![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

29 Cards in this Set

- Front

- Back

|

Fundamental Analysis |

|

|

|

Price-earnings ratio P/E |

|

|

|

Earnings growth |

|

|

|

Dividend yield |

|

|

|

Market to book ratio |

|

|

|

Management evluation |

|

|

|

Investment styles |

|

|

|

Technical analysis |

|

|

|

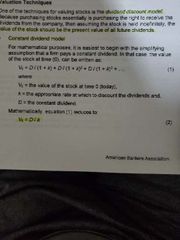

Constant dividend model |

|

|

|

Constant growth model |

|

|

|

Life cycle model |

|

|

|

Efficient market |

|

|

|

Debt market |

Bond market |

|

|

Money market |

Debt instruments with maturity of less than 1 year |

|

|

Capital market |

Debt instruments with maturity greater than 1 year |

|

|

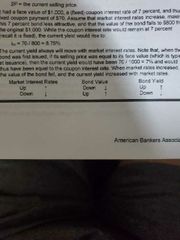

Correlation between market interest, bond value and bond yield |

|

|

|

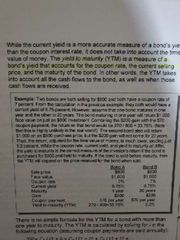

Yield to maturity YTM |

|

|

|

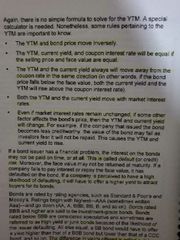

YTM rules |

|

|

|

Bond ratings |

|

|

|

Callable bonds |

|

|

|

Convertible bonds |

|

|

|

Correlation coefficient |

|

|

|

Systemic (nondiversifiable) risk |

|

|

|

Constant mix strategy |

|

|

|

Constant proportions portfolio insurance CPPI strategy |

|

|

|

Capital asset pricing model CAPM |

|

|

|

Duration |

|

|

|

Duration correlation to maturity, coupon and yield |

|

|

|

Laddering |

|