![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

32 Cards in this Set

- Front

- Back

|

"bigger fool" theory of investing |

Value of an asset is irrelevant as long as there is a "bigger fool" around wiling to buy the asset from them |

|

|

"perception" concept of valuation |

Value is in the eye of the beholder, any price can be justified if there are other investors wiling to pay that price |

|

|

"based on CF" concept of valuation |

Price that is paid for the asset should reflect CFs it is expected to generate |

|

|

Myth 1: "Valuation models are quantitative - valuation is objective" |

Models used in valuation are quantitative, but the inputs leave plenty of room for subjective judgments |

|

|

Reducing the bias in the process of valuation |

1. Avoid taking strong public position on the value of the firm before the valuation is complete |

|

|

Equity research analyst bias |

More likely to issue "buy" rather then "sell" recomendation. |

|

|

Self-valuation bias |

Self valuation done by the target firm in takeover is likely to be positively biased. |

|

|

Myth 2: A well-researched and well-done valuation is timeless |

In some cases, new information can affect the valuations of all firms in a sector. Information about the state of the economy and the level of interest rates affect all valuations in an economy |

|

|

Myth 3: A good valuation provides a precise estimate of value |

The degree of precision in valuations is likely to vary widely across investments. The valuation of a large and mature company, with a long financial history, will usually be much more precise than the valuation of a young company, in a sector that is in turmoil. |

|

|

Myth 4: The more quantitative a model, the better the valuation |

1. You do not use more inputs than you absolutely need to value an asset. |

|

|

Myth 5: To make money on valuation, you have to assume that markets are inefficient |

Those who believe that markets are inefficient should spend their time and resources on valuation whereas those who believe that markets are efficient should take the market price as the best estimate of value. |

|

|

Myth 6: The product of valuation (i.e., the value) is what matters; The process of valuation is not important. |

The process can tell us a great deal about the determinants of value and help us answer some fundamental questions - What is the appropriate price to pay for high growth? What is a brand name worth? |

|

|

Valuation by Fundamental Analysts |

Value of the firm can be related to its financial characteristics - its growth prospects, risk profile and cashflows. Any deviation from this true value is a sign that a stock is under or overvalued |

|

|

Valuation by Franchise Buyer |

"We try to stick to businesses we believe we understand," Mr. Buffett writes. Franchise buyers concentrate on a few businesses they understand well, and attempt to acquire undervalued firms. |

|

|

Valuation by Chartists |

Chartists believe that prices are driven as much by investor psychology as by any underlying financial variables. The information available from trading - price movements, trading volume, short sales, etc. - gives an indication of investor psychology and future price movements. |

|

|

Valuation by Information Traders |

Information traders attempt to trade in advance of new information or shortly after it is revealed to financial markets, buying on good news and selling on bad. The focus is on the relationship between information and changes in value, rather than on value |

|

|

Valuation by Market Timers |

That it is easier to predict market movements than to select stocks and that these predictions can be based upon factors that are observable.Valuation of individual stocks may not be of any use to a market timer Market timing strategies can use valuation in at least two ways: |

|

|

Valuation by Efficient Marketers |

Market price at any point in time represents the best estimate of the true value of the firm, and that any attempt to exploit perceived market efficiencies will cost more than it will make in excess profits. |

|

|

Approaches to valuation |

1. Discounted Cashflow Valuation, relates the value of an asset to the present value of expected future cashflows on that asset |

|

|

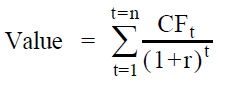

Basis for Discounted Cashflow Valuation |

Where, n = Life of the asset CFt = Cashflow in period t r = Discount rate

|

|

|

Types of DCF valuations |

Equity Valuation - value just the equity stake in the business, Firm Valuation - value the entire firm, which includes, besides equity, the other claimholders in the firm Adjusted Present Value (APV) Valuation - value the firm in pieces, beginning with its operations and adding the effects on value of debt and other non-equity claims. |

|

|

Difficulties with DCF - "Firms in trouble" |

For firms that are expected to survive, CFs will have to be estimated until they turn |

|

|

Difficulties with DCF - "Cyclical Firms" |

CFs of cyclical firms tend to follow the economy - rising during economic booms and falling during recessions. Estimating future cashflows then becomes entangled with analyst predictions about when |

|

|

Difficulties with DCF -"Firms with unutilized assets" |

If a firm has assets that are unutilized (and hence do not produce any cashflows), the value of these assets will not be reflected in the value |

|

|

Difficulties with DCF - "Firms with patents or product options" |

Firms often have unutilized patents or licenses If this is the case, the value obtained from |

|

|

Difficulties with DCF - "Firms in the process of restructuring" |

Firms in the process of restructuring often sell |

|

|

Difficulties with DCF - "Firms involved in acquisitions" |

1. Synergy in the merger and if its value can be estimated. It can be done, though it does require assumptions about the form the synergy will take and its effect on CFs 2. Effect of changing management on CFs and risk. Again, the effect of the change can and should be incorporated into the estimates of future CFs and discount rates and hence into value |

|

|

Difficulties with DCF - "Private Firms" |

The biggest problem in using discounted CFs valuation models to value private firms is the measurement of risk (to use in estimating discount rates), since most risk/return models require that risk parameters be estimated from historical prices on the asset being analyzed |

|

|

Relative Valuation |

The value of an asset is derived from the pricing of 'comparable' assets, standardized using a common variable such as earnings, CFs, Models: A) industry-average price-earnings ratio; B) price to book value ratio; C) multiple of price to sales; D) price to cashflows; E) price to dividends; F) market value to replacement value (Tobin's Q) |

|

|

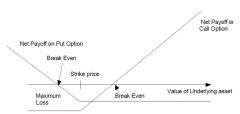

Contingent Claim Valuation |

A contingent claim or option pays off only under certain contingencies - if the value of the underlying asset exceeds a pre-specified value for a call option, or is less than a pre-specified value for a put option. |

|

|

Payoff Diagram on Call and Put Options |

|

|

|

Limitations in using option pricing models |

1) constant variance and dividend yields for options with long lifetimes; 2) underlying asset is not traded - inputs for the value of the underlying asset and the variance in that value cannot be extracted from financial markets and have to be estimated |