![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

15 Cards in this Set

- Front

- Back

|

Two ways inflation can be defined |

1. the sustained rise in the average rise of goods and services over a period of time 2. a fall in the value of money |

|

|

4 types of inflation |

- inflation is when the average price of goods and services is rising - deflation is when the average price is falling - hyperinflation is when prices rise extremely quickly and money rapidly loses value - disinflation is when the rate of inflation is slowing down |

|

|

2 main measurements of inflation |

- retail price index (RPI) - consumer price index (CPI) |

|

|

Retail price index calculation |

1. A base year or starting point is chosen which becomes the standard against which price changes are measured.

2. A list of items bought by an average family is drawn up. 3. A set of weights are calculated, showing the relative importance of the items in the average family budget – the greater the share of the average household bill, the greater the weight. 4. The price of each item is multiplied by the weight given to the item, so that the contribution of the item's price is in proportion to its importance. 5. The price of each item must be found in both the base year and the year of comparison (or month). |

|

|

Consumer price index calculation |

CPI for one item = current cost/base year cost x 100 - mortgage interest payments and council tax are excluded - a larger sample of the population is used than for RPI |

|

|

Limitations of RPI and CPI |

1. RPI excludes households with the top 4% incomes 2. CPI excludes mortgage interest payments and council tax 3. Information given by households in the survey can be inaccurate 4. Basket of goods only changes once a year so may miss trends in spending 5. Differences in price regions aren't taken into account |

|

|

Reasons RPI and CPI are important for government policy |

1. Help determine wages and state benefits - employers and trade unions reference them - state pensions can be decided on 2. Measure changes in the UK's international competitiveness - if the rate of inflation measured by the CPI is higher in the UK than in other countries = less price competitive as good = expensive to buy = exports fall = imports and inflation increase |

|

|

Costs of inflation 1 |

1. standard of living of those on fixed incomes will fall = bigger impact on low income employment 2. Competitiveness of a country will decrease by inflation as exports will be dear and imports cheap - fall in exports and rise in imports = BOP deficit 3. discourages saving as the value of the savings will fall creating demand-pull inflation |

|

|

Costs of inflation 2 |

4. Reluctance to save = shortage of funds for firms to borrow = improvements reduction 5. Uncertainty will reduce investment 6. Shoe leather costs 7. Possibility of hyperinflation |

|

|

Shoe leather costs |

- The cost of time and effort (more specifically the opportunity cost of time and energy) that people spend trying to counter-act the effects of inflation, such as holding less cash, editing the menu card of an restaurant and having to make additional trips to the bank.

|

|

|

Problems with deflation |

- it is a sign that the economy is doing badly as it is caused by falling AD and increased unemployment - can cause consumers to spend less if they think that prices will fall further, meaning less economic growth and profits |

|

|

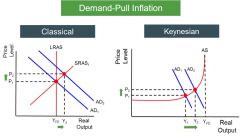

Demand pull inflation |

|

|

|

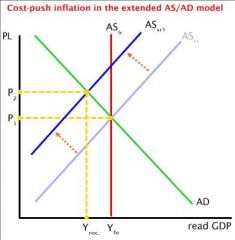

Cost push inflation (classical) |

|

|

|

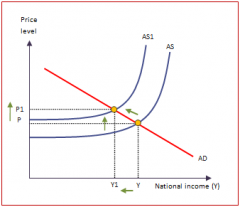

Cost push inflation (Keynesian) |

|

|

|

Policies to reduce inflation |

1. Monetary policy – Higher interest rates. This increases cost of borrowing and discourages spending. This leads to lower economic growth and lower inflation.

2. Fiscal policy – Higher income tax and / or lower government spending, will reduce aggregate demand, leading to lower growth and less demand pull inflation 3. Supply side policies – These aim to increase long-term competitiveness, e.g. privatisation and deregulation may help reduce costs of business, leading to lower inflation. |