![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

12 Cards in this Set

- Front

- Back

|

Partnership |

An unincorporated association of two or more people to pursue a business for profit as co-owners. |

|

|

Partnership Characteristics |

Voluntary association, partnership agreement, limited life, taxation, mutual agency, unlimited liability, and co-ownership of property. |

|

|

Limited partnerships |

Ltd. Has two classes of partners, general and limited. |

|

|

General partner |

Assumes management duties and unlimited liability for the debts of the partnership. |

|

|

Limited Partners |

Have no personal liability beyond the amounts they invest in the partnership. Have no active role except as specified in the partnership agreement. |

|

|

Limited liability partnership |

LLP. Protects innocent partners from malpractice it negligence claims resulting from the acts of another partner. |

|

|

S Corporations |

Corporations with 100 or fewer stockholders can elect to be treated as a partnership for income tax purpose. Salaries are considered expenses |

|

|

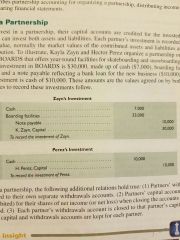

Partnership Investment Posting |

|

|

|

Absence of an agreement - allocating |

Partners will share income or loss equally if there is no agreement |

|

|

Common Methods to ÷ Income & Loss |

Stated ratios, the ratio of capital balances, and salary and interest allowances any any remainder to a fixed ratio |

|

|

Stated ratios |

Aka income and loss sharing ratio, profit and loss ratio (P&L). Gives each partner an agreed fraction of the total. |

|

|

Allocation on Capital Balances |

Assigns an amount based on the ratio of each partners relative capital balance |