|

Note

|

The post-dated check should not be included in cash & cash equivalents because it is dated after the B/S date.

|

|

|

Note

|

FOB Shipping point means that the buyer have received the merchandise on the board of the ship at the port of the seller, but FOB destination means that the buyer receive the merchandise at the buyer's store

|

|

|

Note

|

When a company pledges receivables in return for a loan, the assigning company will retain title to the receivables & will use the proceeds collected from the receivables to repay the loan.

|

|

|

Note

|

Footnote 2 of SFAS No 6, Classification of Short-Term Obligations Expected to Be Refinanced, states "if equity securities have been issued [after the B/S date but before the B/S is issued], the short-term obligation, although excluded from current liabilities, shall not be included in owners' equity."

This entry is not allowed: Dr: Short term liability Cr: CS But rather: Dr:Short term liability Cr:long term liability |

|

|

Note

|

Aging of Receivables method is a B/S approach

|

|

|

Note

|

If the payment of a portion of the payables by a cheque & this cheque didn't mailed till the issuance of the FSs then it will still be recorded as part of the company's payable amounts

|

|

|

Note

|

Rule: The aggregate amount of payments to be made on unconditional purchase obligations should be disclosed (in a footnote to the FSs) for each of the 5 years following the date of the latest B/S.

|

|

|

What are the unconditional purchase obligations?

|

Agreements that are enforceable, legally binding & specify certain minimum quantity & pricing terms.

|

|

|

Note

|

Imputed interest on non-interest bearing note is reported as interest expense, but Interest incurred to finance construction of machinery for own use is capitalized as part of the cost of the machinery.

|

|

|

Note

|

The agricultural products revenue is recognized at time of production & not at the time of sale.

|

|

|

Note

|

Uncollectible Expense is the Bad debt expense

|

|

|

Note

|

Under IFRS, the impairment loss is recognized as the difference between the CV & the recoverable amount, The recoverable amount is the greater of the FV of the assets less cost to sell & the asset's value in use (otherwise known as the PV of future cash flows)

|

|

|

Note

|

Rule: Expense ordinary repairs but capitalize expenditures, which are "additions" or "benefit several periods" or "improve efficiency"

|

|

|

Note

|

Rule: Consignor must include consigned goods (in the hands of the consignee) in his own inventory, at his cost plus warehousing costs of consignor before goods are transferred to consignee plus shipping costs to consignee.

|

|

|

Note

|

Depreciate the lower of cost or market value of the asset

|

|

|

Note

|

Subsequent reversal of an impairment loss is prohibited under U.S. GAAP. Note that reversal of impairment loss is permitted under IFRS.

|

|

|

Note

|

Neither "periodic payment of interest" nor "secured by collateral" are generally associated with payables classified as accounts payable.

|

|

|

Note

|

In the dollar value lifo inventory valuation method, End-of-year cost is the current year cost

|

|

|

Note

|

To determine if there is impairment losses or not under U.S. GAAP you must subtract the "undiscounted future net cash flows from the net carrying amount" & if there is positive result so there is no impairment losses to be reported, but if there is negative one so it can be calculated through subtracting the "FV or PV (whichever is greater) from the net CV"

|

|

|

Note

|

Consigned goods is "inventory" not A/R.

|

|

|

Note

|

Imputed interest on non-interest bearing note is reported as interest expense.

|

|

|

Note

|

Inventory Turnover Ratio = COGS/Average Inventory

|

|

|

Note

|

The in-transit insurance premium is included in inventory costs because it is a cost necessary to bring the goods to their location, but Advanced commissions are excluded because they do not add "time" or "place" utility to the inventory. Rather, they are

classified as a prepaid expense that will become commissions expense when the goods are sold. |

|

|

Note

|

If the lender couldn't fulfill the agreement so the borrower must report the N/P as a current liability because refinancing on a long-term basis will not be available

|

|

|

Note

|

Rule: In all depreciation methods except declining balance, salvage value is subtracted from an asset's cost in arriving at the depreciation base.

|

|

|

Note

|

The net gain from the sale of a warehouse & purchase of a new warehouse will fall under continuing operations on the I/S, under "other'' revenues & gains.

|

|

|

Note

|

The asset shouldn't have to increase the useful life in order to be capitalized

|

|

|

Note

|

Cash in bond sinking fund is restricted cash so its not considered as cash & cash equivalents, The post-dated check should not be included in cash & cash equivalents because it is dated after the B/S date.

|

|

|

Note

|

Neither "periodic payment of interest nor "secured by collateral" are generally associated with payables classified as accounts payable. A liability that requires the periodic payment of interest should be classified as an accrued liability or debt. A liability that is secured by collateral should be classified as a loan payable.

|

|

|

Note

|

Composite life of all assets equal the depreciable cost of all assets divided by the total depreciation expense

|

|

|

Note

|

In Agricultural products revenue is recognized in time of production not in time of sale

|

|

|

Note

|

Inventory Turn over Ratio = COGS/Inventory

|

|

|

Note

|

Probable loss means has great probability of occurrence

|

|

|

Note

|

Applying the lower of cost or market rule (item by item) separately to "each item" results in the lowest inventory amount.

|

|

|

Note

|

Estimated restoration costs should be added to the depletable base of the natural resource. In this way, the amount of depletion charged to expense over the life of the mining operation will include the restoration costs.

|

|

|

Note

|

The Units of Production method of depreciation is most appropriate when an asset's service potential declines with use

|

|

|

Note

|

Using the ratio of past actual losses from uncollectible accounts to past net credit sales, follows the accounting concept of Matching

|

|

|

Note

|

Rule: interest costs incurred during the construction period of machinery to be used by a firm as a fixed asset, should be capitalized as part of the historic cost of acquiring the fixed asset. Interest costs on the fixed asset subsequent to the construction period as well as all interest costs on the routine manufacture of machinery for sale to customers (inventory) should be expensed in the I/S for the period incurred.

|

|

|

Note

|

Probable loss means estimated loss

|

|

|

Note

|

"Security deposits" are not accounts receivable & generally are not a current asset, as is "accounts receivable."

|

|

|

Note

|

The carrying amount of fixed assets should be tested for recoverability at least annually or whenever events or changes in circumstances indicate the carrying amount may not be recoverable.

|

|

|

Note

|

Trade notes & accounts receivable with customary trade terms not exceeding one year may be recorded at face amount.

|

|

|

Note

|

If a revalued asset becomes impaired, the impairment is recorded by first reducing any revaluation surplus to zero, with further impairment losses reported on the I/S

|

|

|

Note

|

Restoration of CV is permitted if the impaired asset is held for disposal, & prohibited if the asset is held for use

|

|

|

Note

|

Perpetual moving average method ("perpetual") will produce a higher inventory carrying amount than periodic weighted average ("periodic") when prices are increasing.

|

|

|

Note

|

Perpetual computes a new weighted-average cost after each purchase while periodic is based on the average price of all purchases during the period. Perpetual will thus be affected more by increasing prices, & inventory will be more reflective of current costs.

|

|

|

Note

|

The lower of cost or market rule will result in a higher inventory cost if applied to total inventory than individual items when prices are generally increasing although a few individual prices are decreasing.

|

|

|

Note

|

The aggregation of the inventory as a whole will "cover up" the impact that individual items with decreasing prices would have under the individual item method.

|

|

|

Note

|

Rule: Under the units-of-production depreciation method, the cost of a fixed asset is allocated to expense based on the number of units produced during the period relative to the total number of units expected to be produced over the asset's life. Accordingly, the total number of units over the asset's life must be able to be estimated.

|

|

|

Note

|

In case of discounting interest bearing N/R the discount is always applied on the maturity value, not the face value

|

|

|

Note

|

If a 3rd party is going to pay the residual value at the end of the lease (& will not be paid by the lessee), it will not be included in the calculation of the lease obligation

|

|

|

Note

|

The previous year price index has been used because no layer has been formed during the current year

|

|

|

Note

|

Interest costs incurred during the construction period of machinery to be used by a firm as a fixed asset should be capitalized as part of the historic cost of acquiring the fixed asset. Interest costs on the fixed asset subsequent to the construction period as well as all interest costs on the manufacture of machinery for sale to customers (inventory) should be expensed in the I/S for the period incurred.

|

|

|

Note

|

Depreciation-related deferred tax liability, must be reported as noncurrent liabilities.

|

|

|

Note

|

If accumulated depreciation equals original cost, then the asset has been depreciated to $0

|

|

|

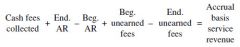

What is the formula to change from Cash basis Revenue to Accrual basis Revenue? |

|