![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

44 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

What Is insurance in 2 words? |

Insurance can be summed up by two words... Spreading risks.

|

|

|

|

What are the 2 ways to quantify the risk of death? |

-Life Expectancy: number of years that you're expected to live from today. -Probability of Death: likelihood that you will die before your next birthday. |

|

|

|

What are the potential financial impact of death? |

-Loss of an income: if one's spouse passes away, his or her income stops immediately but would likely still be needed for the couple's dependents.

-Loss of a caregiver: If the person cared for children, his or her death would have an hardship on the surviving spouse cos paid daycare is then required.

-Debt repayment: Taxes are often payable upon death. The CRA could deem that the deceased had disposed of an asset, which results in tax consequences.

-Estate creation: Creating an estate is when a parent leave money for his dependant children through life insurance.

-Education funds: money saved for years which is used to pay for a child's education (university...)

-Legacies: a financial gift left to someone upon death to be used for a particular purpose.

-Charitable giving: Leaving money to their favorite charity upon death.

-Business continuation: if an important employee died, it could have a negative financial impact in the business. Life insurance proceeds could be used to help offset reduced revenues, attract and train a replacement employee... |

There are 9 of them L. L.D.I.E.E.L.C.B |

|

|

What are the risk management strategies? |

|

|

|

|

Risks and solutions |

|

|

|

|

Term Insurance vs. Permanent Insurance |

|

|

|

|

Insurer |

The insurance company that issued the policy and will pay the death benefit if the life-insured dies from a covered cause while contract is in force. |

|

|

|

Policyholder (insured) |

Owner of the contract: purchased policy or was later assigned to the policy. Responsible for making decisions regarding contract (name beneficiary, cancel policy, assign to another person...) |

|

|

|

Life(s) insured |

The person(s) on whose life is the contract based. This person has to die in order for a death benefit to be payable. |

|

|

|

Beneficiary |

Person(s) whom the death benefit would be payable to. (receives the money after the life insured's death |

|

|

|

Joint life insurance: - Joint First-to-Die policy - Joint Last-to-Die policy |

Joint life insurance is when it is possible to insure more than one single life. Joint First-to-Die policy: Needed when the first person dies (ex: to pay out a mortgage). It covers the missing person share for the income coming in to help with financial expenses. Joint Last-to-Die policy: needed when only the last person dies. (ex: a couple has a cottage or any other asset that is subject to tax disposition) that will result in capital gains taxes upon the second spouse's death. |

|

|

|

Combined insurance |

It is NOT the same as joint life insurance. It is a marketing initiative in which 2 separate policies are able under the same contract. Advantage: only one administration fee is charged. |

|

|

|

Coverage: Level Term |

|

|

|

|

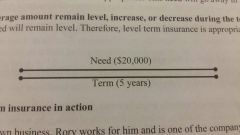

Coverage: Decreasing Term |

|

|

|

|

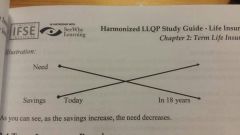

Coverage: Increasing Term |

|

|

|

|

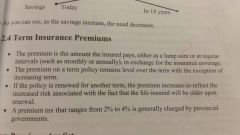

Term Insurance Premiums |

|

|

|

|

How Premiums are set |

1. Mortality (Risk) Costs: Mortality is defined as the risk of death and is commonly expressed as the number of expected death per thousand people per year in a group. Mortality costs approximate the insurer's cost of paying out death benefit claims (actual claim, cist of processing claims, etc.)

2. Administrative Costs/Expenses: the costs that the insurance company will incur to administer the policy (salaries of emoleyees, cos of sending clients statements, office space... also a profit for the insurance company)

3. Investment Returns: when insurance companies collect premiums, they put Kucherov of the money aside to fund (pay) future claims. In the meantime,those funds are invested to earn a return. The greater the expected return in those funds, the less required premium from the client. |

|

|

|

Non-renewable Term Insurance |

- At the end of the term, the policy expires. The insured cannot renew the policy.

- If the insured still requires coverage, he or she would need to apply for a new policy. |

|

|

|

Renewable Term Insurance |

- It allows the policyholder to renew the policy for a certain number of renewal periods, usually up to a maximum age (sush as 70) - The renewal occurs without evidence of insurability. -The premium will increase each period as stipulated in the original contract. -Many renewable policies will have what is called a "re-entry term" |

|

|

|

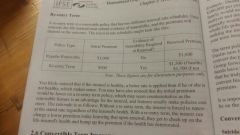

Re-entry Term |

|

|

|

|

Convertible Term Insurance |

|

Example of Convertible Term Insurance |

|

|

Convertible Policy Considerations |

- Suicide Exclusion Period : if the life-insured commits suicide within the first 2 years if the policy, the death benefit will not be payable.

- Contestability Period vs Incontestability Period: CP is the first 2 years of the policy. If the insurer becomes aware of a material misrepresentation in the first two years, it can cancel the policy or deny a claim. IP is the time after the 2 years. The insurer would have to prove fraud and prove that the policyholder lied if there was a material misrepresentation that was noticed after 2 years.

- Attained-Age vs. Original-Age Conversions : Attained-Age is when the policy is converted , the premium on the new policy is the life-insured's Attained-Age. Original-Age Conversion is when the policy is converted, the premium is based in the life-insured's original age (when the policy was first written) |

For Attained-Age and Original-Age Conversions |

|

|

Whole Life insurance |

3 things are guaranteed by an insurer on a whole life policy: 1. Premium will never increase, and at age 100, no more premiums are required. 2. Coverage is permanent, as long as premiums are paid. The coverage will never decrease and the death benefit will always be equal to the face value. 3. Cash value will grow at a guaranteed pace and equal the face value at age 100. |

|

|

|

Impact of the Modal Factor |

|

|

|

|

Premiums Options |

- Single lump-sun premium : Pay an upfront premium of $8,000 with no further premiums. This is referred to as a paid-up policy since not further premiums are payable. - Limited payment : Pay a monthly premium of $50 over the next 20 years. - Ongoing premium : Pay a monthly premium of $25 until the life-insured does or until the policy is cancelled. |

|

|

|

Death Benefit Options |

- Guaranteed Whole Life : most common form of whole life insurance (default). Most policies have a guaranteed death benefit and premium. - Adjustable Whole life : Premium and coverage are guaranteed only for a certain number of years. When guaranteed period is finished, insurer reserves the right to adjust the premium. |

Example for adjustable whole life |

|

|

Non-participating & Participating policies (+ Definition of dividend) |

Non-participating: if there is a policy surplus, the insurer reasons the entire amount and does not share any with the policyholder. Participating: higher premium. If insurance company experiences a surplus, it will share that surplus with the policyholders. The sharing of a surplus with policyholders is referred to as the "dividend". *Dividends on a participating policy are considered a partial refund of the premium and are therefore taxed differently from dividends in an investment. In fact, dividends on a participating policies are generally received tax free. |

|

|

|

Dividend Options |

1. Cash : Dividend sent by cash (cheque) 2. Premium Reduction : The insurance company will apply dividend to the next premium. Next premium will cost less cos of dividend added. 3. Paid-Up Additions (PUAs) : dividend used as a one-time premium to buy as much a additional insurance as it can. It is called "paid-up" because the insured does not have to pay anymore premiums on this new bit of insurance since it has already been paid for with the dividend. 4. Accumulation : dividend is places in an accumulation account M, which is also referred to as a "side account". Side account can be invested in interest-bearing deposits or segregated fund. Money in side account can be withdrawn at any time by policyholder. When life-insured dies, funds in the side account are paid to the beneficiary in addition to the death benefit from the life insurance. 5. Term Insurance (1 yr term) : dividend is used to purchase as much one-year term insurance as the dividend can afford to pay for. |

|

|

|

Nonforfeiture Benefits |

1. Cash Surrender Value (CSV) : it's the cash value you receive minus the surrender charges after you cancel a policy. It's the fair share of the cash value that you get after the cancellation fees.

2. Automatic Premium Loan (APL) : if you miss a premium payment, the insurer will automatically lend it to you using the cash value as collateral.

3. Reduced Paid-up Insurance : Premium is eliminated, coverage (face value) is reduced and new coverage is still permanent (whole life).

4. Extended Term Insurance : Premium is eliminated, coverage remains the same and policy is now term insurance. |

Examples text book p. 38-39 |

|

|

Limited Payment While Life |

|

|

|

|

Premium Offset Policies |

|

|

|

|

Permanent Insurance Needs |

|

|

|

|

Term-100 (T-100) Life Insurance |

- T-100 is a permanent policy - Cheapest of the permanent plans. - does not have cash value. - does not offer nonforfeiture options that Whole Life provides. |

|

|

|

Level Cost Insurance (LCOI) |

T-100 uses LCOI approach. Meaning, rather than having the insurance cost increase on a yearly basis, the total premium is spread out evenly over the life of the policy. |

|

|

|

Limited Payment T-100 |

1. The shorter the payment period, the higher the monthly premium, but the lower the TOTAL premiums. 2. Policyholder of a limited payment T-100 is paying premium earlier than he or she normally would as compared to a traditional T-100. If a payment is missed, many limited payment T-100 policies offer Automatic Premium Loan (APL) feature |

|

|

|

Using T-100 |

- appropriate if the insured is price sensitive and needs permanent coverage. - no cash value, so only purchase if the insured is confident that the policy will never be surrendered. |

|

|

|

Universal Life Insurance |

|

|

|

|

Minimum Funded UL Policy |

Min= Policyholder has paid only just enough premium to cover the actual insurance cost and expenses of the policy but nothing more. Cash value of min funded UL policy = 0 |

|

|

|

Maximum Funded UL policy |

|

|

|

|

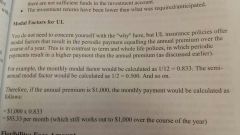

Modal Factors for UL |

|

|

|

|

Flexibility: Face amount |

|

|

|

|

Rider |

Typically results in additional benefits upon death. A Paid-Up Addition (PUA), Which can result in a greater death benefit, is a good example of a rider. |

|

|

|

Supplementary Benefits |

Provide benefits before the death of the insured. An example would be a waiver premium for total disability in which the premium become totally disabled. |

|

|

|

Types of riders |

1. Paid-Up Additions Rider (PUA) 2. Term Insurance Riders 3. Child Coverage Rider 4. Family Coverage Rider 5. Converting Child or Family Coverage Riders 6. Accidental Death (AD) & Rider 8. Accidental Death and Dismemberment (AD&D) 9. Guaranteed Insurability Benefit (GIB) |

|