![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

35 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

3 basic types of term based on face amount |

Level Increasing Decreasing |

|

|

|

Level Term Insurance |

The most common type of term insurance. The death benefit don't change throughout the life of the policy. |

|

|

|

Level Premium Term |

Term insurance that Provides a level death benefit and a level premium |

|

|

|

Annual Renewal Term |

Purest form of insurance. (Term) |

|

|

|

Decreasing Term |

Term insurance where Premium stay the same but the death benefit decrease every year.

Commonly used to insure the payment of a mortgage or other debts. |

|

|

|

Increasing Term |

Term insurance where Premium stays the same and death benefit increases every year. |

|

|

|

Permanent (whole) life insurance |

Is a general term used to refer to various forms of life insurance policies that build up cash value. Remains in effect for whole life or 100 years old. |

|

|

|

Whole Life Insurance Characteristics |

1. Level Premium (same) 2. Death Benefit (guaranteed and level) 3. Cash Value (is scheduled to equal the death benefit when matures[age 100]) 4. Living benefits: is the cash value that can be used. Also called the nonforfeiture value. Don't accumulate until 3rd policy yr. |

|

|

|

Straight Life (Traditional level ) (Ordinary Life) (Continuous) |

-Whole life insurance where premium & Death Benefit is level. -Cash Value accumulates over time. -Has the lowest annual premium of the whole life policies. |

|

|

|

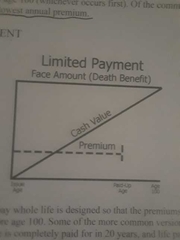

Limited Pay Whole Life |

Whole life insurance Designed so that premiums can be paid before 100. The annual premiums are higher than other whole life policies. Level Premium and death benefit. |

|

|

|

Single Premium |

Whole life that has: One Premium Death Benefit level. Cash Value accumulates immediately |

|

|

|

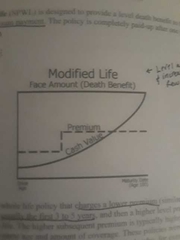

Modified Life (whole life) |

Whole life insurance that Charge lower premium in first 3-5 years then increase and remain at that higher level. The increased rate will be higher than straight whole life premium. -Level death benefit |

|

|

|

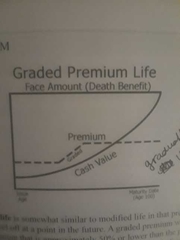

Graded Premium Whole life |

Similar to modified life. Starts with premium that is 50% less than straight life premium. Then over 5-10 years the premiums increase then levels off. Death Benefit is level |

|

|

|

Interest Sensitive Whole Life (current consumption life) |

Whole life insurance with a Level death benefit. Premiums and cash value are impacted by interest rates. |

|

|

|

Indexed Whole Life (equity index whole life ) |

Whole life insurance in which -Interest rates is based upon an index (like S&P500) -Cash Value is based upon the index -Death benefit increases every year to keep up with inflation |

|

|

|

Universal Life |

A whole life policy in which the insurance component is annual renewable term and the cash value is allowed to have a partial surrender |

|

|

|

The two options of Universal Life |

Option A:Level Death Benefit Option B: Increasing Death Benefit |

|

|

|

IRS Corridor States that |

The cash value cannot be more than the face amount of the policy. |

|

|

|

Universal Life Characteristics |

ART insurance inside the policy Flexible Premium Flexible Face Amount Cash Value minimum guarantee |

|

|

|

Variable Life Features |

-Permanent Insurance -Fixed or Flexible Premium -Face Amount has guaranteed minimum -Cash Value not guaranteed |

|

|

|

Are variable contracts insurance policies? |

No. It's a security |

|

|

|

Group life insurance |

Issued to the sponsoring organization and covers the lives of more than one individual member of that group. |

|

|

|

Who owns the group life policy? |

The company. Not the individual. The individual get a certificate of insurance. |

|

|

|

Group Life to Individual Policy |

Employee can convert to an individual policy (usually whole) without proving insurability at a standard rate based on their age. |

|

|

|

What kind of insurance policy can a group life insured convert to? |

Whole life |

|

|

|

Credit life Insurance |

Written as a decreasing term to pay off debt. Cannot payout more than the balance of the debt. |

|

|

|

Who is the beneficiary in a credit insurance policy? |

The creditor |

|

|

|

Who is the owner of the credit life policy |

The creditor |

|

|

|

Under a 20-pay whole life policy, in order for death benefit to pay, the premiums gotta be paid for... |

20 years or until death, whichever is sooner. |

|

|

|

What type of policy would have an IRS required corridor or gap btw the cash value and death benefit? |

Universal Life Option A |

|

|

|

How many days do the employee still have group coverage after they leave the job? |

31 days. If they die during that time frame, they get the full group benefit. |

|

|

|

In order to sell variable life insurance you have to have |

Securities License Life Insurance license FINRA registration |

|

|

|

Which term insurance has the lowest premium with all factors being equal? |

Annual Renewable Term |

|

|

|

In universal life, The insurer must send a report to the policyowner regarding the policy's value every |

Year |

|

|

|

Option A universal has |

The death benefir remains level while the cash value gradually increases. The death will imcrease at a later date in order to fulfill irs corridor. |

|