![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

19 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

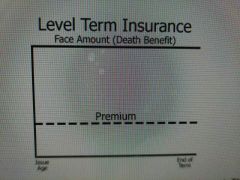

Level Term policy |

Is the most common type of temporary protection purchased. The word level refers to the death benefits that doesn't change through the life of the policy (will not Accumulate Cash Values sense it's a term policy) |

|

|

|

Universal Life |

Also has the wavier of Cost Rider with the exception of premium costs required to accumulate cash value.

Universal life insurance (often shortened to UL) is a type of cash value life insurance, primarily in the United States of America. Under the terms of the policy, the excess of premium payments above the current cost of insurance is credited to the cash value of the policy. |

|

|

|

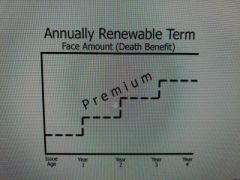

Annually Renewable Term |

(Art) is the Purest form of insurance. the Face Amount (Death Benefit) Remain Level (in the sense it's a term policy) the policy may be guaranteed to be Renewable each year without proof of insurability but the premium will increase Annually according to the attained Age. As the probability of death increases. |

|

|

|

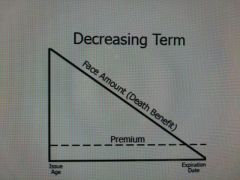

Decreasing Term |

The policy features a level premium and Decreasing Death Benefit each year over the duration of the policy term. Decreasing term coverage is commonly purchased to insure the payments of a Mortgage or other Debits if the insured dies prematurely. a decreasing term is usually convertible however it's not Renewable since the Face amount is $0 at the end of the policy |

|

|

|

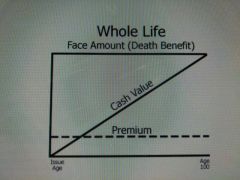

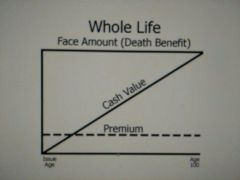

Whole Life |

Provides lifetime protection and includes Cash Value. Whole life policies endow at the insured age 100. Which means the Cash Value created by the Accumulation period is scheduled to Equal the face amount. Premiums for a whole life policy's is usually higher then the term insurance. |

|

|

|

Straight Life |

Also referred to as ordinary life or continuous premium whole life. Is the basic whole life policy straight Life will have the lowest annual Premium. |

|

|

|

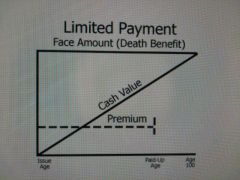

Limited payment |

limited pay whole life is designed so that the premium for coverage will be completely paid up well before the age 100. limited pay life are 20-pay life whereby coverage is completely paid for in 20 years and life paid up at Age 65. Limited pay has a shorter premium paying period so the Annually premium will be Higher but will be accumulate cash value faster. |

|

|

|

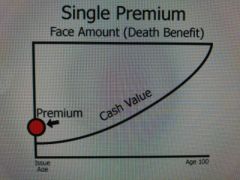

Single Premium |

Is designed to provided a level Face amount to the insured age 100 for a one time lump sum payment. The policy is completely paid up after one premium and generated immediate Cash Value. |

|

|

|

Adjustable Life |

Was designed to provided both Term and Permanent coverage. The Insured typically determines how much coverage is needed and the affordable of premium. the policy owner can make adjustment in his/her policy. Typically the following options increase or decreasing premium and the premium paying period Or increasing or decreasing the face amount Or Change the period of protection. Policy owner also has the options to convert from term to whole life or versa. changing the following will required proof of insurability face amount Or lowering premium. Policy owner may also pay additional premium beyond what is required under the permanent form in order to accumulate greater cash value or to shorten the premium paying period. ( Cash values of adjustable Life policy only develops when the premium paid are more than the cost of the policy.) |

|

|

|

Universal life |

Is also known by generic name of flexible premium adjustable life. policy owner has the flexibility to increase or decrease the premium paid into the policy. In fact policy may even skip a payment and the policy will not lapse as long has there is sufficient cash value at the time to cover the deduction for the cost of insurance. since the premium can be adjusted the insurer may give the choice to pay either of the minimum or target premium. Paying the minimum premium will make the policy perform as an annually Renewable term product. paying the target premium will cover the cost of insurance protection and keep the policy enforce throughout its lifetime. |

|

|

|

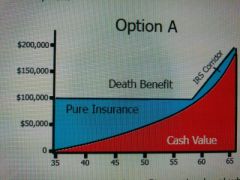

Universal Life Option A |

Under Option A ( level Face Amount Options ) the Face Amount remains level while the cash Value Gradually increases there by lowering the pure insurance with the insurer in later years. According to this definition, there must be a specified "corridor" or gap maintained between the Cash Value and the face amount in a life insurance policy. If this "corridor" or gap isn't maintained the policy is no longer defined as life insurance for tax purposes and consequently loses most of the tax advantages that have been associated with life insurance. |

|

|

|

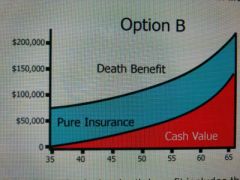

Universal life option B |

Under Option B ( increasing Face Amount option ) the Face amount includes the annual increase in the value so that the face amount Gradually increases each year by the amount that the cash value increase. at any point in time the total death benefits will aways be equal to the face amount of the policy plus the current amount of cash value. Since the pure insurance with insurer remain level for life, the expenses of this option are much higher than those for Option A, thereby causing the cash value to be lower in the older years ( all else being equal ) |

|

|

|

Variable Whole Life |

Is a level, fixed premium , investment based product. the cash value of the policy , however is not guaranteed and fluctuate with the performance of the portfolio in which premium have been invested by the insurer. The policyowner bears the investment Risk in Variable Contracts. |

|

|

|

Variable Universal Life |

Is a combination of universal life and Variable life. Like universal life it provides the policyowner with flexible premium and adjustable death Benefit. Like variable life the policyowner decide where the net Premiums ( Cash Value ) will be invested and like Cash Value it's not Guaranteed and the death benefits is not fixed. The cash value and Face Amount will decrease and increase over the life of the policy depending on the investment performance of the underlying sub-account. The face amount doesn't decrease below the initial Face Amount of the policy. ( Securities and life insurance in order to sell Variable Universal life ) |

|

|

|

Agents of Variable life insurance |

Agents selling variable life insurance products must. Be registered with Financial Industry Regulator Authority. (FINRA) Securities license. ( SEC ) Licensed by the state to sell life insurance. |

|

|

|

Regulation of Variable products |

Variable life Insurance products are dually regulated by the state and federal government . Due to the element of investment risk, the federal government has declared that variable contracts are Securities and are thus regulated by the Securities and Exchange Commission ( SEC ) and the Financial Industry regulatory Authority ( FINRA ) formerly known has the National Association of Security Dealers ( NASD) Variable life insurance is also regulated by the insurance department has Insurance product |

|

|

|

Indexed life |

The main feature of indexed whole life ( or equal index whole life) Insurance is that the cash value is depending upon the performance of an equity index such as S&P 500 as though they are guaranteed a minimum interest rates. The policy face amount increase in Annually to keep the pace with the inflation ( as the consumer Price index increases ) without requiring evidence of insurability.indexed whole life policies are classified depending on whether the policyowner or the insurer assumes the inflation risk. If the policy owner assumes the risk the policy premium increases with the increase in the Face amount. if the insurer assumes the risk, the premium remains level. |

|

|

|

Joint life |

Is a single policy that designed to insure two or more lives. Joint Life policies can be in the form of term insurance or permanent Insurance. the premium for joint life would be less than for the same type and amount of coverage on the same individual. It is more commonly found as joint whole life, which functions similarly to an individual whole life policy with two major exception. Premium is based on a joint average age that is between the age of the insured. The death benefit is paid upon the first death only. |

|

|

|

Survivorship life |

Survivorship life also referred to a ( second to die or last survivor policy ) is much the same as joint life in that it insures two or more lives for a premium that's based on a joint age. The major differences that survivorship life pays on the last death rather than the first death. Since the death benefit is not paid until the last death, The Joint life expectancy in a sense is extended, resulting in a lower premium than that which the typically charged for joint life, which pays upon the first death. This type of policy is often used to offset the liability of estate tax upon the death of the last insured. |

|