![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

6 Cards in this Set

- Front

- Back

|

HR-Payroll Cycle-Hire to Retire

|

The end-to-end processes necessary to obtain labor services in exchange for cash

-Give cash, get labor services 1. Hire, terminate, promote employees -Recruit, train, develop, retire, term employees 2. Receive service (time records) 3. Process payroll 4. Disburse payroll 5. Pay taxes and benefits |

|

|

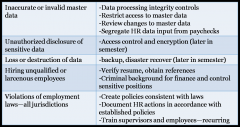

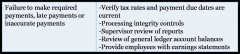

General HR/Payroll Threats and Controls

|

|

|

|

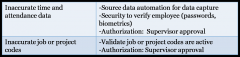

Time and Attendance Threats and Controls

|

Technology:

-Web-based -Linked to job tracking (manufacturing) -ID and access badges (in/out of work area) -Electronic time clocks with log-in/biometric |

|

|

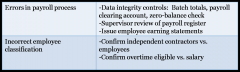

Process Payroll Threats and Controls

|

1. Payroll department verifies and reconciles data

-HR updates are complete -Time records are complete -Tax data is current 2. Process Payroll -Calculate gross pay, withholds, deductions -Update payroll transaction files -Allocate labor costs for job or project tracking 3. Payroll Clearing Account (zero-balance check) -Debit Gross Pay; credit to cash and liabilities -Distribute gross pay to expense accounts |

|

|

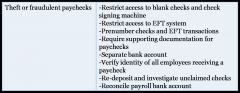

Disburse Payroll Threats and Controls

|

1. Direct deposit goal is 100%

2. Separate payroll bank account -Accounts payable reviews payroll register and prepares disbursement voucher -Cashier prepares check or EFT to fund payroll account 3. Cashier processes and distributes paychecks 4. Cashier reviews direct deposit 5. Unclaimed paychecks sent to internal audit |

|

|

Disburse Taxes, Deductions and Benefits

|

1. Calculate amounts withheld from employees

2. Calculate employer taxes 3. Calculate employer benefit payments 4. Payroll prepares payroll related payment requests -HR benefits function handles third party invoices (for example: health insurance) 5. Accounts payable processes payment 6. Cashier processes payment |