![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

29 Cards in this Set

- Front

- Back

|

Market Failure:

|

When there is an inefficient allocation of resources or a misallocation of resources.

|

|

|

Negative Externalities:

|

Costs which are generated when economic transactions take place.

|

|

|

Private Costs:

|

Costs which are internal to an economic transaction. These are payed by the buyers and sellers.

|

|

|

External Costs:

|

A negative third party spill over effect from a private transaction.

|

|

|

Social Costs:

|

The total costs resulting from an economic activity.

Private Costs + External Costs = Social Costs. |

|

|

Private Benefit:

|

A benefit internal to a transaction. Enjoyed by the buyers and sellers.

|

|

|

External Benefits:

|

A positive spill over effect on to a third party following an economic transaction.

|

|

|

Social Benefits:

|

The total benefits resulting from an economic activity.

Private Benefits + External Benefits = Social Benefits. |

|

|

Reason why there are negative externalities in a market:

|

The market mechanism produces the market generated level of output, not the socially optimum level of output.

|

|

|

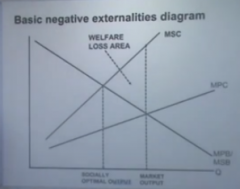

Diagram showing a Negative Externality:

|

MPB = MSB - Downwards Sloping.

MPC - Upward Sloping. MSC - Upward Sloping Further Inwards. MPC Meets MPB/MSB = Market Level of Output MSC meets MPB/MSB = Socially Optimal Level Output. Vertical Distance from where MPC meets MSB = Welfare Loss Are. |

|

|

Positive Externalities:

|

A diagram which shows the underproduction of a good by the market mechanism, which is high in external benefits. The market generated level of output is below the Socially optimal level of output.

|

|

|

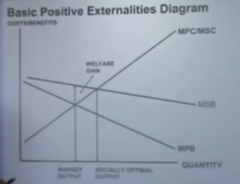

Positive externalities diagram:

|

MPC - Sloping up

MPB - Sloping Down MPC = MSC MSB = Right of the MPB MPC & MPB meet at the Market generated level of output. MPC & MSB meet at the Socially optimal level of output. Welfare Gain is the triangle pointing at MSB. |

|

|

Correcting Positive Externalities:

|

Subsidies: This is a reduction in private costs. Therefore supply increases of the good and the MPC line shifts outwards. The new welfare gain is now smaller, and the new quantity output by the economy is closer to the socially optimal level.

|

|

|

Correcting Positive Externalities - Evaluation (1)

|

Magnitude - If the subsidy is not big enough, it may only have a very small effect on the provision of the good, therefore the new equilibrium market generated level of output will not be much closer to the socially optimal level of output, therefore it could be deemed as ineffective.

|

|

|

Correcting Positive Externalities - Evaluation (2)

|

The money used to subsidise these industries into providing more of the service could be used in other sectors. For example if the subsidy is to ensure the extra provision of education, it could be used alternatively to improve the quality of hospitals.

|

|

|

Correcting Positive Externalities - Evaluation (3)

|

Dependency Culture - Subsidies may become solely driven by the subsidy and this could lead to a decline in the good being subsidises quality, just so that it can be produced faster and in greater quantities.

|

|

|

Correcting Positive Externalities - Evaluation (4)

|

The subsidy may not be used in order to increase provision or the quality of the good. Rather it could simply be pocketed by firms, whilst making no improvements. This would not result in the desired extra consumption or use of the good, therefore would fail in correcting the underprovision of the good.

|

|

|

Correcting Negative Externalities: Method (1).

|

Tradable Pollution Permits. The Emissions Trading System, is a process by which countries in the EU are allocated a set amount of CO2 permits which they then distribute to those producers covered by it. This limits the production of pollution, a huge external cost which is not accounted for by those internal to a transaction, such as producers.

|

|

|

Correcting Negative Externalities: Method (1). Evaluation (1).

|

The tradability of the permits, incentivises firms to invest in clean technology. If the firm is able to produce at the same rate why polluting less, they are able to sell any excess pollution permits they do not need. They are said to have a financial incentive.

|

|

|

Correcting Negative Externalities: Method (1). Evaluation (2).

|

Pollution permits can be reduced over time as part of a co-ordinated plan. This means gradually in the long run, the economy should be able to reach the socially optimal level of output of pollution.

|

|

|

Correcting Negative Externalities: Method (1). Evaluation (3).

|

The European Commission may allocate too few carbon permits so that production costs increase rapidly for countries in the EU, reducing their international competitiveness. Some firms may even relocate outside the EU to reduce production costs.

|

|

|

Correcting Negative Externalities: Method (1). Evaluation (4).

|

Monitoring the different levels of pollution output by all the firms involved in the scheme can be expensive and very time consuming for the government.

|

|

|

Correcting Negative Externalities: Method (1). Evaluation (5).

|

Pollution permits may prevent new firms from entering an industry, therefore restricting competition, something which is essential for growth of new ideas.

|

|

|

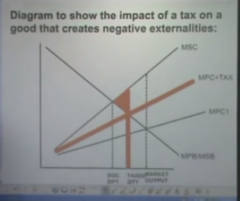

Correcting Negative Externalities: Method (2).

|

Government Regulation:

This is where the government bans or puts strict limitations on a good. This is because they generate large amounts of negative externalities. |

|

|

Correcting Negative Externalities: Method (3).

|

Indirect taxation - these act as an increase in the costs of the producer, therefore the production of this good will decrease and the MPC curve will shift left, closer to the socially optimal level of output.

|

|

|

Correcting Negative Externalities: Method (3). Evaluation (1).

|

Magnitude - If the tax imposed is too small, then the effect of the tax may not be felt in the market and therefore there will be no reduction in the provision of demerit goods.

|

|

|

Correcting Negative Externalities: Method (3). Evaluation (2).

|

Too heavy - if the tax imposed on the good is too heavy, it could lead to the rise of a black market, and the smuggling of the good in from other countries. This is a form of government failure.

|

|

|

Correcting Negative Externalities: Method (3). Evaluation (3).

|

The impact of the tax is very dependent on the Price Elasticity Of Demand for the good. If the demand for the good is price inelastic, as it is with addictive goods with high external costs, such as cigarettes, the tax will hardly impact people's decision to buy them, therefore having a minimal affect on the market.

|

|

|

Correcting Negative Externalities: Method (3). Evaluation (4).

|

Price of Substitutes - if the price of substitutes is high, then there is no incentive for consumers to stop buying the good they currently are. In order for the tax to be effective it should be paired with a subsidy for less externally costly substitutes, such as E-cigarettes.

|