![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

53 Cards in this Set

- Front

- Back

|

Comparable companies analysis steps |

1. Select the universe of comparable companies 2. Locare the necessary financial information 3. Spread key statics, ratios, and trading multiples 4. Benchmark the comparable companies 5. Determine valuation |

|

|

Types of restructuring |

1. Spin off 2. Split off 3. Carve-out 4. Sell-off (generic) 5. Tracking shares |

|

|

Types of valuation analysis |

1. DCF 2. Comparable companies analysis (trading comps) 3. Precedent transactions analysis (transaction comps) |

|

|

IBES and FIRST CALL |

Thomson reuters |

|

|

Comparable companies analysis CCA |

Is a process used to evaluate the value of a company comparing it to its competitors in the industry. |

|

|

Fully diluted outstanding shares: |

Basic outstanding shares + convertible bonds + employees stock options + warrants + convertible preferred stocks |

|

|

Discount rate |

The rate at which the FED lends money to private banks. 2. Rate of interest to apply at an available sum of money to get a determined sum in the future |

|

|

FCF |

Operating cash flow - CAPEX The net cash income avaible to capital providers |

|

|

DCF Analysis |

1) Study the target and performance drivers 2) Project FCF 3) Calculate WACC 4) Determine terminal value 5) Calculate present value & valuation (enterprise value, equity value, share price) |

|

|

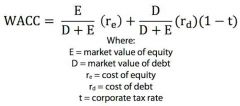

WACC formula |

|

|

|

Methods to compute terminal value |

Exit multiple method & perpetual growth method |

|

|

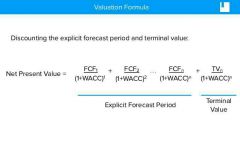

Net present value formula |

|

|

|

Sensitivity analysis |

Different inputs (assumptions) lead to different final results, so you get a range of results |

|

|

Cost of equity |

The amount of money a company must spend to mantain a share price that satisfies investors. There is a formula to compute it |

|

|

What are the perils of calculating market risk premium from historical data? |

Historical data can bias the result |

|

|

Beta |

Is a measure for the volatility, or systematic risk, of a security. It is useful in the CAPM calculation |

|

|

UnSystematic risk (diversifiable risk) |

Is the one that comes from the specific company or asset you invest in. Can be reduced through diversification. |

|

|

Systematic risk (market risk) |

Is the uncertainty inherent to the entire market or entire market segment. Also referred as volatility. Interest rates, recessions and wars are sources of systematic risk. It does not depend on the individual asset. |

|

|

Restructuring |

Is when a distressed company decide to modify its debt, structure or operations. |

|

|

Market Cap does not equal shareholders equity. |

So even the share price goes down, the equity of the firm does not change. |

|

|

Dilution |

Is the reduction in the ownership percentage caused by the issuance of new shares. It usually reduces the value of existing shares and the EPS. Warrants are dilutive |

|

|

Warrants |

Are derivative that confer the right, but not the obligation, to buy or sell a security (normally an equity) at a certain price (strike price) before espiration. The are like options, but the difference is that they are issued directly by the company and they are often traded OTC. Are dilutive |

|

|

Teaser |

Is a short synopsis of the target, including company overview and a summery of financial information |

|

|

CIM |

Confidential Information Memorandum |

|

|

Financial sponsors (buyers) |

Are PE firms, VC, hedge funds. Their goal is to identify private companies with growth opportunities, earn a profit from them by selling or IPO. In valuation they care of cash generating capability. They care of back-office structure (IT, HR, legal) because they do not have them. |

|

|

Strategic buyer |

Is usually a company in the same industry. Want to purchase the company to run it, create synergy and expand business. They make accretion analysis |

|

|

Negotiated sales |

They involve only one interested buyer, usually in the same industry. |

|

|

Equity capital markets tasks |

IPO, accelerated bookbuilds, corporate derivatives, convertible bonds and convertible preferred stocks |

|

|

Bookbuilding |

Is a process to determine the stock price for an IPO. It consists in analysing the possible demand for the stocks and how much investors would be willing to pay. |

|

|

Debt capital markets |

High yield bonds Leveraged loans Investment grade debt Preferred stocks Mezzanine debt |

|

|

Mezzanine |

Is an hybrid of debt and equity financing, gives to the lender the right to convert in equity under certain conditions. Mezzanine investors can reduce the amount of equity needed, they expect a return of 12-20% a year, is more expensive than bank debt, but less than the expected return for equity investors. And it's more flexible. |

|

|

Investment banking tasks |

Corporate sales, divestitures and acquisitions Takeover defense Joint ventures Cross border transactions |

|

|

Takeover defense |

When someone want to buy a company, but investors do no want. So they defend themselves from the takeover, making much difficult the acquisition. For instance, buying more debt, join with a friendly company to raise mark cap and deter acquirer |

|

|

Sturdy |

Solido, robusto. The demand The demand for hard assets remains sturdy |

|

|

Statutory consolidation (merger Luxottica) |

Two companies join to form a new one, both old companies cease to exist. there is always a buyer that buys a target and its assets. They just change name like essilotluxottica |

|

|

Spinoff |

The parent company creates a new legal subsidiary and distributed shares in the subsidiary to its current shareholders as stock dividends. |

|

|

Equity carve-out |

The parent company make public through an IPO a subsidiary. It can raise a lot of cash |

|

|

Friendly takeover |

The target's managers, board and shareholders approve the transaction. They usually receive a gain called purchase premium. They receive money for each stock they have at a premium price |

|

|

Strategic alliance |

Share products or technology with another firm. Often selling them to the other |

|

|

Due diligence analysis |

Investigation you do about the target company; studying its financial data, customers, capital, environment |

|

|

Why mergers |

Achieve synergistic effect Diversification Protect an industry from closing Greater financial resources thank to combined assets Buying assets at a lower price than they would cost Reduce costs, many division such as marketing can be trimmed |

|

|

Disadvantages of mergers |

Adverse financial effect, the anticipated benefits did not materialize Antitrust action delaying procedures Problems caused by minority stockholders, such as proxy fights |

|

|

Main effect to consider on financial performance |

EPS should be higher Share price should be higher or keep the same The merged business should have less financial risk than before |

|

|

Financing package buyers use for mergers |

Cashes, bonds, stocks A key factor is selecting the final package is its impact on current EPS. If you pay target shareholders with new stock, you dilute your EPS |

|

|

Weighted average share outstanding |

Since during a year the number of shares can change due to new issues, covertibles, warrants or repurchasing. Is important to make the average of the year when you compute the EPS |

|

|

Why subtract preferred dividends |

Since preferred dividends are fixed, and have the highest priority among stockholders, their are like a fixed expense for the company. So you must deduct them from net income |

|

|

LBO |

Is the acquisition of a company, division, business using debt to finance a large portion of the purchase price. |

|

|

MBO |

Is an LBO originated and ked by target's management team, often helped by funchal sponsors . |

|

|

LBO candidate characteristics |

Strong cash flow generation Leading and defensible market position Growth opportunities Low capex requirements Strong asset Base Proven management team |

|

|

WACC |

Is the discount rate we use to discount FCF over n-years and also the terminal value |

|

|

Book-to-market ratio |

Book value / maket value If > 1 it is undervalued |

|

|

Why is ttm useful? |

Companies publish earnings only 4 times a year. So to use the the P/E formula you can use the value of the last 4 quarters, so the last twelve months |

|

|

Difference between ebit and ebitda |

Ebitda does not reflect the effect Capex. It is obtained by adding depreciation and amortisation (from cash flow statement) to EBIT |