![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

67 Cards in this Set

- Front

- Back

|

1. (a) (i) State what an MRC is and when its use became mandatory. |

a) (i) MRC stands for Market Reform Contract. |

|

|

(ii) List four of its six sections |

(ii) Any four of the following: |

|

|

(b) Guidelines have been put in place to ensure that its use is consistent with the principles of contract certainty and the Contract Certainty Code of Practice. |

(b) Any four of the following: |

|

|

2. (a) The Financial Services Authority (FSA) makes a clear distinction between a consumer and a commercial customer. State the FSA’s |

‘Consumer’ – any natural person who is acting for purposes which are outside his trade or profession. |

|

|

b) As the broker of a commercial customer, at your renewal meeting you are required to advise your client regarding the basis on which you have carried out the broking of their risks. On this occasion, you have given advice on the basis of fair analysis of the market. |

(i) Giving advice on the basis of fair analysis of the market means that a sufficiently large number of insurance contracts have been considered in the relevant sector of the market, to enable a recommendation to be made in |

|

|

(ii) If you had not given advice on the basis of fair analysis of the market, describe three other ways the broking could be carried out. |

(ii) • Where the broker is under contractual obligation to conduct insurance mediation business exclusively with one or more insurers. |

|

|

(b) Describe briefly why brokers with access to global markets should have an understanding of the different stages of the insurance market cycle. |

|

|

|

4. (a) Self-insurance, through the building up of funds, is a form of active risk retention. |

(a) (i) • To reduce the cost of risk transfer. |

|

|

(ii) Where self-insurance is centrally funded by a company, state a reason why it may be difficult to build up long-term reserves and increase the level of self-insurance. |

(ii) This is because any profit left in the fund at year end will attract taxation. The funds can be taken and used for other purposes by the company |

|

|

(b) Describe briefly two common types of captive insurance company. |

(b) Any two of the following: |

|

|

Your company is a leading niche broker for printing companies in the UK. The |

(a) While operating a delegated authority, the broker is the agent of the insurer, not the |

|

|

(b) When meeting with the insurer to discuss the terms of the delegated authority, list five guidelines that will need to be agreed prior to |

(b) Any five of the following: |

|

|

6. Your company is reviewing the services it offers its clients in order to identify |

Post Loss Control Services. The provision of active assistance in the event of a loss. This |

|

|

7. In relation to contract certainty, reinforced by the Financial Services Authority, best practice requires policy wordings to be issued to the insured ‘promptly’. |

(a) (i) Within seven working days. |

|

|

(ii) all other client classifications. |

(ii) Within 30 calendar days. |

|

|

(b) Having received instructions from your client to bind cover and confirmed in writing the insurer’s agreement to go on risk, state what |

It is standard practice in the London market to prepare a cover note for the client, |

|

|

Insurance: New Conduct of Business Sourcebook (ICOBS) provides a template policy summary to cover the scope of the information that brokers may provide to consumers prior to contract, to enable them to make an informed decision. |

Any eight of the following: |

|

|

reduce the number of client complaints. |

(a) Memorandum - Steps to Reduce Complaints In The Servicing Team |

|

|

(b) Outline for your team three fundamental rules that apply when dealing with a complaint. |

(b) • Follow to the letter your firm’s procedure for dealing with complaints and Treating Customers Fairly. |

|

|

10. The Financial Services Authority describes the process of establishing a client’s requirements as assessing the customer’s demands and needs. |

(a) • The broker should seek information from the customer relating to circumstances, |

|

|

(b) Identify three issues a broker must take into account when making an advised sale, when checking that a policy is suitable for the customer’s demands and needs |

Any three of the following: |

|

|

(c) State, using an example, what the broker should do if all the customer’s demands and needs are not met by the policy and there is no suitable insurance available to the broker |

(c) The broker can make a recommendation that does not meet all of the customer’s |

|

|

11. The risk manager of NTU Ltd, a long-term commercial customer, has asked |

(a) If it is perceived that the current pricing is low, but that the market is likely to harden |

|

|

(b) State and describe briefly two methods of increasing the policy term beyond one year. |

(b) A Long Term Agreement (LTA) may be entered into by the insurer and the customer. |

|

|

12. (a) State the voluntary code of practice which the Association of British Insurers published, in partnership with the Government, in November |

(a) The Code of Practice for Tracing Employers’ Liability Insurance Policies. |

|

|

(b) Summarise what is set out in the code and state what the insurers who sign up to the code have agreed to. |

(b) The code sets out the procedures insurers will follow and the standards they will meet, |

|

|

13. The Financial Services Authority’s requirement that certain information be |

Any eight of the following: |

|

|

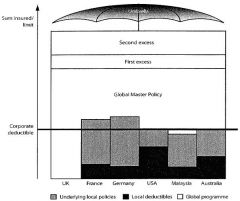

14. Holiday Leisure Ltd are a UK-based luxury hotel group. They have hotels in the UK, France, Germany, the USA and Australia. |

|

|

|

15. (a) The Marine Insurance Act 1906 clarified the duties of brokers regarding the provision of ‘material facts’. |

(a) (i) If the insured or the insured’s agent fails to disclose material circumstances known to them, or misrepresents the facts in a material way. |

|

|

(ii) As listed in Section 19 of the Act, state exactly what brokers must disclose. |

(ii) Brokers must disclose every material fact known to them, including facts which |

|

|

(b) The English and Scottish Law Commissions are currently undertaking a review into insurance contract law in the UK. They have published a |

(b) • That the materiality test is changed from that of a ‘prudent underwriter’ to that of |

|

|

2010 |

april |

|

|

1. (a) State three key factors an insurance broker must take into account when assessing whether an insurance policy is suitable to meet a customer’s demands and needs. |

(a) The following should be taken into account: |

|

|

(b) State two of the three items an insurance broker should record on the suitability statement, following a recommendation. |

(b) Any two of the following: |

|

|

2. (a) State four reasons why a company may decide to self-insure when actively retaining a risk.

|

(a) Any four of the following:

To reduce the cost of risk transfer. To obtain greater control of risk. To reduce administration. To increase emphasis and awareness of the need for loss control. Tax efficiency. |

|

|

(b) (i) Define alternative risk transfer (ART). |

(b) (i) A generic phrase to denote various non-traditional forms of (re)insurance and |

|

|

(ii) Explain, giving an example, how an insurance broker or a reinsurer can gain extra capacity to transfer the risk of a low frequency, high |

(ii) Extra capacity for low frequency, high cost events such as earthquakes and hurricanes (where the cost of the event could be more expensive than the premiums in the market), can be sought from capital market investors through catastrophe bonds (cat bonds). Periods for these bonds are usually from three to five years and they make |

|

|

3. (a) Most complaints, errors and omissions (E&O) arise when a policy does not do what the client expected. Describe two main ways in which such problems can be avoided by insurance brokers. |

(a) -Accurate policy documents should be issued by brokers promptly, evidencing the |

|

|

(b) The Financial Services Authority (FSA) requires registered intermediaries to have a formal procedure for dealing with complaints. |

(b) Intermediaries should provide details of the procedures to their clients. |

|

|

(c) The FSA has made E&O insurance compulsory for regulated insurance intermediaries. |

(c) (i) Errors and omissions (E&O) policies are designed to provide compensation for any customer who suffers a loss as a consequence of their broker’s negligence; covering any damages the customer may be awarded |

|

|

(ii) Identify four occasions when an insurance broker’s E&O policy would not provide cover |

(ii) Any four of the following: |

|

|

4. (a) You have been asked to place a large property risk. To gather enough |

(a) (i) The leading market will offer the best combination of knowledge, capacity and |

|

|

(ii) State why it is important to find the right leader in this situation |

(ii) A recognised lead is essential on a subscription risk to attract the support of |

|

|

(b) In addition, you are considering the use of an excess layer. |

(b) (i) An excess layer, sits over the primary programme. The excess layer usually has its attachment point at the total limit of the primary policy. It usually follows the same terms and conditions as the primary policy. |

|

|

(ii) State the main difference between an umbrella policy and an excess layer. |

(ii) An umbrella policy is independent of the cover provided underneath. It will |

|

|

5. One of your UK-based clients purchased a composite insurance policy through you; covering buildings, contents, travel and motor risks. Following renewal, he calls to ask you what taxes he is being charged. |

Insurance premium tax, (IPT) a tax levied against the buildings, contents and motor premium and set at 5% of the premium. Value Added Tax (VAT), charged against the travel section and set at 15%. |

|

|

6. There is a current trend amongst many brokers to change from day-to-day claims processing to a claims advocacy approach.(a) Describe the process of claims advocacy, giving an example of a type of claim where this approach is common. |

(a) The claim is reported by the client directly to the insurer and the broker only becomes |

|

|

(b) Explain two main reasons for this trend. |

(b) The main reasons for the trend are as follows: |

|

|

7. (a) Explain, with an example, the term ‘delegated authority’. |

(a) Delegated authority is where the insurer has given the broker underwriting |

|

|

(b) State what a ‘lineslip’ is, how it operates, and how it differs from standard risk placement. |

(b) A ‘lineslip’ is the name given to a scheme or facility placed with Lloyd’s underwriters. Risks are bound under the facility by way of ‘off-slips’. Where there is no delegated |

|

|

(c) (i) State the two main benefits for an insurance broker in arranging a facility or scheme with an underwriter, even if no delegated authority exists. |

(c) (i) Broker can establish in advance with the insurer(s) that they can write that class of business, within defined limits and cover. |

|

|

(ii) Identify two types of risk which would particularly suit such a |

(ii) Miscellaneous, non-hazardous risks (e.g. travel, personal accident, all risks). |

|

|

8. Describe briefly six of the Financial Services Authority’s eleven Principles of Business. |

Any six of the following: |

|

|

9. You are preparing a submission for a commercial risk and all the prospective |

(a) Any five of the following: |

|

|

(b) List five of the risk details that you will include. |

(b) Any five of the following: |

|

|

10. (a) In terms of an insurance contract, define ‘subjectivity’ and provide an example. |

(a) Subjectivities can be described as specific terms imposed by the insurer, which must |

|

|

(b) In order to comply with contract certainty, explain what should be made clear to the client in relation to any subjectivity that may be imposed. |

(b) Who needs to do what, by when and to what standard? |

|

|

(c) State what you should do if your client informs you that they are unable to comply with the subjectivity imposed. |

(c) You should tell the insurer immediately and a practical amendment to it should be |

|

|

11. The Financial Services Authority (FSA) has published six improved outcomes in an initiative to provide guidance to insurance brokers in relation to treating customers fairly (TCF). |

(a) Any four of the following: |

|

|

(b) Describe briefly four different ways in which your company could demonstrate that TCF is an integral part of its culture. |

(b) Any four of the following: |

|

|

12. (a) You have recently joined a new insurance broking firm with the aim of |

(a) Any six from the following: |

|

|

(b) Identify and describe four motor fleet risk management activities that |

(b) Review of driver handbook, which should be kept up to date for each employee. |

|

|

13. (a) Explain how the Financial Services Authority (FSA) defines ‘contract certainty’. (3) |

(a) Contract Certainty is achieved by the complete and final agreement of all terms |

|

|

(b) In relation to contract certainty, state how the FSA defines the word ‘promptly’ for both retail consumers and commercial customers. |

(b) ‘Promptly’ is defined as seven working days for retail consumers and 30 days for commercial customers. |

|

|

14. State the five requirements of the general law of agency as they apply to insurance brokers. |

The general law of agency requires a broker to: |

|

|

15. (a) State four simple ways in which the financial security of a particular insurer could be assessed before deciding to trade with it. |

(a) Any four of the following: |

|

|

(b) Assuming that your company is happy with the insurer’s security, list four other factors that may be taken into account when assessing which |

(b) Credit facilities. |