![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

57 Cards in this Set

- Front

- Back

|

What are the three types of Income Tax? |

Non Savings Income (earnings from employment)

Savings Income (interest from bank accounts)

Dividend Income (dividends payable by companies and investment funds) |

|

|

What are the three steps to calculate income tax? |

1 - All the income from the three categories is added up for the year

2 - Deduct the annual personal allowance from the bottom pile of income

3 - Calculate the tax due on the remaining income after deducting the personal allowance |

|

|

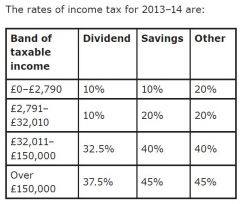

What are the income rates of tax for 2013/14? |

|

|

|

What types of income can be tax free? (6) |

Premium Bond Prizes Interest on National Savings Certificates Incomes from ISA's Gambling National Lottery Wins Compensation from loss of employment (up to 30k) |

|

|

What is Interest Income referred to by the HMRC? |

Non Dividend Savings Income - Taxed after earned income |

|

|

What does Non-Dividend Savings income apply to? |

UK and Overseas savings income from the following sources

Interest from banks and building societies Interest from gilts and corporate bonds Purchased life annuities Some distributions from unit trusts |

|

|

What is the starting rate of tax for Saving Incomes Only? |

10% |

|

|

What is the amount of tax on Savings between £2,791 - £32,010? |

20% |

|

|

What is CGT? |

Capital Gains Tax |

|

|

Explain Capital Gains Tax |

A tax levied on an increase in the capital value of an asset.

Usually paid when disposed of/sold on |

|

|

What may Capital Gains Tax be added on? |

Shares Unit Trusts Certain Bonds Property (Except Main Home) |

|

|

What is exempt from Capital Gains Tax? |

Main Home Car and other possessions up to £6,000 Gains on Gilts Betting, Lottery or Pools Winnings Transfers between spouses |

|

|

What is the "Annual Exempt Amount"? |

Annual tax free allowance which allows a certain amount of gains tax free each year |

|

|

What is the annual tax free allowance on Capital Gains? |

£10,900 |

|

|

What are the three excess charges for Capital Gains tax? |

18% and 28% for individuals (rate used depends on amount of total taxable income and gains)

28% for trustees or personal representatives

10% for gains qualifying for Entrepreneurs Relief |

|

|

What is Inheritance Tax based on? |

The value of assets that are transferred during an individuals lifetime or that are remaining at death |

|

|

What is the Nil Rate Band set at for Inheritance Tax? |

£325,000 any transfer in excess of this is charged at 40% |

|

|

What is exempt from Inheritance Tax? |

Assets left to a spouse Assets left to registered charitites Gifts made more than 7 years before death |

|

|

When would Inheritance Tax change from 40% to 36%? |

If 10% or more of a net estate (after deductions) is left to charity |

|

|

What is Stamp Duty? |

A tax paid on UK share trades where a stock transfer form is used |

|

|

What is Stamp Duty Reserve Tax? |

A tax paid when an individual buys shares electronically with no stock transfer form |

|

|

When is no Stamp Duty added? (5) |

When purchasing foreign shares Bonds OEIC's Unit Trusts ETF's |

|

|

What is VAT? |

Value Added Tax

A charge added by firms and individuals whose turnover exceeds a certain amount when they supply taxable goods or services |

|

|

What is the standard rate of VAT? |

20% |

|

|

What are Investment Wrappers? |

A way for individuals to own both savings and shares with certain tax advantages |

|

|

What do Investment Wrappers include? (4) |

ISA's Child Trust Funds/Junior ISA's Pensions Investment Bonds |

|

|

Who creates the rules around Investment Wrappers? |

The HMRC (Her Majesty's Revenue and Customs) |

|

|

What is an ISA? |

Individual Savings Account

An account that holds other savings and investments such as deposits, shares, OEIC's and unit trusts

They are invested in a tax efficient manner |

|

|

Who are ISA's available for? |

Stocks and Shares ISA's - UK residents over 18 Cash ISA's - Aged 16 or over |

|

|

What are the tax incentives for ISA's? |

They are free of Income Tax and Capital Gains Tax

As of 2005 is it no longer possible to reclaim tax credit on dividends |

|

|

How many ISA's are available for savers? |

One, with two components;

Cash or, Stocks and Shares |

|

|

What is the annual maximum overall subscription limit for ISA's? |

No more than 50% may be placed in the cash component |

|

|

What is the overall ISA subscription limit? |

£11,520, of which £5,760 can be subscribed to a cash ISA |

|

|

What is the time limit to transfer shares in ISA's? |

Within 90 days of receipt |

|

|

Can you transfer a cash ISA to a stocks and shares ISA? |

Yes, it cannot however be made the other way round |

|

|

What are Junior ISA's? |

A tax free savings account for children |

|

|

Who are eligible for Junior ISA's? |

All UK residents under 18 who do not already have a Child Trust Fund |

|

|

What is the annual subscription limit for JISA's? |

£3,720, indexed by the Consumer Price Index |

|

|

Who can open a JISA account? |

Anyone responsible for an eligible child. Any eligible child over the age of 16 can also open an account for themselves |

|

|

When can you withdraw from a JISA? |

At the age of 18, except in the case of terminal illness of death |

|

|

What is a Pension? |

An investment fund where contributions are made, uusually during a persons working life |

|

|

What are the main tax incentives for Pensions? (5) |

Tax relief on contributions made by individuals and employers

Not subject to income tax

You can have it at age 55

Option to take a tax free lump sum at retirement

Option to include death benefits as part of the scheme |

|

|

What are the two parts to a State Pension Scheme? |

Basic State Pension Additional State Pension |

|

|

How are State Pensions Provided? |

Through National Insurance contributions |

|

|

What age can you redeem a State Pension? |

If born after 6/10/1954 but before 06/04/1968 (66 years) If born after 1968 it will increase from 66 to 67 then 68 |

|

|

What is the Pension Credit Guarantee? |

A way for the basic state pension to be topped up if they have had long periods of unemployment |

|

|

What is the State Second Pension (S2P)? |

It is earning related, the higher the earnings the bigger the pension |

|

|

Explain Defined Benefit Scheme and Defined Contribution pension |

Defined Benefit Scheme - Pension is related to number of years service

Defined Contribution - Driven by contributions made and the performance of the fund |

|

|

What is a stakeholder pension? |

A type of personal pension that incurs low charges |

|

|

What government standards do Stakeholder Pensions have to satisfy in order to be offered? |

Low Charges - 1.5% cap for first 10 years Low and Flexible Contributions - minimum no greater than £20 Transferability - No charges Default Option - Can allocate funds between investment |

|

|

What is NEST? |

National Employment Savings Trust

A pension scheme employers can use to meet their new duties, providing a low cost pension scheme |

|

|

What are the 3 retirement option pensions available? |

Scheme Pension - Pension paid directly out of scheme assets Lifetime Annuity - Payable by insurance company the member has chosen Drawdown Pension - Member draws an income from the pension fund |

|

|

What is an Investment Bond described as? |

A single premium life assurance policy that is taken out for the purposes of investment |

|

|

What Investment Bonds are available? |

With profits investment bonds Distribution bonds Guaranteed equity bonds Unit linked bonds |

|

|

What is a Trust? |

The legal means by which one person gives property to another person to look after for someone else |

|

|

What are the three parties involved in a Trust? |

Settlor - Creator of Trust Trustee - Has the property Beneficiary - Who it is intended for |

|

|

What are the three types of Trusts? |

Bare or absolute - Where a trustee holds assets for one or more persons absolutely

Interest in possession - Beneficiary has right to the income of the trust during their life, capital passes to others on their death

Discretionary - Trustee has discretion over to who the capital and income is paid |