![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

99 Cards in this Set

- Front

- Back

|

Policyowner of a Life Policy must have _____ in life of insured. |

Insurable Interest |

|

|

Who of the following can you not insure the life of? A) Rich Aunt B) Yourself C) Your Spouse D) Your Business Partner E) Your Favorite Bartender |

E; you have no Insurable interest in your bartender |

|

|

Whom might you be able to insure the life of depending on the case? |

Dating (not married), Employer-> Employee |

|

|

Whom can you not take out life insurance policies on? |

Employee—> Employer Landlord—> Tennant |

|

|

Does a man who has a life insurance policy on his ex-husband get benefits upon his ex’s death? Why? |

Yes; the insurable interest does NOT need to exist at the time of loss. |

|

|

What is the process for Personal Insurance Planning? |

1) Identify Goals 2) Gather Data 3) Create Plan based on Data 4) Regularly Monitor |

|

|

When considering how much financial loss a man’s family will incure, what factors does the Human Life Value Approach take into consideration? |

Income, Projected Raises, Household Services, Employment Benefits |

|

|

What is considered during a Needs Approach for a life insurance policy? |

Funeral Expenses, Medical Expenses, Emergency Fund, Mortgage, Debts/Loans, Childcare, Legal Fees, Estate Taxes, Educational Expenses, Business Buyout |

|

|

What is the amount the insurer is obligated to pay out for a death benefit called? |

Limit of Liability |

|

|

How do you calculate the Limit of Liability? |

$150,000 (Face Amount) - $4,000 (Policy Loan) - $1,000 (Policy Interest) —————— $145,000 ( Limit if Liability) |

|

|

What does “Life Insurance creates an Immediate Estate” mean? |

Instead of saving to leave something after you die, a life insurance policy Is an easy way to leave something to those you love. |

|

|

What are the Personal Uses of Life Insurance? |

Provide Income, Pay for Medical/Funeral Cost, Payoff Mortgages and Loans |

|

|

What are some Business Uses of Life Insurance? |

Salary Continuation, Overhead Expenses, Split Dollar Insurance, Key Person Insurance |

|

|

What Uses are Key Employee Insurance benefits permitted? |

Recruiting and training replacement, lost profits, assure potential creditors |

|

|

Buy-Sell Agreements govern what happens to co-partnerships if _________. |

One partner dies or leaves |

|

|

When an employer offers to split a life insurance policy it is called ______. |

Split Dollar Life Insurance |

|

|

A company is allowed to take out a life insurance policy on an employee when they use a _____ , a plan to defer parts of payment to accumulate for retirement. |

Non Qualified Deferred Compensation Plan |

|

|

The Salary Continuation Plan is a plan where employees make continued income after retirement and is reserved for ____. |

Key Personelle |

|

|

What is the typical Mortality Rate expressed in? |

/1000 people per year |

|

|

What do Mortality Tables separate people as? |

Make and female |

|

|

Types of Life Insurance? |

Back (Definition) |

|

|

What is it called when a Life Insurance Policy pays out if insured does in a specific term? |

Term Life Insurance |

|

|

What does a Term Life Insurance Cover? (Lets say $500,000 20-Year Term) |

Mortgage, Loans, Children -18 |

|

|

Can you take out CV for Term Life Insurance? |

No |

|

|

What are some common Terms for Terms Life Ins? |

1, 5, 10, 15, 20, 25, 30 yr terms |

|

|

What’s the most affordable life insurance policy? |

Term Life Insurance |

|

|

What kind of face amounts are there? |

Level, increasing, and decreasing |

|

|

What are the payouts for a $100,000 15-year policy for a Level Term, Decreasing Term, and Increasing Term? |

Level- $100,000 Decreasing- <$100,000 Increasing- >$100,000 |

|

|

When an insured person dies holding a Mortgage Redeptiom Insurance (decreasing term ins) whenpolicy what is the amount the policy pays out? |

The amount of the rest of the mortgage |

|

|

What is it called when someone can take a Term Policy and convert part or all of it to a permanent plan (without need for Evidence of Insurability)? |

Term Conversion Provision |

|

|

What happens to the Policyholder’s premium every time they renew a Renewable Term Lease (without EoI)? |

They have to pay a higher premium |

|

|

In Term Life Policies, is the greater or lesser Term length more expensive premiums? |

Greater length of term= greater premium |

|

|

What is the difference between a Guaranteed, Indeterminate, and Non-Guaranteed Premium Types? |

Guaranteed- premiums cannot change Indeterminate- premiums can go up to a max amount after initial fixed period Non-Guaranteed- premiums increase after initial fixed period with no cap |

|

|

What are the types of insurance under the umbrella of Permanent Life Insurance? |

Whole Life, Universal Life, Variable Life, and Variable Universal Life |

|

|

What are some typical term lengths in Whole Life Policies? |

Till you turn 100 or 121 |

|

|

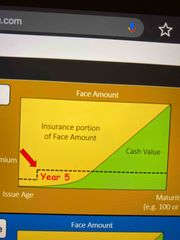

What is the Level Premium Concept? |

Premiums remain level throughout policy by starting higher than it should be at initiating the policy |

|

|

What is the issue of a whole life insurance policy if you live past the age of maturity and what is a possibly solution? |

The cash value is tax deductible if cashed out; a Maturity Extention Rider can be added |

|

|

When an insurer loans an insured person money it’s called _____ and uses the policy’s _____ as collateral. |

Policy Loan; cash value |

|

|

Benefits of Policy Loan? |

Loan interest can be fixed or variable. Interest accrued. No fixed time for repayment. Upon insured death, loan and interest can be taken from benefits. |

|

|

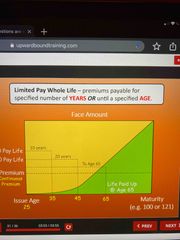

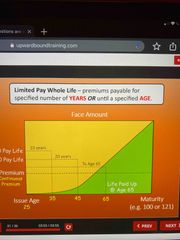

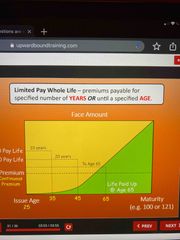

What are the benefits and detriments of a Limited Pay Whole Life Policy? |

You only pay for a set amount of years and the coverage lasts your whole life (whether a set term of years or at an age). Higher Premiums

|

|

|

What is a Life Paid Up at Age 65 look like compared to other types of Limited Pay Whole Life Insurance Plans? |

Steady throughout life |

|

|

What is the difference between a Guaranteed, Indeterminate, and Non-Guaranteed Premium Types? |

Guaranteed- premiums cannot change Indeterminate- premiums can go up to a max amount after initial fixed period Non-Guaranteed- premiums increase after initial fixed period with no cap |

|

|

What are the types of insurance under the umbrella of Permanent Life Insurance? |

Whole Life, Universal Life, Variable Life, and Variable Universal Life |

|

|

What are some typical term lengths in Whole Life Policies? |

Till you turn 100 or 121 |

|

|

What is the Level Premium Concept? |

Premiums remain level throughout policy by starting higher than it should be at initiating the policy |

|

|

What is the issue of a whole life insurance policy if you live past the age of maturity and what is a possibly solution? |

The cash value is tax deductible if cashed out; a Maturity Extention Rider can be added |

|

|

When an insurer loans an insured person money it’s called _____ and uses the policy’s _____ as collateral. |

Policy Loan; cash value |

|

|

Benefits of Policy Loan? |

Loan interest can be fixed or variable. Interest accrued. No fixed time for repayment. Upon insured death, loan and interest can be taken from benefits. |

|

|

What are the benefits and detriments of a Limited Pay Whole Life Policy? |

You only pay for a set amount of years and the coverage lasts your whole life (whether a set term of years or at an age). Higher Premiums

|

|

|

What is a Life Paid Up at Age 65 look like compared to other types of Limited Pay Whole Life Insurance Plans? |

Steady throughout life |

|

|

What is the term used when no more premium payments must be made? |

Paid-Up |

|

|

What is the difference between a Guaranteed, Indeterminate, and Non-Guaranteed Premium Types? |

Guaranteed- premiums cannot change Indeterminate- premiums can go up to a max amount after initial fixed period Non-Guaranteed- premiums increase after initial fixed period with no cap |

|

|

The most expensive Limited Pay Whole Life Policy is the Single Premium Whole Life Policy where ___________ is made and the owner is insured for life. |

One payment |

|

|

What are the types of insurance under the umbrella of Permanent Life Insurance? |

Whole Life, Universal Life, Variable Life, and Variable Universal Life |

|

|

What are some typical term lengths in Whole Life Policies? |

Till you turn 100 or 121 |

|

|

What is the Level Premium Concept? |

Premiums remain level throughout policy by starting higher than it should be at initiating the policy |

|

|

What is the issue of a whole life insurance policy if you live past the age of maturity and what is a possibly solution? |

The cash value is tax deductible if cashed out; a Maturity Extention Rider can be added |

|

|

When an insurer loans an insured person money it’s called _____ and uses the policy’s _____ as collateral. |

Policy Loan; cash value |

|

|

Benefits of Policy Loan? |

Loan interest can be fixed or variable. Interest accrued. No fixed time for repayment. Upon insured death, loan and interest can be taken from benefits. |

|

|

What is a Life Paid Up at Age 65 look like compared to other types of Limited Pay Whole Life Insurance Plans? |

Steady throughout life |

|

|

What is a Life Paid Up at Age 65 look like compared to other types of Limited Pay Whole Life Insurance Plans? |

Steady throughout life |

|

|

What is the term used when no more premium payments must be made? |

Paid-Up |

|

|

What are the Term & WL Policy Price ranges (estimated)? |

10,20,30 year term policies, continuous whole life, 10 pay life, single premium |

|

|

What is the whole life policy that has lesser premiums and then one increase somewhere between 3-5 called? |

Modified Whole Premium |

|

|

What is the whole life policy that has lesser premiums and then increases annually for 5-10 years called? |

Graded Premium Whole Life |

|

|

What is the term for a continuous whole life policy that has a less than standard maturity age? |

Endowment |

|

|

What are the big differences between Whole Life and Universal Life Policies? |

Whole: -premiums must be paid exact amount, paid on time, Face Amount is fixed Universal: -premiums can vary, be payed on a more flexible schedule, the Face Amount can increase potentially |

|

|

What are the big differences between Whole Life and Universal Life Policies? |

Whole: -premiums must be paid exact amount, paid on time, Face Amount is fixed Universal: -premiums can vary, be payed on a more flexible schedule, the Face Amount can increase potentially |

|

|

Account Value Mechanics (Cash Value Mechanics) of UL Policy |

+$1000 Acct. Balance +$100 Premium -$5 Premium Expense Charge (e.g. 5%) -$7 Monthly Fee (e.g. $7/mo) -$3.52 Mortality (monthly cost of insurance) (e.g. $3.52) +$42 Monthly Interest Earned (e.g. $42) —————— $1,126.48 |

|

|

When does the Universal Life Policy lapse? |

When the policy has insufficient funds to support the policy (monthly charges) |

|

|

What is it called when your Universal Life Death Benefits aren’t enough and the insured needs to increase it? |

Universal Life Increasewhat |

|

|

What is a Bundled Policy? What is an example of one? |

Not Flexible/ Fixed Whole Life Policies |

|

|

What is a Unbundled Policy? What is an example of one? |

Flexibility Universal Life Policy |

|

|

What is the Insurer’s secondary accounts called? |

Separate Account (made up of sub accounts) |

|

|

Why does a Variable Life policy have the possibility of lower death benefits and/or Cash Value? |

Policyowner becomes liable for risk by choosing subaccounts to have their policy backed by (for possible larger benefits) |

|

|

Equity index only applies to _______ Insurance. |

Universal Live |

|

|

What are a few Equity Indexes a policy owner can use to back their Universal Life Policy? |

NASDAQ DOW JONES S&P 500 |

|

|

Which Policy combines a WL Policy with Level Term Rider to cover a monthly income for the breadwinner’s family and a DB to be assigned after income runs out? |

Family Protection Policy |

|

|

What is a Family Policy? |

Combination of WL Policy with Term Riders to cover family. |

|

|

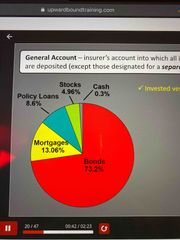

Where does an Insurer collect all incoming funds? |

General Account |

|

|

What are some perks of the Childrens’ Term Rider? |

New Children are automatically covered |

|

|

A ______ is a type of Rider that combines level term coverage on both a spouse and children. |

Family Rider |

|

|

_______ is a WL Policy of an insured minor (-16) which’s face value increases x5 when the insured turns 21. |

Jumping Juvenile |

|

|

What is the pay out for an Option 1 UL Policy Death Benefit? |

Basic Amount |

|

|

When do Joint Life Policies payout? |

After 1st Death |

|

|

What are some benefits of a Joint Life Policy? Detriments? |

Less expensive, can insure 2+ business partners Surviving Spouse is Left without Insurance |

|

|

What’s the difference between Survivorship Life and Joint Life? |

Survivorship pays out after both deaths |

|

|

What are the benefits of a Survivorship Life? |

Typically larger face value Ideal for paying estate taxes after death Providing needs for special needs children/adults Less expensive than separate insurances |

|

|

What is the Term insurance policy that pays all or a portion of the total premiums collected? What is the downfall of this option?co |

Return of Premium Policy; high premiums |

|

|

Contrary to instinct, Joint and Survivorship Policies are ______, not group policy. |

Individual |

|

|

What is the difference in Participating and Non-Participating Policies? |

Par: eligible to receive policy dividends

Non-Par: ineligible to receive policy dividends |

|

|

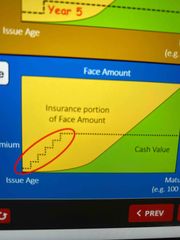

The insurance + the account value = ___? |

Basic Amount |

|

|

Option 1- Level death benefit Death Benefit= _____ |

Basic amount |

|

|

Option 2- Increasing Death Benefit Death Benefit= _____+_____ |

Basic Amount + Account Value |

|

|

UL Policies have a _________, a few charged when policy is surrendered. |

Surrender Charge |

|

|

The Term and UL Policies collect premiums or, Cash Value and Account Value that grow over time through investment, what are the 3 investment options used on each account? |

Fixed Equity Indexed Variable |

|

|

Where does an Insurer collect all incoming funds? |

General Account |

|

|

The General Account is __________ and invested _______. |

Highly regulated; conservatively |

|

|

What is the type of Life Insurance Investment where the investments are backed by and insurer’s General Account? |

Fixed Life |