![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

18 Cards in this Set

- Front

- Back

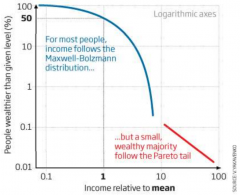

Pareto Tail

|

Result: the richest 10% are those that are most inclined to save.

=> Inequality can be reduced if we all start saving |

|

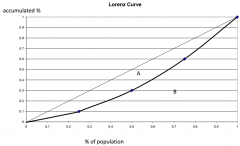

Lorenz Curve

|

shows the degree of equality in income distribution:

- closer the Lorenz curve is to the diagonal, the more equally income is distributed. |

|

|

Gini Coefficient

|

The Gini coefficient calculates the area between the

Lorenz curve and the 45 degree line. Gini coefficient = A/(A+B) Perfect equality Gini = 0 Imperfect equality Gini = 1 (one person has all income) |

|

|

Poverty rate:

|

Percentage of population whose family income falls below an absolute level called the poverty line.

|

|

|

Poverty Line

|

Absolute level of income set by the government for

each family size below which a family is deemed to be in poverty |

|

|

Relative poverty

|

If income < some % of median income)

Relative poverty is inevitable! (unless everyone is exactly equal!) |

|

|

Problems in measuring inequality

|

1. Expenditure-based vs. income-based measures

2. Economic life cycle. 3. Transitory vs. permanent income. 4. Economic mobility |

|

|

Pareto optimal

|

No-one can be made better off without at least one person being made worse off.

|

|

|

Pareto improving reform

|

Means at least some people are better off, and no one is worse off.

Note: dictatorship may be pareto optimal, but not desirable from a society’s point of view |

|

|

Utilitarianism

|

Social happiness is the sum of the individuals,

so maximize society’s total utility. Note: Utilitarian GOVT has to balance gains from greater equality against losses from distorted incentives. |

|

|

Diminishing marginal utility

|

First unit of consumption of a good or service yields more utility than the second or subsequent units.

….taking 1 $ from rich to the poor will decrease the rich's utility and increase the poor's, but rich's falls by less than poor's rises. Therefore, overall utility increases. |

|

|

Liberalism:

Max-min criterion: |

Choose rules from behind a ‘veil of ignorance’

Maximize the position of the poorest in society! |

|

|

Libertarianism

|

Political philosophy according to which govt should

punish crimes and enforce voluntary agreements but not redistribute income. Equality of opportunities is more important than equality of income! |

|

|

Policies to reduce poverty

|

1. Minimum wage laws

2. Social security 3. Negative income tax 4. In-kind transfers 5. Anti-poverty programs and work incentives |

|

|

Negative Income Tax

|

tax owed = (0.4 × income) - $15,000

e.g. - family that earns $70,000 pays $13,000 tax - family that earns $37,500 owes nothing - family that earns $30,000 owes -$3,000. |

|

|

Classic liberal / libertarians

|

Emphasising self-reliance, individualism and free markets with less regulation, tax and government services.

eg. US & UK: least healthy among wealthy democracies |

|

|

Modern liberal

|

Emphasise full employment, income protection, housing, education, health and social insurance.

eg. Sweede & Norway: enjoy better health |

|

|

“cut-throat” US versus “cuddly” Sweden:

There are trade-off's between: |

Economic growth/innovation and growing inequality/high poverty/a weak social safety net.

|