![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

43 Cards in this Set

- Front

- Back

|

Quantity Supplied & Supply |

The quantity of real GDP supplied is the total quantity of goods and services, valued in constant base-year dollars, that firms plan to produce during a given period. |

|

|

Aggregate Supply |

The relationship between the quantity of real GDP supplied and he price level. |

|

|

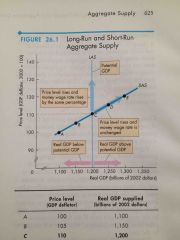

Long Run Aggregate Supply |

Relationship et week quantity of real GDP supplied and the price level when the money wage rate changes in step with the price level to maintain full employment. |

|

|

Short Run Aggregate Supply |

Relationship between the quantity of real GDP supplied and the price level when the money wage rate, the prices of other resources as potential GDP remain constant. |

|

|

Long Run & Short Run Aggregate Supply |

Back (Definition) |

|

|

Changes in Aggregate Supply |

A change in the price level changes the quantity of real GDP supplied. AS changes when an influence on production plans other than the price level changes. |

|

|

Changes in Potential GDP |

When potential GDP changes, aggregate supply changes. An increase in potential GDP increases long run & short run AS. -Increase in full employment quantity of labour -An increase in quantity of capital -An advance in technology |

|

|

Change in Potential GDP |

Back (Definition) |

|

|

Change in Money Wage Rate |

Back (Definition) When money wage rate (or money price of any other factor of production) changes, short run AS changes but long run AS does not. |

|

|

Aggregate Demand |

Quantity of real GDP demanded (Y) is the sum of real consumption expenditure (C), investment (I), government expenditure (G), and exports (X) minus imports (M). Y= C+I+G+X-M |

|

|

Buying Plans |

Depend on factors such as: -The price level -Expectations -Fiscal policy and monetary policy -The world economy |

|

|

Aggregate Demand |

Relationship between the quantity of real GDP demanded and the price level. Slopes downward because: -Wealth effect -Substitution effects |

|

|

Aggregate Demand |

Back (Definition) |

|

|

Wealth Effect |

When the price level rises, real wealth decreases. Real wealth is the amount f money in he bank, bonds, stocks and other assets people own, measure not in dollars but in terms of goods and services that the money, bonds, and stocks will buy. |

|

|

Substitution Effect |

When price level rises, interest rate rises. A rise in price level decreases the real value of money in people's pockets and bank accounts. |

|

|

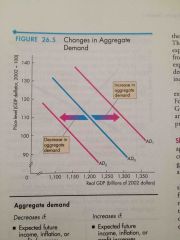

Changes in Aggregate Demand |

A change in any factor that influences buying plans other than the price level brigs a change in AD. Main factors are: -Expectations -Fiscal policy and monetary policy -The world economy |

|

|

Fiscal Policy |

Government's attempts to influence the economy by setting and changing taxes, making transfer payments, and purchasing goods and services. |

|

|

Disposable Income |

Aggregate income minus taxes plus transfer payments. |

|

|

Monetary Policy |

The Bank Of Canada's attempt to influence the economy by changing interest rates and the quantity of money. |

|

|

Changes in Aggregate Demand |

|

|

|

Short Run Macroeconomic Equilibrium |

Occurs when the quantity of real GDP demanded equals the quantity of real GDP supplied. |

|

|

Long Run Macroeconomic Equilibrium |

Occurs when real GDP equals potential GDP-equivalently, when the economy is on its LAS curve. |

|

|

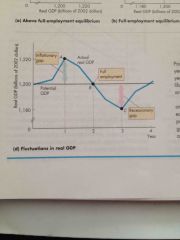

Economic Growth |

Results from a growing labour force and increasing labour productivity, which together make potential GDP grow. |

|

|

Economic Growth & Inflation |

|

|

|

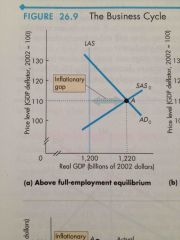

Above Full-Employment Equilibrium |

Equilibrium when real GDP exceeds potential GDP. |

|

|

Output Gap |

Gap between real GDP and potential GDP. |

|

|

Inflationary Gap |

When real GDP exceeds potential GDP, the output gap is called an inflationary gap. |

|

|

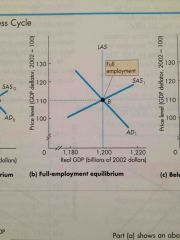

Full-Employment Equilibrium |

Real GDP equals potential GDP. |

|

|

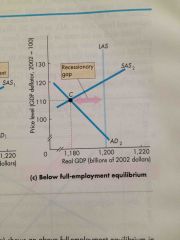

Below Full-Employment Equilibrium |

An equilibrium in which potential GDP exceeds real GDP. |

|

|

Recessionary Gap |

When potential GDP exceeds real GDP, the output gap is called a recessionary gap. |

|

|

Above Full-Employment Equilibrium |

|

|

|

Full Employment Equilibrium |

|

|

|

Below Full-Employment Equilibrium |

|

|

|

Fluctuations in real GDP |

|

|

|

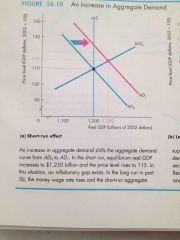

Increase in Aggregate Demand (Short Run) |

|

|

|

Increase in Aggregate Demand (Long Run) |

|

|

|

Decrease in Aggregate Supply |

Graph

|

|

|

Stagflation |

A combination of recession and inflation. |

|

|

Classical View |

Believes the economy is self-regulating and always at full employment. |

|

|

New Classical View |

That business cycle fluctuations are the efficient repainted of a well-functioning market economy that is bombarded by shocks that arise from the uneven pace of technological change. |

|

|

Keynesian View |

Believes that left alone, the economy would rarely operate at full employment and that to achieve and maintain full employment, active help from fiscal policy and monetary policy is required. |

|

|

New Keynesian View |

Holds that not only the money wage rate is sticky, but also that prices of goods and services are sticky. |

|

|

Monetarist View |

Believes that the economy is self-regulating and that it will normally operate at full employment, provided that monetary policy is not erratic and that the pace of money growth is kept steady. |