![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

40 Cards in this Set

- Front

- Back

|

President Bush is successful in passing a $5 billion tax cut. Assume that taxes arefixed, the economy is closed, and the marginal propensity to consume is 0.75. Whathappens to equilibrium GDP? |

There is a $15 billion increase in equilibrium GDP. |

|

|

The multiplier effect is the series of ________ increases in ________ expenditures thatresult from an initial increase in ________ expenditures. |

induced; consumption; autonomous |

|

|

If the federal budget has an actual budget deficit of $100 billion and a cyclicallyadjusted budget deficit of $75 billion, then the economy. |

must be below potential real GDP. |

|

|

Tax reduction and simplification should ________ long-run aggregate supply and________ aggregate demand. |

increase; increase |

|

|

Fiscal policy actions that are intended to have long-run effects on real GDP attemptto increase ________ through changing ________. |

aggregate supply; taxes |

|

|

Double taxation refers to |

corporations paying taxes on profits and individuals paying taxes on dividends. |

|

|

If we include consideration of potential effects of a proposed tax reduction andsimplification on the labor supply, we would expect crowding out of investmentand net exports brought about by the tax cut to be |

less than it would be without the supply-side effects. |

|

|

If tax reduction and simplification are effective, then |

saving and investment in new capital will increase. |

|

|

A recent study by Edward Prescott found that the ________ marginal tax rates in theUnited States relative to Europe resulted in a ________ quantity of labor supplied inthe United States. |

lower; larger |

|

|

Reducing the marginal tax rate on income will |

reduce the tax wedge faced by workers and increase labor supplied. |

|

|

Borrowing to pay for long-lived capital expenditures makes sense as |

the benefits are received over many years so the burden of paying for them should be spread over many years. |

|

|

Government deficits tend to increase during |

periods of war and recession. |

|

|

If the federal government's expenditures are less than its tax revenues, then |

a budget surplus results. |

|

|

The total value of U.S. Treasury bonds outstanding equals |

the federal government debt. |

|

|

Crowding out, following an increase in government spending, results from (theexchange rate is the foreign exchange price of the domestic currency) |

higher interest rates and a higher exchange rate. |

|

|

Poorly timed discretionary policy can do more harm than good. Getting the timingright with fiscal policy is generally |

more difficult than with monetary policy. |

|

|

If policy makers implement an expansionary fiscal policy but do not take intoaccount the potential for crowding out, the new equilibrium level of GDP is likely to |

be below potential GDP. |

|

|

Recent research shows that during recessions, temporarily unemployed people mayexperience improving |

physical health. |

|

|

Increases in government spending result in ________ in the short run, andpermanent increases in government spending result in ________ in the long run. |

partial crowding out; complete crowding out |

|

|

Crowding out will be greater |

the more sensitive investment spending is to changes in the interest rate. |

|

|

A cut in tax rates effects equilibrium real GDP through two channels: ________disposable income and consumer spending, and ________ the size of the multipliereffect. |

increasing; increasing |

|

|

Cutting taxes |

will raise disposable income and raise spending. |

|

|

The tax multiplier |

is negative. |

|

|

An equal increase in government purchases and taxes will cause |

an increase in real GDP. |

|

|

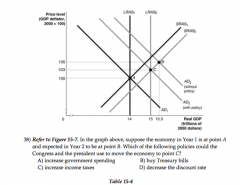

Suppose real GDP is $13 trillion, potential real GDP is $13.5 trillion, and Congressand the president plan to use fiscal policy to restore the economy to potential realGDP. Assuming a constant price level, Congress and the president would need toincrease government purchases by |

less than $500 billion |

|

|

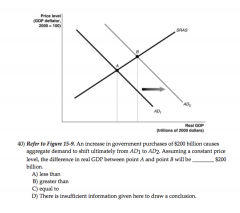

An increase in government purchases of $200 billion will shift the aggregate demandcurve to the right by |

more than $200 billion. |

|

|

In an open economy, the government purchases multiplier will be larger the |

All of the above are correct. |

|

|

Calculate the government purchases multiplier if the marginal propensity toconsume equals 0.8, the tax rate is 0.1, and the marginal propensity to import equals0.2. |

2.1 |

|

|

What is the government purchases multiplier if the tax rate is 0.1 and the marginalpropensity to consume is 0.9? Assume the economy is closed. |

5.3 |

|

|

Assume a closed economy, that taxes are fixed, and the marginal propensity toconsume is equal to 0.8. What is the government spending multiplier? |

5 |

|

|

In an open economy, the government purchases multiplier will be |

smaller as the marginal propensity to import increases. |

|

|

Suppose that Congress allocates $1 billion to clean up after the hurricanes of 2005. Italso raises taxes by $1 billion to keep the deficit from growing. If the marginalpropensity to consume is 0.9, what is the effect on equilibrium GDP? |

GDP increases by $1 billion. |

|

|

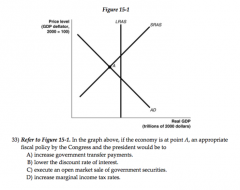

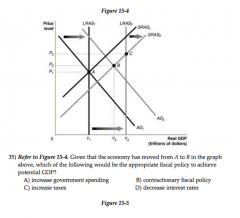

increase government transfer payments. |

|

|

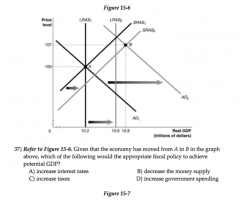

increase taxes |

|

|

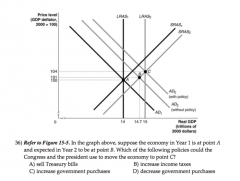

increase government purchases |

|

|

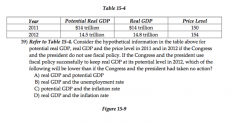

real GDP and the inflation rate |

|

|

increase income taxes |

|

|

increase government spending |

|

|

a decrease in income taxes |

|

|

B) greater than |