![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

22 Cards in this Set

- Front

- Back

|

income statement |

financial statemenr showing revenyes earned by a business, the expenses incurred in earning the revenues and the resulting net income/loss. |

|

|

Balance sheet |

financial report showing the assets, liabilities and owner's equity of a firm on a specifiv date |

|

|

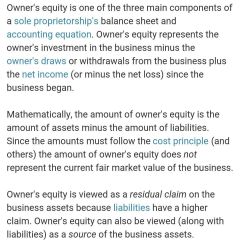

owner's equity |

|

|

|

balance sheet equation |

Assets=Liabilities+owner's equity an expressuon in dollar amounts of the equivalency of the assets and equties of a firm |

|

|

net assets |

assets-liabilities |

|

|

net loss |

the excess of expenses over revenues |

|

|

revenue |

an inflow of assets, not necessarly cash, in exchange for goods and services sold |

|

|

asset acounts |

●cash ●notes recievable ●accounts recievable ●prepaid insurance ●office supplies ●store supplies |

|

|

cash /asset accounts/ |

recorded are the increases/decreases in cash, in bank account as a medium of exchange |

|

|

notes recievable /asset accounts/ |

notes recievable: an account for the written promise to be paid a definite sum of money at a fixed future date |

|

|

accounts recievable /asset accounts/ |

the expectef future payment for goods sold (known as sales on credit) is a recievablem The relative account is increased by sales and decreased by the customer payment |

|

|

prepaid insurance /asset accounts/ |

the amount paid in advance for insurance protecion is a "premium". A large portion of each premium is an asset for a long time. When yhe premium is paid, the asset "prepaid insurance" is increased and recorded in the respective account. At intervals the balance of the account "prepaid insurance" is reduced. |

|

|

office supplies /assets account/ |

small assets when purchased and recorded in a specific account, and become expenses when consumed and expired. |

|

|

store supplies /assets account/ |

detailed materials used by a store and recorded in an account of that name. |

|

|

other paid expenses /assets account/ |

these are assets at the time of purchase, but become expenses as they are consumed. ex: prepaid insurance, office supplies,store supplies; others are prepaid rent and prepaid taxes. Each are accounted for a separate account. |

|

|

equipment,buildings, land/assets account/ |

●equipment-different office machines; ●buildings-factory,store,garage, warehouse; ●land-owned lands by business have their increasea and decreases recorded in separate respective accounts. ■EQUIPMENT AND BUILDINGS depreciate and wear out it's value in the process of carrying out it's business operations. |

|

|

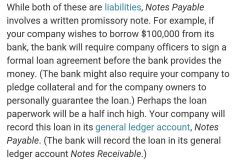

notes payable/liabilities account/ |

recorderd in respecyive account they increase and decrease in amounts owed due to promissory notes given to creditors |

|

|

accounts payable /liabilities account/ |

recorded is the amount owed to a creditor that result from a purchase of merchandise, supplies or equipment on credit. |

|

|

other short-term payable /liabilities/ |

wages payable, taxes payable and interest payable are short-term liablilities. An individual accounrs must be kept for each of them. |

|

|

unearned revenues/liabilities account/ |

payments recieved for goods before delivery. They lead in liability that will be extinguished by delivering the goods paid in advance. Rent collected in advance by a landlord is an example. Upon receipt the amount is recorded in the account "Unearned revenues". When earned by delivery, the amounts earned are transferred ti revennue account. |

|

|

mortgage payable /liabilities account/ |

a long-term debt of which the creditor has a secured prior claim against some debtor's assets. The creditor has the right to force the mortgaged assets' sale if the debr of mortgagw is not paid when duw. In thw adequate account are recorded the movemenrs of the amount owed on mortgagw |

|

|

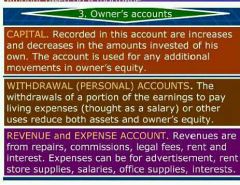

owner's accounts |

|